Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Health Consciousness and Shift Toward Low-Oil Diets

One of the primary drivers propelling the U.S. air fryer market is the increasing health consciousness among American consumers. In 2024, The Centers for Disease Control and Prevention (CDC) reports that over 40% of U.S. adults are obese, with obesity rates being similar among men and women. This alarming figure highlights the growing public health challenge of obesity in the United States, which is associated with a higher risk of numerous chronic conditions, including heart disease, type 2 diabetes, and certain cancers. Over the past decade, there has been a marked shift toward healthier lifestyles, with a growing emphasis on low-oil and fat-reduced diets.Consumers are becoming more aware of the link between excessive oil consumption and health issues such as obesity, heart disease, and high cholesterol. Air fryers, which use hot air circulation to achieve a crisp texture with little to no oil, present an attractive solution for those seeking to reduce fat intake without compromising on taste or texture.

This health-driven trend is particularly prevalent among millennials and Gen Z consumers, who are more likely to adopt cooking appliances that align with their dietary goals. Additionally, the rise of plant-based and clean eating movements has accelerated the demand for cooking methods that retain nutritional value while minimizing the use of unhealthy fats. Health professionals, influencers, and nutrition-focused blogs often recommend air frying as a superior alternative to deep frying, reinforcing its appeal. As more Americans prioritize wellness and home-cooked meals over processed or fast foods, the air fryer has gained a prominent place in modern kitchens, driving consistent market expansion.

Key Market Challenges

Market Saturation and Intense Competition Among Brands

As the popularity of air fryers has surged across the U.S., the market has become increasingly saturated with a wide array of domestic and international brands competing for consumer attention. This saturation has led to intense price competition, making it difficult for companies to maintain strong profit margins without compromising on quality or features. While established players like Ninja, Philips, and Instant Brands continue to dominate, numerous low-cost entrants - particularly from Asian manufacturers - have flooded the online and retail space with budget-friendly alternatives. As a result, consumers face a dizzying number of options, often leading to decision fatigue and brand commoditization.The intense competition also makes it harder for newer or smaller companies to establish a foothold without aggressive marketing or deep discounting, which can strain resources. Additionally, the presence of counterfeit or substandard products in e-commerce marketplaces further disrupts consumer trust and brand loyalty. This overcrowded market environment poses a major challenge for businesses trying to differentiate through innovation, customer service, or durability, especially when price remains a key decision-making factor. Over time, unless brands continuously innovate and enhance their value proposition, the risk of stagnant sales and consumer disinterest may increase, slowing long-term growth.

Key Market Trends

Integration of Smart Technology and App Connectivity

One of the most prominent trends redefining the U.S. air fryer market is the integration of smart technology, including Wi-Fi connectivity, mobile app control, and compatibility with voice assistants like Amazon Alexa and Google Assistant. Today’s tech-savvy consumers, especially millennials and Gen Z, increasingly favor appliances that align with their digital lifestyles. Leading manufacturers are capitalizing on this by offering air fryers that can be controlled remotely via smartphone apps, allowing users to start, pause, adjust temperatures, or monitor cooking progress from anywhere.Apps like VeSync by Cosori or SmartThings by Samsung not only enable remote operation but also provide access to hundreds of guided recipes, cooking presets, and automatic updates. Voice-controlled air fryers, which allow users to initiate cooking or receive status updates through verbal commands, add a layer of convenience that appeals to multitasking households. Additionally, AI-powered features such as adaptive cooking and personalized recipe recommendations are being explored to enhance user experience. As homes become more interconnected through the Internet of Things (IoT), the demand for smart kitchen appliances, including advanced air fryers, is poised to rise. This trend reflects the broader consumer expectation for convenience, automation, and customization in everyday cooking.

Key Market Players

- Koninklijke Philips N.V.

- De’Longhi Group

- Cuisinart

- NuWave, LLC

- Newell Brands (Oster)

- GoWISE USA

- Breville Group Limited

- Arovast Corporation (Cosori)

- Instant Brands Inc.

- Gourmia

Report Scope:

In this report, the United States Air Fryer Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Air Fryer Market, By Product Type:

- Drawer

- Lid

United States Air Fryer Market, By Technology:

- Digital

- Manual

United States Air Fryer Market, By Distribution Channel:

- Supermarkets/Hypermarkets

- Multi-Branded Stores

- Online

- Others

United States Air Fryer Market, By Region:

- South

- West

- Midwest

- Northeast

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Air Fryer Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Koninklijke Philips N.V.

- De’Longhi Group

- Cuisinart

- NuWave, LLC

- Newell Brands (Oster)

- GoWISE USA

- Breville Group Limited

- Arovast Corporation (Cosori)

- Instant Brands Inc.

- Gourmia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 83 |

| Published | September 2025 |

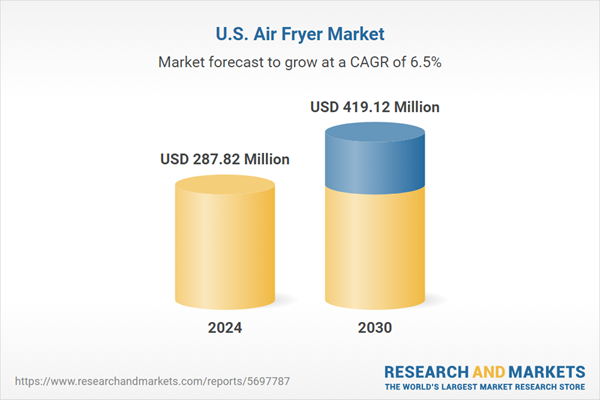

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 287.82 Million |

| Forecasted Market Value ( USD | $ 419.12 Million |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |