Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Technological advancements are unlocking new opportunities for feed binder manufacturers, especially with the introduction of multifunctional binders that support gut health, toxin control, and improved digestibility. Additionally, the industry is witnessing a strong shift toward natural and sustainable ingredients, driven by regulatory scrutiny and consumer demand for safer animal products. This transition is encouraging companies to invest in R&D and diversify their portfolios to align with evolving animal nutrition standards.

Key Market Drivers

Growing Demand for Compound Feed

The increasing demand for compound feed is a significant driver for the feed binders market, as livestock producers prioritize uniform and nutritionally balanced feed to improve growth rates and overall animal health. This trend is particularly prevalent in intensive poultry and swine farming operations, where feed conversion efficiency directly impacts profitability.According to a 2024 Alltech report, global compound feed production rose by 1.2%, with poultry feed maintaining the largest share. This growth highlights the expanding preference for formulated feed, even amid economic uncertainty.

In the aquaculture sector, feed demand is also on the rise. The FAO reported a 3.7% global increase in aquafeed production in 2024, largely driven by Asia’s growing fish farming operations. Pelletized, water-stable feed formulations are critical in these systems, intensifying the demand for high-performance binders. These feeds not only improve conversion ratios but also help address environmental concerns such as water pollution, reinforcing the role of binders in sustainable aquaculture practices.

Key Market Challenges

Volatility in Raw Material Supply and Prices

One of the primary challenges facing the feed binders market is the volatility in the supply and pricing of essential raw materials, including agricultural products like wheat, corn, guar gum, and cassava starch, as well as mineral-based inputs like bentonite.These materials are susceptible to disruptions from climate events, inconsistent crop yields, and fluctuations in global commodity markets. For example, a poor monsoon season in India - one of the world’s major guar gum producers - can result in supply shortages and price spikes, affecting product consistency and profitability.

Additional cost pressures from rising energy prices and transportation inefficiencies compound the issue, particularly in regions with underdeveloped logistics infrastructure. Given the price-sensitive nature of feed binders, these cost increases can either erode margins or lead to higher prices for end-users, potentially limiting demand and hindering market growth.

Key Market Trends

Surge in Natural & Sustainable Binders

A significant trend in the feed binders industry is the growing shift toward natural, biodegradable, and eco-friendly alternatives to synthetic binders. Regulatory changes and consumer preferences are prompting feed producers to eliminate ingredients associated with toxicity and residues in animal products.As a result, natural binders such as guar gum, cassava starch, wheat gluten, lignosulfonates, and seaweed extracts are gaining traction. These binders are non-toxic, sustainable, and often provide additional nutritional value, making them suitable for use in antibiotic-free and clean-label feed formulations.

Livestock producers, particularly in markets with strict feed additive regulations, are adopting these solutions to support animal welfare and enhance market appeal. Feed manufacturers are responding by reformulating products to ensure pellet stability, water resistance, and digestibility, aligning with broader sustainability and food safety goals across the feed-to-food supply chain.

Key Market Players

- Beneo GmbH

- Borregaard AS

- CP Kelco U.S., Inc.

- Anpario plc.

- Roquette Freres SA

- Bentoli, Inc.

- Royal Avebe U.A.

- Cra-Vac Industries Inc.

- Uniscope Inc.

- Elixir Bio Life Science

Report Scope:

In this report, the Global Feed Binders Market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Feed Binders Market, By Type:

- Lignosulfonates

- Plant Gums and Starches

- Molasses

- Clay

- Others

Feed Binders Market, By Livestock:

- Poultry

- Ruminants

- Swine

- Aquatic Animals

- Others

Feed Binders Market, By Nature:

- Natural

- Synthetic

Feed Binders Market, By Region:

North America

- United States

- Mexico

- Canada

Europe

- France

- Germany

- United Kingdom

- Spain

- Italy

Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

South America

- Brazil

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies in the Global Feed Binders Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Beneo GmbH

- Borregaard AS

- CP Kelco U.S., Inc.

- Anpario plc.

- Roquette Freres SA

- Bentoli, Inc.

- Royal Avebe U.A.

- Cra-Vac Industries Inc.

- Uniscope Inc.

- Elixir Bio Life Science

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | July 2025 |

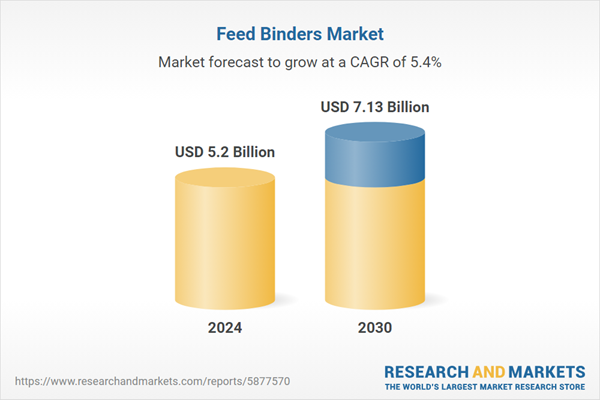

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 7.13 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |