Overall Reduced Cost of Care Due to Early Diagnosis with Syndromic Testing

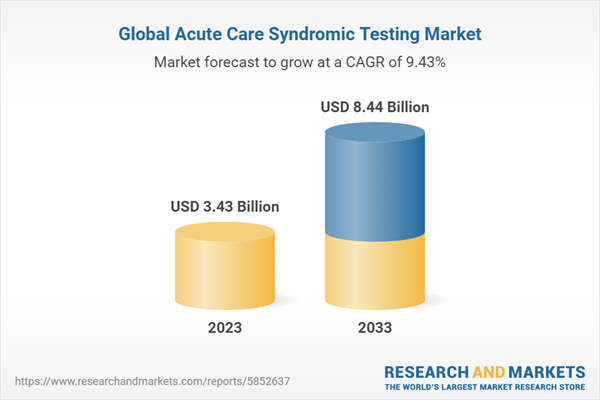

The acute care syndromic testing market was valued at $3.14 billion in 2022 and is expected to reach $8.44 billion by 2033, growing at a CAGR of 9.43% between 2023 and 2033. Syndromic panels are molecular diagnostics tests that can detect more than one pathogen at the same time. These pathogens generally have similar or overlapping clinical symptomatology, which enables better management of patients and easier diagnosis with respect to certain symptoms.

Market Introduction

Before the advent of syndromic tests’ physicians relied on the single-plex test, which could detect one pathogen at a time, and multiple tests had to be done to finally identify the pathogen causing the disease. Additionally, till all the tests were completed, physicians had to rely on general therapy until definitive results were available. This delayed the treatment process. As per the report, the acute care syndromic testing market includes panels and instruments that can test for more than one type of pathogen and specific instruments that are used to perform these tests. These are predominantly polymerase chain reaction-based testing kits, panels, or assays. The most common syndromic testing panels include respiratory, gastrointestinal, genitourinary, and tropical diseases, among others.

Industrial Impact

The global acute care syndromic testing market has witnessed significant growth, attributed to the increasing demand for early detection of infectious diseases. The increasing prevalence of infectious diseases and the increasing occurrence of pandemics have played a critical role in market growth. Furthermore, the rising temperature of the planet and the detection of new infectious disease in regions around the world is also influencing the market growth.

Global acute care syndromic testing has immense potential to deliver the next level of healthcare solutions. For instance, in April 2023, Abbott Laboratories partnered with the Climate Amplified Disease and Epidemics (CLIMADE) consortium, which is a group of more than 100 scientists globally in various academia and public health agencies. With this partnership, they plan to use diagnostic testing and data science technologies to mitigate future disease outbreaks. Additionally, the advent of better diagnosing, predicting, treating, and monitoring tools for infectious diseases is driving the acute care syndromic testing market growth. Other factors also impact the market growth, including increased patient demand and low turnaround time of these tests.

Market Segmentation

Segmentation 1: by Disease Type

- Respiratory Diseases

- Gastrointestinal Diseases

- Genitourinary Diseases

- Tropical Diseases

- Other Disease Types

Respiratory Diseases Segment to Dominate the Global Acute Care Syndromic Testing Market (by Disease Type)

The acute care syndromic testing market is led by the respiratory panels, with a 56.29% share in 2022. The burden of viral respiratory illnesses and pneumonia is huge, and thus syndromic diagnostic testing is a good and fast approach to distinguish between viral and bacterial respiratory pathogens and should be implemented by hospitals and doctors aiming to optimize antimicrobial use.

Segmentation 2: by Target

- Bacteria

- Viruses

- Fungi

- Parasites

Bacteria Segment to Dominate the Global Acute Care Syndromic Testing Market (by Target)

The acute care syndromic testing market is led by bacteria panels, with a 41.65% share in 2022. Bacteria are microbes that have a simple cell structure with a control center that contains genetic information, and the DNA is contained in a single loop. Bacterial can cause numerous types of infections that can affect humans as well as animals. These infections can affect the skin, brain, lungs, blood, or any other body part of the human body. The infection increases as the bacteria multiply and that increase the area of infection.

Segmentation 3: by Sample Type

- Blood

- Urine

- Biofluids

- Stool

- Swabs

- Others

Swabs Segment to Dominate the Global Acute Care Syndromic Testing Market (by Sample Type)

The acute care syndromic testing market is led by swabs, with a 51.90% share in 2022. The key reason for the increasing popularity of swabs is that it is an easy-to-use, non-invasive, and inexpensive sampling method.

Segmentation 4: by End User

- Hospitals

- Clinical and Diagnostic Laboratories

- Research and Academic Institutions

- Other End Users

Hospitals Segment to Dominate the Global Acute Care Syndromic Testing Market (by End User)

The acute care syndromic testing market is led by hospitals, with a 42.53% share in 2022. Hospitals are also at the forefront of adopting syndromic testing panels into routine healthcare procedures. Hospitals, particularly in leading regions such as North America and Europe, and also to a certain extent in Asia-Pacific, have incorporated syndromic testing panels and assays to provide superior care to patients.

Segmentation 5: by Region

- North America - U.S., Canada

- Europe - Germany, U.K., France, Italy, Spain, and Rest-of-Europe

- Asia-Pacific - Japan, India, China, South Korea, Australia, and Rest-of-Asia-Pacific

- Latin America - Brazil, Mexico, and Rest-of-Latin America

- Rest-of-the-World

North America held the highest market share at 40.41% in 2022, mainly due to the high number of legacy companies in the region. Further, increasing approvals and synergistic activities are also increasing their dominance in the market. However, the highest CAGR in the market was seen by Asia-Pacific at 10.97% due to the increasing adoption of syndromic panels in the region, especially in highly populated countries such as China and India.

Recent Developments in the Acute Care Syndromic Testing Market

- In May 2023, Hologic, Inc. got FDA clearance for its Panther Fusion SARS-CoV-2/Flu A/B/RSV assay. This molecular diagnostic test can test for the most prevalent respiratory viruses exhibiting similar conditions all at once, including severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), influenza A (flu A), influenza B (flu B), and respiratory syncytial virus (RSV).

- In March 2023, Lucira Health got FDA approval for its home testing kit that can detect respiratory infections, including COVID-19 and flu. It is easy to use at-home test and can be done on children as young as two years old.

- In April 2023, Abbott Laboratories partnered with the Climate Amplified Disease and Epidemics (CLIMADE) consortium, which is a group of more than 100 scientists globally in various academia and public health agencies. With this partnership, they plan to use diagnostic testing and data science technologies to mitigate future disease outbreaks.

- In May 2023, Applied BioCode, Inc. made an agreement with Medline Industries, which is an industry leader in distributing healthcare products. Medline Industries agreed to distribute the MDx-3000 system, which enables the diagnosis of gastrointestinal and upper respiratory infections, in addition to a suite of Analyte Specific Reagents (ASRs).

- In April 2023, QIAGEN N.V. announced the availability of its QIAstat-Dx syndromic testing solution in Japan, which can detect more than 20 respiratory pathogens, including SARS-CoV-2, from a single sample.

- In January 2023, Fusion Genomics established a fully automated, first-of-its-kind facility for infectious disease surveillance at the Toronto Pearson Internation Airport. This facility is using the company's ONETest platform for the detection of SARS-CoV-2 and other respiratory pathogens in wastewater.

Demand - Drivers and Limitations

Market Demand Drivers:

Faster Results Acquired with Syndromic Tests: The traditional single-plex testing methods for infectious disease detection use methods such as microscopy and bacterial culture, whereas syndromic multi-plex tests use PCRs. This is where syndromic testing really shines, as PCR testing is more accurate and less time-consuming. These quick and comprehensive results then allow physicians to provide better care for the patients and make faster clinical decisions.

Increasing Incidence of Infectious Diseases: The global health system is undergoing severe change as the incidence of infectious diseases constantly increases and building a system against known and unknown pathogen threats. Governments from all over the world have joined hands to maintain the risk of the pandemic at all levels, including the different regional levels such as local, national, and regional. Even though this global health system is doing a lot to protect and promote human health, the world is always being confronted by numerous emerging, reemerging, and longstanding infectious diseases.

Overall Reduced Cost of Care Due to Early Diagnosis with Syndromic Testing: Diagnosis of infectious diseases can be made much easier with the help of syndromic testing. This benefits not only the individual patient but the institution as a whole in numerous ways, especially by decreasing the costs for patients drastically. If the correct pathogen is not detected on the first try using singleplex testing, then subsequent tests are just an added cost which also takes patients time till the final diagnosis. Higher treatment costs due to later diagnosis and, thus, more aggressive treatment measures are big issues that can be addressed with the use of syndromic panels and decrease the personal and economic burden on the individual and their family/friends.

Market Challenges:

The Need for Better Reimbursement of Syndromic Tests: Syndromic panels have faster turnaround time and can save patients money in the long run. However, there is still a gap in the reimbursement of these panels. This is because not all syndromic panels are FDA-approved and thus are not reimbursed. Additionally, all home-use panels, including the ones approved by the FDA, are not reimbursed. This slows down the adoption of these syndromic panels, which can only increase to all income classes if either these panels are constantly reimbursed, or the cost of syndromic panels drastically decreases.

Lack of High-Complexity Testing Center: With the ongoing rapid advancements, new genomic platforms require significant capital investment and high-test volume to enable operation at scale and achieve competitive price points. Additionally, there is also difficulty in establishing and maintaining different technology platforms.

Market Opportunities:

Quick Access to Treatment and Reduced Use of Antibiotics: When diagnosed with an infectious disease, the most efficient cure for late-stage infections is antibiotics. This can be combated with the use of syndromic testing, as it can help to detect pathogens at the earliest stages. According to a report by Zhu et al. published in 2019, stated that antibiotic prescriptions could be reduced by 30% with the use of syndromic testing.

High Number of Synergic Activities and Mergers and Acquisitions: The acute care syndromic testing market has witnessed many synergistic activities and mergers and acquisitions since January 2020. This is leading to the consolidation of the market. In June 2022, R-Biopharm acquired AusDiagnostics and with it their wide range of syndromic diseases testing product range.

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The global acute care syndromic testing market has been extensively segmented on the basis of various categories, such as disease type, target, sample type, end user, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Synergistic activities, product launches, and approvals accounted for the maximum number of key developments, i.e., nearly 91% of the total developments in the global acute care syndromic testing market were between January 2021 to June 2023.

Competitive Strategy: The global acute care syndromic testing market has numerous startups paving their way into manufacturing kits, panels, assays, and instruments and entering the market. Key players in the global acute care syndromic testing market analyzed and profiled in the study involve established players that offer various kinds of disease-specific panels and multiplex instruments.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

The top disease-type segment players who are leading capture around 56.30% of the presence in the market. Players in other industries, such as gastrointestinal, genitourinary, and tropical disease, among others, account for approximately 43.70% of the presence in the market.

Key Companies Profiled:

- Abbott Laboratories

- Becton, Dickinson and Company

- Biocartis NV

- bioMérieux SA (BioFire Diagnostics)

- Danaher Corporation (Cepheid, Inc.)

- DiaSorin S.p.A (Luminex Corporation)

- Eurofins Scientific (Eurofins Viracor)

- Karius

- Laboratory Corporation of America Holdings.

- QIAGEN N.V.

- QuantuMDx Group Ltd.

- Seegene Inc.

- Siemens Healthineers AG

- SpeeDx

- Thermo Fisher Scientific Inc.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Becton, Dickinson and Company

- Biocartis NV

- bioMérieux SA (BioFire Diagnostics)

- Danaher Corporation (Cepheid, Inc.)

- DiaSorin S.p.A (Luminex Corporation)

- Eurofins Scientific (Eurofins Viracor)

- Karius

- Laboratory Corporation of America Holdings.

- QIAGEN N.V.

- QuantuMDx Group Ltd.

- Seegene Inc.

- Siemens Healthineers AG

- SpeeDx

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 227 |

| Published | July 2023 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 3.43 Billion |

| Forecasted Market Value ( USD | $ 8.44 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |