Hormonal Contraceptive: Introduction

Hormonal contraceptives work by preventing ovulation or thickening cervical mucus to block sperm from reaching an egg. Some of the different types of hormonal contraceptives include the birth control pill, hormonal intrauterine devices (IUDs), the contraceptive patch, and the contraceptive injection.The development of hormonal contraceptives has been a significant advancement in the field of reproductive health, giving women greater control over their reproductive choices. Companies in this market aim to create safe and effective birth control options with minimal side effects.

The hormonal contraceptive market is highly competitive, with many companies vying to create the next breakthrough contraceptive. In recent years, there has been a growing demand for long-acting reversible contraceptives (LARCs) such as hormonal IUDs and contraceptive implants. Additionally, there is a trend towards developing contraceptives with fewer or no side effects, as well as non-hormonal contraceptive options.

Hormonal Contraceptive Market Scenario

The market for hormonal contraceptive is a rapidly growing market. The increasing awareness regarding family planning and the need for safe and effective contraceptives are the major driving factors for the growth of this market. The use of hormonal contraceptive methods has increased in recent years due to the ease of use, reliability, and effectiveness of these methods. The market is also driven by the rise in population and the need to control it. Additionally, the increasing incidence of sexually transmitted diseases (STDs) is driving the growth of the market as hormonal contraceptives are effective in reducing the risk of STDs.However, the market is facing challenges such as the side effects associated with the use of hormonal contraceptives, which has led to a decline in their adoption rate. The high cost of these contraceptives is also a restraining factor for market growth.

Hormonal Contraceptive Market Segmentations

Market Breakup by Method

- Pills

- Intrauterine Devices (IUD)

- Injectables

- Vaginal Ring

- Implant

- Patch

Market Breakup by Hormonals

- Androgens

- Estrogens

- Progesterone

- Antiandrogens

- Gonadotrophins

- Others

Market Breakup by Gender

- Male

- Female

Market Breakup by End User

- Hospitals

- Homecare

- Clinics

- Gynecology Centers

- Ambulatory Surgical Centers (ASC)

Market Breakup by Region

North America

- United States of America

- Canada

Europe

- United Kingdom

- Germany

- France

- Italy

- Others

Asia Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

Latin America

- Brazil

- Argentina

- Mexico

- Others

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Key Trends in the Hormonal Contraceptive Market

Some key trends in the hormonal contraceptive market are:- Increasing popularity of long-acting reversible contraception (LARC) methods such as hormonal intrauterine devices (IUDs) and contraceptive implants

- Growing demand for personalized and effective hormonal contraceptive options for women

- Technological advancements in the development of hormonal contraceptives, such as the use of progestin-only pills and non-oral methods of delivery such as patches, injections, and vaginal rings

- Rising awareness about the importance of family planning and the benefits of using hormonal contraceptives

- Increasing focus on developing affordable and accessible hormonal contraceptives for women in developing countries

- Growing adoption of digital health technologies and telemedicine for the distribution of hormonal contraceptives and related services

- Emergence of new players and partnerships in the market, leading to increased competition and innovation in the industry

Hormonal Contraceptive Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Allergan Inc

- Pfizer Inc

- Bayer AG

- Afaxys, Inc

- Merck and Co., Inc

- Teva Pharmaceutical Industries Ltd

- Sun Pharmaceutical Industries Ltd

- Reckitt Benckiser Group plc

- Boehringer Ingelheim International GmbH

- Agile Technologies

- Warner Chilcott

- Novartis AG

Table of Contents

Companies Mentioned

- Allergan Inc.

- Pfizer Inc.

- Bayer AG

- Afaxys, Inc.

- Merck and Co. Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Reckitt Benckiser Group plc.

- Boehringer Ingelheim International Gmbh.

- Agile Technologies

- Warner Chilcott

- Novartis Ag

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | May 2023 |

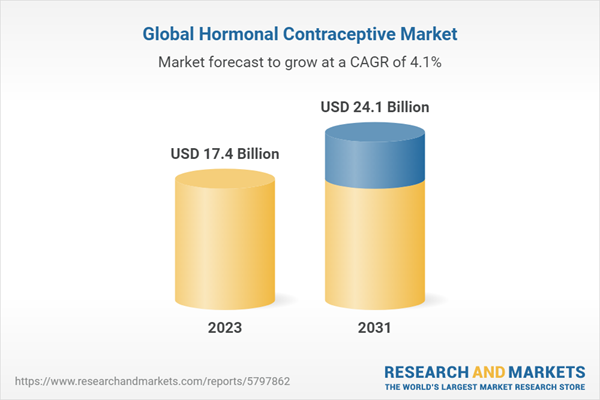

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 17.4 Billion |

| Forecasted Market Value ( USD | $ 24.1 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |