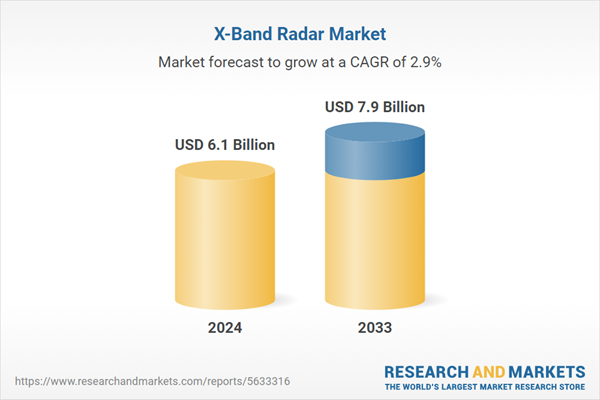

The global X-band radar market size reached USD 6.1 Billion in 2024. Looking forward, the publisher expects the market to reach USD 7.9 Billion by 2033, exhibiting a growth rate (CAGR) of 2.98% during 2025-2033. The growing use of tracking severe weather conditions and detecting natural disasters like hurricanes, cyclones, and floods, increasing improvements in radar technology for enhancing radar precision, distance, and effectiveness, and rising maritime surveillance needs are some of the factors impelling the market growth.

Non-portable is primarily used in fixed installations for applications like air traffic control, weather monitoring, and coastal surveillance. This system offers high precision and is equipped with advanced features for long-range detection and tracking of small objects. It is widely adopted by defense and government agencies because of its robust design and large-scale capabilities.

Portable is gaining popularity due to its mobility, ease of deployment, and compact size, which make it ideal for military operations, disaster response, and field research. It is utilized in scenarios where adaptability and rapid installation are essential, such as in distant locations or during strategic operations.

Active electronically scanned array (AESA) is becoming popular because of its advanced capabilities in fast, precise tracking and multitarget detection. AESA radars are widely used in defense applications for fighter jets, naval ships, and missile defense systems, where high performance and quick adaptability are critical.

Passive electronically scanned array (PESA), while older than AESA technology, continue to be an essential part of the market because of their cost-effectiveness and established use in many defense and civilian applications. These radars are typically deployed in long-range tracking and surveillance systems.

Command and control system is the largest segment because it plays a vital role in overseeing and organizing military and defense activities. This system allows for smooth integration and communication among different radar units, guaranteeing effective tracking, threat detection, and strategic response. The ability to analyze vast data quickly and offer useful insights is crucial in contemporary military operations and monitoring. Defense forces worldwide are prioritizing enhancing their operational capabilities, which is driving the demand for advanced command and control systems. The importance of the system in coordinating land, air, and sea operations makes it a key component in defense infrastructure upgrades and modernization efforts.

Defense dominates the market due to the critical need for advanced radar systems in military applications, including air defense, missile detection, and surveillance. X-Band radar systems offer high precision and long-range capabilities, making them essential for monitoring airspace, tracking potential threats, and guiding defense systems. The rising defense budgets and increasing focus on national security are driving the demand for these radars. The X-band radar market scope is expanding as technological advancements and defense modernization efforts increase the adoption of these systems across various military operations.

North America holds the biggest market share due to strong investments in defense and security infrastructure. The region benefits from notable funding directed towards military modernization, advanced radar systems, and border security. Additionally, the presence of key radar manufacturers and ongoing technological advancements are offering a favorable X-band radar market outlook in the region. The rising demand for X-band radar systems in applications like missile defense, surveillance, and air traffic management, driven by the need to enhance national security and maintain technological superiority, is bolstering the market growth. In 2023, Raytheon Technologies received a $94.1 million order from the US. Navy for components of the RIM-162 Evolved Seasparrow Missile (ESSM) Block 2. This missile, equipped with a dual-mode X-band radar seeker, was designed to engage enemy planes and missiles beyond 25 miles. The ESSM Block 2 was used by the U.S. and allied navies for advanced ship self-defense.

2. What is the expected growth rate of the global X-band radar market during 2025-2033?

3. What are the key factors driving the global X-band radar market?

4. What has been the impact of COVID-19 on the global X-band radar market?

5. What is the breakup of the global X-band radar market based on the system component?

6. What is the breakup of the global X-band radar market based on the application?

7. What are the key regions in the global X-band radar market?

8. Who are the key players/companies in the global X-band radar market?

X-Band Radar Market Analysis:

- Major Market Drivers: The market is experiencing steady growth because of rising defense budgets, heightened national security concerns, and the need for advanced radar systems in missile detection, air defense, and surveillance. Additionally, the growing adoption of X-band radar in the maritime sector for better navigation and detection is positively influencing the market.

- Key Market Trends: Technological advancements in radar systems, such as improved signal processing and enhanced detection capabilities, are key trends in the market. There is also a high demand for multi-functional radar systems capable of operating in harsh environments.

- Geographical Trends: North America holds the biggest market share because of strong investments in defense and security infrastructure.

- Competitive Landscape: Some of the major market players in the industry include Japan Radio Co., Ltd., Raytheon Company, Furuno Electric Co. Ltd., Northrop Grumman Corporation, Terma A/S, Saab AB, HENSOLDT UK, Israel Aerospace Industries, Selex ES, and Reutech Radar (Pty) Ltd.

- Challenges and Opportunities: High costs and technical complexities in radar system development present challenges to the market. However, opportunities in the increasing demand for radars in both military and civilian sectors, particularly in border surveillance and air traffic control, are bolstering the market growth.

X-Band Radar Market Trends:

Growing Demand for Weather Monitoring and Disaster Management

X-band radar is extremely efficient in monitoring weather patterns, tracking severe weather conditions, and detecting natural disasters like hurricanes, cyclones, and floods. The precise, real-time data it offers is extremely valuable for early warning systems, enabling authorities to react promptly and reduce the consequences of disasters. Governing bodies and organizations are making notable investments in radar systems to improve disaster readiness, particularly in areas susceptible to severe weather. Furthermore, these radars support public safety initiatives by providing crucial data for flood prediction, storm tracking, and coastal monitoring. This growing focus on environmental monitoring, coupled with the increasing risks associated with natural disasters, is leading to the adoption of X-band radar in both commercial and government sectors. In 2024, the Government of India declared the placement of ten X-Band Doppler Weather Radars in northeastern states and Himachal Pradesh to improve weather predictions. Placed in sites like Guwahati, Aizawl, and Imphal, these radars will enhance readiness for disasters in areas susceptible to abrupt weather shifts. The goal is to strengthen meteorological infrastructure and protect lives during severe weather events.Technological Advancements

Modern X-band radar systems come with active electronically scanned array (AESA) technology, which is critical for enhancing their tracking speed and ability to monitor multiple targets simultaneously. These advancements are important for defense purposes, air traffic management, and weather surveillance. The integration of these systems into autonomous platforms and unmanned vehicles is supporting the growth of the market. As radar systems become more sophisticated, industries and defense sectors are adopting X-band radar to enhance their operational capabilities. In 2024, Wärtsilä ANCS introduced the NACOS Platinum solid-state X-band radar, which eliminates the necessity of traditional magnetrons, thereby decreasing vessels' maintenance and lifecycle expenses. The radar improves safety during navigation by providing advanced capabilities for detecting and tracking targets.Increasing Maritime Surveillance Needs

With the increasing movement of cargo ships, naval vessels, and fishing boats, monitoring maritime borders and ensuring safety at sea is becoming crucial. X-band radar systems are frequently utilized for coastal surveillance to identify illicit activities including smuggling, piracy, and unauthorized border crossings. Additionally, they assist in guiding ships safely through high-traffic zones and bad weather conditions. The growing international trade and maritime operations are driving the need for reliable radar systems for monitoring and managing maritime activities. In 2024, the VL-SRSAM was tested by DRDO and the Indian Navy at the Integrated Test Range in Chandipur, using a new Ku-Band AESA seeker. Pairing this advanced missile system with the X-band Multi-Function Radar (MFR-X) for fire control boosts target detection and tracking capabilities, thereby increasing its efficiency against aircraft and anti-ship missiles.X-Band Radar Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on type, array, system component, and application.Breakup by Type:

- Non-Portable

- Portable

Non-portable is primarily used in fixed installations for applications like air traffic control, weather monitoring, and coastal surveillance. This system offers high precision and is equipped with advanced features for long-range detection and tracking of small objects. It is widely adopted by defense and government agencies because of its robust design and large-scale capabilities.

Portable is gaining popularity due to its mobility, ease of deployment, and compact size, which make it ideal for military operations, disaster response, and field research. It is utilized in scenarios where adaptability and rapid installation are essential, such as in distant locations or during strategic operations.

Breakup by Array:

- Active Electronically Scanned Array (AESA)

- Passive Electronically Scanned Array (PESA)

Active electronically scanned array (AESA) is becoming popular because of its advanced capabilities in fast, precise tracking and multitarget detection. AESA radars are widely used in defense applications for fighter jets, naval ships, and missile defense systems, where high performance and quick adaptability are critical.

Passive electronically scanned array (PESA), while older than AESA technology, continue to be an essential part of the market because of their cost-effectiveness and established use in many defense and civilian applications. These radars are typically deployed in long-range tracking and surveillance systems.

Breakup by System Component:

- Communications System

- Command and Control system

Command and control system represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the system component. This includes communications system and command and control system. According to the report, command and control system represented the largest segment.Command and control system is the largest segment because it plays a vital role in overseeing and organizing military and defense activities. This system allows for smooth integration and communication among different radar units, guaranteeing effective tracking, threat detection, and strategic response. The ability to analyze vast data quickly and offer useful insights is crucial in contemporary military operations and monitoring. Defense forces worldwide are prioritizing enhancing their operational capabilities, which is driving the demand for advanced command and control systems. The importance of the system in coordinating land, air, and sea operations makes it a key component in defense infrastructure upgrades and modernization efforts.

Breakup by Application:

- Defense

- Government

- Commercial

Defense exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes defense, government, commercial. According to the report, defense accounted for the largest market share.Defense dominates the market due to the critical need for advanced radar systems in military applications, including air defense, missile detection, and surveillance. X-Band radar systems offer high precision and long-range capabilities, making them essential for monitoring airspace, tracking potential threats, and guiding defense systems. The rising defense budgets and increasing focus on national security are driving the demand for these radars. The X-band radar market scope is expanding as technological advancements and defense modernization efforts increase the adoption of these systems across various military operations.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

North America leads the market, accounting for the largest X-band radar market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, North America represents the largest regional market for X-band radar.North America holds the biggest market share due to strong investments in defense and security infrastructure. The region benefits from notable funding directed towards military modernization, advanced radar systems, and border security. Additionally, the presence of key radar manufacturers and ongoing technological advancements are offering a favorable X-band radar market outlook in the region. The rising demand for X-band radar systems in applications like missile defense, surveillance, and air traffic management, driven by the need to enhance national security and maintain technological superiority, is bolstering the market growth. In 2023, Raytheon Technologies received a $94.1 million order from the US. Navy for components of the RIM-162 Evolved Seasparrow Missile (ESSM) Block 2. This missile, equipped with a dual-mode X-band radar seeker, was designed to engage enemy planes and missiles beyond 25 miles. The ESSM Block 2 was used by the U.S. and allied navies for advanced ship self-defense.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industry include Japan Radio Co., Ltd., Raytheon Company, Furuno Electric Co. Ltd., Northrop Grumman Corporation, Terma A/S, Saab AB, HENSOLDT UK, Israel Aerospace Industries, Selex ES, Reutech Radar (Pty) Ltd., etc.

- Key players in the market are focusing on innovation, strategic partnerships, and expanding their product portfolios to meet the growing demand in defense and commercial sectors. They are investing in research operations to enhance radar capabilities, including improving detection accuracy, range, and resistance to jamming. Companies are also securing government contracts and collaborating with defense agencies to develop cutting-edge radar systems. In addition, they are exploring opportunities in emerging markets where the demand for advanced surveillance and defense solutions is increasing. From April 8-10, 2024, Saab showcased its Sea Giraffe 1X Multi-Modal Radar at Sea-Air-Space, highlighting its capabilities in air and surface surveillance, as well as counter-drone functions. The compact, X-band AESA radar offers fast reaction times and is easily adaptable to naval and ground platforms. Its deployment set configuration ensures flexibility and seamless integration with combat management systems.

Key Questions Answered in This Report

1. What is the size of the global X-band radar market in 2024?2. What is the expected growth rate of the global X-band radar market during 2025-2033?

3. What are the key factors driving the global X-band radar market?

4. What has been the impact of COVID-19 on the global X-band radar market?

5. What is the breakup of the global X-band radar market based on the system component?

6. What is the breakup of the global X-band radar market based on the application?

7. What are the key regions in the global X-band radar market?

8. Who are the key players/companies in the global X-band radar market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global X-Band Radar Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Type

5.5 Market Breakup by Array

5.6 Market Breakup by System Component

5.7 Market Breakup by Application

5.8 Market Breakup by Region

5.9 Market Forecast

6 Market Breakup by Type

6.1 Non-Portable

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Portable

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Array

7.1 Active Electronically Scanned Array (AESA)

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Passive Electronically Scanned Array (PESA)

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Breakup by System Component

8.1 Communications System

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Command and Control System

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by Application

9.1 Defense

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Government

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Commercial

9.3.1 Market Trends

9.3.2 Market Forecast

10 Market Breakup by Region

10.1 Asia Pacific

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Europe

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 North America

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Middle East and Africa

10.4.1 Market Trends

10.4.2 Market Forecast

10.5 Latin America

10.5.1 Market Trends

10.5.2 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porter’s Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Japan Radio Co., Ltd

15.3.2 Raytheon Company

15.3.3 Furuno Electric Co. Ltd

15.3.4 Northrop Grumman Corporation

15.3.5 Terma A/S

15.3.6 Saab AB

15.3.7 HENSOLDT UK

15.3.8 Israel Aerospace Industries

15.3.9 Selex ES

15.3.10 Reutech Radar (Pty) Ltd.

List of Figures

Figure 1: Global: X-Band Radar Market: Major Drivers and Challenges

Figure 2: Global: X-Band Radar Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: X-Band Radar Market: Breakup by Type (in %), 2024

Figure 4: Global: X-Band Radar Market: Breakup by Array (in %), 2024

Figure 5: Global: X-Band Radar Market: Breakup by System Component (in %), 2024

Figure 6: Global: X-Band Radar Market: Breakup by Application (in %), 2024

Figure 7: Global: X-Band Radar Market: Breakup by Region (in %), 2024

Figure 8: Global: X-Band Radar Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: X-Band Radar Industry: SWOT Analysis

Figure 10: Global: X-Band Radar Industry: Value Chain Analysis

Figure 11: Global: X-Band Radar Industry: Porter’s Five Forces Analysis

Figure 12: Global: X-Band Radar (Non-Portable) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: X-Band Radar (Non-Portable) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: X-Band Radar (Portable) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: X-Band Radar (Portable) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: X-Band Radar (Active Electronically Scanned Array) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: X-Band Radar (Active Electronically Scanned Array) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: X-Band Radar (Passive Electronically Scanned Array) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: X-Band Radar (Passive Electronically Scanned Array) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: X-Band Radar (Communications System) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: X-Band Radar (Communications System) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: X-Band Radar (Command and Control System) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: X-Band Radar (Command and Control System) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: X-Band Radar (Defense) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: X-Band Radar (Defense) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: X-Band Radar (Government) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: X-Band Radar (Government) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: X-Band Radar (Commercial) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: X-Band Radar (Commercial) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Asia Pacific: X-Band Radar Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Asia Pacific: X-Band Radar Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Europe: X-Band Radar Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Europe: X-Band Radar Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: North America: X-Band Radar Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: North America: X-Band Radar Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Middle East and Africa: X-Band Radar Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Middle East and Africa: X-Band Radar Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Latin America: X-Band Radar Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Latin America: X-Band Radar Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

Table 1: Global: X-Band Radar Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: X-Band Radar Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Global: X-Band Radar Market Forecast: Breakup by Array (in Million USD), 2025-2033

Table 4: Global: X-Band Radar Market Forecast: Breakup by System Component (in Million USD), 2025-2033

Table 5: Global: X-Band Radar Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 6: Global: X-Band Radar Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: X-Band Radar Market Structure

Table 8: Global: X-Band Radar Market: Key Players

Companies Mentioned

- Japan Radio Co. Ltd.

- Raytheon Company

- Furuno Electric Co. Ltd.

- Northrop Grumman Corporation

- Terma A/S

- Saab AB

- HENSOLDT UK

- Israel Aerospace Industries

- Selex ES

- Reutech Radar (Pty) Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 6.1 Billion |

| Forecasted Market Value ( USD | $ 7.9 Billion |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |