Holter ECG Market

The Holter ECG market covers ambulatory cardiac monitoring solutions that continuously capture multi-lead ECG for 24 hours to several days, including compact wearable recorders, patch-based single/dual-lead devices, multi-channel digital recorders, lead wires/electrodes, docking/upload stations, analysis software with arrhythmia detection, and reporting workflows integrated with cardiology information systems and EHRs. Demand is propelled by rising prevalence of atrial fibrillation and intermittent arrhythmias, expanded screening of cryptogenic stroke and syncope, and the shift to outpatient diagnostics that relieve hospital bottlenecks. Vendors differentiate on wearability (profile, adhesive comfort, shower resistance), signal fidelity under motion, battery/runtime, automated analytics (PVC/AF/AFL, pauses, ST-trend), and report turnaround enabled by cloud pipelines and certified technician over-reads. Care models are evolving from traditional 24/48-hour Holter toward extended wear and event solutions, with triage protocols that match suspicion level and symptom frequency to device duration, while reimbursement and operational simplicity still anchor classic Holter usage for many indications. Provider priorities include end-to-end workflow (kit logistics, patient onboarding, remote tech support), data security, and integration that reduces double entry and speeds final signature. Barriers remain around skin tolerance for long wear, artifact from high activity, and variability in automated calls that necessitates expert review. Competitive intensity spans established cardiology OEMs, remote cardiac monitoring service providers, and digital health entrants bundling devices with reading services. Over the horizon, continuous improvements in low-noise electronics, AI-assisted adjudication, and hybrid “Holter-plus-telemetry” service models will expand addressable use cases, enabling faster rule-in/rule-out decisions across primary care, neurology, and peri-procedural pathways.Holter ECG Market Key Insights

- Clinical pathways drive device choice: Clear triage algorithms (24/48-hour Holter for frequent symptoms; extended wear/event for elusive episodes) optimize diagnostic yield and reduce repeat testing, aligning modality to pre-test probability and clinic throughput.

- Wearability and adherence = data quality: Low-profile recorders, skin-friendly adhesives, and waterproofing reduce drop-outs and motion artifacts; patient education, quick start guides, and 24/7 support materially improve analyzable hours.

- Signal fidelity under motion is decisive: High-resolution ADCs, motion-tolerant filtering, and secure lead placement templates preserve P-wave visibility and ST trends in daily living - critical for AF burden, pauses, and ischemia screening.

- AI augments tech review, not replaces it: Robust arrhythmia pre-classification, artifact suppression, and episode clustering speed technician over-read and cardiologist sign-off; human-in-the-loop adjudication and audit trails maintain trust.

- End-to-end workflow beats device specs: Frictionless ordering, kit logistics, auto-notify when uploads complete, and EHR-embedded structured reports cut days from turnaround and lift provider satisfaction more than marginal hardware gains.

- Home-first operations lower total cost: Mail-to-patient and curbside pickup models minimize clinic visits; remote onboarding and adhesive troubleshooting reduce re-fits and postage waste while sustaining analyzable wear time.

- Service models shape ROI: Hospitals decide between owning equipment with in-house readers vs. partnering with remote monitoring services; transparent SLAs, over-read quality, and predictable per-study economics drive contracts.

- Cybersecurity and privacy are table stakes: Encrypted devices, secure cloud transfer, role-based access, and tamper-evident chains of custody protect PHI; compliance documentation shortens IT approvals, especially in multi-site systems.

- Interoperability compounds value: DICOM-waveform/HL7/FHIR deliver discrete results, PDF narratives, and billing cues directly into cardiology systems, avoiding “portal fatigue” and enabling population analytics on arrhythmia prevalence and burden.

- Beyond cardiology, new users emerge: Neurology (post-stroke AF detection), electrophysiology pre/post-ablation, sports cardiology, and occupational health expand indications; bundled pathways with BP/SpO₂/activity open richer insights on triggers.

Holter ECG Market Reginal Analysis

North America

High ambulatory cardiology volumes and mature remote monitoring networks sustain demand for both classic Holter and extended-wear programs. Providers emphasize rapid TAT, EHR integration, and home-first kit logistics. Consolidated health systems favor enterprise agreements with clear SLAs, audit trails, and flexible staffing models (in-house vs. outsourced over-read). Consumer familiarity with wearables supports patient adherence, while privacy and cybersecurity reviews shape procurement timelines.Europe

Guideline-driven care, national e-health infrastructure, and data-protection norms favor vendors with strong interoperability and documentation. Hospitals and community cardiology share pathways, often coupling Holter with event monitoring for elusive AF. Public tenders highlight quality systems, service coverage, and multilingual patient support. Emphasis on reusable recorders with hygienic turn-around and eco-conscious packaging aligns with sustainability goals.Asia-Pacific

Large, aging populations and urbanization drive rapid growth in ambulatory diagnostics. Price bands range from value Holter recorders to advanced patch ecosystems with cloud analytics. Regional service providers differentiate via fast reporting and multilingual onboarding. Integration with super-app health platforms and telecardiology expands reach into primary care; local manufacturing and distributor support are important for scale and service continuity.Middle East & Africa

Flagship hospitals and expanding private cardiology networks adopt turnkey Holter solutions with remote over-read to address specialist shortages. Reliability, simple patient instructions, and robust adhesives for hot climates are key. Procurement favors vendors with onsite training, Arabic/English reporting, and responsive swap-out logistics. National initiatives around NCDs encourage scale-up of ambulatory screening programs.South & Central America

Growing cardiovascular screening and stroke workups in urban centers lift adoption. Budget variability drives preference for durable, easy-to-service recorders paired with regional reading centers or SaaS analysis. Spanish/Portuguese patient materials, straightforward kit returns, and integration with local EMR platforms improve completion rates. Public-private partnerships and payor pilots support wider access in primary care networks.Holter ECG Market Segmentation

By Product

- Wired Holter ECG Monitors

- Wireless Holter ECG Monitors

- Software

By Lead Type

- 12-lead

- 3-lead

- Patch Type 1-lead

- 6-lead

- Others

By End-User

- Hospitals and Specialty Clinics

- Ambulatory Surgical Centers

- Others

Key Market players

GE HealthCare, Philips, Medtronic, Nihon Kohden, Schiller AG, Spacelabs Healthcare, Hillrom (Baxter) - Welch Allyn, Edan Instruments, Mindray, Fukuda Denshi, BPL Medical Technologies, Cardioline, Norav Medical, NorthEast Monitoring, Bionet Co., Ltd.Holter ECG Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Holter ECG Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Holter ECG market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Holter ECG market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Holter ECG market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Holter ECG market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Holter ECG market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Holter ECG value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Holter ECG industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Holter ECG Market Report

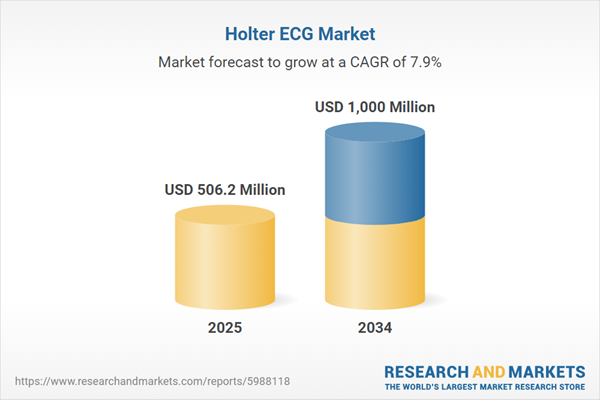

- Global Holter ECG market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Holter ECG trade, costs, and supply chains

- Holter ECG market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Holter ECG market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Holter ECG market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Holter ECG supply chain analysis

- Holter ECG trade analysis, Holter ECG market price analysis, and Holter ECG supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Holter ECG market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- GE HealthCare

- Philips

- Medtronic

- Nihon Kohden

- Schiller AG

- Spacelabs Healthcare

- Hillrom (Baxter) – Welch Allyn

- Edan Instruments

- Mindray

- Fukuda Denshi

- BPL Medical Technologies

- Cardioline

- Norav Medical

- NorthEast Monitoring

- Bionet Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 506.2 Million |

| Forecasted Market Value ( USD | $ 1000 Million |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |