Vitamin B complex is a group of water-soluble vitamins that play essential roles in various bodily functions, including energy production, metabolism, and the maintenance of a healthy nervous system. The B complex vitamins consist of eight individual vitamins, namely thiamine (B1), riboflavin (B2), niacin (B3), pantothenic acid (B5), pyridoxine (B6), biotin (B7), folate (B9), and cobalamin (B12). Sources of vitamin B complex ingredients can be found in a variety of foods. Thiamine (B1) is abundant in whole grains, legumes, and pork. Riboflavin (B2) is found in dairy products, lean meats, and leafy greens, which is necessary for energy production, cell function, and fat metabolism. Niacin (B3) is present in poultry, fish, and nuts and is used by the body to turn food into energy. Pantothenic acid (B5) is found in meat, eggs, and whole grains and is utilized for the production of blood cells. Pyridoxine (B6) can be obtained from meat, fish, and bananas to assists in amino acid metabolism, red blood cell production, and the creation of neurotransmitters. Biotin (B7) is found in organ meats, eggs, and nuts, which is essential for hair, skin, and nail health. Folate or folic acid (B9) plays an important role in mental and emotional health and is abundant in leafy greens, legumes, and citrus fruits. Cobalamin (B12) plays a critical role in the pathways of the body that produce cellular energy and is primarily found in animal products such as meat, fish, and dairy. Each vitamin has a unique structure and function due to which they work together synergistically. Vitamin B complex ingredients typically contain varying amounts of these vitamins to ensure adequate intake for optimal health.

Vitamin B Complex Ingredients Market Trends:

One of the primary factors driving the market is the increasing awareness about the importance of nutrition and the impact of nutrient deficiencies. These ingredients play an essential role in maintaining overall health and well-being of individuals. Each vitamin in the B complex has specific functions that contribute to various physiological processes, making them crucial for optimal bodily function. Besides this, the outbreak of coronavirus disease (COVID-19) pandemic has accelerated the product sales as people look to improve their immune health and reduce susceptibility to illnesses. . Apart from this, with the increase in the elderly population, who often need more dietary supplements due to decreased nutrient absorption with age, the market is expected to grow. Furthermore, as people have become more health-conscious, the fitness and wellness industry has expanded. As a result, several individuals are opting for vitamin B complex supplements to support their general health, boost energy levels, or aid in recovery and muscle growth. This is expected to escalate the demand for vitamin B complex ingredients. Moreover, the advancement in technology has allowed manufacturers to fortify a wide range of food products with vitamin B complex, thus creating a positive market outlook.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the global vitamin B complex ingredients market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type and application.Type Insights:

- Vitamin B1

- Vitamin B2

- Vitamin B3

- Vitamin B5

- Vitamin B6

- Vitamin B7

- Vitamin B9

- Vitamin B12

Application Insights:

- Pharmaceuticals

- Foods and Beverages

- Animal Feed

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global vitamin B complex ingredients market. Detailed profiles of all major companies have been provided. Some of the companies covered include Adisseo France S.A.S. (China National Bluestar (Group) Co. Ltd.), AIE Pharamceuticals Inc., Amway Corp (Alticor Inc.), BASF SE, Bluebonnet Nutrition Corporation, Koninklijke DSM N.V., North American Herb and Spice, Nutrivolv Ltd., Parkacre Ltd., Thorne Healthtech Inc., Vertellus Holdings LLC, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report

- How big is the vitamin B complex ingredients market?

- What is the future outlook of vitamin B complex ingredients market?

- What are the key factors driving the vitamin B complex ingredients market?

- Which region accounts for the largest vitamin B complex ingredients market share?

- Which are the leading companies in the global vitamin B complex ingredients market?

Table of Contents

Companies Mentioned

- Adisseo France S.A.S. (China National Bluestar (Group) Co. Ltd.)

- AIE Pharamceuticals Inc.

- Amway Corp (Alticor Inc.)

- BASF SE

- Bluebonnet Nutrition Corporation

- Koninklijke DSM N.V.

- North American Herb and Spice

- Nutrivolv Ltd.

- Parkacre Ltd.

- Thorne Healthtech Inc.

- Vertellus Holdings LLC

Table Information

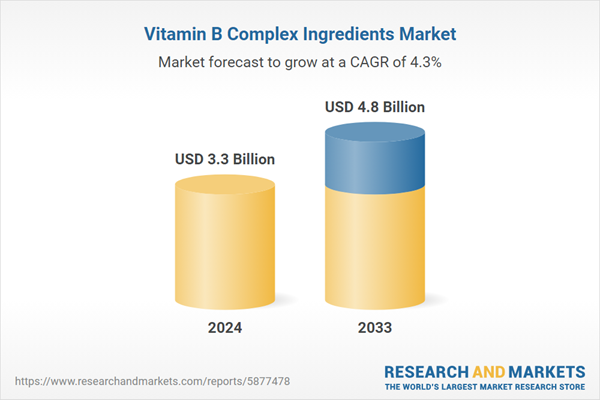

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.3 Billion |

| Forecasted Market Value ( USD | $ 4.8 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |