The Next-generation Sequencing (NGS) technology market refers to the rapidly growing industry centered around advanced DNA sequencing techniques that enable the high-throughput, cost-effective analysis of genomic information. NGS has revolutionized genomics research, clinical diagnostics, and personalized medicine by allowing researchers and healthcare professionals to decode an individual's entire genome, transcriptome, or epigenome quickly and accurately. This technology has a wide range of applications, from studying genetic variations and identifying disease-causing mutations to monitoring treatment responses and tracking the spread of infectious diseases. Additionally, the driving factor for the growth of the NGS technology market is its increasing adoption in clinical diagnostics. As precision medicine gains momentum, NGS plays a crucial role in identifying genetic markers associated with diseases, enabling more accurate diagnoses and personalized treatment plans. The ability to sequence entire genomes or targeted gene panels at a reasonable cost has led to the integration of NGS into routine clinical practice, particularly in oncology, rare disease diagnosis, and reproductive health. Moreover, ongoing advancements in NGS platforms and bioinformatics tools continue to enhance the technology's reliability and scalability, further fueling its adoption in healthcare, research, and other fields, and contributing to the market's expansion.

The clinical application segment is emerging as the fastest-growing sector in the Next-generation Sequencing (NGS) technology market. This rapid expansion is driven by the increasing integration of NGS into routine clinical diagnostics and healthcare practices. NGS offers an invaluable tool for identifying genetic mutations, variants, and biomarkers associated with various diseases, including cancer, rare genetic disorders, and infectious diseases. One major factor fueling this growth is the surge in precision medicine initiatives. Healthcare providers are increasingly adopting NGS to personalize treatment plans based on an individual's unique genetic makeup, thereby improving therapeutic outcomes and reducing adverse effects. Furthermore, the continuous reduction in sequencing costs and advancements in bioinformatics tools have made NGS more accessible to clinical laboratories and healthcare institutions. The COVID-19 pandemic has also accelerated the adoption of NGS for viral genome sequencing, tracking emerging variants, and enhancing diagnostic accuracy. As NGS continues to prove its value in clinical settings, its role in disease diagnosis, treatment selection, and monitoring is expected to expand further, solidifying its position as the fastest-growing segment in the NGS technology market.

Next-generation Sequencing (NGS) technology is increasingly becoming a standard clinical diagnostic procedure. Key factors driving this trend include the growing incidence of chronic and infectious diseases, higher investments in genomics research, and ongoing advancements made by prominent industry leaders. These factors collectively contribute to the anticipated expansion of the market. For instance, according to Canada Cancer Society's statistics in 2022, approximately 6,700 cases of leukemia diagnosed in Canada in 2021, with 4,000 cases occurring in males and 2,700 cases in females. Also, as per the American Cancer Society's data in 2023, it is projected that approximately 59,610 new cases of leukemia and 20,380 new cases of Acute Myeloid Leukemia (AML) will be diagnosed in the United States in 2023. This elevated prevalence of these diseases is contributing to the growing utilization of NGS technology-based devices, consequently propelling market expansion in the region.

Report Findings

1) Drivers

- Growing demand for personalized medicine and research advancements fuel the adoption of next-generation sequencing technology.

- The need for quicker and more efficient sequencing processes drives the next-generation sequencing technology market.

2) Restraints

- High costs and data analysis complexities limit the widespread implementation of next-generation sequencing.

3) Opportunities

- Expansion into clinical diagnostics and emerging markets presents significant growth opportunities for next-generation sequencing technology.

Research Methodology

A) Primary Research

The primary research involves extensive interviews and analysis of the opinions provided by the primary respondents. The primary research starts with identifying and approaching the primary respondents, the primary respondents are approached include1. Key Opinion Leaders

2. Internal and External subject matter experts

3. Professionals and participants from the industry

The primary research respondents typically include

1. Executives working with leading companies in the market under review2. Product/brand/marketing managers

3. CXO level executives

4. Regional/zonal/ country managers

5. Vice President level executives.

B) Secondary Research

Secondary research involves extensive exploring through the secondary sources of information available in both the public domain and paid sources. Each research study is based on over 500 hours of secondary research accompanied by primary research. The information obtained through the secondary sources is validated through the crosscheck on various data sources.The secondary sources of the data typically include

1. Company reports and publications2. Government/institutional publications

3. Trade and associations journals

4. Databases such as WTO, OECD, World Bank, and among others.

5. Websites and publications by research agencies

Segment Covered

The global next-generation sequencing technology market is segmented on the basis of technology, application, and end user.The Global Next-generation Sequencing Technology Market by Technology

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Sequencing by Ligation

- Pyrosequencing

- Single-molecule real-time

The Global Next-generation Sequencing Technology Market by Application

- Clinical Application- Cardiovascular

- Oncology

- Reproductive Health Diagnostics

- Others

- Research Application- Drug Discovery

- Agriculture & Animal Research

- Others

The Global Next-generation Sequencing Technology Market by End User

- Academic and Research Centers

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinics

Company Profiles

The companies covered in the report include- Agilent Technologies, Inc.

- Twist Bioscience

- DNASTAR

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- Illumina, Inc.

- Macrogen, Inc.

- PacBio

- QIAGEN

- Thermo Fisher Scientific Inc.

What does this Report Deliver?

1. Comprehensive analysis of the global as well as regional markets of the next-generation sequencing technology market.2. Complete coverage of all the segments in the next-generation sequencing technology market to analyze the trends, developments in the global market and forecast of market size up to 2030.

3. Comprehensive analysis of the companies operating in the global next-generation sequencing technology market. The company profile includes analysis of product portfolio, revenue, SWOT analysis and latest developments of the company.

4. Growth Matrix presents an analysis of the product segments and geographies that market players should focus to invest, consolidate, expand and/or diversify.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Agilent Technologies, Inc.

- Twist Bioscience

- DNASTAR

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd

- Illumina, Inc.

- Macrogen, Inc.

- PacBio

- QIAGEN

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 255 |

| Published | April 2023 |

| Forecast Period | 2022 - 2030 |

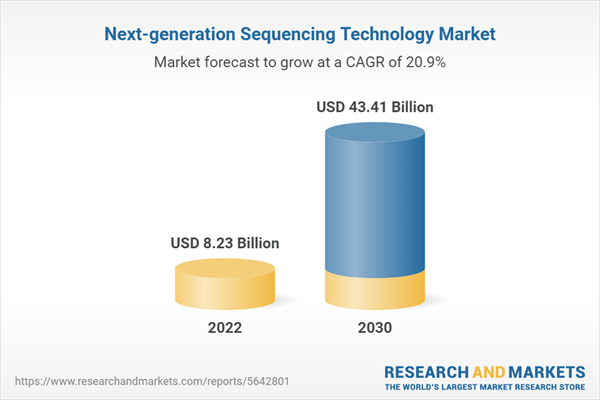

| Estimated Market Value ( USD | $ 8.23 Billion |

| Forecasted Market Value ( USD | $ 43.41 Billion |

| Compound Annual Growth Rate | 20.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |