A key factor driving the growth of the craniomaxillofacial (CMF) devices market is the rising incidence of facial and cranial injuries resulting from accidents, trauma, and sports-related activities. These injuries often require advanced surgical interventions, boosting the demand for CMF devices. Additionally, the rising adoption of minimally invasive procedures has enhanced the use of technologically advanced devices, including resorbable implants and 3D-printed solutions. Surgeons are progressively opting for these devices due to their accuracy, shorter recovery periods, and enhanced patient results. Growing awareness about reconstructive surgeries and government support for advanced healthcare infrastructure further contribute to the expansion of the craniomaxillofacial (CMF) devices market growth.

The United States plays a significant role in the craniomaxillofacial (CMF) devices market with 85.0% market share due to its advanced healthcare infrastructure and high adoption of cutting-edge medical technologies. The growing occurrence of facial injuries from road accidents, sports, and violence is fueling the demand for CMF devices. Additionally, facial injuries are a notable concern in the U.S., with motor vehicle collisions being a leading cause. A study analyzing pediatric trauma admissions found that 55.1% of facial fractures resulted from motor vehicle collisions, underscoring the demand for CMF devices. Also, an aging population with increasing cases of congenital deformities and bone-related disorders contributes to craniomaxillofacial (CMF) devices market demand. Supportive reimbursement policies, along with strong research and development efforts, are accelerating the adoption of advanced CMF solutions. Leading manufacturers in the U.S. focus on developing bioresorbable implants and 3D-printed devices, reinforcing the country's position as a key market driver.

Craniomaxillofacial (CMF) Devices Market Trends:

Increasing Incidence of Traumatic Injuries

The increasing incidence of traumatic injuries leads to the advancement of the market for CMF devices. Injuries to the cranial, facial, and maxillofacial regions can include fractures, dislocations, and soft tissue trauma that are operatively managed. According to data from Massachusetts General Hospital and Houston Methodist, emergency rooms in the United States admit more than 3 million for treatment of facial trauma yearly. The stabilization and reconstruction of such injuries are very much dependent on CMF devices, including plates, screws, and implants. Other than accidents and falls, the rise in traumatic injuries is due to the increased level of urbanization, higher rates of motorization, and increased participation in sports activities. Interpersonal violence, especially in areas with high levels of interpersonal violence, also shows growth in the market for CMF devices since interpersonal violence tends to result in more severe facial injuries. The urgent and effective treatment requirements have increased the use of CMF devices in emergency departments and surgical facilities. Moreover, the rising incidence of interpersonal violence, including assaults and conflicts, is driving the demand for CMF devices. These violent incidents often result in severe facial injuries that require surgical reconstruction.Advancements in Surgical Techniques and Technology

Another craniomaxillofacial (CMF) devices market trends involve continuous improvements of surgical techniques and technology, and that is upgrading the outcomes achieved from CMF procedures. In its main feature, the computer-aided design CAD technology enables a surgeon to draft precise three-dimensional models of the anatomy of the patient's craniofacial features. These have become helpful to aid in surgery and to customize implants used in the procedure. Due to this customizing, there will be enhanced functional and aesthetical outcomes of the implanted work. Furthermore, the increased adoption of 3D in the manufacture of CMF implants is helping this market to grow. Such implants are produced with accurate precision and aligned to meet patient needs exactly in order to lower the chances of complications. Journal of Craniofacial Surgery asserts that MIS procedures in CMF surgery have cut the length of hospital stay by a significant 30% and have reduced complication rates by as much as 40%. These devices require smaller incisions, causing less tissue disruption, which results in reduced post-operative pain, quicker recovery, and greater comfort for patients. These technological advancements have made CMF procedures more accessible and less invasive, leading to increased patient acceptance and a growing market for CMF devices.Aging Population and Demand for Aesthetic Procedures

Another critical driver of market growth is the aging population of the world. The United Nations predicts that one in six people worldwide will be 60 years of age or older by 2030, meaning that 1.4 billion people will have attained this age. As humans grow old, their bones naturally experience a decrease in bone density and volume in the craniofacial region. This can lead to changes in facial contours and the appearance of aging. CMF devices, such as facial implants and bone grafts, are used to address these issues by restoring volume and structure to the face. In addition, the rising preferences of individuals of various age groups to enhance their facial aesthetics are bolstering the market growth. CMF devices aid in addressing cosmetic concerns. Procedures such as rhinoplasty, chin augmentation, and cheekbone enhancement often involve the use of CMF implants to achieve the desired facial symmetry and balance. In this regard, many individuals seek aesthetic procedures to enhance their self-esteem and confidence. CMF devices allow surgeons to create subtle and natural-looking enhancements that align with the aesthetic goals of patients.Craniomaxillofacial (CMF) Devices Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global craniomaxillofacial (CMF) devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, material type, application, fixation type, and end user.Analysis by Product Type:

- Cranial Flap Fixation Systems

- Distraction Systems

- Temporomandibular Joint Replacement Systems

- Thoracic Fixation Systems

- MF Plate and Screw Fixation Systems

- Bone-Graft Substitutes

- Others

Analysis by Material Type:

- Metals and Alloys

- Bioabsorbable Materials

- Ceramics

- Others

Analysis by Application:

- Neurosurgery & ENT

- Orthognathic and Dental Surgery

- Plastic Surgery

- Others

Analysis by Fixator Type:

- Resorbable Fixators

- Non-resorbable Fixators

Analysis by End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centres

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Craniomaxillofacial (CMF) Devices Market Analysis

The U.S. craniomaxillofacial (CMF) devices market is booming because of technology and an ever-increasing need for trauma and aesthetic surgeries. According to industrial reports, 55,385 CMF procedures were performed in 2023. The rise in incidence of facial trauma and road accidents coupled with increasing demand for facial reconstruction and cosmetic surgeries drives this growth. Another innovative technology that's revolutionizing the outcome of a patient is the use of 3D-printed implants, minimally invasive techniques, and robotic-assisted surgery. Aging populations and a rise in the requirement for dental implants and reconstructive facial procedures will help expand this market. Leaders of the market are Stryker, Zimmer Biomet, and Medtronic, holding wide product lines in surgical navigation systems and high-end implantable devices. The U.S. also is experiencing considerable investments in research and development, such as bioresorbable materials, to ensure sustainability and effectiveness in CMF solutions. The health infrastructure is very strong, and this supports continuous growth in the market for U.S. CMF devices.Europe Craniomaxillofacial (CMF) Devices Market Analysis

Europe's market for CMF devices is on an ascending streak because trauma cases are increasing along with a huge growth in aesthetic facial surgeries. More than 100,000 facial trauma surgeries take place each year, which requires manufacturers to adopt solutions, stated the research study. Key players such as KLS Martin and DePuy Synthes are improving the portfolios of these devices through technological innovation with solutions such as patient-specific implants and robotic-assisted surgery systems. Germany and France lead the market in growth, an aspect that has been facilitated by significant healthcare expenditure. Aging population and demand for less-invasive procedures add to the increase in demand. Additionally, sustainable healthcare solutions with a cost-effective perspective are motivating CMF devices toward advanced materials. Innovation is promoted due to regional policies and governmental funding in R&D, making Europe a leading global market.Asia Pacific Craniomaxillofacial (CMF) Devices Market Analysis

The Asia Pacific CMF devices market is growing significantly due to healthcare investments, rising trauma cases, and increasing demands for facial surgeries. According to industry reports, in 2022, the country of China performed 57,780 procedures for craniomaxillofacial fixation (CMF), which largely contributed to regional market growth. The demand can be attributed to road traffic accidents, facial trauma, and the booming popularity of reconstructive and aesthetic surgeries. Technological advancements in CMF technologies such as 3D printing and minimally invasive procedures are other factors driving growth in the market. The region is also witnessing an increase in disposable incomes, as well as government-backed healthcare programs, to increase access to specialized CMF treatments. This is an extremely competitive market, with market leaders such as Stryker, Zimmer Biomet, and Medtronic, which drive innovation in the fixation and reconstruction devices. Further market development is being fostered by collaboration between local and global players, thus positioning Asia Pacific as a key player in the global CMF devices industry.Latin America Craniomaxillofacial (CMF) Devices Market Analysis

Latin America craniomaxillofacial devices market is seeing an upward growth in the face of increasing cosmetic and reconstructive procedures. According to industry reports, in 2023, Mexico did more than 1.7 million cosmetic procedures, that both surgical and nonsurgical ones; it came to be at number three with such a quantity. This can illustrate the rise of demand in this region regarding aesthetic and reconstructive facial surgery in general. Brazil continues to be one of the prominent players in the Latin American healthcare market, mainly focusing on trauma surgeries and facial reconstructive procedures. Government initiatives, coupled with the growth in disposable incomes and demand for advanced medical technologies, are driving the growth of the CMF market. Major players in the region are channeling investments into R&D to improve surgical outcomes and optimize device performance. These factors all add up to position Latin America as a prime region in the global CMF market.Middle East and Africa Craniomaxillofacial (CMF) Devices Market Analysis

The CMF devices market in the Middle East and Africa is expanding due to increasing healthcare investments and a rise in trauma cases. According to the UAE Government's official portal, the federal budget allocated for healthcare in 2022 was AED 4.25 billion, or about USD 1.16 billion, as part of the country's commitment to improving healthcare infrastructure. Modernization activities, government expenditure, and an emphasis on high-quality medical care are boosting the UAE's health care sector and CMF devices. Saudi Arabia is another country in the region, where health care investment is picking up pace due to growing needs for reconstructive surgeries, trauma treatments, and facial aesthetics. Local and international companies are also capitalizing on such opportunities to boost their market presence, thus increasing innovation in CMF solutions. Additionally, the region's growing healthcare needs are shaping a dynamic and competitive landscape for CMF device manufacturers.Competitive Landscape:

The leading players in the market are consistently investing in research and development (R&D) activities to bring innovative CMF devices into the market. Such activities include advanced implants, surgical instruments, and biocompatible materials that help in achieving better patient outcomes and minimizing the complexity of surgical procedures. Many key players are concentrating on mergers and acquisitions to expand their product offerings and enter new markets. These strategic actions enable them to provide comprehensive solutions, thereby bolstering their competitive edge. Along with this, they follow stringent regulatory requirements; they are also investing in quality control measures so that their products are safe as well as effective. Furthermore, comprehensive training and educational programs are being offered to healthcare professionals to ensure the proper usage of CMF devices, which enhances patient safety.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Integra Lifesciences Corporation

- Johnson & Johnson Medical Devices Companies (JJMDC)

- KLS Martin

- Medartis AG

- Medtronic Inc.

- OsteoMed

- Stryker Corporation

- TMJ Concepts

- Zimmer Biomet Inc.

Key Questions Answered in This Report

1. How big is the craniomaxillofacial (CMF) devices market?2. What is the future outlook of the craniomaxillofacial (CMF) devices market?

3. What are the key factors driving the craniomaxillofacial (CMF) devices market?

4. Which region accounts for the largest craniomaxillofacial (CMF) devices market share?

5. Which are the leading companies in the global craniomaxillofacial (CMF) devices market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Craniomaxillofacial Devices Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Product Type

6.1 Cranial Flap Fixation Systems

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Distraction Systems

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Temporomandibular Joint Replacement Systems

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Thoracic Fixation Systems

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 MF Plate and Screw Fixation Systems

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Bone-Graft Substitutes

6.6.1 Market Trends

6.6.2 Market Forecast

6.7 Others

6.7.1 Market Trends

6.7.2 Market Forecast

7 Market Breakup by Material Type

7.1 Metals and Alloys

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Bioabsorbable Materials

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Ceramics

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Others

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market Breakup by Application

8.1 Neurosurgery & ENT

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Orthognathic and Dental Surgery

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Plastic Surgery

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Others

8.4.1 Market Trends

8.4.2 Market Forecast

9 Market Breakup by Fixator Type

9.1 Resorbable Fixators

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Non-resorbable Fixators

9.2.1 Market Trends

9.2.2 Market Forecast

10 Market Breakup by End-User

10.1 Hospitals and Clinics

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Ambulatory Surgical Centres

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Others

10.3.1 Market Trends

10.3.2 Market Forecast

11 Market Breakup by Region

11.1 North America

11.1.1 United States

11.1.1.1 Market Trends

11.1.1.2 Market Forecast

11.1.2 Canada

11.1.2.1 Market Trends

11.1.2.2 Market Forecast

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Market Trends

11.2.1.2 Market Forecast

11.2.2 Japan

11.2.2.1 Market Trends

11.2.2.2 Market Forecast

11.2.3 India

11.2.3.1 Market Trends

11.2.3.2 Market Forecast

11.2.4 South Korea

11.2.4.1 Market Trends

11.2.4.2 Market Forecast

11.2.5 Australia

11.2.5.1 Market Trends

11.2.5.2 Market Forecast

11.2.6 Indonesia

11.2.6.1 Market Trends

11.2.6.2 Market Forecast

11.2.7 Others

11.2.7.1 Market Trends

11.2.7.2 Market Forecast

11.3 Europe

11.3.1 Germany

11.3.1.1 Market Trends

11.3.1.2 Market Forecast

11.3.2 France

11.3.2.1 Market Trends

11.3.2.2 Market Forecast

11.3.3 United Kingdom

11.3.3.1 Market Trends

11.3.3.2 Market Forecast

11.3.4 Italy

11.3.4.1 Market Trends

11.3.4.2 Market Forecast

11.3.5 Spain

11.3.5.1 Market Trends

11.3.5.2 Market Forecast

11.3.6 Russia

11.3.6.1 Market Trends

11.3.6.2 Market Forecast

11.3.7 Others

11.3.7.1 Market Trends

11.3.7.2 Market Forecast

11.4 Latin America

11.4.1 Brazil

11.4.1.1 Market Trends

11.4.1.2 Market Forecast

11.4.2 Mexico

11.4.2.1 Market Trends

11.4.2.2 Market Forecast

11.4.3 Others

11.4.3.1 Market Trends

11.4.3.2 Market Forecast

11.5 Middle East and Africa

11.5.1 Market Trends

11.5.2 Market Breakup by Country

11.5.3 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

14 Porters Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Competition

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Price Indicators

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

16.3.1 Integra Lifesciences Corporation

16.3.1.1 Company Overview

16.3.1.2 Product Portfolio

16.3.1.3 Financials

16.3.1.4 SWOT Analysis

16.3.2 Johnson & Johnson Medical Devices Companies (JJMDC)

16.3.2.1 Company Overview

16.3.2.2 Product Portfolio

16.3.2.3 Financials

16.3.2.4 SWOT Analysis

16.3.3 KLS Martin

16.3.3.1 Company Overview

16.3.3.2 Product Portfolio

16.3.3.3 Financials

16.3.4 Medartis AG

16.3.4.1 Company Overview

16.3.4.2 Product Portfolio

16.3.5 Medtronic Inc.

16.3.5.1 Company Overview

16.3.5.2 Product Portfolio

16.3.5.3 Financials

16.3.6 OsteoMed

16.3.6.1 Company Overview

16.3.6.2 Product Portfolio

16.3.7 Stryker Corporation

16.3.7.1 Company Overview

16.3.7.2 Product Portfolio

16.3.7.3 Financials

16.3.7.4 SWOT Analysis

16.3.8 TMJ Concepts

16.3.8.1 Company Overview

16.3.8.2 Product Portfolio

16.3.9 Zimmer Biomet Inc.

16.3.9.1 Company Overview

16.3.9.2 Product Portfolio

16.3.9.3 Financials

16.3.9.4 SWOT Analysis

List of Figures

Figure 1: Global: Craniomaxillofacial Devices Market: Major Drivers and Challenges

Figure 2: Global: Craniomaxillofacial Devices Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Craniomaxillofacial Devices Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Craniomaxillofacial Devices Market: Breakup by Material Type (in %), 2024

Figure 5: Global: Craniomaxillofacial Devices Market: Breakup by Application (in %), 2024

Figure 6: Global: Craniomaxillofacial Devices Market: Breakup by Fixator Type (in %), 2024

Figure 7: Global: Craniomaxillofacial Devices Market: Breakup by End-User (in %), 2024

Figure 8: Global: Craniomaxillofacial Devices Market: Breakup by Region (in %), 2024

Figure 9: Global: Craniomaxillofacial Devices Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Craniomaxillofacial Devices (Cranial Flap Fixation Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Craniomaxillofacial Devices (Cranial Flap Fixation Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Craniomaxillofacial Devices (Distraction Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Craniomaxillofacial Devices (Distraction Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Craniomaxillofacial Devices (Temporomandibular Joint Replacement Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Craniomaxillofacial Devices (Temporomandibular Joint Replacement Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Craniomaxillofacial Devices (Thoracic Fixation Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Craniomaxillofacial Devices (Thoracic Fixation Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Craniomaxillofacial Devices (MF Plate and Screw Fixation Systems) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Craniomaxillofacial Devices (MF Plate and Screw Fixation Systems) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Craniomaxillofacial Devices (Bone-Graft Substitutes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Craniomaxillofacial Devices (Bone-Graft Substitutes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Craniomaxillofacial Devices (Other Product Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Craniomaxillofacial Devices (Other Product Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Craniomaxillofacial Devices (Metals and Alloys) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Craniomaxillofacial Devices (Metals and Alloys) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Craniomaxillofacial Devices (Bioabsorbable Materials) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Craniomaxillofacial Devices (Bioabsorbable Materials) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Craniomaxillofacial Devices (Ceramics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Craniomaxillofacial Devices (Ceramics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Craniomaxillofacial Devices (Other Material Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Craniomaxillofacial Devices (Other Material Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Craniomaxillofacial Devices (Neurosurgery & ENT) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Craniomaxillofacial Devices (Neurosurgery & ENT) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Craniomaxillofacial Devices (Orthognathic and Dental Surgery) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Craniomaxillofacial Devices (Orthognathic and Dental Surgery) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Craniomaxillofacial Devices (Plastic Surgery) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Craniomaxillofacial Devices (Plastic Surgery) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Craniomaxillofacial Devices (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Craniomaxillofacial Devices (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Craniomaxillofacial Devices (Resorbable Fixators) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Craniomaxillofacial Devices (Resorbable Fixators) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Global: Craniomaxillofacial Devices (Non-resorbable Fixators) Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Global: Craniomaxillofacial Devices (Non-resorbable Fixators) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Global: Craniomaxillofacial Devices (Hospitals and Clinics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Global: Craniomaxillofacial Devices (Hospitals and Clinics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Global: Craniomaxillofacial Devices (Ambulatory Surgical Centers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Global: Craniomaxillofacial Devices (Ambulatory Surgical Centers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Global: Craniomaxillofacial Devices (Other End-Users) Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Global: Craniomaxillofacial Devices (Other End-Users) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: North America: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: North America: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: United States: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: United States: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Canada: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Canada: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Asia Pacific: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Asia Pacific: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: China: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: China: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Japan: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Japan: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: India: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: India: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: South Korea: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: South Korea: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Australia: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Australia: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Indonesia: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Indonesia: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Others: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Others: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Europe: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Europe: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Germany: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Germany: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: France: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: France: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: United Kingdom: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: United Kingdom: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Italy: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Italy: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Spain: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Spain: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Russia: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Russia: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Others: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Others: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Latin America: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 89: Latin America: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 90: Brazil: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 91: Brazil: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 92: Mexico: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 93: Mexico: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 94: Others: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 95: Others: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 96: Middle East and Africa: Craniomaxillofacial Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 97: Middle East and Africa: Craniomaxillofacial Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 98: Global: Craniomaxillofacial Devices Industry: SWOT Analysis

Figure 99: Global: Craniomaxillofacial Devices Industry: Value Chain Analysis

Figure 100: Global: Craniomaxillofacial Devices Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Craniomaxillofacial Devices Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Craniomaxillofacial Devices Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 3: Global: Craniomaxillofacial Devices Market Forecast: Breakup by Material Type (in Million USD), 2025-2033

Table 4: Global: Craniomaxillofacial Devices Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 5: Global: Craniomaxillofacial Devices Market Forecast: Breakup by Fixator Type (in Million USD), 2025-2033

Table 6: Global: Craniomaxillofacial Devices Market Forecast: Breakup by End-User (in Million USD), 2025-2033

Table 7: Global: Craniomaxillofacial Devices Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 8: Global: Craniomaxillofacial Devices Market: Competitive Structure

Table 9: Global: Craniomaxillofacial Devices Market: Key Players

Companies Mentioned

- Integra Lifesciences Corporation

- Johnson & Johnson Medical Devices Companies (JJMDC)

- KLS Martin

- Medartis AG

- Medtronic Inc.

- OsteoMed

- Stryker Corporation

- TMJ Concepts

- Zimmer Biomet Inc.

Table Information

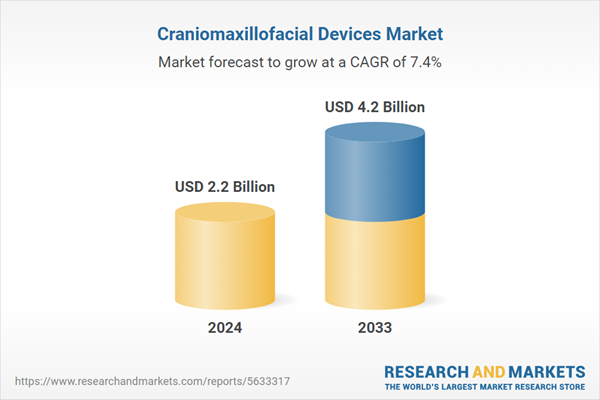

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 4.2 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |