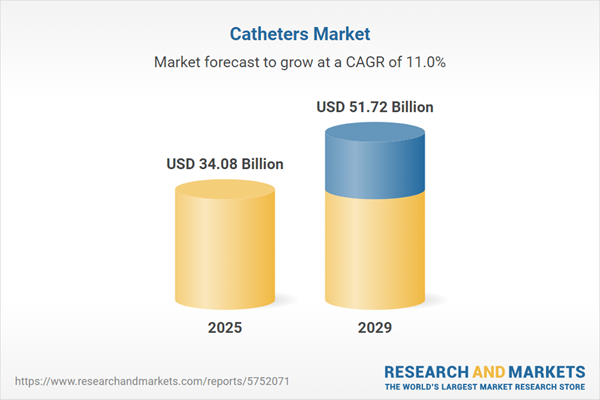

The catheters market size has grown strongly in recent years. It will grow from $31.65 billion in 2024 to $34.08 billion in 2025 at a compound annual growth rate (CAGR) of 7.7%. The growth in the historic period can be attributed to the increasing aging population, prevalence of chronic diseases, shift toward minimally invasive surgical procedures, increased awareness and treatment of urinary incontinence, and expansion of healthcare infrastructure.

The catheters market size is expected to see rapid growth in the next few years. It will grow to $51.72 billion in 2029 at a compound annual growth rate (CAGR) of 11%. The growth in the forecast period can be attributed to increased use of telemedicine and remote patient monitoring, focus on personalized medicine, utilization of regenerative medicine techniques, increasing shift towards patient-centric care, and growing emphasis on sustainable and eco-friendly catheter materials. Major trends in the forecast period include integration of artificial intelligence (ai) and robotics in catheter-based procedures, development of advanced infection control technologies, technological advancements, product innovations, and adoption of iot.

The increasing prevalence of cardiovascular disorders is anticipated to drive the growth of the catheters market in the coming years. Cardiac catheterization is a procedure that involves threading a catheter through a blood vessel to the heart for improved diagnosis of health conditions. The rise in the incidence of cardiovascular diseases and the growing demand for cardiovascular treatments are expected to boost the need for catheters. For example, in May 2024, the Centers for Disease Control and Prevention, a national public health agency based in Georgia, reported that in 2022, heart disease accounted for 702,880 deaths, which is one in every five fatalities. This means that someone dies from cardiovascular disease every 33 seconds. Annually, around 805,000 individuals in the United States experience a heart attack; of these, 605,000 are experiencing their first heart attack, while 200,000 are repeat patients. Therefore, the rising prevalence of cardiovascular disorders is driving the growth of the catheter market during the forecast period.

Additionally, the catheters market is expected to benefit from the increasing incidence of neurological conditions. Neurological problems affecting the brain, nerves, and spinal cord necessitate interventions using specialized catheters like neurovascular catheters. These catheters play a crucial role in both diagnosis and treatment during neurovascular procedures. According to a 2022 report from the World Health Organization, one in four people over the age of 25 is projected to experience a stroke during their lifetime. With 13.7 million individuals facing their first stroke each year, and 5.5 million succumbing to it, neurological conditions are a significant driver for the catheters market.

A prominent trend in the catheter market is the rise of strategic collaborations between companies. To enhance research and development efforts for innovative products and bolster market share, companies in the catheter market are engaging in strategic partnerships. An illustrative example is the collaboration between CEMMA, a China-based advanced medical equipment company, and LipoCoat, a Dutch biotech company specializing in catheter products. This collaboration, initiated in April 2022, focuses on co-creating a central venous catheter with LipoCoat's bioinspired coating technology, emphasizing long-term infection prevention. Strategic collaborations are proving to be instrumental in advancing catheter technologies and addressing evolving healthcare needs.

Leading companies in the catheter market are prioritizing the development of innovations such as atraumatic tracking, which removes the need for a microcatheter during procedures. Atraumatic tracking refers to the technique of monitoring a biological or physical process while minimizing or eliminating trauma, damage, or adverse effects on the subject being tracked. For instance, in July 2024, Route 92 Medical, Inc., a US-based manufacturer of medical equipment, introduced the FreeClimb 88 Catheter System, designed for efficient navigation through complex neurovascular anatomy. This catheter system has received FDA 510(k) clearance, confirming its safety and effectiveness in navigating neurovasculature. Offered in lengths of 125 cm and 132 cm, it provides flexibility for healthcare providers. A specially designed delivery catheter featuring a soft, tapered tip reduces the 'ledge effect' and facilitates smooth passage through critical arteries. Its design enhances clinical procedures by simplifying setup complexity and improving vessel size matching for optimal flow control.

In a strategic move to enhance its capabilities, VitalPath, a US-based manufacturer of custom, highly complex catheter solutions, acquired Modern Catheter Technologies in January 2022. This acquisition aimed to broaden VitalPath's expertise, particularly in neurovascular and electrophysiology fields, including the use of microcatheters and applications in peripheral vascular domains. Modern Catheter Technologies, a US-based manufacturer of catheters, contributed valuable knowledge to further enrich VitalPath's offerings and serve the evolving needs of the medical community.

Major companies operating in the catheters market include Boston Scientific Corporation, Coloplast A/S, ConvaTec Group Plc, Edwards Lifesciences Corporation, Hollister Incorporated, Johnson & Johnson, Medtronic Plc, B. Braun Melsungen AG, Terumo Corporation, Lumend Corporation, Acist Medical Systems Inc., Cook Medical Inc., Becton Dickinson and Company, Stryker Corporation, Merit Medical Systems Inc., Abbott Laboratories, Manfred Sauer GmbH, Koninklijke Philips N.V., Teleflex Incorporated, C. R. Bard Inc., Vascular Solutions Inc., Cordis Corporation, Rochester Medical Corporation, Navilyst Medical Inc., AngioDynamics Inc., Cardinal Health Inc., Olympus Corporation, Penumbra Inc., Siemens Healthineers AG, Smiths Medical Inc.

A catheter is a medical device employed for the extraction of urine or other fluids from the body. These devices serve various medical purposes, including the administration of fluids, medications, or gases, as well as the drainage of fluids or urine.

The primary types of catheters encompass cardiovascular, neurovascular, urology, intravenous, and specialty catheters. The cardiovascular catheter market pertains to the sales of catheters specifically designed for cardiac purposes. Catheters are available in three variations such as single-lumen, double-lumen, and triple-lumen. They find application in diverse healthcare settings, including hospitals, clinics, and ambulatory surgical centers.

The catheter market research report is one of a series of new reports that provides catheter market statistics, including global market size, regional shares, competitors with a catheter market share, detailed catheter market segments, market trends and opportunities, and any further data you may need to thrive in the catheter industry. This catheter market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

North America was the largest region in the catheters market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the catheters market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

The countries covered in the catheters market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

The catheter market consists of sales of Indwelling catheter, Condom catheter, Intermittent self-catheter. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Catheters Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on catheters market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for catheters? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The catheters market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Cardiovascular Catheters; Neurovascular Catheters; Urology Catheters; Intravenous Catheters; Specialty Catheters2) By Lumen: Single-lumen; Double-lumen; Triple-lumen

3) By End User: Hospitals & Clinics; Ambulatory Surgical Centers

Subsegments:

1) By Cardiovascular Catheters: Angiographic Catheters; Balloon Catheters; Electrophysiology Catheters; Stent Delivery Catheters2) By Neurovascular Catheters: Microcatheters; Guiding Catheters; Balloon Catheters

3) By Urology Catheters: Foley Catheters; Intermittent Catheters; Suprapubic Catheters

4) By Intravenous Catheters: Peripheral IV Catheters; Central Venous Catheters (CVCs); Peripherally Inserted Central Catheters (PICC)

5) By Specialty Catheters: Dialysis Catheters; Temperature Monitoring Catheters; Gastrostomy Catheters

Key Companies Mentioned: Boston Scientific Corporation; Coloplast A/S; ConvaTec Group Plc; Edwards Lifesciences Corporation; Hollister Incorporated

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Catheters market report include:- Boston Scientific Corporation

- Coloplast A/S

- ConvaTec Group Plc

- Edwards Lifesciences Corporation

- Hollister Incorporated

- Johnson & Johnson

- Medtronic Plc

- B. Braun Melsungen AG

- Terumo Corporation

- Lumend Corporation

- Acist Medical Systems Inc.

- Cook Medical Inc.

- Becton Dickinson and Company

- Stryker Corporation

- Merit Medical Systems Inc.

- Abbott Laboratories

- Manfred Sauer GmbH

- Koninklijke Philips N.V.

- Teleflex Incorporated

- C. R. Bard Inc.

- Vascular Solutions Inc.

- Cordis Corporation

- Rochester Medical Corporation

- Navilyst Medical Inc.

- AngioDynamics Inc.

- Cardinal Health Inc.

- Olympus Corporation

- Penumbra Inc.

- Siemens Healthineers AG

- Smiths Medical Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 34.08 Billion |

| Forecasted Market Value ( USD | $ 51.72 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |