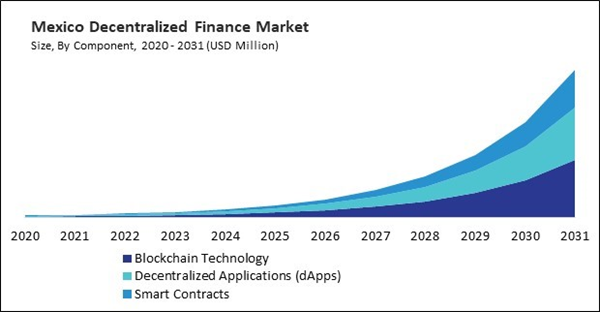

The US market dominated the North America Decentralized Finance Market by country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of $89.55 billion by 2031. The Canada market is experiencing a CAGR of 51.1% during 2024-2031. Additionally, the Mexico market is expected to exhibit a CAGR of 50% during 2024-2031.

Decentralized Finance (DeFi) rapidly transforms the global financial landscape, offering an alternative to traditional banking and financial services through blockchain technology. Unlike conventional financial systems, which rely on centralized institutions such as banks, regulatory bodies, and payment processors, DeFi operates on decentralized blockchain networks that facilitate peer-to-peer transactions without intermediaries.

Additionally, by leveraging smart contracts, decentralized applications (DApps), and digital assets, DeFi enables individuals and businesses to access financial services, including lending, borrowing, trading, yield farming, staking, and asset management, in a transparent, secure, and permissionless manner. This paradigm shift reshapes how people interact with money, making financial services more accessible, inclusive, and efficient for the audience.

Across North America, the market is experiencing diverse growth patterns influenced by each nation's unique economic and technological landscapes. The region's sophisticated infrastructure, coupled with an increasing interest in decentralized financial solutions, establishes North America as a prominent participant in the global decentralized finance ecosystem. DeFi use is anticipated to grow as public awareness and regulatory frameworks continue to change, providing cutting-edge financial services to a wider range of people.

List of Key Companies Profiled

- Aave

- Balancer Labs

- Compound Labs, Inc.

- Badger DAO

- Bancor

- SushiSwap (Yearn Finance)

- MakerDao

- Synthetix

- Curve Finance

Market Report Segmentation

By Component

- Blockchain Technology

- Decentralized Applications (dApps)

- Smart Contracts

By Application

- Data & Analytics

- Decentralized Exchange

- Payments

- Stablecoins

- Marketplaces & Liquidity

- Compliance & Identity

- Prediction Industry

- Assets Tokenization

- Other Application

By Country

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Aave

- Balancer Labs

- Compound Labs, Inc.

- Badger DAO

- Bancor

- SushiSwap (Yearn Finance)

- MakerDao

- Synthetix

- Curve Finance