Vitamins are increasingly being integrated into food products like cereals, snacks, dairy, and beverages, while personal care brands are embedding them in skincare and haircare formulations to cater to demands for anti-aging, hydration, and environmental protection benefits. This dual application across sectors is accelerating market adoption. In personal care, vitamins serve as active ingredients offering anti-inflammatory, brightening, and restorative properties, particularly in serums, lotions, and shampoos. Evolving consumer preferences toward clean labels, plant-derived ingredients, and functional health benefits further amplify the uptake of vitamin ingredients, both in ingestible and topical formulations.

The vitamin B complex segment accounted for USD 2.9 billion in 2024 and is expected to grow at a CAGR of 6.4% through 2034. Known for its essential role in metabolism, energy production, neurological function, and prenatal care, this category includes various forms like B1, B2, B3, B6, B9, and B12. These ingredients are widely formulated in dietary supplements, energy drinks, and fortified foods.

In personal care, derivatives such as B3 and B5 are popular for their ability to support skin hydration, reduce redness, and enhance overall skin tone. Due to their wide applicability and cost-effectiveness, B complex vitamins remain a preferred ingredient for manufacturers. Their versatility and efficacy make them ideal for a range of both nutritional and cosmetic applications, strengthening their footprint in the vitamin ingredients space.

The natural source segment was valued at USD 3.5 billion in 2024 and is projected to grow at a CAGR of 6.5% between 2025 and 2034, holding a 38.2% market share. A growing consumer preference for clean-label, naturally derived, and plant-based ingredients is pushing brands to use natural vitamin sources in product formulations. These vitamins, extracted from botanicals, fruits, and vegetables, are widely perceived as safer, more effective, and better absorbed.

Demand is especially high in premium categories across food and beauty, where transparency and sustainability are top priorities. Natural sources such as acerola for vitamin C or sunflower oil for vitamin E are widely adopted for their compatibility with organic and minimally processed formulations, supporting the push toward ethical and transparent product development.

U.S. Vitamin Ingredients Market for Food & Personal Care Applications was valued at USD 2.1 billion in 2024 and is anticipated to grow at a 6.4% CAGR through 2034. In the U.S., increasing consumer focus on preventive health, coupled with rising awareness of clean-label products, continues to fuel demand. The advanced food and beauty industries, combined with strong regulatory support and innovation in product formulation, are key factors driving market expansion. R&D capabilities allow companies to improve bioavailability and efficacy, while nutrient fortification guidelines issued by authorities foster consumer trust. The use of vitamin-infused skincare and functional foods also contributes to market traction.

Key companies operating in this Vitamin Ingredients Market for Food & Personal Care Applications include BASF, Glanbia, Bluestar Adisseo, Lonza Group, and DSM N.V. These players are focusing on innovation, product development, and expanding their natural ingredient portfolios to stay competitive. To strengthen their presence in the vitamin ingredients market for food and personal care, leading companies are adopting multi-pronged strategies.

These include expanding product lines with natural and clean-label ingredients, forming strategic partnerships across food and beauty sectors, and investing in R&D to enhance ingredient bioavailability and stability. Firms are also leveraging consumer demand for transparency by offering traceable sourcing and sustainability certifications. In addition, companies are increasingly targeting niche health segments like prenatal care, aging skin, and vegan diets to diversify their offerings and tap into high-growth categories.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this vitamin ingredients market report include:- Adisseo (Bluestar Adisseo Company)

- Archer Daniels Midland Company (ADM)

- BASF SE

- DSM-Firmenich AG

- Eastman Chemical Company

- Fenchem Biotek Ltd.

- Foodchem International Corporation

- Glanbia plc

- Kappa Bioscience AS

- Koninklijke DSM N.V.

- Lonza Group

- Lycored

- Nutraceutical Corporation

- Prinova Group LLC

- Sternchemie GmbH & Co. KG

- The Lubrizol Corporation

- Vertellus Holdings LLC

- Vitablend Nederland B.V.

- Vitalife Biosciences

- Zhejiang NHU Co.- Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 235 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

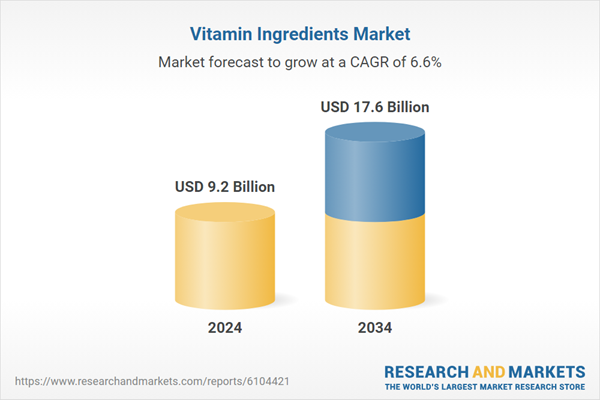

| Estimated Market Value ( USD | $ 9.2 Billion |

| Forecasted Market Value ( USD | $ 17.6 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |