In India EMC Immunity Testing Market, irrespective of the uncertainties that originated from the onset of the COVID-19 pandemic, service providers continued to work for fast adoption of 5G, with more than 160 commercial 5G services already available. 5G subscriptions sometime include larger buckets or even limitless data, in addition to much faster speeds. Significant engineering efforts are required on test specifications, instruments, and firmware before 5G user devices can deliver on the efficiency of the new technology. According to the assessments of the government and the Department of Telecom, the large-scale network infrastructure required for the introduction of 5G India is still insufficient. As a result, an accelerated rate of fiberization in the next 6-9 months to connect rural India to the impending 5G services can be expected. According to the National Broadband Mission, over 2 million kilometers of optical fiber would be built across the country by 2024, covering 70% of the country's towers. Thus, the growing usage of 5G would drive India EMC immunity testing market.

Impact of COVID-19 on India EMC Immunity Testing Market

Due to severe burden of losses over manufacturing companies in response of the COVID-19 pandemic, the investment on new technologies and implementation of the same deferred significantly. This negatively impacted the EMC immunity testing market growth. Production at original equipment manufacturers was halted due to the pandemic-induced lockdown (OEM). It also caused a disturbance in the whole value chain of India's key industries, affecting the production of vehicle replacement parts in micro, small, and medium-sized businesses. According to the Society of Indian Automobile Manufacturers, all vehicle categories experienced negative growth in FY21 (2.24% decline in sales of passenger vehicles, 13.19% fall in sales of two-wheelers, 20.77% fall in sales of commercial vehicles, and 66.06% fall in sales of three-wheelers). The slowdown of the automotive sector also hindered the growth of upcoming automotive technologies such as electronic vehicles, which negatively impacted the growth of the EMC immunity testing market in the country.

According to several surveys, consumer electronics and industrial & automotive sectors were the most affected industries by the COVID-19 pandemic in India EMC immunity testing market. Because of China's resilient engineering capability and supply chains that rely primarily on China, Europe, and the US, these areas were severely impacted than other commerce, thereby impacting the supply of raw materials to India EMC immunity testing market. Electronic manufacturing plants in medical, defense, and aerospace sectors, on the other hand, were the least affected. This is due to lower reliance and a better supply-demand ratio. The above-mentioned factors are hindering the growth of the India EMC immunity testing market.

A few of the key companies operating in the India EMC immunity testing market are AE Techron Inc., ETS Lindgren, Ar Inc, Frankonia Group, HILO-Test GmbH, Newtons4th Ltd., LISUN Instruments Ltd., 3C Test Limited, NOISE LABORATORY CO., LTD.; PFIFFNER Group, Rohde & Schwarz GmbH & Co., Transient Specialists, EMC PARTNER AG, Schlöder GmbH, and URS Products and Testing. The India EMC immunity testing market players followed bot organic and inorganic growth strategies to sustain the competitive edge.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the India EMC Immunity Testing Market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the India EMC Immunity Testing Market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth India market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution

Table of Contents

Executive Summary

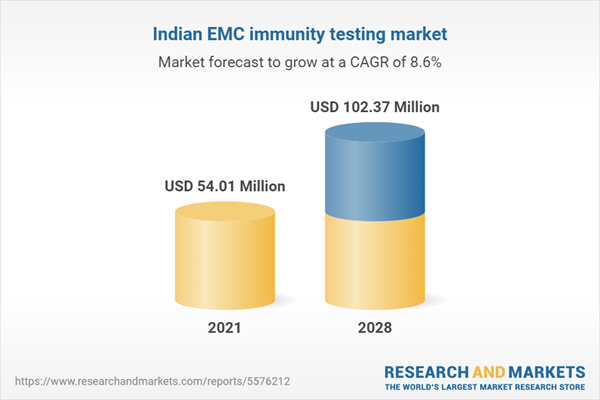

The India EMC immunity testing market was valued US$ 54.01 million in 2020 and is expected to reach US$ 102.37 million by 2028 at a CAGR of 8.6% from 2021 to 2028.Based on offering, the India EMC immunity testing market is segmented as hardware, software, and services. The services segment led the India EMC immunity testing market with a market share of more than 50% in 2020 and is expected to account for 48% of the total market by 2028. The stellar expansion of the services segment is due to an increase in the number of EMC test labs, such as Wipro Tarang, ITI Limited, and ComPlus, across India. The growing number of test labs is also attributed to the high cost of test equipment, thereby compelling manufacturers to rely on service providers rather than hardware and software manufacturers.

Based on testing offering, the India EMC immunity testing market is bifurcated into radiated immunity and conducted immunity. Radiated emissions are unintentional energy that escape the equipment in the form of electric, magnetic, or electromagnetic fields. Conducted emissions are unintentional energy carried out of the equipment on the equipment's power cables or attached signal cables.

The reduction in consumer demand for passenger vehicles contributed to a loss in revenue and a severe liquidity crisis in the automotive sector. According to the Society of Indian Automobile Manufacturers, all vehicle categories experienced negative growth in FY21 (2.20% decline in sales of passenger vehicles, 13% fall in sales of two-wheelers, 20% fall in sales of commercial vehicles, and 66% fall in sales of three-wheelers). The slowdown of the automotive sector also hindered the growth of upcoming automotive technologies such as electronic vehicles, which negatively impacted the growth of the India EMC immunity testing market.

Most electrical equipment that generates unwanted electronic noises is subject to EMI/EMC. Presently, consumer electronics, power electronics, electric motors, automobiles/equipment/accessories, industrial scientific medical (ISM) equipment, power lines & conductors electronics surveillance devices, wireless devices, telecom equipment/devices, mobile phones & towers, IC engines, household & kitchen appliances, electrical tools, electrical lighting, IT equipment, induction heating, electro static discharge (ESD), industrial plants, power system, high altitude equipment are covered under the EMC/EMI requirements.

Increasing digitization and electronic system integration in vehicles fuelled by the rise of connected cars will create favorable opportunities for the India EMC immunity testing market. Automotive suppliers have to stringently comply with the performance requirements of the onboard electronics and other electronic systems. In addition, the growing electric vehicles and autonomous cars will require testing and certification services for telemetry ad infotainment systems, UX and sensor safety, cyber security, and data privacy. Stringent regulatory compliance in India regarding automotive safety will augment the India EMC immunity testing market in the coming years.

ETS Lindgren, Frankonia Group, Rohde & Schwarz GmbH, Schlöder GmbH, and URS Products and Testing are among a few players operating in the India EMC immunity testing market.

A holistic approach was adopted to list/position these players by considering the following key parameters: overall revenue and segment revenue; brand image and industry expertise; current portfolio; geographic reach; partner/distributor network; research and development capabilities; technology integration; new product launches, partnerships, mergers and acquisitions, and other strategic activities. The India EMC immunity testing market players provide a diverse range of products and services that are suited to the needs of specific industry verticals, allowing them to strengthen their market positions.

Computers, cell phones, tablets, and laptops, among other electronic devices, are extensively used by people for applications such as communication, entertainment, and official work. Increasing popularity of voice-assisted personal infotainment systems, rising demand for electronic appliances in automobiles, surge in the use of smartphones, growing knowledge about the impact of artificial intelligence, and deployment of 5G cellular networks are contributing to the elevated sales of consumer electronics. Factors such as the high potential for emissions owing to variable supply voltages, higher clock frequencies, quicker slew rates, and increased package density along with a high need for smaller, lighter, cheaper, and low-power devices are bolstering the demand for EMC shielding. Reliable EMI protection contributes considerably to machines’ reliability, adding value to them. Thus, a continuously rising demand for consumer electronics is fuelling the India EMC immunity testing market.

Advancements in 5G Infrastructure

According to the assessments of the government and the Department of Telecom, the large-scale network infrastructure required for the introduction of 5G India is still insufficient. As a result, we should expect an accelerated rate of fiberization in the next 6–9 months to connect rural India to the impending 5G services. According to the National Broadband Mission, over 2 million kilometers of optical fiber would be built across the country by 2024, covering 70% of the country's towers. The growing usage of 5G would drive India EMC immunity testing market.

Medical Devices: India EMC immunity testing market

The healthcare sector is witnessing continuous technological advancements in terms of medical devices. The emergence of small health monitoring devices and medical wearable devices is propelling the growth of India EMC immunity testing market in this segment. Further, a requirement of low power consumption, remote monitoring and communication, and low cost of medical devices is bolstering the India EMC immunity testing market growth in the country. EMC testing has trustworthy solution for healthcare equipment in terms of reliability, quality, security, and practical implementations of systems.

Companies Mentioned

- Ae Techron Inc.

- Ets Lindgren

- Ar Inc

- Frankonia Group

- Hilo-Test GmbH

- Newtons4Th Ltd.

- Lisun Instruments Ltd.

- 3C Test Limited

- Noise Laboratory Co. Ltd.

- Pfiffner Group

- Rohde & Schwarz GmbH & Co.

- Schlöder GmbH

- Urs Products and Testing

- Transient Specialists

- Emc Partner Ag

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | March 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 54.01 Million |

| Forecasted Market Value ( USD | $ 102.37 Million |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | India |

| No. of Companies Mentioned | 15 |