Key Highlights

- Increasing demand for protective coatings and growing usage of corrosion coatings are expected to drive the industrial coatings market’s growth in India.

- Rising demand for highly durable products is likely to act as an opportunity in the future.

- The adverse environmental effects of solvent-borne coatings are likely to impede market expansion.

India Industrial Coatings Market Trends

Automotive Segment to Dominate the Market

- Automotive parts such as cars, motorcycles, and heavy motor vehicles are coated to make them rust-free and have a smooth finish and shiny look.

- In the automotive sector, urethane is the most common resin which is used as a topcoat due to its long-lasting nature and affordability. In addition to this, it is UV resistant, which also increases its consumption in that sector.

- According to India Brand Equity Foundation (IBF), India is likely to hit the electric vehicles market with annual sales of 17 million units by 2030 which shows a better growth opportunity for industrial coatings in the automotive sector.

- In 2021, production and sales of vehicles increased significantly in India. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), India produced 43,99,112 vehicles in 2021, witnessing a growth rate of 30%, compared to the previous year.

- Hence, increasing demand for coatings in the automotive segment is likely to dominate the market.

Growing Demand for Water-borne Coatings Technology

- Waterborne technology is a surface treatment that uses water as a solvent to dissolve resin for making coatings or paints. Water-borne coatings are most widely used due to their non-reactive and environmental nature.

- Solvent-borne coatings use organic solvent to disperse the resin which is costly as well as toxic in nature as compared to water-borne coatings. Hence, water-borne coatings are gradually replacing solvent-borne coatings in the automotive and construction sectors.

- Nowadays, water-borne coatings are widely used in the construction sector for floor paints, walls, roofs, metal bodies, swimming pools, and many other applications.

- Automotive industries are extensively making use of water-borne technology. For instance, according to India Brand Equity Foundation (IBF), India is the largest tractor producer, second-largest bus manufacturer, and third-largest heavy truck manufacturer, thus the demand for water-borne technology in the automotive sector is expected to be high.

- According to the Ministry of Road Transport and Highways (India), the construction of national highways reached 36.4 kilometers per day in 2021, this is estimated to increase over the forecast period. Water-borne coatings are mostly used in road construction due to their fast drying and environment-friendly properties which further promote the demand for water-borne industrial coatings.

- Hence, with increasing demand for water-borne coatings technology, the market for Indian Industrial coatings is projected to increase over the forecast period.

India Industrial Coatings Market Competitor Analysis

India's industrial coatings market is consolidated in nature. Some of the major players in the market include Asian Paints PPG Pvt. Ltd., AkzoNobel India Ltd., Berger Paints India Ltd., the Sherwin-Williams Company, and Nippon Paint (India) Private Ltd.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Increasing Demand for Protective Coatings

4.1.2 Increasing Usage Of Corrosion Coatings

4.2 Restraints

4.2.1 Harmful Environmental Impact of Solvent-borne Coatings

4.2.2 Other Restraints

4.3 Industry Value-Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Consumers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION

5.1 Resin Type

5.1.1 Epoxy

5.1.2 Polyurethane

5.1.3 Acrylic

5.1.4 Polyester

5.1.5 and other resin types

5.2 Technology

5.2.1 Water-borne Coatings

5.2.2 Solvent-borne Coatings

5.2.3 Other coatings Technologies

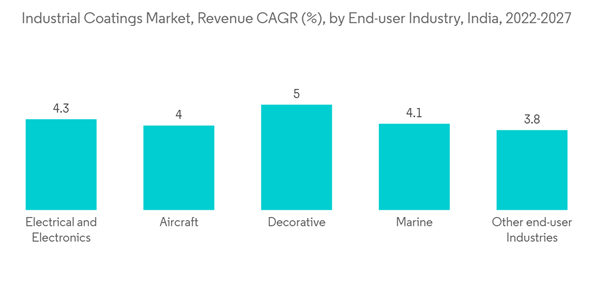

5.3 End-User Industry

5.3.1 Automotive

5.3.2 Oil and Gas

5.3.3 Electrical and Electronics

5.3.4 Aircraft

5.3.5 Decorative

5.3.6 Marine

5.3.7 Other End-user industries

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share(%)**/Rank Analysis**

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 AkzoNobel India Ltd.

6.4.2 Asian Paints PPG Pvt. Ltd

6.4.3 Axalta Coating Systems

6.4.4 BASF SE

6.4.5 Beckers Group

6.4.6 Berger Paints India Ltd.

6.4.7 Chugoku Marine Paints, Ltd

6.4.8 Hempel A/S

6.4.9 Jotun

6.4.10 Kansai Nerolac Paints Limited

6.4.11 Nippon Paint (India) Private Ltd.

6.4.12 RPM International, Inc.

6.4.13 Sika AG

6.4.14 The Sherwin-Williams Company

6.4.15 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Increasing Demand For High Durable Products

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AkzoNobel India Ltd.

- Asian Paints PPG Pvt. Ltd

- Axalta Coating Systems

- BASF SE

- Beckers Group

- Berger Paints India Ltd.

- Chugoku Marine Paints, Ltd

- Hempel A/S

- Jotun

- Kansai Nerolac Paints Limited

- Nippon Paint (India) Private Ltd.

- RPM International, Inc.

- Sika AG

- The Sherwin-Williams Company

- Wacker Chemie AG