Advanced mezzanine card (AMC) central processing unit (CPU) cards are high-performance computing modules that are computer expansion cards used in telecommunications and other industries. AdvancedTCA and MicroTCA are some of the commonly used AMC CPU cards. They provide high-speed processing power and can be easily integrated into existing systems. AMC CPU cards are widely used in network processing and packet filtering, storage and data management, high-performance computing, image and video processing, and digital signal processing. They are cost-effective, scalable, interoperable, highly reliable, and resilient, ensuring that applications run smoothly and without interruption. As a result, AMC CPU cards are extensively used in communications and network infrastructure, healthcare, industrial automation and control, military and aerospace, and transportation (including infotainment infrastructure).

AMC CPU Cards Market Trends:

The increasing demand for high-performance computing is one of the key factors creating a positive outlook for the market. AMC CPU cards are widely used to deliver enhanced processing capabilities due to the increasing data-intensive workloads and advanced algorithms. In line with this, the widespread product adoption due to the changing trend towards modular and scalable computing architectures is favoring the market growth. Moreover, the increasing need for AMC CPU cards in the telecommunications industry to offer high-performance computing, packet processing, and network functions virtualization (NFV) is propelling the market growth. Apart from this, the rising adoption of cloud computing is driving the demand for more powerful computing solutions that can support cloud-based applications and services, which in turn is positively influencing the market growth. Furthermore, the increasing demand for robust computing solutions due to the integration of various new technologies, such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), is providing a thrust to the market growth. Besides this, the widespread product adoption in embedded systems, which are extensively used in a variety of applications, including industrial automation, medical devices, and automotive systems, is acting as another growth-inducing factor. Other factors, including increasing adoption of AdvancedTCA, enhanced focus on research and development (R&D) activities, and the launch of miniaturized AMC CPU cards, are supporting the market growth.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global AMC CPU cards market, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on product type and application.Product Type Insights:

- AdvancedTCA

- MicroTCA

Application Insights:

- Communications and Network Infrastructure

- Healthcare

- Industrial Automation and Control

- Military and Aerospace

- Transportation (Including Infotainment Infrastructure)

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global AMC CPU cards market. Detailed profiles of all major companies have also been provided. Some of the companies covered include Adax Inc., Extreme Engineering Solutions Inc, Kontron, Mercury Systems Inc., etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

- How has the global AMC CPU cards market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global AMC CPU cards market?

- What is the impact of each driver, restraint, and opportunity on the global AMC CPU cards market?

- What are the key regional markets?

- Which countries represent the most attractive AMC CPU cards market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the AMC CPU cards market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the AMC CPU cards market?

- What is the competitive structure of the global AMC CPU cards market?

- Who are the key players/companies in the global AMC CPU cards market?

Table of Contents

Companies Mentioned

- Adax Inc.

- Extreme Engineering Solutions Inc

- Kontron

- Mercury Systems Inc.

Table Information

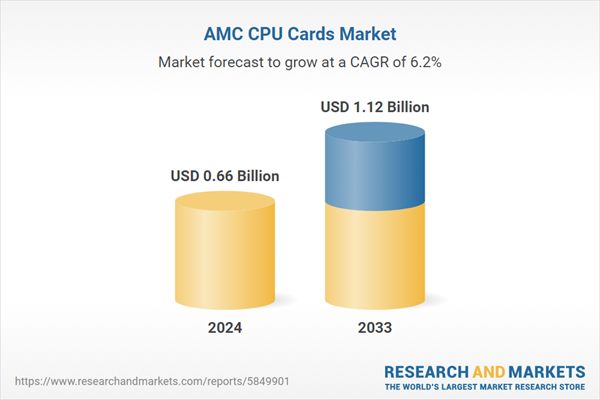

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 0.66 Billion |

| Forecasted Market Value ( USD | $ 1.12 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |