The outbreak of COVID-19 heavily impacted the manufacturing and services sector, particularly the building and construction industry. Strict social distancing norms and nationwide lockdowns resulted in several construction and renovation projects getting delayed and, in some cases, abandoned. However, with the complete lifting of restrictions and the steady revival of the manufacturing and services sector, the building and construction industry is expected to witness a strong recovery in the future.

Key Highlights

- The growing demand for residential construction across the world and the rising awareness of the potential benefits of plastic roofing tiles are expected to drive demand for the market during the forecast period.

- However, demand for the plastic roofing market could be slightly hindered, with plenty of potential substitutes being readily available in the market.

- On the flip side, owing to its low heat conductivity, the growing concept of constructing energy-efficient 'green buildings' could potentially provide future opportunities for the plastic roofing tiles market.

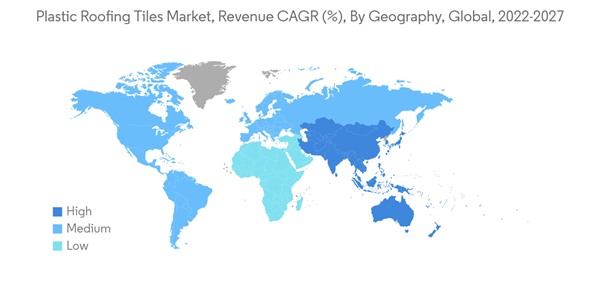

- With an ever-increasing population and rapid urbanization across major economies, the Asia-Pacific region is expected to dominate the demand for the plastic roofing tiles market across the world.

Plastic Roofing Tiles Market Trends

Growing Demand for Residential Construction

- Plastic roofing tiles have various advantages which give them an edge over other potential substitutes, including low thermal conductivity, lower maintenance costs, lesser susceptibility to damage, and easy transport and installation, which make them ideal for application in residential construction.

- Demand for residential construction is anticipated to rise in tandem with the growing population during the forecast period. According to the World Population Prospects by the United Nations, as of 2022, the global population is expected to reach 8.5 billion by 2030 and touch 9.7 billion by 2050.

- Major economies are witnessing growing demand for housing construction, with demand expected to continue to rise during the forecast period. For instance, according to a recent report by the House of Commons published in 2022, the number of households across England is anticipated to increase gradually to 26.9 million by 2043, registering an average increase of approximately 150,000 households each year.

- Similarly, according to the Ministry of Housing, Communities and Local Government (UK), new housing unit construction in the United Kingdom increased to 42,350 units in the first quarter of 2022 from 41,600 units in the fourth quarter of 2021.

- Across the North American region, the United States is expected to lead residential construction, with new residential construction expected to reach USD 881 billion by 2022 end, according to Statista.

- The aforementioned factors indicate strong growth potential for residential construction across the world, thereby driving demand for the plastic roofing tiles market during the forecast period.

Asia-Pacific Region Expected to Dominate the Market

- The rising population in major economies like China and India and the rapid urbanization in emerging economies across the Asia-Pacific region are expected to drive the need for residential and infrastructure construction across the region.

- For instance, by 2030, more than 40% of the total population is expected to relocate to urban areas in comparison to a present value of 34%, creating a huge demand for residential construction during the period. As per a joint study conducted by Global Construction Perspectives and Oxford Economics, India will need to construct close to 170 million homes by 2030, to suffice the growing housing demand in the country.

- According to Invest India, India has a total of USD 1.4 trillion in infrastructure investment budget under NIP, out of which 16% is allocated to urban infrastructure. With the support of such strong investments, the Indian construction industry is expected to reach USD 1.4 trillion by 2025. On the other hand, the real estate demand is forecasted to increase by 15-18 million sq. ft. during the same period across major metro cities.

- China witnessed a year-on-year increase of 7.4% in investment in infrastructure between January-July of 2022, with the government considering allowing local governments to sell up approximately USD 220 billion of the 2023 special bond quota in a bid to fund infrastructure construction.

- On the other hand, China's building construction completion value touched CNY 7.94 trillion (USD 1.12 trillion) in 2021, with residential construction contributing to 63% of the total, indicating strong demand for residential construction across the country.

- These aforementioned factors may drive regional growth during the forecast period.

Plastic Roofing Tiles Market Competitor Analysis

The plastic roofing tiles market is fragmented in nature. Some players in the market include Supaplastics Limited, Roofeco, SOGO Amarillo S.A. (MITASA Group), AHM Group, Pingyun International, and other companies.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Growing Demand for Residential Construction Globally

4.1.2 Potential Benefits over Other Types of Roofing Tiles

4.2 Restraints

4.2.1 Easy Availability of Potential Substitutes

4.3 Industry Value-Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 End-user Industry

5.1.1 Residential

5.1.2 Non-residential

5.1.2.1 Commercial

5.1.2.2 Infrastructure

5.1.2.3 Industrial

5.2 Geography

5.2.1 Asia-Pacific

5.2.1.1 China

5.2.1.2 India

5.2.1.3 Japan

5.2.1.4 South Korea

5.2.1.5 Rest of Asia-Pacific

5.2.2 North America

5.2.2.1 United States

5.2.2.2 Canada

5.2.2.3 Mexico

5.2.3 Europe

5.2.3.1 Germany

5.2.3.2 United Kingdom

5.2.3.3 Italy

5.2.3.4 France

5.2.3.5 Rest of Europe

5.2.4 South America

5.2.4.1 Brazil

5.2.4.2 Argentina

5.2.4.3 Rest of South America

5.2.5 Middle East and Africa

5.2.5.1 Saudi Arabia

5.2.5.2 South Africa

5.2.5.3 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%)**/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 AHM Group

6.4.2 Foshan Nanhai HONGBO Plastic Factory

6.4.3 Foshan Rufu Tile Industry Co. Ltd

6.4.4 Foshan Yiquan Plastic Building Material Co. Ltd

6.4.5 Green Sustainable Products Company Ltd.

6.4.6 Gudangdong Gaoyi Building Materials Science and Technology Co. Ltd

6.4.7 Jieli Industrial Co. Ltd

6.4.8 Pingyun International

6.4.9 Roofeco

6.4.10 Shandong Eyeshine New Material Co. Ltd

6.4.11 SMARTROOF

6.4.12 SOGO Amarillo SA (MITASA Group)

6.4.13 TILECO Sp. z.o.o.

6.4.14 Supaplastics Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Growing Concept of Energy-efficient Green Buildings

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AHM Group

- Foshan Nanhai HONGBO Plastic Factory

- Foshan Rufu Tile Industry Co. Ltd

- Foshan Yiquan Plastic Building Material Co. Ltd

- Green Sustainable Products Company Ltd.

- Gudangdong Gaoyi Building Materials Science and Technology Co. Ltd

- Jieli Industrial Co. Ltd

- Pingyun International

- Roofeco

- Shandong Eyeshine New Material Co. Ltd

- SMARTROOF

- SOGO Amarillo SA (MITASA Group)

- TILECO Sp. z.o.o.

- Supaplastics Limited