The basis function of substation is to connect the data center to its different electric supply, however distributed power generating methods like fuel cells or solar arrays are also considered. In addition, a substation is a power network structure that connects transmission lines and distribution feeders with circuit breakers or switches and busbars. This enables the network's power flow to be controlled, as well as general switching procedures for maintenance. The voltage in transmission lines is mostly stepped up or down in these confined zones to a certain level suited for the distribution system.

One of the key trends of the overall Data Center Substation market is growing penetration of the Internet of Things (IoT), social media, and digitization. In addition, the growing utilization of these applications and technologies has necessitated the construction of larger and more sustainable data centers in recent years. Moreover, increased data volumes handled by data centers have resulted from the increased use of social media and a surge in online video content streaming, prompting organizations to invest in reliable and dedicated data centers to minimize data loss and ensure business continuity, energy transmission and distribution, and security. As a result of the expansion of data centers, the demand for electricity to power them has skyrocketed.

The demand for efficient and trustworthy substations is driven by the rapid development in the volume of structured and unstructured data, as well as the growing demand for cloud computing. In addition, the market is expected to increase due to the rising demand for uninterrupted and seamless transmission and distribution of electricity to power data center facilities. ABB, for example, designed a purpose-built substation to cater to the fast-expanding data center industry. The data center substation market is likely to benefit from the increased focus on replacing ageing electrical substation infrastructure with enhanced, high-quality, digital, modular, and gas-insulated systems.

COVID-19 Impact Analysis

Despite the fact that the COVID-19 pandemic had a large-scale impact on businesses around the world, posing numerous hurdles in 2020, the data center substation market continued to grow. The exponential surge in data generation and consumption by individuals and businesses during the pandemic fueled the demand for data storage, leading in an increase in the number of dependable and efficient data centers. With the advent of work-from-home jobs, data centers are becoming computational hubs for a variety of businesses and end users around the world. As a result of the unprecedented increase in data output and the need to improve data center performance, the demand for new data centers and the restoration of old ones has risen. As a result, in the next few years, a surge in the number of data center restoration and building projects is projected to generate growth opportunities for the data center substation market.Market driving Factors:

The massive increase in the number of data centers around the world

From the servers in SMEs to the organization data centers supporting large enterprise and the plantations running cloud computing services hosted by several top technology companies like Amazon, Facebook, and Google, data centers have become an increasingly important part of the modern economy. In addition, different end users have evolved to separate themselves with various data center requirements in the wake of a globally snowballing digital economy and the data center sector, which is always tasked with staying ahead of customers' IT roadmaps. The demand for data storage is also expanding as big data analytics and cloud-based services, like online content such as movies, apps, videos, and social media, become more popular.The growing popularity of Digital Substation

Digital substations contribute to lower maintenance costs and a smaller environmental footprint while extending asset life. Fiber optic connections are used to connect these devices to control panels, removing the requirement for copper control lines. For example, Hitachi ABB Power Grids released its smart digital substation product in March 2021, which combines the latest innovations in digital substation technology with Hitachi's Lumada Asset Performance Management solution's prescriptive, predictive, and prognostic capabilities. In addition to increasing reliability, integrating new types of clean energy, and delivering energy services in better and safer ways, smart digital substations are essential for navigating the change to more distribute and less predictable renewable power sources.Marketing Restraining Factor:

Need for high initial investment

In order to shift to an on-site power supply, data centers must overcome a number of challenges. The initial investment required for on-site energy is frequently the most significant obstacle for businesses. In the near term, moving power on site costs a lot of money and resources, which eventually discourage many businesses to embrace data center substation. In addition, fuel prices fluctuate year to year, making long-term planning difficult, thereby creating uncertainty among the company’s leadership about whether to adopt these systems or not. When constructing a data center, there are various variables to consider. Engineering, permits, and permissions are all taken into account, as are power systems, generators with enclosures, conduit and cabling for generators, data center lighting, lighting protection, HVAC, fire suppression, and other issues.Component Outlook

Based on Component, the market is segmented into Switchgears (Gas Insulated and Air Insulated), Transformers, Relays, Capacitors, Busbars, and Surge Arrestors. The Transformers segment held a significant revenue share of the Data Center Substation Market in 2020. This is because transformers aid in the distribution of electric power throughout the data center. In addition, they are critical substation components because they help with power transfer between networks with minimal loss and no frequency fluctuations. Furthermore, the transformers segment is predicted to rise due to the upgrading and renewal of current substations over the projection period.Voltage Type Outlook

Based on Voltage Type, the market is segmented into Above 500 kV, 220 kV - 500 kV, 110 kV - 220 kV, and 33 kV - 110 kV. In 2020, the Above 500 kV segment garnered the maximum revenue share of the Data Center Substation Market. This is because of a boom in demand for high-voltage substations. In addition, high-voltage substations are designed to meet the high-power demands of mission-critical facilities like data centers, ensuring a consistent and high-quality power supply to server buildings.Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, the North America emerged as the dominating region in the overall Data Center Substation Market by collecting the highest revenue share. In addition, the regional market is anticipated to showcase a similar trend even during the forecasting period. The massive revenue of the regional market can be attributed to the presence of significant competitors like Eaton and General Electric. Moreover, the United States is primarily driving regional expansion, since the country has shown consistent rise in data center construction activities. Furthermore, North America has the largest cloud computing market, which presents a profitable prospect for data centers. As a result, new opportunities for energy transmission and distribution, such as data center substations, open up. North American datacenter colocation providers are focusing on making major investments in new data center facilities, which is projected to fuel market expansion in the region.The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Siemens AG is the major forerunner in the Data Center Substation Market. Companies such as Schneider Electric SE, Hitachi, Ltd., Eaton Corporation PLC are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include S&C Electric Company, NR Electric Co., Ltd., NEI Electric Power Engineering, Inc., Tesco Automation, Inc., General Electric (GE) Co., Schneider Electric SE, Siemens AG, Hitachi, Ltd., Eaton Corporation PLC, and Hyosung Heavy Industries Corporation.

Partnerships, Collaborations and Agreements:

- Dec 2021: GE Digital formed a partnership with UK Power Networks, a distribution network operator for electricity covering South East England, the East of England, and London. This partnership is expected to be focused on a world-first smart substation project known as Constellation, which is developed to optimize usage of the distribution network to streamline the rise of renewable energy generation across the United Kingdom.

- Jun 2021: Schneider Electric came into a partnership with ETAP, the global leader in energy management & engineering solutions. Through this partnership, the two companies is expected to together offer end-to-end lifecycle digitalization, boost efficiency, sustainability, and resiliency to a broader audience and customer base. Schneider Electric's position as a major player in electrical design is expected to be strengthened by ETAP's unique electrical digital twin platform, which will provide customers with a wide range of software capabilities to model, simulate, operate, automate, and optimize utilities and energy-intensive systems as designed, and further enhance Schneider Electric's digital twin capabilities in Power, Grid, Commercial & Building, Data Centers, and other mission-critical sectors.

- Jan 2021: Hyosung Heavy Industries came into a 60:40 partnership with ST Telemedia Global Data Centres (STT GDC), a leading data center service provider headquartered in Singapore. Following this partnership, the two companies is expected to together create and operate their first carrier-neutral data center campus in South Korea. Under this partnership, Hyosung Heavy Industries aimed to expand its skills and go into creating green data centers to satisfy the rising demands of IT infrastructure sustainably, utilizing its long-standing knowledge and leveraging STT GDC's operational Data Centre competence.

- Aug 2020: Siemens Indonesia joined hands with Bandung Institute of Technology (ITB). Through this collaboration, Siemens Substation Automation and Protection Systems is expected to be employed in the university's Power System and Distribution Laboratory. The purpose of the Substation Automation and Protection Systems grant is to better prepare students and graduates for the complicated and competitive substation automation industry, as well as to lay a solid foundation for future Smart Grid technologies.

- May 2020: Schneider Electric extended its partnership with AVEVA, a British multinational information technology consulting company. Following the partnership, the two entities aimed to provide innovative solutions for the data center market. By combining Schneider Electric's EcoStruxureTM for Data Centers power, building, and IT management systems with AVEVATM Unified Operations Center, the two companies is expected to offer a complete data center operations solution in the industry.

Acquisitions and Mergers:

- Jun 2021: Eaton took over a 50 percent stake in Jiangsu YiNeng Electric's busway business, which manufactures and markets busway products in China. This acquisition is expected to expand Eaton's power distribution offerings in the Asia-Pacific market, specifically for customers in high-growth data centers and premier commercial applications.

- Jan 2021: Schneider Electric took over DC Systems, a Netherlands-based start-up specializing in active AC/DC microgrids, DC power conversion, and a comprehensive range of DC solutions. Following the acquisition, Schneider Electric aimed to streamline its portfolio in order to help clients boost simplicity and resiliency for important applications like creating microgrids in unreliable public grid situations and long-distance applications like public lighting.

- Jan 2020: Siemens signed took over C&S Electric Limited, a manufacturer of electrical equipment & exports to over 85 countries, making it India's largest exporter of industrial electrical products. Siemens' position in the business is expected to be strengthened by the combined portfolios of the two companies, allowing it to better serve customers that require electrification in areas such as construction, manufacturing, data centers, smart campuses, and other municipal infrastructure.

Product Launches and Product Expansions:

- Aug 2021: Siemens Energy introduced SenseSolution. The company claims the new solution to be the world's first power transmission technology with cloud connectivity and a specialized web application suite. It enables secure substation data transmission to the cloud, allowing operators to evaluate, monitor, and support system operations in real-time.

- Jun 2021: S&C Electric Company released a new version of its Vista Underground Distribution Switchgear to support sustainability goals. S&C's Vista green switchgear designs utilize a mixture of carbon dioxide (CO2) and 3M NovecTM 4710 Insulating Gas, which provides more than 97 percent decrease in CO2e, or carbon dioxide equivalent when compared to SF6 gas.

- May 2021: Schneider Electric expanded its EcoStruxure Micro Data Center C-Series with the new 43U, providing the maximum capacity in the company's commercial and office line of micro data centers. The new 43U C-Series features intelligent cooling technology for improved protection and energy efficiency, and it's the only solution on the market that dynamically shifts between three cooling modes according to the system's real-time needs.

- Feb 2021: Hitachi ABB Power Grids introduced its Smart Digital Substation offering, which combines the latest in digital substation technology with Hitachi's Lumada Asset Performance Management (APM) solution's unique predictive, prescriptive, and prognostic capabilities. The Smart Digital Substation is expected to also provide increased reliability and resilience, as well as the integration of new forms of cleaner energy and the delivery of energy services in smarter, safer ways, all of which are essential for navigating the transition to more distributed and less predictable renewable power generation.

Geographical Expansions:

- May 2020: General Electric expanded its geographical reach by opening its newest data center in Louisville, Kentucky (USA). In this data center, the company selected high-density computer servers that need only half the floor space of the previous facility. When compared to ordinary buildings, a high-efficiency cooling system saves 34% on electricity.

Scope of the Study

Market Segments Covered in the Report:

By Component

- Switchgears

- Gas Insulated

- Air Insulated

- Transformers

- Relays

- Capacitors

- Busbars

- Surge Arrestors

By Voltage Type

- Above 500 kV

- 220 kV - 500 kV

- 110 kV - 220 kV

- 33 kV - 110 kV

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- S&C Electric Company

- NR Electric Co., Ltd.

- NEI Electric Power Engineering, Inc.

- Tesco Automation, Inc.

- General Electric (GE) Co.

- Schneider Electric SE

- Siemens AG

- Hitachi, Ltd.

- Eaton Corporation PLC

- Hyosung Heavy Industries Corporation

Unique Offerings from the publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- S&C Electric Company

- NR Electric Co., Ltd.

- NEI Electric Power Engineering, Inc.

- Tesco Automation, Inc.

- General Electric (GE) Co.

- Schneider Electric SE

- Siemens AG

- Hitachi, Ltd.

- Eaton Corporation PLC

- Hyosung Heavy Industries Corporation

Table Information

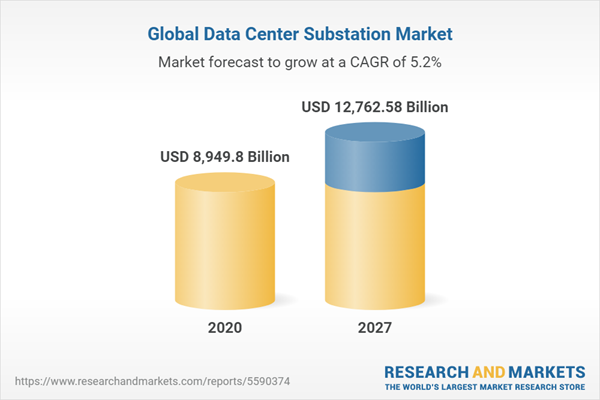

| Report Attribute | Details |

|---|---|

| No. of Pages | 232 |

| Published | March 2022 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 8949.8 Billion |

| Forecasted Market Value ( USD | $ 12762.58 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |