Growth of E-commerce & Logistics Sector Boosts Asia Pacific Slip and Tier Sheets Market

The logistics industry growth is attributed to rising demand for e-commerce and online shopping, rapid expansion of various sectors such as the retail sector, and various government initiatives on infrastructure development. In the last few years, e-commerce has grown exponentially, and companies such as Amazon, Walmart, and Alibaba have ensured that customers receive their required products using e-commerce platforms on their smartphones.The high preference for online shopping is leading to a huge increase in demand for logistics services. Due to the growth of online grocery shopping, many logistics companies are experiencing a significant need for their services. Moreover, the high number of last-mile and express deliveries and the implementation of reverse logistics are influencing the global expansion of the logistics industry.

The growth of the e-commerce sector has allowed the logistics industry to branch out and diversify its operations. During the COVID-19 pandemic, many people preferred online shopping. The e-commerce industry is driving the road freight transport sector across the region. Further, the growing demand for food and beverages, pharmaceuticals, chemicals, and electronics positively impacts the logistics industry.

In India, the expansion of the warehousing and logistics industry is likely to be aided by a robust economy, government efforts to improve infrastructure, and a favorable business environment. The logistics industry in India is growing due to technological advancements and the flourishing e-commerce market. According to the India Brand Equity Foundation, the logistics sector in India is predicted to account for 14.4% of the GDP. An increase in e-commerce leads to expanded operations to meet increased demand. Consumers are demanding convenience through last-mile connectivity, ease of returns, and other value-added services. The expansion of Direct-to-Consumer (D2C) brands is also demanding end-to-end logistics services.

Slip and tier sheets find application in the transportation of various products, including food, beverage, consumer goods, chemicals, and pharmaceutical products. The use of slip and tier sheets offers many logistical advantages such as cost-effectiveness, maximizing space for shipping & storage, and being environmentally friendly. Therefore, the growing e-commerce & logistics sector in different countries across the globe is increasing the use of slip and tier sheets, which is driving the slip and tier sheet market growth.

Asia Pacific Slip and Tier Sheets Market Overview

The Asia Pacific region is one of the major regions for the slip and tier sheet market owing to the growth of the retail, food and beverage, pharmaceuticals, consumer electronics, and many other industries. Also, the rise in foreign direct investments leads to regional economic growth. Government initiatives and policies, such as Make-in-India, encourage the setup of different manufacturing plants in India. Further, manufacturers in Asia Pacific are shifting toward cost-effective and sustainable packaging materials. This is also fueling the demand for slip and tier sheets.Asia Pacific is a global hub for the manufacturing and exporting of technical consumer goods (TCG), including many consumer electronics such as mobile phones, laptops & computers, radio sets, sound systems, and television sets; essential electronic parts; and small and big domestic appliances. Thailand is one of the major manufacturers of consumer electronics across Southeast Asia. The strong presence of the consumer electronics industry in the region drives the demand for slip and tier sheets.

The growing online retail sector is also positively impacting the demand for slip and tier sheets in the Asia Pacific region. The factors driving the growth of the online retail sector are the rising number of people shopping online and the increasing sales of fashion and beauty, electronics, snack foods, home appliances, and sports and leisurewear products through online channels.

In recent years, the major market players in the region have invested heavily in R&D initiatives. This significant increase in investments in research and development is expected to propel the slip and tier sheet market growth in Asia Pacific during the forecast period.

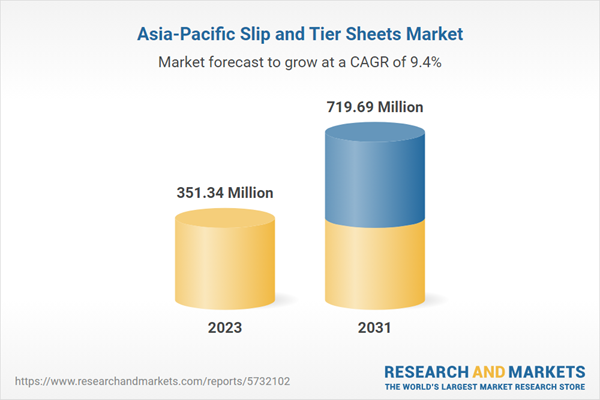

Asia Pacific Slip and Tier Sheets Market Revenue and Forecast to 2031 (US$ Thousand)

Asia Pacific Slip and Tier Sheets Market Segmentation

The Asia Pacific slip and tier sheets market is categorized into material, end-use industry, and country.Based on material, the Asia Pacific slip and tier sheets market is segmented into kraft paperboard, corrugated fiberboard, high density polyethylene (HDPE), and others. The kraft paperboard segment held the largest share of Asia Pacific slip and tier sheets market share in 2023.

In terms of end-use industry, the Asia Pacific slip and tier sheets market is categorized into food & beverage, consumer electronics, chemicals, pharmaceuticals, retail, and others. The food & beverage segment held the largest share of Asia Pacific slip and tier sheets market in 2023.

By country, the Asia Pacific slip and tier sheets market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific slip and tier sheets market share in 2023.

Fresh Pak Corp, International Paper Co, Georgia-Pacific LLC, Signode Industrial Group LLC, WestRock Co, Crown Paper Converting, Eltete TPM Oy, and Sonoco Products Co are some of the leading companies operating in the Asia Pacific slip and tier sheets market.

Reasons to buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific slip and tier sheet market.

- Highlights key business priorities to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific slip and tier sheet market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific slip and tier sheet market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Asia Pacific Slip and Tier Sheets Market include:- Fresh Pak Corp

- International Paper Co

- Georgia-Pacific LLC

- Signode Industrial Group LLC

- WestRock Co

- Crown Paper Converting

- Eltete TPM Oy

- Sonoco Products Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 127 |

| Published | February 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 351.34 Million |

| Forecasted Market Value ( USD | $ 719.69 Million |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 9 |