Argentina witnessed a significant increase in the number of start-ups in the financial and insurance industries in the last few months. The total number of companies that operated in the Argentina insurance market in 2021 amounted to 207, 191 being from insurance entities and 16 local reinsurers. The intermediation in the market is in the hands of the advisers that produce insurance (individuals and legal entities) and reinsurance intermediaries that, in total, reached 44,556 agents, of which 44,531 are in the insurance area, and 25 are reinsurance intermediaries.

The COVID-19 pandemic set the path for enhanced operational performance and efficiency through digital channels and technology improvements. For example, La Caja signed an arrangement with Mercado Libre, the largest e-commerce platform in Latin America, to promote its non-life insurance business. The digital platform will allow users to browse rates and insure their auto and house policies online.

Motor insurance is expected to witness significant growth; Argentina's government intends to implement a new tax scheme that would target polluting vehicles. Over the next few years, the demand for automobile insurance is likely to be driven by the introduction of usage-based insurance (UBI) and technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and online pricing comparison.

Argentina Life & Non Life Insurance Market Trends

Increasing Focus Towards Digitization in the Life Insurance and Non-life Insurance Industry

The Inter-American Development Bank (IDB) has approved a USD 100 million loan for a program to promote internet access and digitization in Argentina. The operation seeks to improve digital connectivity infrastructure in remote areas, increase the National Data Center's capacity, and improve citizens' digital capabilities in connected areas.The Program for the Development of the Federal Fiber Optic Network (REFEFO) will finance the expansion and equipping of infrastructure to connect 258 localities in remote areas with fiber optics. It will also enhance international connectivity infrastructure to boost digitization quality, lower prices, and provide regional digital integration.

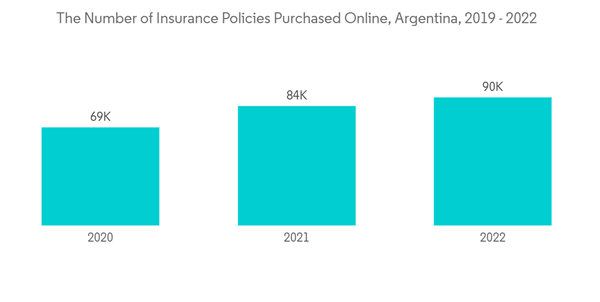

The usage of digital services and applications was further bolstered by the inception of the COVID-19 pandemic, which allowed consumers to carry out insurance-related processes from their homes. Due to the imposition of a lockdown and stay-at-home restrictions in Argentina, most of the claims were processed online.

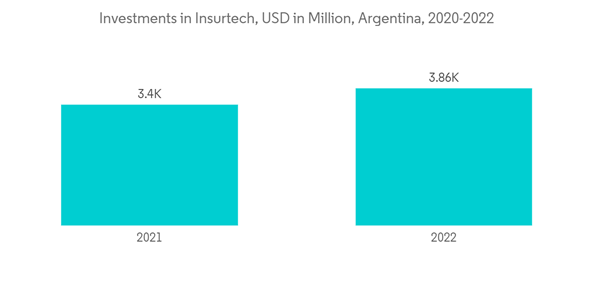

InsurTech Start-ups Revolutionizing Insurance in Argentina

Argentina is the third largest country in Latin America, having InsurTech companies. The Superintendencia de Seguros de la Nacion of Argentina officially launched an InsurTech Innovation Hub in 2019, a collaborative space to boost the growth of innovative solutions for insurance through the use of technology, which will draw together the insurance industry, the technology sector, academia, the regulator, and government agencies.123Seguro is a start-up that empowers its customers by combining instant price comparison with professional advice. It provides the widest offer on the Internet and creates a new user experience in the insurance sector. With this, it makes insurance more agile, with no formalities, and brings the best prices.

Argentina Life & Non Life Insurance Industry Overview

The report covers major players operating in the Argentina Life and Non-life Insurance Market. A few major players currently dominate the market in terms of market share. However, with technological advancement and service innovation, domestic and international companies are increasing their market presence by securing new contracts and tapping new markets. It has major players including Mercantil Andina, Marsh Mclennan, Sancor seguros, Grupo asegurador la segunda, and San cristobal seguros.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Mercantil Andina

- Marsh Mclennan

- Sancor Seguros

- Grupo asegurador la segunda

- San cristobal seguros

- Chubb

- Parana Seguros

- Holando Seguros

- Experta Aseguradora de Riesgos del Trabajo S.A

- Federacion Patronal Seguros

- Orbis Seguros

- Seguros Sura*