Toys serve as interactive objects that facilitate learning and development in infants and young children. They come in a variety of materials, such as plastic, cloth, clay, metal, and wood, and are available in different shapes, colors, and sizes. Toys can be categorized into physical activity toys, brain training toys, promotional merchandise, and collectibles. These playthings play a crucial role in cognitive development by assisting in the acquisition of reasoning and logical skills, as well as spatial reasoning abilities. Various types of toys are available, including puzzles, cards, board games, rattles, construction and building sets, and educational toys.

The market in China for toys is being driven by inflating disposable income levels of the masses. Furthermore, there is a shift in preference from traditional toys to modern and high-tech electronic toys as they contribute to enhancing intelligence quotient (IQ), enhancing motor skills, improving concentration and creativity, and promoting personality and communication skills which is further strengthening the market. Besides, the increasing use of smartphones, easy access to internet connectivity, and the rise of e-banking systems are also contributing to the market's expansion.

Several leading players in the industry are focusing on developing innovative toys using eco-friendly materials such as cork, clay, and bamboo, thereby supporting the overall growth of the market. Additionally, the growth of organized distribution channels and the emergence of the e-commerce industry, which offers doorstep delivery and secure payment methods, are creating a favorable market outlook. Other factors, such as the increasing influence of social media and the presence of strong income levels among the masses, are also impacting the market.

China Toys Market Trends/Drivers:

Increasing Parental Concerns

Parents in China have become increasingly concerned about the safety of toys due to past incidents involving substandard or hazardous products. In response, manufacturers and retailers are responding to these concerns by ensuring their products undergo thorough testing and certification processes to guarantee safety. This is creating a positive market outlook.Moreover, With the rise of digital toys and smart devices, parents are increasingly concerned about online safety and privacy. They seek toys that have robust security measures, protect children's personal information, and provide a safe digital environment. Furthermore, continual development of toys that incorporate educational elements, such as building blocks, puzzles, coding toys, and science kits is providing a boost to the market across China.

Rising implementation of government policies

The Chinese government has implemented various policies, such as providing tax incentives, subsidies, and financial support to encourage investment in toy production facilities, research and development, and innovation to support domestic toy manufacturing and promote the development of the industry. These policies aim to strengthen the domestic toy industry, enhance competitiveness, and reduce reliance on imported toys. Moreover, they have taken measures to improve the enforcement of intellectual property rights (IPR) in the toy industry. This has led to increased protection of patented designs, trademarks, and copyrights.Furthermore, the government has implemented import and export regulations that also impact the toy market as these regulations govern the importation of toys, including safety certifications, customs procedures, and labeling requirements. Also, the government imposes export standards to ensure that toys meet the quality and safety requirements of target markets.

China Toys Industry Segmentation:

The research provides an analysis of the key trends in each segment of the China toys market, along with forecasts at the country and province levels from 2025-2033. The market has been categorized based on product type, distribution channel, end-user, and province.Breakup by Product Type:

- Plush Toys

- Electronic/Remote Control Toys

- Games and Puzzles

- Construction and Building Toys

- Dolls

- Ride-Ons

- Sports & Outdoor Play Toys

- Infant/Pre-School Toys

- Activity Toys

- Other.

Electronic/remote control toys represent the most widely used product type

the report has provided a detailed breakup and analysis of the market based on the product type. this includes plush toys, electronic/remote control toys, games and puzzles, construction and building toys, dolls, ride-ons, sports & outdoor play toys, infant/pre-school toys, activity toys and others. According to the report, electronic/remote control toys represented the largest segment.Electronic/remote control toys incorporate features, such as sound effects, lights, motion sensors, touchscreens, voice recognition, and connectivity, making them highly engaging and appealing to children. These toys often provide educational benefits by incorporating interactive learning experiences. They can help develop cognitive skills, problem-solving abilities, creativity, language acquisition, and STEM knowledge.

The proliferation of smartphones, tablets, and other smart devices has contributed to the dominance of electronic toys. Many electronic toys can be connected to these devices, allowing for additional features, app integration, and access to online content. These product type also provide entertainment beyond traditional play since they include features, including music, videos, games, and digital storytelling.

On the other hand, games and puzzles are highly valued for their educational benefits. They help develop critical thinking, problem-solving skills, spatial awareness, hand-eye coordination, logical reasoning, and strategic planning. They encourage family bonding and social interaction.

Breakup by End-User:

- Unisex

- Boys

- Girl.

Unisex account for the majority of the market share

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes unisex, boys, and girls. According to the report, unisex segment accounted for the largest market share.Unisex toys appeal to a broader audience as they are designed without specific gender stereotypes. Unisex toys often focus on educational and skill development, appealing to parents who prioritize learning and cognitive growth. These toys offer opportunities for creativity, problem-solving, critical thinking, and fine motor skills development, regardless of gender. Parents across China recognize the value of such toys and their impact on their child's overall development.

Unisex toys offer a wide range of play experiences that are not limited to stereotypical gender roles. They encompass various themes, such as building blocks, puzzles, arts and crafts, science kits, and imaginative play sets, allowing children to explore their interests and preferences freely. This diversity in play experiences contributes to the dominance of the unisex sector.

Breakup by Distribution Channel:

- Specialty Toy Chain Stores

- Supermarkets and Hypermarkets

- Departmental Stores

- Online Stores

- Other.

Specialty toy chain stores hold the largest share in the market

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes specialty toy chain stores, supermarkets and hypermarkets, departmental stores, online stores, and others. According to the report, specialty toy chain stores segment accounted for the largest market share.Specialty toy chain stores focus on offering a wide variety of toys that are carefully curated to meet specific customer preferences and interests. They specialize in niche categories, unique products, and high-quality toys that may not be readily available in other retail outlets. These stores prioritize toys that offer educational benefits and promote child development. They cater to parents' desires for toys that enhance cognitive skills, problem-solving abilities, creativity, and STEM learning. By focusing on educational toys, specialty toy chain stores differentiate themselves from general retailers and meet the demands of parents seeking enriching play experiences for their children.

On the contrary, online stores offer unparalleled convenience and accessibility to consumers. They provide a wide range of products from various brands, often offering more choices than physical retail stores. Online stores often offer competitive pricing due to reduced overhead costs compared to traditional retail. They can provide discounts, promotions, and flash sales that attract price-conscious consumers.

Breakup by Province:

- Guangdong

- Jiangsu

- Shandong

- Zhejiang

- Henan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Guangdong, Jiangsu, Shandong, Zhejiang, Henan and others.

Guangdong held the biggest market share as it is referred as a major manufacturing hub, particularly for toys. The province is home to numerous factories and production facilities, offering a wide range of manufacturing capabilities and expertise. It has developed industrial clusters focused on the toy industry. It comprises clusters of toy manufacturers, suppliers, and related businesses.

These clusters foster collaboration, innovation, and efficiency within the industry, contributing to the dominance of Guangdong in the toys market. It has accumulated years of experience and expertise in toy manufacturing. Guangdong has a vibrant culture of innovation and design in the toy industry. Toy companies in the region invest in research and development, design creativity, and product innovation.

On the other hand, Jiangsu province also holds a significant position in the industry. Jiangsu has a strong manufacturing capacity, particularly in the production of plastic toys, electronic toys, and related components as the province hosts a large number of toy manufacturing companies and factories, leveraging its manufacturing expertise, technology, and infrastructure to produce a wide range of toys.

Competitive Landscape:

The key players in the market have invested in research and development (R&D) activities to introduce new and innovative toy products that capture consumer attention. This may involve incorporating emerging technologies, interactive features, unique designs, or eco-friendly materials to differentiate their offerings. They are also developing educational toys that promote learning, cognitive development, and skill-building. These toys often align with educational curricula and cater to parental preferences for toys that offer educational value.Additionally, they are developing mobile apps, online platforms, or interactive websites to enhance the play experience, engage with customers, and provide additional digital content related to their toys. Also, they are upgrading packaging designs, implementing user-friendly instructions, providing after-sales support, or enhancing customer service through responsive communication channels.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Mattel, Inc.

- LEGO System A/S

- Hasbro, Inc.

- VTech Holdings Limited

- Hape International AG

- Silverlit Toys Manufactory Limited

- Sieper GmbH

- Micro Mobility Systems AG

- Ravensburger Ltd

- Shantou City Big Tree Toys Co., Lt.

Key Questions Answered in This Report

- How big is the toys market in China?

- What factors are driving the growth of the China toys market?

- What is the forecast for the toys market in China?

- Which segment accounted for the largest China toys market share?

- Who are the major players in the China toys market?

Table of Contents

Companies Mentioned

- Mattel Inc.

- LEGO System A/S

- Hasbro Inc.

- VTech Holdings Limited

- Hape International AG.

- Silverlit Toys Manufactory Limited

- Sieper GmbH

- Micro Mobility Systems AG

- Ravensburger Ltd.

- Shantou City Big Tree Toys Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 117 |

| Published | June 2025 |

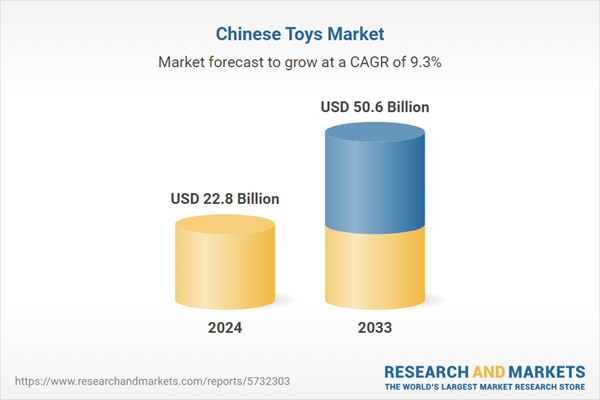

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 22.8 Billion |

| Forecasted Market Value ( USD | $ 50.6 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | China |

| No. of Companies Mentioned | 10 |