Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As industries face mounting regulatory and operational pressure to optimize throughput, reduce emissions, and transition to cleaner production technologies, there is a clear shift toward tailor-made, application-specific zeolite molecular sieves. This marks a strategic departure from bulk commodity grades to high-performance materials integrated into mission-critical systems ranging from gas separation units in LNG facilities to catalytic reactors in complex refining streams.

The market’s future trajectory is underpinned by tightening environmental frameworks, increased investment in green hydrogen, advanced water recycling systems, and low-impact chemical processing, as well as rising interest in material innovations that offer both functional performance and regulatory compliance. As a result, zeolite molecular sieves are evolving from conventional industrial inputs to strategic enablers of next-generation industrial efficiency and sustainability.

Key Market Drivers

Expansion of the Oil & Gas and Petrochemical Industries

The expansion of the Oil & Gas and Petrochemical industries is one of the most influential factors driving the growth of the Global Zeolite Molecular Sieves Market. Zeolite molecular sieves are indispensable in a wide range of refining, gas processing, and petrochemical applications due to their unique structural properties, high selectivity, and stability under extreme conditions. As global demand for natural gas continues to rise driven by its reputation as a cleaner-burning fossil fuel the need for advanced gas purification technologies has become more critical.Zeolite molecular sieves are widely used in Dehydration of natural gas to prevent hydrate formation during transportation, Removal of impurities such as CO₂, H₂S, and other trace contaminants, Sweetening of sour gas to meet safety and environmental standards The Dahej LNG terminal, originally commissioned with a capacity of 5 MMTPA, structured its regasification tariffs in 2004 based on projected variables such as power costs, interest rates, and applicable tax regimes at the time. Over the past two decades, the facility has undergone multiple phased expansions, scaling up its operational capacity to 17.5 MMTPA, reflecting both increased market demand and strategic infrastructure enhancement aligned with India's evolving energy landscape.

Zeolite molecular sieves are at the core of catalytic processes in oil refining, particularly in Fluid catalytic cracking (FCC) used to convert heavy hydrocarbons into valuable lighter fractions such as gasoline, olefins, and diesel. Hydrocracking and isomerization to improve fuel quality and yield. These processes rely on the precise pore size, high surface area, and acidic properties of zeolites to ensure efficient conversion, selectivity, and longer catalyst life. As refineries across the world expand and modernize to handle heavier crude feeds and stricter fuel quality norms, the use of zeolite-based catalysts is becoming increasingly central to operations.

Governments worldwide are imposing stricter emission regulations and fuel quality standards, such as Ultra-low sulfur diesel (ULSD) requirements, Tier 3 gasoline standards in the U.S. Euro VI emission norms in Europe and India. To comply with these mandates, refiners are investing in upgraded process technologies that often require advanced zeolite catalysts and adsorbents. Zeolite molecular sieves help in Removing sulfur, nitrogen compounds, and aromatics, Enhancing octane levels, Reducing greenhouse gas emissions during processing. This regulatory momentum is directly translating into higher consumption of zeolites in refining operations.

Key Market Challenges

High Production and Processing Costs

One of the most significant barriers to the growth of the zeolite molecular sieves market is the relatively high cost of production, particularly for synthetic zeolites. Key cost drivers include Energy-intensive manufacturing processes, especially during calcination and activation stages, High-grade raw materials such as alumina, silica, and alkaline earth metals, The need for precise temperature and pressure control to maintain pore structure and selectivity.For specialized applications (e.g., in pharmaceuticals, petrochemicals, and gas separation), manufacturers are often required to produce custom-engineered zeolite structures, which further increases complexity and cost. This makes it difficult for smaller manufacturers or cost-sensitive industries to adopt zeolite molecular sieves at scale. Additionally, price volatility in raw materials and energy markets can adversely impact profit margins and deter new investment in capacity expansion.

Key Market Trends

Shift Toward Circular Economy and Sustainable Manufacturing

A major emerging trend influencing the zeolite molecular sieves market is the integration of circular economy principles across industries. Businesses and governments are increasingly emphasizing resource efficiency, waste minimization, and closed-loop systems, prompting a demand for materials that support sustainable operations.Zeolites enable water and solvent recovery, allowing industries to reuse processed materials and reduce discharge. They play a key role in nutrient recovery from wastewater, such as capturing ammonia or phosphates for use in fertilizers. Spent zeolites can be regenerated or repurposed, reducing material waste and aligning with zero-waste goals. As industries redesign processes around circularity especially in chemicals, water treatment, and agriculture zeolite molecular sieves are increasingly viewed as enabling materials, opening new markets where environmental sustainability is a competitive advantage.

Key Market Players

- Albemarle Corporation

- KNT Group

- Tosoh India Pvt. Ltd.

- Union Showa K.K (Resonac Holdings Corporation)

- BASF SE

- CLARIANT

- Huiying Chemical Industry (Xiamen) Co., Ltd

- Arkema

- W. R. Grace & Co.-Conn.

Report Scope:

In this report, the Global Zeolite Molecular Sieves Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Zeolite Molecular Sieves Market, By Application:

- Detergents

- Catalysts

- Others

Zeolite Molecular Sieves Market, By End Use:

- Oil and Gas

- Pharmaceutical

- Water Treatment

- Agricultural

- Construction

- Others

Zeolite Molecular Sieves Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Zeolite Molecular Sieves Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Albemarle Corporation

- KNT Group

- Tosoh India Pvt. Ltd.

- Union Showa K.K (Resonac Holdings Corporation)

- BASF SE

- CLARIANT

- Huiying Chemical Industry (Xiamen) Co., Ltd

- Arkema

- W. R. Grace & Co.-Conn.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | September 2025 |

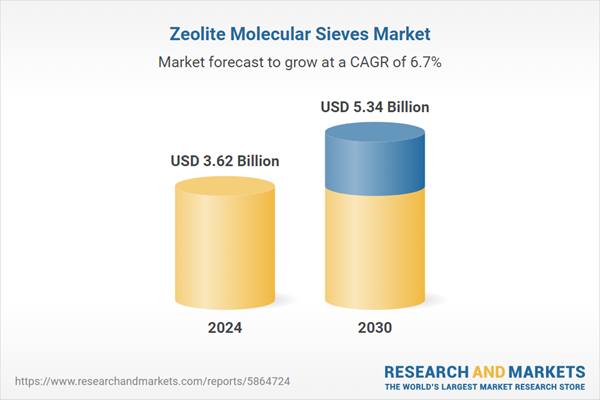

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.62 Billion |

| Forecasted Market Value ( USD | $ 5.34 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |