Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Two-wheelers offer affordability, maneuverability, and suitability for short commutes, making them ideal for cities like Ho Chi Minh and Hanoi. A burgeoning middle class and rising disposable incomes are pushing consumers towards mid-range and premium vehicles, encouraging international brands to expand their presence. Electrification is another powerful trend, driven by government incentives, falling battery costs, and green consumer preferences. Domestic manufacturers like VinFast, Dat Bike, and PEGA are challenging legacy ICE players by launching efficient, connected electric models.

Key Market Drivers

Urbanization and Traffic Congestion

Vietnam's rapid urbanization has put immense pressure on city infrastructure. As per the General Statistics Office (GSO), nearly 37.3% of working-aged Vietnamese lived in urban areas in 2023, up from 34.4% in 2015. Cities like Hanoi and Ho Chi Minh City witness dense traffic, leading to an increasing demand for agile, space-efficient vehicles. Two-wheelers provide a cost-effective and practical alternative to cars, particularly for daily commuting and short-distance travel.The continued rise of ride-hailing and delivery services using motorcycles has also added to the demand. Two-wheelers provide a compact and fuel-efficient solution for navigating narrow streets and traffic snarls. With limited parking infrastructure, motorcycles remain the preferred commuting choice. Moreover, the rise in gig-based delivery services - such as Grab, Gojek, and Baemin - has boosted demand for two-wheelers as commercial tools. Daily riders benefit from reduced commute times and operating costs, reinforcing the two-wheeler’s central role in Vietnam’s mobility landscape.

Key Market Challenges

Inadequate Charging Infrastructure for EVs

Although electric two-wheelers are gaining traction, Vietnam’s charging infrastructure remains underdeveloped. Most users depend on home-charging solutions, which are not feasible for apartment dwellers or urban residents with shared housing. While companies like VinFast and Dat Bike are setting up public charging stations, the pace of development is slow. According to the Ministry of Transport, fewer than 1,000 public EV charging points existed nationwide in 2024. The lack of standardized battery swapping and charging protocols further hinders market penetration.Key Market Trends

Rise of Electric Two-Wheelers and Battery Innovation

Vietnam is witnessing a major shift toward electric mobility, with domestic production of e-scooters seeing growth. Manufacturers are investing in next-gen battery technologies such as solid-state and graphene-enhanced lithium-ion batteries. Companies like VinFast have begun integrating IoT-based battery management systems (BMS) to provide predictive analytics and remote diagnostics. Furthermore, government programs promoting lithium-ion recycling and second-life battery applications are creating a more sustainable ecosystem.Key Market Players

- Honda Vietnam

- Yamaha Motor Vietnam

- SYM Vietnam

- Suzuki Vietnam

- Piaggio Vietnam

- VinFast

- Kymco Vietnam

- Pega Vietnam

- Ducati Vietnam

- Dat Bike

Report Scope:

In this report, the Vietnam Two Wheeler market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Two Wheeler Market, By Vehicle Type:

- Scooter/Moped

- Motorcycle

Vietnam Two Wheeler Market, By Engine Capacity:

- Up to 125cc

- 126cc- 250cc

- 251-500cc

- Above 500cc

Vietnam Two Wheeler Market, By Propulsion:

- ICE

- Electric

Vietnam Two Wheeler Market, By Region:

- North Vietnam

- South Vietnam

- Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Two Wheeler market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Honda Vietnam

- Yamaha Motor Vietnam

- SYM Vietnam

- Suzuki Vietnam

- Piaggio Vietnam

- VinFast

- Kymco Vietnam

- Pega Vietnam

- Ducati Vietnam

- Dat Bike

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | July 2025 |

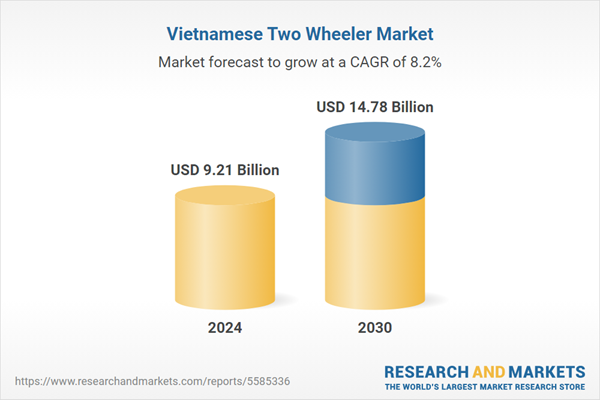

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.21 Billion |

| Forecasted Market Value ( USD | $ 14.78 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |