Latest Research Finds That by the End of June 2022, the Cumulative Total of Data Centre Space Announcement in 2022 is at 50% of the Total of Space Announcements Made in 2021

The Data Centre Developments in Europe - 2022 onwards report is based on research made for Data Centre planned developments in European Countries using Ddatacentrepricing's unique database of third-party Data Centres in Europe.

For the six-month period (from January to June) of 2022, just under sixty new Data Centre facilities have been tracked by the analyst. By the number of new facilities being developed in 2021 and in 2022 Data Centre growth rates are relatively similar.

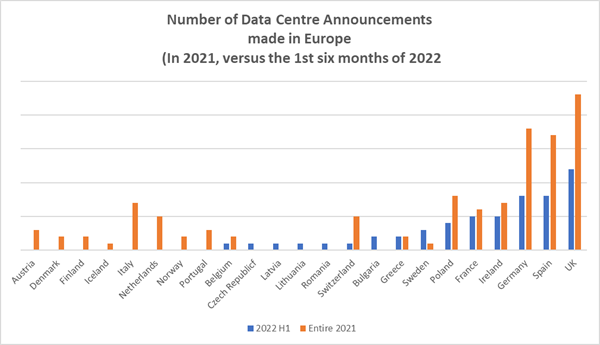

The UK sees the highest number of new Data Centre projects with twelve - followed by Germany and Spain seeing eight new announcements.

The report provides a profile of each of the Data Centre that is expanding giving an insight into the presence across Europe as well as details of the proposed development(s).The report Data Centre Developments in Europe - H1 2022 uses information on just under sixty projects collated by the analyst on key new third-party Data Centres planned across fifteen European countries.

From the research, the analyst highlights the following key trends:

- The UK sees the highest number of new Data Centre projects with twelve followed by Germany and Spain each eight.

- The total announced Data Centre space in Europe to-date in 2022 is 467,815 m2.

- The chart below shows, in which countries Data Centre announcements have been made in 2021 and 2022, with a number of countries showing no announcements made to date in 2022.

- Space announced vary from 325 m2 DataVita in Glasgow (announced in June 2022) up to the 50,000 m2 size development announced by Thor Digital for build in Madrid.

- A focus on new markets for Data Centres: Over the last six-month period to the end of June 2022, there has been a move in Data Centre investment away from the traditional FLAP (Frankfurt, London Amsterdam and Paris) markets - which have previously attracted the majority of Data Centre investment - to smaller Tier II/III markets including Sofia (Bulgaria), Hamburg (Germany), Birmingham (UK) and others.

- Data Centre construction in Europe continues to boom - 29% of the announced data centre space being launched in 2022, 12% in 2023, 23.5% in 2024, 26.5% in 2025 and 9% in 2026.

- The growth in new facilities in Europe reflects the spread of Data Centres to smaller metro markets in Europe who are now catching up with the larger FLAP markets with large campus developments.

The analyst will continue to track new data centre announcements for the remainder of 2022.

Table of Contents

Methodology

Executive Summary

European Data Centre Development Overview: First half of 2022, covering key countries.

Methodology

The analyst researches its reports typically within a three-month period. All of its reports are based on primary and secondary research including interviews with relevant companies/operators covered in the report. The analyst also draws on its extensive in-house database and its contacts in the field of telecommunications it has established since the company was launched in 2006.

The analyst has 26-years of experience in the field of telecoms pricing both mobile and fixed. They have a network of consultants as well as a multi-lingual research team, with languages spoken French, German, Polish and Spanish.

LOADING...