Genetic Testing Market Analysis:

Market Growth and Size: The sector is seeing strong growth as the public becomes more informed and the appetite for personalized medicine increases. With advancements in testing technologies, the market is penetrating new healthcare sectors at an extremely rapid pace and has become one of the most dynamic segments of the healthcare industry.Major Market Drivers: The main factors are the introduction of new technologies, the increase in the prevalence of genetic diseases and chronic conditions and the increasing of the consumer's knowledge about genetic risks. Government initiatives and funding of genetic research also greatly assist the industry in market growth, which provide an accurate answer to how big is the genetic testing market.

Technological Advancements: Innovations in NGS (next-generation sequencing) and CRISPR technologies have revolutionized testing providing precise and budget-friendly methods. These developments have enlarged the range and opportunity of genetic testing, which in turn has increased the usage of it both in clinical settings and in research.

Industry Applications: The application of the testing includes cancer diagnosis, genetic disease diagnosis, and cardiovascular disease diagnosis. It can be used for diagnosing and managing genetic diseases makes it an inseparable part of modern healthcare.

Key Market Trends: There is a rising preference for direct-to-consumer services, in which users can acquire genetic information without using an intervening doctor. The market is also experiencing a trend where testing is becoming part of regular healthcare practices for disease screening and management, which indicates a positive outlook for the future of genetic testing market.

Geographical Trends: North America dominates the market, followed by Europe and the Asia Pacific. Factors including healthcare facilities, per capita medical expenditure, and governmental assistance also contribute to the development of these regions. Emerging markets in Latin America and the Middle East and Africa show potential for growth despite current challenges.

Competitive Landscape: The market is highly competitive with key players engaging in research and development, strategic partnerships, and regulatory compliance. These companies are focusing on expanding their testing portfolios and exploring new market opportunities to maintain their competitive edge.

Challenges and Opportunities: While the market offers substantial growth opportunities, it faces challenges such as ethical and legal implications of testing, the need for skilled professionals, and public perception issues. Addressing these challenges and harnessing technological advancements present significant opportunities for market expansion and innovation.

Genetic Testing Market Trends:

Advancements in genetic testing technologies

Advancements in genetic testing technologies have been instrumental in driving the genetic testing market size. These technological innovations have led to more accurate, efficient, and cost-effective genetic analysis methods, expanding the scope of testing into areas such as oncology, pharmacogenomics, and predictive testing, further driving the genetic testing market growth. Enhanced sequencing techniques, such as next-generation sequencing (NGS), provide detailed insights into genetic disorders, enabling early detection and personalized treatment plans. For instance,A study on 1914 women revealed cfDNA testing significantly reduces false positives for trisomies 21 and 18 compared to standard screening, with a 100% success rate in detecting aneuploidies and higher predictive values. Furthermore, simplified processes have increased the adoption of genetic testing across various healthcare settings, contributing to the genetic testing market demand.

Increasing awareness and demand for personalized medicine

Increasing awareness and demand for personalized medicine have also played a significant role in shaping the genetic testing market outlook. Personalized medicine, which relies on genetic information to tailor treatments, has heightened the demand for genetic tests. This demand is particularly evident in sectors such as oncology and reproductive health, where genetic testing guides therapy decisions and assesses genetic disorder risks in offspring. For example, according to a study, survey with a 36% response rate showed that 83% of the 312 respondents had minimal inquiries about direct-to-consumer genetic testing, 14% dealt with result interpretation, and over 50% supported the role of genetic counsellors and clinical settings for genetic testing, with 70% open to considering it for patients with privacy, anonymity, or access concerns. Additionally, growing consumer interest in understanding genetic predispositions to health conditions further fuels genetic testing market overview, driving genetic testing market statistics and genetic testing market trends.Rise in genetic disorders and chronic diseases

The rise in genetic disorders and chronic diseases globally is further escalating the genetic testing market statistics. Genetic testing plays a vital role in the early detection, diagnosis, and management of various conditions such as cystic fibrosis, sickle cell anemia, and Huntington’s disease. Moreover, with the increasing incidence of chronic diseases, including cancer, cardiovascular diseases, and diabetes, there is a heightened need for testing to identify genetic mutations predisposing individuals to these conditions. The World Health Organization (WHO) reports that non-communicable diseases (NCDs), such as cancer, cardiovascular diseases, and diabetes, are responsible for 73% of global deaths annually. Genetic testing can help identify individuals at risk for these conditions. Early detection through testing improves patient outcomes, further propels the genetic testing market. The genetic testing market is substantial, with a considerable growth in the number of genetic testing per year in USA and other developed countries. Looking ahead, the future of genetic testing is promising, with continued technological advancements expected to enhance accuracy and accessibility. Genetic testing in pregnancy is also becoming increasingly prevalent, providing valuable insights into fetal health and genetic conditions.Genetic Testing Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global genetic testing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, and application.Breakup by Type:

- Predictive and Presymptomatic Testing

- Carrier Testing

- Prenatal and Newborn Testing

- Diagnostic Testing

- Pharmacogenomic Testing

- Others

Diagnostic testing accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes predictive and presymptomatic testing, carrier testing, prenatal and newborn testing, diagnostic testing, pharmacogenomic testing, and others. According to the report, diagnostic testing represented the largest segment.The largest sector of the market is the diagnostic testing market, which is employed to reveal or confirm specific inherited disease in symptomatic people. This sector is on the rise due to its contribution to a precise diagnosis, which is necessary for appropriate treatment and control of a plethora of genetic conditions. The fact of its broad fields of using from rare genetical diseases till common conditions brings attention to this issue in medical sector. An investigation that appeared in the Journal of Molecular Diagnostics revealed that the percentage of medical professionals who had integrated genetic diagnostic testing for hereditary cancers definitely had grown from 19.8% in 2014 to 38.4% in 2018.

Breakup by Technology:

- Cytogenetic Testing and Chromosome Analysis

- Biochemical Testing

- Molecular Testing

- DNA Sequencing

- Others

Molecular testing holds the largest share in the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes cytogenetic testing and chromosome analysis, biochemical testing, and molecular testing (DNA sequencing, and others). According to the report, molecular testing accounted for the largest market share.Molecular testing represents the largest section in the market. The methodology portion cover PCR, NGS, and other filtered DNA related analysis terms. It is very practical as it can be applied for many sections, from detecting genetic changes that give rise to diseases, to exploring cancer genetics for the reason of targeted treatments, and to unearthing genetic predispositions for different conditions. The unique capability of molecular testing associated with the precision it offers has established the field of genetic diagnostics, individualized medicine, and research as a key area in molecular science, giving it a leading position in this field. A 2021 study evaluated various COVID-19 molecular tests, revealing a high sensitivity rate of 95.9% for minimizing false negatives, and a specificity rate of 97.2% to reduce false positives. Besides, cytogenetic testing, including chromosome analysis means looking through section of chromosome in attempted to get information about chromosomal abnormalities of the patient. This part has a vital role in recognition the chromosome count, missing only one chromosome could cause genetic disorders such as Down syndrome, Klinefelter syndrome or Turner syndrome. It is widely use in pre-natal testing, cancer diagnosis and also for studying cells chromosome change, which are hardly beyond disease.

The biochemical testing, on the other hand, is directed towards the measurement of the exact amount of activity in most cases of specific enzymes in the body or the levels of proteins, hormones and other substances that comprise the body. This segment is a vital step in identifying metabolic disorders that result from enzyme deficiency by determining conditions like PKU or Tay- Sachs Disease, as possible causes.

Breakup by Application:

- Cancer Diagnosis

- Genetic Disease Diagnosis

- Cardiovascular Disease Diagnosis

- Others

Genetic disease diagnosis represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes cancer diagnosis, genetic disease diagnosis, cardiovascular disease diagnosis, and others. According to the report, genetic disease diagnosis represented the largest segment.Genetic testing is currently utilized to diagnose a large number of diseases that are affected by both single-gene and multiple-gene factors. Genetic disease diagnosis is essential for the early detection of diseases and prompt intervention that finally aid in the condition's management. This growth is powered by its rear-rooted importance in the field of medicine which is represented in the accurate diagnoses of the genetic diseases not only for treatment but also for family planning. Between 2012 and 2022, the US led in the expansion of genetic tests, primarily for clinical diagnosis, highlighting the need for mandatory reporting and international collaboration for a comprehensive understanding of global genetic testing.

Using genetic analysis for cancer diagnosis implies finding out genetic mutations or alterations which cause cancer to develop. This portion is very vital for early tumor detection, diagnosis and controlling different categories of cancer.

Moreover, the genetic diagnosis of cardiovascular diseases involves locating these genetic variants to establish an increased risk for such heart-related defects as congenital heart defects, various cardiomyopathies, and arrhythmias.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest genetic testing market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America is the largest segment in the world market, driven by the world class healthcare infrastructure, the high amount of money that is spent on the healthcare sector and the presence of top companies and research institutions. The region is propelled by strong private investment, in the field of personalized medicine, large investments by governments in gene research, and favorable policy decisions from the national government. Besides, genetic disorders as well as chronic diseases, with a growing number of patients and informed population ready to access testing services, boost propel this company’s leading position in the market.

The European region remains of crucial importance in terms of the market structure which is based on well-developed healthcare systems and governmental financial support of genetic research. The locale's market growth is propelled by the growing awareness about genetic DNA, personalized medicine, and the availability of qualified personnel in the field of genetics.

The Asia Pacific region is experiencing a growing market come from the fact that it is a large population base, infrastructure on healthcare rising and increasing the expenditure on healthcare. The market also draws support from genetic disease awareness growth, personalized medicine demanded growth, and government initiatives in health care reform.

The Latin American market is developing steadily, it is stimulated by improvement of the healthcare infrastructure, by the growth of the wages, and by the increase in public health awareness. As region is faced with the increasing demand for testing services for diseases prevention, diagnosis, and treatment.

The middle east and Africa market holds a lot of promise of significant growth. Factors that include the rising number of healthcare expenditure, the growing prevalence of genetic diseases, as well as the heightened level of awareness of the significant effects of genetic testing across the industry are the major drivers of genetic testing in this part of the world.

Leading Key Players in the Genetic Testing Industry:

Market’s key players adopt different strategies to achieve fundamental objective of strengthening their market share. This include is investing heavily in research and development to innovation and evolution of genetic testing technologies, especially in the direction of next-generation sequencing (NGS) and CRISPR. They also engage in the establishment of partnerships and collaboration with other biotech companies, academic institutions, as well as healthcare providers to help them grow in their services portfolio and geographical reach. Besides this, manufacturers are making efforts to get the new devices approved by the regulator agencies to be in compliance with regulations and guarantee the patient safety. Additionally, direct-to-consumer services have been developed with the aim of leveraging consumers’ growing demand for personalized healthcare and genetic wellness.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- 23andme Inc.

- Ambry Genetics Corporation (Konica Minolta Healthcare Americas Inc.)

- Bio-RAD Laboratories Inc.

- Cepheid (Danaher Corporation)

- Eurofins Scientific

- Illumina Inc.

- Invitae Corporation

- Luminex Corporation (DiaSorin)

- Myriad Genetics Inc.

- QIAGEN

- Quest Diagnostics

- Thermo Fisher Scientific

Latest News:

11 July 2023: Quest Diagnostics launched Consumer-Initiated Genetic Test on questhealth.com to Deliver Personalized, Actionable Health Risk Insights. The new offering helps people understand their potential risk of developing certain inheritable health conditions, with advanced technology and end-to-end support that includes personalized health reports and access to genetic counseling.14 April 2023: QIAGEN launched the Applied Biosystems QuantStudio Absolute Q Digital PCR System, the first fully integrated digital PCR (dPCR) system designed to provide highly accurate and consistent results within 90 minutes.

10 March 2022: Thermo Fisher Scientific introduced latest generation of SeqStudio Flex Series Genetic Analyzer to enable customer’s cutting-edge research in areas such as gene editing and infectious disease.

Key Questions Answered in This Report

1. What is genetic testing?2. How big is the genetic testing market?

3. What is the expected growth rate of the global genetic testing market during 2025-2033?

4. What are the key factors driving the global genetic testing market?

5. What is the leading segment of the global genetic testing market based on type?

6. What is the leading segment of the global genetic testing market based on technology?

7. What is the leading segment of the global genetic testing market based on application?

8. What are the key regions in the global genetic testing market?

9. Who are the key players/companies in the global genetic testing market?

Table of Contents

Companies Mentioned

- 23andme Inc.

- Ambry Genetics Corporation (Konica Minolta Healthcare Americas Inc.)

- Bio-RAD Laboratories Inc.

- Cepheid (Danaher Corporation)

- Eurofins Scientific

- Illumina Inc.

- Invitae Corporation

- Luminex Corporation (DiaSorin)

- Myriad Genetics Inc.

- QIAGEN

- Quest Diagnostics

- Thermo Fisher Scientific

Table Information

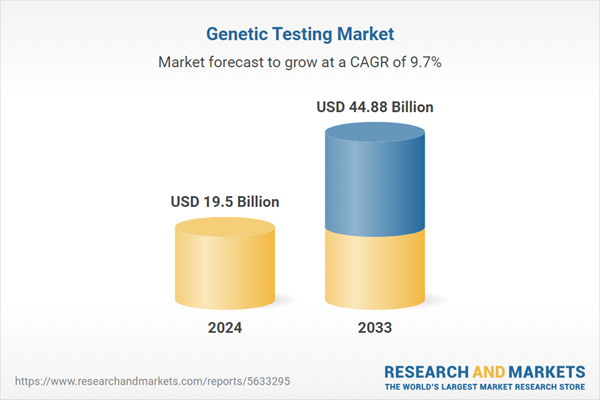

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 19.5 Billion |

| Forecasted Market Value ( USD | $ 44.88 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |