Laboratory equipment and disposables are essential tools used in scientific research and analysis. These items are essential for conducting experiments, testing, and data collection across various fields, including chemistry, biology, and physics. It includes numerous devices, microscopes, pipettes, centrifuges, and spectrophotometers. These instruments are developed to measure, analyze, and manipulate substances with precision and accuracy. Additionally, disposables refer to single-use items, including test tubes, pipette tips, gloves, and culture dishes, essential for maintaining a sterile environment and preventing contamination during experiments. As a result, laboratory equipment and disposables are gaining immense popularity across the globe.

The market is primarily driven by several advancements in scientific research and healthcare sectors. In addition, the escalating demand for high-quality laboratory equipment and disposables among researchers and healthcare professionals for precise and reliable tools to conduct experiments, diagnose diseases, and examine samples, the demand for accuracy and efficiency is contributing to market growth. Moreover, the ongoing coronavirus disease (COVID-19) pandemic highlighted the importance of laboratory equipment and disposables in diagnostic testing and vaccine development, representing another major growth-inducing factor.

Along with this, laboratories are working tirelessly to conduct tests, analyze data, and develop vaccines, which require a substantial supply of laboratory equipment and disposables, thus propelling the market growth. Furthermore, the adoption of automation and digitalization in laboratories is escalating the demand for modern, technologically advanced equipment that improves efficiency, reduces human error, and saves valuable time, making them attractive investments for various industries, thus creating a positive market outlook.

Laboratory Equipment and Disposables Market Trends/Drivers:

The significant expansion in the healthcare sector

The market is witnessing substantial growth in the healthcare sector, particularly in the fields of diagnostics and personalized medicine. In addition, several advancements in healthcare technology are transforming diagnostics with the advent of cutting-edge diagnostic tools, such as high-throughput sequencers and advanced imaging systems, which enable quicker and more accurate disease detection, thus influencing market growth. These technologies rely heavily on laboratory equipment and disposables, ranging from sample preparation kits to specialized diagnostic reagents which is escalating the demand for these tools.Moreover, personalized medicine tailors treatments to individual patients based on their genetic makeup, lifestyle, and other factors relying heavily on molecular diagnostics, genetic testing, and biomarker analysis, which require specialized laboratory equipment and consumables, thus representing another major growth-inducing factor. Besides this, the growing geriatric population and the rise in chronic diseases led to the adoption of laboratory equipment and disposables in the healthcare systems to process a large volume of tests efficiently and shift toward automation and high-throughput testing, thus accelerating the product adoption rate.

The emerging technological advancements

The market is witnessing a transformative wave of emerging technological advancements in scientific research and experimentation. These innovations can enhance precision, efficiency, and data accuracy, ultimately driving market growth. In addition, the integration of automation and robotics into laboratory workflows is influencing market growth. Moreover, automated systems can perform repetitive tasks with precision, reducing human error and increasing throughput which accelerates research, and minimizes the risk of contamination, particularly in sensitive experiments, representing another major growth-inducing factor.For instance, automated liquid handling systems allow precise and consistent dispensing of reagents, contributing to the reliability of results. Besides this, the introduction of microfluidic devices allows researchers to conduct experiments on a much smaller scale, conserving valuable samples and reagents that offer greater control over experimental parameters and can be used in applications ranging from drug discovery to deoxyribonucleic acid (DNA) analysis, thus accelerating the market growth. Along with this, the integration of data analytics and artificial intelligence (AI) to analyze vast datasets generated by laboratory equipment, identifying patterns and insights enables predictive modeling and optimization of experiments, which is propelling market growth.

The implementation of several government initiatives

The implementation of government initiatives is shaping market growth. These initiatives include several objectives, from promoting scientific research to ensuring the quality and safety of healthcare services, thus influencing market growth. Moreover, several governments are allocating substantial budgets to support research and development (R&D) activities in various fields, including healthcare and life sciences, representing another major growth-inducing factor. This funding often includes grants and subsidies that enable research institutions to acquire advanced laboratory equipment and disposables which stimulate the market by increasing the demand for advanced tools and technologies.Apart from this, the implementation of regulatory initiatives for ensuring the safety and quality of equipment is propelling the market growth. These regulations include product quality, performance, and safety standards. Along with this, government-sponsored innovation programs, tax incentives, and research grants encourage the development of new laboratory technologies and solutions resulting in the introduction of novel products in the market, attracting the attention of research professionals and healthcare providers, thus augmenting the market growth.

Laboratory Equipment and Disposables Industry Segmentation:

This report provides an analysis of the key trends in each segment of the laboratory equipment and disposables market, along with forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type and end use.Breakup by Product Type:

- Equipment

- Incubators

- Laminar Flow Hood

- Micro Manipulation Systems

- Centrifuges

- Lab Air Filtration System

- Scopes

- Sonicators and Homogenizers

- Autoclaves and Sterilizers

- Spectrophotometers and Microarray Equipment

- Others

- Disposables

- Pipettes

- Tips

- Tubes

- Cuvettes

- Dishes

- Gloves

- Masks

- Cell Imaging Consumables

- Cell Culture Consumables

Equipment is the predominant market segment

The report has provided a detailed breakup and analysis of the market based on the product type. This includes equipment (incubators, laminar flow hood, micro manipulation systems, centrifuges, lab air filtration system, scopes, sonicators and homogenizers, autoclaves and sterilizers, spectrophotometers and microarray equipment, and others) and disposables (pipettes, tips, tubes, cuvettes, dishes, gloves, masks, cell imaging consumables, and cell culture consumables). According to the report, equipment accounted for the largest market share.Incubators are instrumental in maintaining precise temperature and environmental conditions for cell culture and microbiology experiments. In addition, laminar flow hoods provide a sterile workspace by directing filtered air to prevent contamination while micro manipulation systems facilitate intricate procedures at the microscale, enabling precision in genetic engineering and cell research, thus influencing the market growth.

Moreover, centrifuges are indispensable for separating components in biological samples, while lab air filtration systems ensure a clean and controlled laboratory environment, thus representing another major growth-inducing factor. Besides this, scopes, including microscopes, are fundamental for visualizing samples, making them vital for biology and materials science and sonicators and homogenizers help break down samples and cell structures, essential for DNA extraction and tissue analysis, thus accelerating the product adoption rate.

Along with this, autoclaves and sterilizers are essential for decontaminating laboratory tools and equipment, ensuring aseptic conditions while spectrophotometers allow accurate measurement of light absorption, essential in chemistry and biochemistry, thus augmenting the market growth. Microarray equipment aids in high-throughput gene expression analysis and genotyping, advancing genomics research. This equipment empowers researchers and scientists across numerous fields, from pharmaceuticals to environmental science, to carry out experiments with precision and efficiency.

Breakup by End Use:

- Hospitals

- Laboratories

- Others

Hospitals dominates the market

A detailed breakup and analysis of the market based on the end use has also been provided in the report. This includes hospitals, laboratories, and others. According to the report, hospitals accounted for the largest market share.Hospitals are the primary providers of comprehensive medical services. They require an extensive array of laboratory equipment for diagnostic purposes, including blood analyzers, centrifuges, and diagnostic imaging systems including magnetic resonance imaging (MRI) and computed tomography (CT) scanners aid in the accurate diagnosis of diseases, enabling timely treatment and better patient outcomes.

Moreover, hospitals have a constant need for disposable items such as syringes, test tubes, and medical gloves, thus representing another major growth-inducing factor. These disposables are essential for maintaining strict hygiene standards and preventing the spread of infections within a hospital environment. Along with this, the growing emphasis on infection control led to the demand for disposables in healthcare settings, thus propelling the market growth.

Furthermore, the ongoing advancements in medical technology and the adoption of advanced equipment due to the need for up-to-date laboratory equipment driven by the desire to provide patients with the best possible care, thus propelling the market growth. As a result, hospitals frequently invest in advanced technologies, contributing significantly to the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest laboratory equipment and disposables market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The North America market is primarily driven by strong research and development (R&D) activities. It is home to numerous world-renowned research institutions, universities, and pharmaceutical companies that heavily rely on advanced laboratory equipment and disposables to conduct cutting-edge research, drive innovation, and develop new products, thus influencing market growth.

Moreover, several technological advancements in the field of laboratory equipment and investment in research and innovation to create advanced, user-friendly, and precise laboratory instruments to meet local demands and attract international buyers, thus representing another major growth-inducing factor.

Besides this, the growing healthcare infrastructure is escalating the product demand. For instance, the United States allocates a substantial portion of its gross domestic product (GDP) to healthcare. Healthcare providers prioritize diagnostic accuracy, patient care, and research to improve treatment outcomes.

Furthermore, the North America market has well-established laboratory equipment manufacturers and disposables suppliers headquartered in the region, leading to numerous product offerings and competitive pricing, thus propelling the market growth.

Competitive Landscape:

At present, key players in the market are actively taking strategic measures to strengthen their positions in the industry. These actions are a response to the competitive landscape and the evolving needs of customers. They are investing heavily in research and development (R&D) to introduce innovative and technologically advanced products including the development of precise and efficient laboratory equipment, disposables with enhanced features, and automation solutions that streamline laboratory processes.Moreover, companies form strategic partnerships and collaborations with research institutions, universities, and other industry players which facilitate knowledge exchange, access to new technologies, and the development of customized solutions. Apart from this, key players are expanding their presence globally by establishing subsidiaries or acquiring local companies in emerging markets to serve customers across the globe.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- FUJIFILM Irvine Scientific Inc (FUJIFILM Holdings Corporation)

- PerkinElmer Inc.

- Sartorius AG

- Shimadzu Scientific Instruments Incorporated (Shimadzu Corporation)

- Siemens Healthcare GmbH (Siemens AG)

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

Key Questions Answered in This Report:

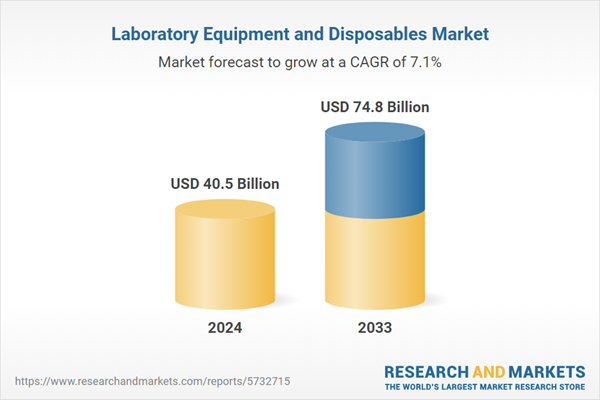

- What was the size of the global laboratory equipment and disposables market in 2024?

- What is the expected growth rate of the global laboratory equipment and disposables market during 2025-2033?

- What are the key factors driving the global laboratory equipment and disposables market?

- What has been the impact of COVID-19 on the global laboratory equipment and disposables market?

- What is the breakup of the global laboratory equipment and disposables market based on the product type?

- What is the breakup of the global laboratory equipment and disposables market based on the end use?

- What are the key regions in the global laboratory equipment and disposables market?

- Who are the key players/companies in the global laboratory equipment and disposables market?

Table of Contents

Companies Mentioned

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- FUJIFILM Irvine Scientific Inc (FUJIFILM Holdings Corporation)

- PerkinElmer Inc.

- Sartorius AG

- Shimadzu Scientific Instruments Incorporated (Shimadzu Corporation)

- Siemens Healthcare GmbH (Siemens AG)

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 40.5 Billion |

| Forecasted Market Value ( USD | $ 74.8 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |