Wound closure devices are specifically designed sutures, staples, and mechanical equipment that assist in wound closure by moving wound tissue edges closer together. They vary in design and, depending on the purpose and manufacturer, may require tension/pressure adjustment once applied to a patient or absorbed into the skin. It may be used to treat chronic, traumatic, and surgical wounds, as well as skin transplants and flaps.

Market Drivers:

Rise in the number of surgeries worldwide:

The growth of the wound closure devices market is the increase in the number of surgeries worldwide. The rise in demand for these devices, which help in strengthening the injured tissue and reducing tissue stress, as well as the increase in the incidence of impairments, accelerates market expansion.Furthermore, these devices are gaining popularity as they minimize the risk or danger of excessive scarring and infection, as well as the rise in the prevalence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, further affecting the market. Attempts to minimize hospital stays to reduce surgical healthcare expenses, as well as a growing preference for goods that improve therapeutic results, are also increasing demand for improved wound closure and closure devices.

Growing chronic wounds:

The rise in chronic wounds, spurred by conditions such as diabetes, obesity, and vascular diseases, is fueling substantial demand for advanced wound closure products designed to facilitate healing and address associated complications.As an example, WHO Europe reports that diabetes affects approximately 52 million individuals, with a rising proportion of the population, reaching close to 10-14% in numerous European countries. This trend underscores the need for innovative solutions tailored to address various types and complexities of chronic wounds, thereby driving the expansion of the global wound closure market.

Market Restraint:

The growing demand for minimally invasive operations is likely to hamper the market growth:

The increasing preference for minimally invasive surgeries poses a potential challenge to the growth of the global wound closure market. Minimally invasive procedures typically entail smaller incisions compared to traditional open surgeries, resulting in reduced tissue damage and often necessitating fewer wound closure devices.Nonetheless, many surgical interventions still rely on traditional open approaches, ensuring continued demand for wound closure devices in such cases.

Global wound closure market segmentation by end-user into hospitals and clinics, ambulatory care centers, and home healthcare.

The global wound closure market is categorized by end user into hospitals and clinics, ambulatory care centers, and home healthcare. Hospitals and clinics are characterized by a high volume of surgical procedures, driving the demand for diverse wound closure devices.

Ambulatory care centers are witnessing a trend towards minimally invasive surgeries and outpatient procedures, necessitating smaller incisions and simpler closure methods. Home healthcare is marked by a preference for at-home wound management due to its convenience and cost-effectiveness.

North America is anticipated to hold a significant share of the global wound closure market:

The North American region is expected to hold a significant share due to the presence of major players in the region and the rising prevalence of chronic wounds. Due to the existence of significant competitors in the area and the growing frequency of chronic wounds, the North American market is projected to maintain a leading position.Furthermore, the rising number of patients undergoing operations, as well as increased awareness regarding minimally invasive surgeries, are driving regional market expansion. 3M, Johnson & Johnson Services, Inc., B. Braun Melsungen AG and Medtronic are among the key competitors in the North American market.

Market Developments:

- November 2023- Kane Biotech Inc., in collaboration with ProgenaCare Global LLP ("ProgenaCare"), announced the launch of the rebranded revyve™ Antimicrobial Wound Gel (formerly coactiv+™ Antimicrobial Wound Gel). Clinicians who had been exposed to the product up to that point had shown great appreciation for the combination of advanced technology with an affordable price point.

- December 2022- Advanced Medical Solutions Group plc, the globally renowned expert in tissue-healing technologies, announced that it had received FDA 510(k) approval for LiquiBand® XL, a novel device designed to close longer wounds compared to the existing LiquiBand® products. The device comprised a surgical mesh utilized for wound closure, along with LiquiBand® glue applied to reinforce the closure and prevent infection.

- June 2022- Ethicon, a division of Johnson & Johnson MedTech, announced the U.S. launch of the ECHELON 3000 Stapler, a digitally enabled device aimed at providing surgeons with straightforward, one-handed powered articulation to address the distinctive requirements of their patients.

Market Segmentation:

By Product

- Staples

- Adhesives

- Sealants

- Sutures

- Strips

- Mechanical Wound closure devices

By

End-User

- Hospitals & Clinics

- Ambulatory Care Centers

- Home Healthcare

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- France

- Germany

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- Thailand

- Taiwan

- Indonesia

- Others

Table of Contents

Companies Mentioned

- B. Braun Melsungen AG

- Johnson & Johnson

- 3M Healthcare

- Integra Lifesciences

- Cardinal Health

- Medtronic

- DermaClip US LLC

- BandGrip Inc.

- Stryker

- Clozex Medical Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | March 2024 |

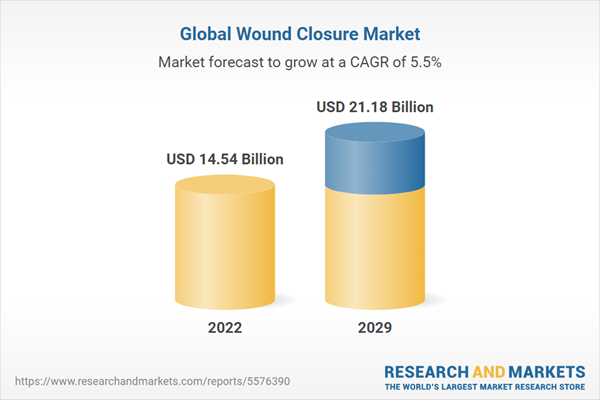

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( USD | $ 14.54 Billion |

| Forecasted Market Value ( USD | $ 21.18 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |