Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The global bio-composites market is set for strong, sustained growth, driven by the intersection of sustainability goals, continuous material innovation, and an expanding range of industrial applications. What was once a niche, eco-focused material category is now evolving into a mainstream industrial solution, meeting both environmental commitments and high-performance standards demanded by modern industries.

Key Market Drivers

Rising Demand for Sustainable Materials

Rising demand for sustainable materials is one of the most influential forces driving the expansion of the global bio-composites market, as industries and consumers increasingly prioritize environmental responsibility without compromising on performance or aesthetics. This shift is rooted in growing awareness of climate change, depletion of natural resources, and the harmful impacts of petroleum-based plastics, creating a strong market pull toward renewable, low-carbon alternatives. Bio-composites made from natural fibers such as wood, hemp, flax, jute, or agricultural residues combined with bio-based or recycled polymers offer a compelling solution to these challenges. They not only reduce dependence on fossil fuels but also contribute to lowering greenhouse gas emissions throughout their lifecycle. For businesses seeking to align with Environmental, Social, and Governance (ESG) goals, bio-composites present a strategic opportunity to meet regulatory expectations and enhance brand reputation.In construction, the preference for sustainable materials is driving the use of bio-composites in decking, cladding, roofing, and insulation, where they deliver strength, weather resistance, and longevity alongside a reduced environmental footprint. The automotive sector is adopting them for interior panels, trims, and structural parts to achieve weight reduction, improve fuel efficiency, and comply with stringent emission standards. Consumer goods manufacturers are leveraging bio-composites to design products that appeal to eco-conscious buyers, from furniture and electronics casings to reusable packaging.

The market momentum is further strengthened by regulatory measures such as On July 1, 2022, India implemented a nationwide ban on a range of single-use plastic products, including plastic cutlery, carry bags, and styrofoam food containers. This decisive regulatory action forms a key component of the country’s strategy to curb plastic pollution at its source.

Beyond domestic measures, India has also taken a leadership role on the international stage by introducing a resolution at the United Nations Environment Assembly (UNEA) aimed at establishing a coordinated global framework to tackle plastic pollution, tax incentives for eco-friendly materials, and procurement policies favoring bio-based products. In many developed markets, sustainable materials are no longer a niche preference but a baseline expectation, making bio-composites a natural choice for manufacturers seeking long-term competitiveness. As sustainability continues to transition from a trend to a global business imperative, the rising demand for eco-friendly materials will remain a key growth catalyst for the bio-composites market, accelerating adoption across both established and emerging applications.

Key Market Challenges

High Production Costs Compared to Conventional Materials

One of the primary barriers is that bio-composites often have higher initial production costs than petroleum-based composites or traditional materials. The sourcing of high-quality natural fibers, the use of bio-based polymers, and specialized processing techniques can increase manufacturing expenses. While lifecycle cost advantages such as lower maintenance and recyclability help offset these expenses over time, many industries remain cost-sensitive and prioritize lower upfront prices, particularly in price-competitive markets like packaging and consumer goods. The lack of economies of scale in some regions also keeps prices elevated, limiting adoption in budget-constrained sectors.Key Market Trends

Integration of Bio-Composites in Advanced Manufacturing and 3D Printing

A notable trend is the increasing use of bio-composites in additive manufacturing, particularly 3D printing, for customized, lightweight, and sustainable components. Natural fiber-reinforced bio-polymers are being formulated into printable filaments and powders, enabling on-demand production of parts for automotive interiors, consumer electronics housings, medical devices, and architectural models. This integration supports decentralized manufacturing, reduces material wastage, and allows for rapid prototyping of eco-friendly designs. As 3D printing technology matures, bio-composites are poised to play a key role in producing functional, sustainable products at both small and industrial scales.Key Market Players

- Stora Enso Oyj

- UPM-Kymmene Corporation

- UFP Industries, Inc.

- Natural Fibre Technologies Ltd

- RBT BioComposites

- Fiberwood Oy

- Bcomp Ltd

- JELU-WERK J. Ehrler GmbH & Co. KG

- Hemka

- Norske Skog Saugbrugs

Report Scope:

In this report, the Global Biocomposites Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Biocomposites Market, By Fiber:

- Wood Fibers

- Non-wood Fibers

Biocomposites Market, By Product:

- Wood Plastic Composites

- Natural Fiber Composites

- Hybrid Biocomposites

Biocomposites Market, By Technology:

- Compression Molding

- Injection Molding

- Extrusion

- Resin Transfer Molding

- Pultrusion

- Thermoforming

- Others

Biocomposites Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Biocomposites Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Stora Enso Oyj

- UPM-Kymmene Corporation

- UFP Industries, Inc.

- Natural Fibre Technologies Ltd

- RBT BioComposites

- Fiberwood Oy

- Bcomp Ltd

- JELU-WERK J. Ehrler GmbH & Co. KG

- Hemka

- Norske Skog Saugbrugs

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

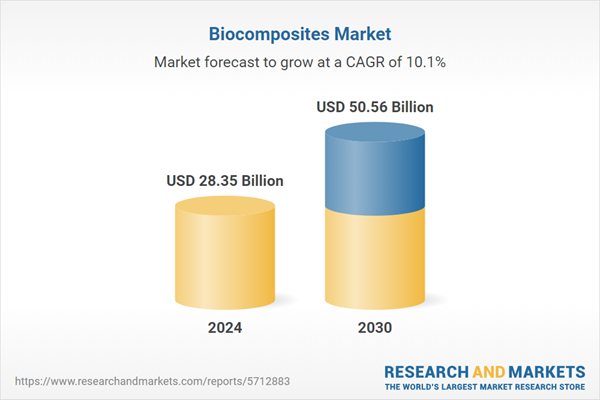

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 28.35 Billion |

| Forecasted Market Value ( USD | $ 50.56 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |