Speak directly to the analyst to clarify any post sales queries you may have.

MARKET TRENDS & DRIVERS

Increasing Usage of Advanced Sensors & Artificial Intelligence in Wearable ECG Devices

a) Artificial intelligence (AI) and wearable sensors are two rapidly evolving healthcare technologies poised to transform cardiac care. Together, these technologies enable high-quality electrocardiogram (ECG) acquisition and automatic signal interpretation with cardiologist-level accuracy. Various arrhythmias, such as atrial fibrillation (AF), are detectable, and their diagnosis has important therapeutic implications and may improve patient outcomes.b) Mobile ECG sensors are integrated into wearable devices like smartwatches (Apple Watch, AliveCor Kardia), patches (iRhythm Zio), bands (Fitbit Sense), necklaces (toSense CoVa), clothing, rings, and other wearable forms. Key considerations for device selection include electrode type and configuration, storage capacity, power consumption, battery life, signal processing electronics, and wireless communication capabilities. Most mobile RM devices use a 1-lead ECG configuration for ease of use, but six or more lead configurations (such as the AliveCor KardiaMobile 6L) are also available. The emergence of advanced sensors, AI, ML, and DL in wearable ECG is boosting the wearable ECG devices market.

The Emergence Of Smartwatches Equipped With ECG

a) One of the biggest health features in smartwatches today is the ECG feature. EKG stands for Electrocardiogram and is sometimes abbreviated as EKG. A medical procedure that measures heart activity to check for abnormalities. An electrocardiogram taken in a hospital would require a more detailed reading. Still, the advantage of equipping smartwatches with similar hardware is that the owner can take an electrocardiogram at any time and provide that data to the doctor. The Apple Watch (Series 4, 5, and 6) features an FDA-cleared ECG app that captures 30-second electrocardiogram segments and then analyzes normal rhythm and AF using the user's smartphone.b) Similarly, the Fitbit Sense is another smartwatch-type device with FDA clearance for AF detection. The Samsung Galaxy Watch3 and Galaxy Watch Active2 also include an FDA-cleared ECG monitoring function that includes screening for AF. With the help of built-in connectivity technologies and apps, smartwatches frequently combine ECG data with monitoring other physiologic indicators. They also feature streamlined data storage and transmission capabilities. Such integration of ECG with smartwatches contributes to the growth of the wearable ECG devices market.

The Paradigm Shift from Conventional ECG Towards Ambulatory ECG

a) Ambulatory monitors enable a new paradigm in healthcare by collecting and analyzing long-term data for a reliable diagnosis. These devices are becoming increasingly popular for continuous cardiac monitoring. Advances in hardware and software have created new devices that are convenient and affordable. This allows vulnerable people to be monitored from the comfort of their own homes while providing critical alerts about events requiring urgent medical attention or hospitalization. The essential advantage of wearable ECG devices is that one can continue daily activities while the heart is being monitored.b) Wearable ambulatory monitoring devices, including Holter monitors, are mainly embedded with electrocardiogram sensors for monitoring irregular heartbeats. It is challenging for the HCPs to detect arrhythmic disorders with conventional ECG due to their characteristic of intermittent short episodes. Holter monitors can overcome the challenge faced by conventional ECG devices of low successful diagnosis outcomes. Owing to the benefits of ambulatory monitoring, wearable ECG devices market players are significantly focusing on developing user-friendly, safe & accurate ambulatory ECG devices. For instance, introducing the latest-generation patch-based Holter monitors can be worn up to a few weeks instead of 24/48 hours while offering the greatest patient comfort.

SEGMENTATION ANALYSIS

INSIGHT BY PRODUCT

The smartwatch-based ECG accounted for the largest share of 83.31% in the global wearable ECG devices market in 2021 under the product segment. The higher share can be attributed to the biggest health feature in smartwatches today, the ECG feature. Apple, a key player in smartwatch-based ECG, released its first smartwatch in 2018 and received FDA clearance for automatic AF detection. Still, smartwatches from other leading players such as Samsung, Withings, and Alphabet (Fitbit) also take ECG recordings and alert the wearer when AF is detected. The process of acquiring an electrocardiogram, analyzing it to produce an automated diagnosis of AF, and providing options for communicating those results to the wearer's physician is similar across smartwatch makers. In September 2022, Apple launched Apple Watch Series 8 and the new Apple Watch SE. The ECG app can record the user’s heartbeat and rhythm using the pioneering electrical heart sensor on the company’s Watch Series 4, Series 5, Series 6, Series 7, Series 8, or ultra and then check the recording for AF, a form of irregular rhythm.Segmentation By Product

- Smartwatch-Based ECG

- Mobile Cardiac Telemetry

- Holter Monitoring

- Cardiac Event Monitoring

INSIGHTS BY FREQUENCY

The global wearable ECG devices market is segmented into episodic & Adhoc and continuous by frequency segmentation. The global wearable ECG devices market by episodic & Adhoc market is expected to reach USD 22.28 billion by 2027, growing at a CAGR of 19.48% during the forecast period. Ad-hoc (i.e., one-time) fixed monitoring has been used in many research studies to address different medical settings using different types of ECG sensors and monitoring platforms. Several investigators emphasized that ad hoc non-ambulatory monitoring may reduce the burden of post-ablation outpatient visits and atrial fibrillation-related hospital visits. As the smartwatch-based ECG is the leading segment and has the largest share, 83.31%, in the global wearable ECG devices market, the episodic & ad hoc segment is also the largest share, 62.36% in the global wearable ECG devices market.Segmentation By Frequency

- Episodic & Adhoc

- Continuous

GEOGRAPHICAL ANALYSIS

a) North America accounted for the largest share of 34.08% in the global wearable ECG devices market in 2021 and is likely to witness the highest incremental growth of around USD 9.01 billion during the forecast period. The US is the major revenue contributor to the North American wearable ECG devices market and accounted for a share of 91.30% in 2021. The growth in the region is mainly attributed to the increasing incidence of AF, CVDs such as CAD, surge in diagnosis procedures for treating such diseases. The availability of advanced wearable ECG devices developers, constant technological innovations, and growing acceptance of technologically advanced wearable ECG devices further accelerate the region's market growth.b) The wearable ECG devices market in APAC is growing significantly and is expected to grow at a similar pace during the forecast period. Some factors contributing to this region’s growth are a large pool of patient population, improvements in healthcare infrastructure, and increased healthcare expenditure. Further, the increasing prevalence of cardiac diseases, including AF, the aging population, and the smart wearable adoption trends among the young generation are the key factors driving the wearable ECG devices market in the region.

c) In 2021, Europe accounted for 25.09% of the global wearable ECG devices market share. The rising awareness of ambulatory ECG devices for AF, and CVDs, coupled with improved healthcare infrastructure, various favorable guidelines, and the availability of technologically advanced ECG-based smartwatches, patch are driving the growth of the wearable ECG devices market in the region. Germany, France, the UK, Italy, and Spain are the major revenue generators in the region. These five countries of the ECG devices market collectively accounted for around 65.03% of the European wearable ECG devices market in 2021.

By Geography

- APAC

- China

- India

- Japan

- South Korea

- Australia

- Europe

- Germany

- Italy

- Spain

- France

- UK

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Turkey

- South Africa

- South Arabia

VENDOR LANDSCAPE

Vendors in the global wearable ECG device market are actively researching and commercializing their novel and advanced wearable ECG device. In the past five years, many vendors received regulatory approvals for their wearable ECG devices. For instance, Withings has received US FDA clearance for the launch of the ScanWatch in the US. The watch was launched in Europe and Australia in 2020 and released in the US in November 2021. In November 2020, VitalConnect, a leader in remote and in-hospital wearable biosensor technology companies, announced that it had launched its VitalPatch RTM cardiac monitoring solution for users who want to expand Holter monitoring. Vendors operating the wearable ECG device market are pursuing various strategies to provide the impetus for growth over the next few years. These market participants adopt collaboration, partnerships, mergers, acquisitions, product launches, and other strategies.Recent Developments In The Global Wearable ECG Devices Market

- In September 2022, Apple launched Apple Watch Series 8 and the new Apple Watch SE.

- In April 2022, Biotricity, a medical diagnostic and healthcare technology player, launched the commercial sales of the Biotres, an FDA-approved wireless wearable extended Holter monitor for Up to 30-day wear duration.

- In 2021, Philips acquired BioTelemetry, a leading vendor in the mobile cardiac telemetry segment.

- In 2021, Boston Scientific acquired Preventice Solutions.

- In December 2021, Baxter International acquired Hill-Rom Services.

ECG-Based Smartwatches: Key Company Profiles

- Apple

- Alphabet

- Samsung Electronics

- Withings

Other Wearable ECG Devices: Key Company Profiles

- Boston Scientific

- GE Healthcare

- iRhythm Technologies

- Hill-Rom

- Koninklijke Philips

- OSI Systems

Other Prominent Vendors

- BPL Medical Technologies

- Bardy Diagnostics

- Bittium

- CardiacSense

- Cortrium

- FUKUDA DENSHI

- Masimo

- Medicalgorithmics

- Advanced Instrumentations

- AMEDTEC MEDIZINTECHNIK AUE

- ASPEL

- Hangzhou Beneware Medical Equipment

- Biotricity

- Borsam Biomedical Instruments

- BTL

- Contec Medical System

- Custo Med

- Oy Diagnostic Devices Development - DDD

- DMS-Service

- EB-Neuro

- Edan Instruments

- Forest Medical

- Holter Supplies

- Labtech

- LPU Medical

- LIVEWELL

- Lumed

- medical ECONET

- Medicomp

- Meditech KFT

- Meditech Equipment

- Midmark

- Monitor

- Nasan Medical Electronics

- Nasiff Associates

- Neurosoft

- Norav Medical

- Northeast Monitoring

- Recorders & Medicare Systems

- Scottcare Cardiovascular Solutions

- Schiller

- Shenzhen Biocare Bio-Medical Equipment

- Suzuken Company

- Trimpeks

- UPOLife

- VivaLNK

KEY QUESTIONS ANSWERED

1. How big is the wearable ECG devices market?2. What is the growth rate of the global wearable ECG devices market?

3. Which region holds the most prominent global wearable ECG devices market share?

4. Who are the global wearable ECG devices market's key players?

5. What are the growth opportunities in the wearable ECG devices market?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.3.1 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Market at a Glance

7 Introduction

7.1 Overview

7.1.1 Wearable Ecg Devices

8 Premium Insights

8.1 Market Scenario

8.1.1 Overview

8.1.2 Market Segmentation

9 Market Opportunities & Trends

9.1 Increasing Use of Advanced Sensors & Ai in Wearable Ecg Devices

9.2 Emergence of Smartwatches Equipped With Ecg

9.3 New Product Approvals & Launches in Wearable Ecg Devices

9.4 Growing Popularity of Smart Wearable Technology in Ecg

10 Market Growth Enablers

10.1 Increasing Global Prevalence of Cardiovascular Diseases

10.2 Paradigm Shift from Conventional Ecg Toward Ambulatory Ecg

10.3 High Demand for Mct & Next-Generation Holter Monitors

11 Market Growth Restraints

11.1 Limitations & Risks Associated With Wearable Ecg Devices

11.2 High Cost of Wearable Ecg Devices

11.3 Availability of Alternate Cardiac Monitoring Devices

12 Market Landscape

12.1 Market Overview

12.2 Market Size & Forecast

12.2.1 Geography Insights

12.2.2 Product Insights

12.2.3 Frequency Insights

12.3 Five Forces Analysis

12.3.1 Threat of New Entrants

12.3.2 Bargaining Power of Suppliers

12.3.3 Bargaining Power of Buyers

12.3.4 Threat of Substitutes

12.3.5 Competitive Rivalry

13 Product

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.3 Smartwatch-Based Ecg

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Market by Geography

13.4 Mobile Cardiac Telemetry

13.4.1 Market Overview

13.4.2 Market Size & Forecast

13.4.3 Market by Geography

13.5 Holter Monitoring

13.5.1 Market Overview

13.5.2 Market Size & Forecast

13.5.3 Market by Geography

13.6 Cardiac Event Monitoring

13.6.1 Market Overview

13.6.2 Market Size & Forecast

13.6.3 Market by Geography

14 Frequency

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.3 Episodic & Adhoc

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Market by Geography

14.4 Continuous

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Market by Geography

15 Geography

15.1 Market Snapshot & Growth Engine

15.2 Geographic Overview

16 North America

16.1 Market Overview

16.1.1 Market Size & Forecast

16.1.2 North America: Product Segmentation

16.1.3 North America: Frequency Segmentation

16.2 Key Countries

16.2.1 Us: Market Size & Forecast

16.2.2 Canada: Market Size & Forecast

17 Europe

17.1 Market Overview

17.1.1 Market Size & Forecast

17.1.2 Europe: Product Segmentation

17.1.3 Europe: Frequency Segmentation

17.2 Key Countries

17.2.1 Germany: Market Size & Forecast

17.2.2 France: Market Size & Forecast

17.2.3 Uk: Market Size & Forecast

17.2.4 Italy: Market Size & Forecast

17.2.5 Spain: Market Size & Forecast

18 Apac

18.1 Market Overview

18.1.1 Market Size & Forecast

18.1.2 Apac: Product Segmentation

18.1.3 Apac: Frequency Segmentation

18.2 Key Countries

18.2.1 Japan: Market Size & Forecast

18.2.2 China: Market Size & Forecast

18.2.3 India: Market Size & Forecast

18.2.4 South Korea: Market Size & Forecast

18.2.5 Australia: Market Size & Forecast

19 Latin America

19.1 Market Overview

19.1.1 Market Size & Forecast

19.1.2 Latin America: Product Segmentation

19.1.3 Latin America: Frequency Segmentation

19.2 Key Countries

19.2.1 Brazil: Market Size & Forecast

19.2.2 Mexico: Market Size & Forecast

19.2.3 Argentina: Market Size & Forecast

20 Middle East & Africa

20.1 Market Overview

20.1.1 Market Size & Forecast

20.1.2 Middle East & Africa: Product Segmentation

20.1.3 Middle East & Africa: Frequency Segmentation

20.2 Key Countries

20.2.1 Turkey: Market Size & Forecast

20.2.2 Saudi Arabia: Market Size & Forecast

20.2.3 South Africa: Market Size & Forecast

21 Competitive Landscape

21.1 Competition Overview

21.2 Market Share Analysis

22 Ecg-Based Smartwatches: Key Company Profiles

22.1 Apple

22.1.1 Business Overview

22.1.2 Apple in Wearable Ecg Devices Market

22.1.3 Product Offerings

22.1.4 Key Strategies

22.1.5 Key Strengths

22.1.6 Key Opportunities

22.2 Alphabet

22.2.1 Business Overview

22.2.2 Alphabet in Wearable Ecg Devices Market

22.2.3 Product Offerings

22.2.4 Key Strategies

22.2.5 Key Strengths

22.2.6 Key Opportunities

22.3 Samsung Electronics

22.3.1 Business Overview

22.3.2 Samsung Electronics in Wearable Ecg Devices Market

22.3.3 Product Offerings

22.3.4 Key Strategies

22.3.5 Key Strengths

22.3.6 Key Opportunities

22.4 Withings

22.4.1 Business Overview

22.4.2 Withings in Wearable Ecg Devices Market

22.4.3 Product Offerings

22.4.4 Key Strategies

22.4.5 Key Strengths

22.4.6 Key Opportunities

23 Other Wearable Ecg Devices: Key Company Profiles

23.1 Boston Scientific

23.1.1 Business Overview

23.1.2 Boston Scientific in Wearable Ecg Devices Market

23.1.3 Product Offerings

23.1.4 Key Strategies

23.1.5 Key Strengths

23.1.6 Key Opportunities

23.2 GE Healthcare

23.2.1 Business Overview

23.2.2 GE Healthcare in Wearable Ecg Devices Market

23.2.3 Product Offerings

23.2.4 Key Strategies

23.2.5 Key Strengths

23.2.6 Key Opportunities

23.3 Irhythm Technologies

23.3.1 Business Overview

23.3.2 Irhythm Technologies in Wearable Ecg Devices Market

23.3.3 Product Offerings

23.3.4 Key Strategies

23.3.5 Key Strengths

23.3.6 Key Opportunities

23.4 Hill-Rom

23.4.1 Business Overview

23.4.2 Hill-Rom in Wearable Ecg Devices Market

23.4.3 Product Offerings

23.4.4 Key Strategies

23.4.5 Key Strengths

23.4.6 Key Opportunities

23.5 Koninklijke Philips

23.5.1 Business Overview

23.5.2 Koninklijke Philips in Wearable Ecg Devices Market

23.5.3 Product Offerings

23.5.4 Key Strategies

23.5.5 Key Strengths

23.5.6 Key Opportunities

23.6 Osi Systems

23.6.1 Business Overview

23.6.2 Osi Systems in Wearable Ecg Devices Market

23.6.3 Product Offerings

23.6.4 Key Strategies

23.6.5 Key Strengths

23.6.6 Key Opportunities

24 Other Prominent Vendors

24.1 Aerotel Medical Systems

24.1.1 Business Overview

24.1.2 Product Offerings

24.2 Advanced Instrumentations

24.2.1 Business Overview

24.2.2 Product Offerings

24.3 Amedtec Medizintechnik Aue

24.3.1 Business Overview

24.3.2 Product Offerings

24.4 Aspel

24.4.1 Business Overview

24.4.2 Product Offerings

24.5 Bpl Medical Technologies

24.5.1 Business Overview

24.5.2 Product Offerings

24.6 Bardy Diagnostics

24.6.1 Business Overview

24.6.2 Product Offerings

24.7 Bittium

24.7.1 Business Overview

24.7.2 Product Offerings

24.8 Biotricity

24.8.1 Business Overview

24.8.2 Product Offerings

24.9 Borsam Biomedical Instruments

24.9.1 Business Overview

24.9.2 Product Offerings

24.10 Btl

24.10.1 Business Overview

24.10.2 Product Offerings

24.11 Cardiacsense

24.11.1 Business Overview

24.11.2 Product Offerings

24.12 Cortrium

24.12.1 Business Overview

24.12.2 Product Offerings

24.13 Contec Medical Systems

24.13.1 Business Overview

24.13.2 Product Offerings

24.14 Custo Med

24.14.1 Business Overview

24.14.2 Product Offerings

24.15 Dms-Service

24.15.1 Business Overview

24.15.2 Product Offerings

24.16 Eb Neuro

24.16.1 Business Overview

24.16.2 Product Offerings

24.17 Edan Instruments

24.17.1 Business Overview

24.17.2 Product Offerings

24.18 Fukuda Denshi

24.18.1 Business Overview

24.18.2 Product Offerings

24.19 Forest Medical

24.19.1 Business Overview

24.19.2 Product Offerings

24.20 Hangzhou Beneware Medical Equipment

24.20.1 Business Overview

24.20.2 Product Offerings

24.21 Holter Supplies

24.21.1 Business Overview

24.21.2 Product Offerings

24.22 Labtech

24.22.1 Business Overview

24.22.2 Product Offerings

24.23 Lepu Medical Technology

24.23.1 Product Offerings

24.24 Livewell

24.24.1 Business Overview

24.24.2 Product Offerings

24.25 Lumed

24.25.1 Business Overview

24.25.2 Product Offerings

24.26 Masimo

24.26.1 Business Overview

24.26.2 Product Offerings

24.27 Medicalgorithmics

24.27.1 Business Overview

24.27.2 Product Offerings

24.28 Medical Econet

24.28.1 Business Overview

24.28.2 Product Offerings

24.29 Medicomp

24.29.1 Business Overview

24.29.2 Product Offerings

24.30 Meditech Kft

24.30.1 Business Overview

24.30.2 Product Offerings

24.31 Meditech Equipment

24.31.1 Business Overview

24.31.2 Product Offerings

24.32 Midmark

24.32.1 Business Overview

24.32.2 Product Offerings

24.33 Monitor

24.33.1 Business Overview

24.33.2 Product Offerings

24.34 Nasan Medical Electronics

24.34.1 Business Overview

24.34.2 Product Offerings

24.35 Nasiff Associates

24.35.1 Business Overview

24.35.2 Product Offerings

24.36 Neurosoft

24.36.1 Business Overview

24.36.2 Product Offerings

24.37 Norav Medical

24.37.1 Business Overview

24.37.2 Product Offerings

24.38 Northeast Monitoring

24.38.1 Business Overview

24.38.2 Product Offerings

24.39 Oy Diagnostic Devices Development - Ddd

24.39.1 Business Overview

24.39.2 Product Offerings

24.40 Recorders & Medicare Systems

24.40.1 Business Overview

24.40.2 Product Offerings

24.41 Scottcare Cardiovascular Solutions

24.41.1 Business Overview

24.41.2 Product Offerings

24.42 Schiller

24.42.1 Business Overview

24.42.2 Product Offerings

24.43 Shenzhen Biocare Bio-Medical Equipment

24.43.1 Business Overview

24.43.2 Product Offerings

24.44 Suzuken Company

24.44.1 Business Overview

24.44.2 Product Offerings

24.45 Trimpeks

24.45.1 Business Overview

24.45.2 Product Offerings

24.46 Upolife

24.46.1 Business Overview

24.46.2 Product Offerings

24.47 Vivalnk

24.47.1 Business Overview

24.47.2 Product Offerings

25 Report Summary

25.1 Key Takeaways

25.2 Strategic Recommendations

26 Quantitative Summary

26.1 Market by Product

26.1.1 North America: Product Segmentation

26.1.2 Europe: Product Segmentation

26.1.3 Apac: Product Segmentation

26.1.4 Latin America: Product Segmentation

26.1.5 Middle East & Africa: Product Segmentation

26.2 Market by Frequency

26.2.1 North America: Frequency Segmentation

26.2.2 Europe: Frequency Segmentation

26.2.3 Apac: Frequency Segmentation

26.2.4 Latin America: Frequency Segmentation

26.2.5 Middle East & Africa: Frequency Segmentation

26.3 Market by Geography

26.3.1 Smartwatch-Based Ecg: Geography Segmentation

26.3.2 Mobile Cardiac Telemetry: Geography Segmentation

26.3.3 Holter Monitoring: Geography Segmentation

26.3.4 Cardiac Event Monitoring: Geography Segmentation

26.3.5 Episodic & Adhoc: Geography Segmentation

26.3.6 Continuous: Geography Segmentation

27 Appendix

27.1 Abbreviations

Companies Mentioned

- Apple

- Alphabet

- Samsung Electronics

- Withings

- Boston Scientific

- GE Healthcare

- iRhythm Technologies

- Hill-Rom

- Koninklijke Philips

- OSI Systems

- BPL Medical Technologies

- Bardy Diagnostics

- Bittium

- CardiacSense

- Cortrium

- FUKUDA DENSHI

- Masimo

- Medicalgorithmics

- Advanced Instrumentations

- AMEDTEC MEDIZINTECHNIK AUE

- ASPEL

- Hangzhou Beneware Medical Equipment

- Biotricity

- Borsam Biomedical Instruments

- BTL

- Contec Medical System

- Custo Med

- Oy Diagnostic Devices Development - DDD

- DMS-Service

- EB-Neuro

- Edan Instruments

- Forest Medical

- Holter Supplies

- Labtech

- LPU Medical

- LIVEWELL

- Lumed

- medical ECONET

- Medicomp

- Meditech KFT

- Meditech Equipment

- Midmark

- Monitor

- Nasan Medical Electronics

- Nasiff Associates

- Neurosoft

- Norav Medical

- Northeast Monitoring

- Recorders & Medicare Systems

- Scottcare Cardiovascular Solutions

- Schiller

- Shenzhen Biocare Bio-Medical Equipment

- Suzuken Company

- Trimpeks

- UPOLife

- VivaLNK

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

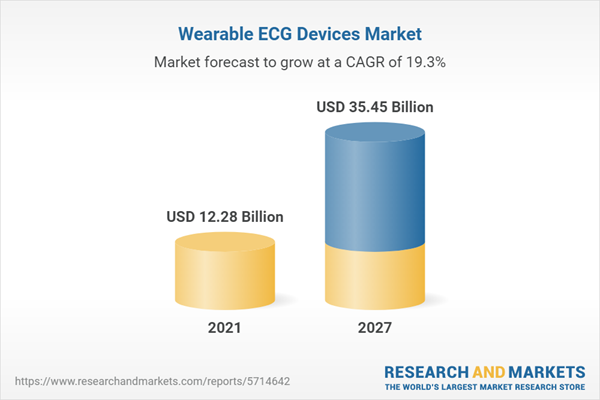

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | January 2023 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 12.28 Billion |

| Forecasted Market Value ( USD | $ 35.45 Billion |

| Compound Annual Growth Rate | 19.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 56 |