The COVID-19 pandemic impacted the entire pharmaceutical supply chain, along with disrupting the supply of APIs from India and China. As per the FDA in August 2021, the United States has less than 5% API sites. More than 80% of the APIs are used in critical therapeutic areas, and vital medications were imported from China and India. As per the same source, a vast scarcity of active pharmaceuticals was reported in the country as the Government of India temporarily banned the export of 26 medicines, including acetaminophen and several antibiotics. More than 40 Chinese manufacturers were placed under national restrictions too. This impacted the market growth during the pandemic in the United States. However, the United States government is engaged in making policies to set up API manufacturing sites in the country, which might take a long time. Thus, with released restrictions and resumed import-export activities United States continues to import essential medicines, as well as API for drug manufacturing from other countries to combat the shortage of drug supplies. Thus the studied market is expected to grow over the forecast period.

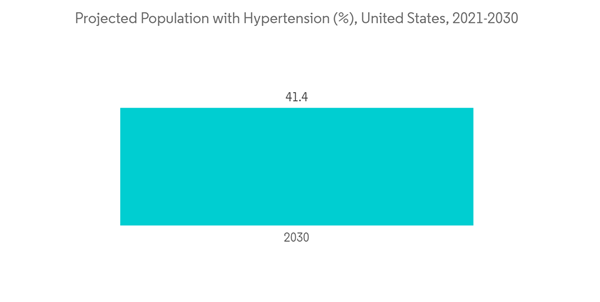

Certain factors propelling the market growth are the increasing prevalence of infectious, genetic, cardiovascular, and other chronic disorders, the growing adoption of biologics and biosimilars, and the rising prevalence of cancer, along with growing sophistication in oncology drug research.

The increasing prevalence and burden of chronic diseases, infectious diseases, and genetic disorders are driving the demand for effective and safe drugs. Due to this factor, the demand for active pharmaceutical ingredients is increasing, which is further anticipated to fuel market growth. For instance, as per the data published by CDC, in April 2022, an estimated 58.5 million United States adults have arthritis with an estimated 25.7 million adults limited in their usual activities. This number is expected to reach 35 million by 2040. Also, as per the 2022 statistics published by IDF, about 32 million people were suffering from diabetes in 2021 in the United States, and this number is estimated to reach 34.7 million and 36.2 million by 2030 and 2045, respectively. Thus, the high diabetic population in the country raises the company’s focus on developing advanced and safe drugs which require a large amount of API, hence propelling the market growth.

The increasing development and clinical trials of biosimilar and biologics drugs as well as rising approvals for new therapeutic classes, are expected to increase their adoption by the physician and patients, which, in turn, is anticipated to raise the demand for APIs, thereby propelling the market growth. For instance, as per the data published by the United States Food and Drug Administration, in October 2022, 10 biologic drugs approved in 2022, namely Skysona (neurologic dysfunction), Zynteglo (ß-thalassemia), Alintity (Hepatitis C Virus), Priorix (measles, mumps, and rubella), Carvykti (relapsed or refractory multiple myeloma), Spikevax (COVID-19), and Anti-C3d (IgG and C3d) products.

Various biosimilar utilization management programs were initiated to encourage the use and adoption of biosimilars which is expected to increase the demand for active pharmaceutical ingredients for fulfilling the high demand for biosimilars. For instance, Providence St Joseph Health, a United States nonprofit health system, has introduced a biosimilar utilization management program that encouraged using lower-cost biosimilars instead of the higher-cost bio-originators. With this program, the United States saved USD 26.9 million (2019-2020) in spending on prescription drugs. With the implementation of this program, the biosimilar adoption rate reached 62% in November 2020. Such initiatives are expected to boost market growth over the forecast period.

Furthermore, the rising activities in expanding manufacturing facility for APIs is contributing to market growth. For instance, in August 2021, Curia announced plans to expand its commercial manufacturing capacity at its Rensselaer, New York facility. This expansion increased the capability to flexibly manufacture complex Active Pharmaceutical Ingredients (APIs) and further strengthened Curia’s ability to partner with customers, meeting small-scale to large-volume requirements with reliable delivery.

Therefore, owing to the aforementioned factors, the studied market is expected to grow over the forecast period. However, the drug price control policies in the country, stringent regulations for drug approvals, and high competition between API manufacturers are expected to impede the growth of the active pharmaceutical ingredients market over the forecast period.

US Active Pharmaceutical Ingredients (API) Market Trends

Oncology Segment Expects to Register a High CAGR

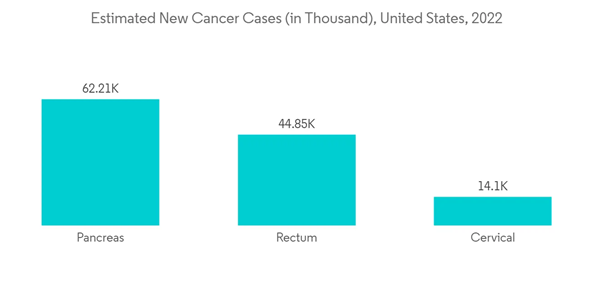

The oncology segment is expected to witness significant growth in the API market over the forecast period. This is because of various factors, such as the rising prevalence of multiple types of cancer, increasing company activities in developing drugs like biologics and biosimilars, and growing awareness programs in the country.The statistics published by the American Cancer Society expected the diagnosis of over 1.9 million new cancer cases in the United States in 2022. Also, as per 2022 statistics published by Breastcancer.org, an estimated 287,850 new cases of invasive breast cancer and 51,400 new cases of non-invasive (in situ) breast cancer were expected to be diagnosed in the United States in 2022. With the growing burden of cancer cases, the demand for oncology drugs increases which needs API for drug formulation. Hence, the market is expecting a significant impact over the forecast period.

In addition, the presence of well-established healthcare infrastructure and high healthcare expenditure in the country is also contributing to market growth. The data published by the CMS in March 2022 observed that the annual increase in national health spending is expected to be an average of 5.1% over 2021-2030. According to the same source, the National Health Spending in 2020 was USD 4.1 trillion and is projected to reach USD 6.8 trillion by 2030. Thus, the increasing healthcare spending is expected to increase the company’s activities in developing pharmaceutical products, raising the need for drug development APIs. This is anticipated to fuel market growth over the forecast period.

Furthermore, the rising company activities and increasing drug approvals in the country are expected to boost the market growth. For instance, in November 2022, the FDA approved tremelimumab in combination with durvalumab and platinum-based chemotherapy for adult patients with metastatic non-small cell lung cancer (NSCLC) with no sensitizing epidermal growth factor receptor (EGFR) mutation. Also, in August 2022, the USFDA approved Enhertu, an IV infusion, for treating unresectable or metastatic HER2-low breast cancer. Such developments are expected to increase the demand for APIs for manufacturing drugs and other formulations, hence bolstering market growth.

Therefore, owing to the factors such as the high burden of cancer, the presence of established healthcare expenditure along with high spending and increasing drug approvals in the country, the studied segment is anticipated to witness growth over the forecast period.

Branded Segment Expected to Have the Significant Market Share

The branded segment is expected to grow over the forecast period owing to factors such as the high burden of chronic diseases, growing awareness regarding branded drugs among the population, as well as increasing company activities in developing drugs in the country. For instance, as per a research study published by Giuseppe Lippi et al. in July 2021, it was observed that about 6-12 million people in the United States are expected to suffer from atrial fibrillation by 2050 and 17.9 million people by 2060. Additionally, as per 2022 statistics published by Parkinson's Foundation, about 1 million people were living with Parkinson's in the United States in 2021, and this number is projected to reach 1.2 million by 2030. Thus, the high burden of cardiovascular and Parkinson's disease among the population is anticipated to increase the demand for effective drugs which require APIs for drug development. This is expected to increase segment growth over the forecast period.The rising company activities in developing branded drugs also contribute to market growth. For instance, in February 2021, Adamas Pharmaceuticals, Inc. received marketing authorization from the United States Food and Drug Administration (FDA) for a supplemental New Drug Application for GOCOVRI (amantadine) extended-release capsules. GOCOVRI is approved as an adjunctive treatment to levodopa/carbidopa in patients with Parkinson's disease experiencing OFF episodes, in addition to its indication for the treatment of dyskinesia in patients with Parkinson's disease receiving levodopa-based therapy, with or without concomitant dopaminergic medications.

Furthermore, initiatives such as facility expansion by key market players are expected to increase company focus on developing high-quality APIs, which is anticipated to fuel the market growth over the forecast period. In July 2021, AbbVie expanded its global operations, enabling end-to-end drug substance and product supply for AbbVie CMO manufacturing partners. New AbbVie Contract Manufacturing service offerings include biologics fill-finish, topical creams and ointments, sterile ophthalmic ointments, and custom API. Also, the acquisition of Allergan and capital expenditure enable AbbVie CMO to provide expanded capabilities to clients on several manufacturing fronts in the United States.

Moreover, in October 2021, Merck's Life Science business sector launched new technology and expanded its capacity to advance antibody-drug-conjugates (ADC) therapies. This new initiative by the company will focus on investment in ADC and high-potent active pharmaceutical ingredient capacity.

Therefore, owing to the factors such as the rising burden of cardiovascular and Parkinson's diseases, increasing branded product launches as well as a growing company focus on facility expansion to grow their API business, the studied segment is anticipated to witness growth over the forecast period.

US Active Pharmaceutical Ingredients (API) Market Competitor Analysis

The United States Active Pharmaceutical Ingredients market is relatively fragmented. The API market has several manufacturers focusing on expanding their footprints by adopting various business strategies, such as collaborations, facility expansion, and drug approvals. Some of the companies in the market are Pfizer Inc., Novartis AG, BASF SE, Viatris Inc., Lupin Ltd, Teva Pharmaceutical Industries Ltd, and Merck KGaA, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aurobindo Pharma

- Pfizer Inc.

- Novartis AG

- BASF SE

- Teva Pharmaceutical Industries Ltd

- Viatris Inc.

- Sanofi Inc.

- Merck KGaA

- Dr. Reddy's Laboratories Ltd

- Lupin Ltd

- Bristol-Myers Squibb