The growing healthcare sector is projected to have a positive impact on the packaging equipment sector since it is widely used for the packing of capsules, tablets, liquids, and antiseptic creams, among others. Moreover, R&D in the pharmaceutical industry for developing new generic medicines and over-the-counter medicines is further expected to propel industry growth.

The growing demand for pharmaceutical products including oral and topical is likely to drive the demand for efficient pharmaceutical packaging machinery across the globe. The manufacturers are expected to expand their manufacturing capacities to cater to this increased demand, which is likely to aid in new product development and the introduction of novel packaging technologies.

The COVID-19 vaccination packaging requirement provided a significant opportunity for pharmaceutical packaging firms. Due to COVID-19, the restrictions imposed on the movements of people led to significant demand for home deliveries of pharmaceutical products. This resulted in larger demand for pharmaceutical solutions and pharmaceutical packaging throughout the global pandemic. The above mention factors will positively influence the pharmaceutical packaging equipment industry.

Several packaging equipment manufacturers have undertaken R&D initiatives to produce highly sophisticated and efficient equipment at competitive prices. Furthermore, there is a continued demand for complete packing lines that can incorporate numerous functions from a single source and for modular machines that can offer flexibility driven by the increased variety of packing materials and styles. For instance, in 2022, Romaco showed its latest technologies for granulating and tableting nutraceuticals and pharmaceuticals at Vitafoods Europe.

Pharmaceutical Packaging Equipment Market Highlights

- Wrapping machine segment is anticipated to progress at a CAGR of 7.1% over the forecast period on account of the growing need for secondary and tertiary packaging of pharma products

- Asia Pacific emerged as the leading regional market and accounted for 38.5% of the overall revenue share in 2022, owing to the expanding pharmaceutical manufacturing in India and China

- Europe emerged as the second-largest regional market and held a share of 27.4% in terms of revenue in 2022. This can be attributed to the high demand for highly automated, flexible, and efficient packing solutions

- The Drug Quality and Security Act (DQSA), which requires pharmaceutical products to have serialized coding, is anticipated to propel the demand for packing equipment further

- Key participants are majorly investing in innovative technologies like robotics, big data, and Human Machine Interface (HMI) to produce highly productive and efficient machines

- In September 2018, Robert Bosch Packaging Technology agreed to form a partnership with ASPIRx Ltd. (located in Ghana) to produce pharmaceuticals. The role of Bosch Packaging Technology in this partnership was to design and provide a multi-purpose system, which will manufacture and package both solid and liquid pharmaceuticals

Table of Contents

Chapter 1. Methodology and Scope1.1. Research Methodology

1.2. Research Scope & Assumption

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Pharmaceutical Packaging Equipment Market Variables, Trends & Scope

3.1. Market Segmentation & Scope

3.2. Penetration and Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.4. Technology Overview

3.5. Regulatory Framework

3.6. Market Dynamics

3.6.1. Market Driver Analysis

3.6.2. Market Restraint Analysis

3.6.3. Industry Challenges

3.6.4. Industry Opportunities

3.7. Business Environment Analysis: Pharmaceutical Packaging Equipment Market

3.7.1. Industry Analysis - Porter’s

3.7.1.1. Supplier Power

3.7.1.2. Buyer power

3.7.1.3. Threat of substitutes

3.7.1.4. Threat of new entrants

3.7.1.5. Competitive rivalry

3.7.2. PESTEL Analysis

3.7.2.1. Political Landscape

3.7.2.2. Economic Landscape

3.7.2.3. Social Landscape

3.7.2.4. Technological Landscape

3.7.2.5. Environmental Landscape

3.7.2.6. Legal Landscape

3.8. COVID-19 Impact Analysis

Chapter 4. Pharmaceutical Packaging Equipment Market: Machine Type Estimates & Trend Analysis

4.1. Machine Type Movement Analysis & Market Share, 2022 & 2030

4.2. Filling

4.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.3. Labelling

4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.4. Form Fill & Seal

4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.5. Cartoning

4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.6. Wrapping

4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.7. Palletizing

4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.8. Cleaning

4.8.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

4.9. Others

4.9.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Pharmaceutical Packaging Equipment Market: Regional Estimates & Trend Analysis

5.1. Regional Movement Analysis & Market Share, 2022 & 2030

5.2. North America

5.2.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.2.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.2.3. U.S.

5.2.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.2.3.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.2.4. Canada

5.2.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.2.4.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.2.5. Mexico

5.2.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.2.5.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.2.5.2.1. Market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

5.2.5.3. Market estimates and forecasts, by sample, 2018 - 2030 (USD Billion)

5.2.5.4. Market estimates and forecasts, by target-tested, 2018 - 2030 (USD Billion)

5.2.5.5. Market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

5.3. Europe

5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.3.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.3.3. Germany

5.3.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.3.3.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.3.4. Russia

5.3.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.3.4.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.3.5. U.K.

5.3.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.3.5.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.3.6. Spain

5.3.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.3.6.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.3.7. Italy

5.3.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.3.7.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.4. Asia Pacific

5.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.4.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.4.3. China

5.4.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.4.3.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.4.4. Japan

5.4.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.4.4.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.4.5. South Korea

5.4.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.4.5.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.4.6. India

5.4.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.4.6.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.4.7. Australia

5.4.7.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.4.7.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.5. Central & South America

5.5.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.5.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.5.3. Brazil

5.5.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.5.3.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.6. Middle East & Africa

5.6.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.6.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.6.3. Saudi Arabia

5.6.3.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.6.3.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

5.6.4. United Arab Emirates

5.6.4.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

5.6.4.2. Market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Chapter 6. Pharmaceutical Packaging Equipment Market - Competitive Analysis

6.1. Key global players & recent developments & their impact on the industry

6.2. Key Company/Competition Categorization

6.3. Vendor Landscape

6.4. Public Companies

6.4.1. Company market position analysis

6.5. Private companies

6.5.1. List of key emerging companies and their geographical presence

Chapter 7. Company Profiles

7.1. Robert Bosch

7.1.1. Company Overview

7.1.2. Financial Performance

7.1.3. Product Benchmarking

7.1.4. Strategic Initiatives

7.2. Romaco Holding

7.2.1. Company Overview

7.2.2. Financial Performance

7.2.3. Product Benchmarking

7.2.4. Strategic Initiatives

7.3. Marchesini Group

7.3.1. Company Overview

7.3.2. Financial Performance

7.3.3. Product Benchmarking

7.3.4. Strategic Initiatives

7.4. Korber AG

7.4.1. Company Overview

7.4.2. Financial Performance

7.4.3. Product Benchmarking

7.4.4. Strategic Initiatives

7.5. I.M.A. Industria Macchine Automatiche S.p.A.

7.5.1. Company Overview

7.5.2. Financial Performance

7.5.3. Product Benchmarking

7.5.4. Strategic Initiatives

7.6. Uhlmann Group

7.6.1. Company Overview

7.6.2. Financial Performance

7.6.3. Product Benchmarking

7.6.4. Strategic Initiatives

7.7. Accutek Packaging Equipment Companies

7.7.1. Company Overview

7.7.2. Financial Performance

7.7.3. Product Benchmarking

7.7.4. Strategic Initiatives

7.8. Bausch + Ströbel

7.8.1. Company Overview

7.8.2. Financial Performance

7.8.3. Product Benchmarking

7.8.4. Strategic Initiatives

7.9. Coesia

7.9.1. Company Overview

7.9.2. Financial Performance

7.9.3. Product Benchmarking

7.9.4. Strategic Initiatives

7.10. Vanguard Pharmaceuticals Equipment

7.10.1. Company Overview

7.10.2. Financial Performance

7.10.3. Product Benchmarking

7.10.4. Strategic Initiatives

7.11. MULTIVAC Group

7.11.1. Company Overview

7.11.2. Financial Performance

7.11.3. Product Benchmarking

7.11.4. Strategic Initiatives

7.12. OPTIMA Packaging Group

7.12.1. Company Overview

7.12.2. Financial Performance

7.12.3. Product Benchmarking

7.12.4. Strategic Initiatives

7.13. ACG Worldwide

7.13.1. Company Overview

7.13.2. Financial Performance

7.13.3. Product Benchmarking

7.13.4. Strategic Initiatives

7.14. BREVETTI CEA S.P.A

7.14.1. Company Overview

7.14.2. Financial Performance

7.14.3. Product Benchmarking

7.14.4. Strategic Initiatives

7.15. GEA Group Aktiengesellschaft

7.15.1. Company Overview

7.15.2. Financial Performance

7.15.3. Product Benchmarking

7.15.4. Strategic Initiatives

List of Tables

Table 1 Pharmaceutical packaging equipment market estimates and forecasts by filling, 2018 - 2030 (USD Billion)

Table 2 Pharmaceutical packaging equipment market estimates and forecasts by labeling, 2018 - 2030 (USD Billion)

Table 3 Pharmaceutical packaging equipment market estimates and forecasts by form fill & seal, 2018 - 2030 (USD Billion)

Table 4 Pharmaceutical packaging equipment market estimates and forecasts by cartoning, 2018 - 2030 (USD Billion)

Table 5 Pharmaceutical packaging equipment market estimates and forecasts by wrapping, 2018 - 2030 (USD Billion)

Table 6 Pharmaceutical packaging equipment market estimates and forecasts by palletizing, 2018 - 2030 (USD Billion)

Table 7 Pharmaceutical packaging equipment market estimates and forecasts by cleaning, 2018 - 2030 (USD Billion)

Table 8 Pharmaceutical packaging equipment market estimates and forecasts by others, 2018 - 2030 (USD Billion)

Table 9 North America pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 10 North America pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 11 North America pharmaceutical packaging equipment market estimates and forecasts, by sample, 2018 - 2030 (USD Billion)

Table 12 U.S. pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 13 U.S. pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 14 Canada pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 15 Canada pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 16 Mexico pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 17 Mexico pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 18 Europe pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 19 Europe pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 20 Germany pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 21 Germany pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 22 Russia pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 23 Russia pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 24 U.K. pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 25 U.K. pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 26 Spain pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 27 Spain pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 28 Italy pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 29 Italy pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 30 Asia Pacific pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 31 Asia Pacific pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 32 China pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 33 China pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 34 Japan pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 35 Japan pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 36 South Korea pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 37 South Korea pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 38 India pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 39 India pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 40 Australia pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 41 Australia pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 42 Central & South America pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 43 Central & South America pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 44 Brazil pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 45 Brazil pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 46 Middle East & Africa pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 47 Middle East & Africa pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 48 Saudi Arabia pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 49 Saudi Arabia pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

Table 50 United Arab Emirates pharmaceutical packaging equipment market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 51 United Arab Emirates pharmaceutical packaging equipment market estimates and forecasts, by machine type, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Primary Research Process

Fig. 4 Market Research Approaches - Bottom-Up Approach

Fig. 5 Market Research Approaches - Top-Down Approach

Fig. 6 Market Research Approaches - Combined Approach

Fig. 7 Market Outlook

Fig. 8 Segmental Outlook

Fig. 9 Competitive Insights

Fig. 10 Market Segmentation & Scope

Fig. 11 Value Chain Analysis

Fig. 12 Market Driver Analysis

Fig. 13 Market Restraint Analysis

Fig. 14 Market Opportunity Analysis

Fig. 15 Market Challenges Analysis

Fig. 16 Pharmaceutical Packaging Equipment Market: Machine Type Movement Analysis, 2022 & 2030

Fig. 17 Key Company/Competition Categorization

Fig. 18 Competitive Dashboard Analysis

Fig. 19 Company Market Position Analysis

Companies Mentioned

- Robert Bosch

- Romaco Holding

- Marchesini Group

- Korber AG

- I.M.A. Industria Macchine Automatiche S.p.A.

- Uhlmann Group

- Accutek Packaging Equipment Companies

- Bausch + Ströbel

- Coesia

- Vanguard Pharmaceuticals Equipment

- MULTIVAC Group

- OPTIMA Packaging Group

- ACG Worldwide

- BREVETTI CEA S.P.A

- GEA Group Aktiengesellschaft

Table Information

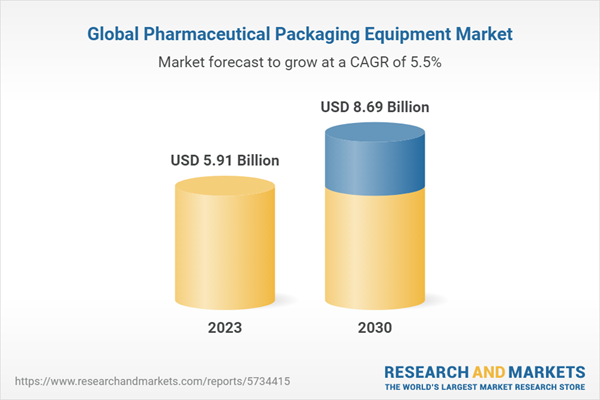

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | January 2023 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 5.91 Billion |

| Forecasted Market Value ( USD | $ 8.69 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |