Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction that frames task management as an integrated organizational capability driving measurable productivity, collaboration, and governance outcomes

The contemporary executive agenda increasingly centers on optimizing task management capabilities to sustain productivity, enable hybrid workflows, and support rapid organizational change. Executives face converging pressures from distributed workforces, expectations for digital collaboration experiences, and the need to rationalize tool portfolios while preserving security and compliance. In response, successful leaders are reframing task management not as an isolated toolset but as an integrated capability that spans process design, governance, and employee experience.Against this backdrop, executives must balance short-term operational continuity with long-term strategic transformation. Technology choices influence organizational rhythms and can either reduce friction or create administrative overhead depending on integration, usability, and governance. As a result, the selection, deployment, and scaling of task management solutions have become central to initiatives in workforce enablement, cost optimization, and customer delivery. The synthesis of people, process, and platform forms the basis for sustained productivity improvements and creates the conditions for measurable outcomes in project throughput and cross-functional coordination.

To navigate these realities, leadership teams should prioritize clarity around desired outcomes, establish measurable adoption indicators, and commit to iterative change management. By doing so, organizations can unlock the full potential of task management investments and convert tactical improvements into durable operational advantages.

A clear perspective on transformative shifts in task management driven by cloud architectures, intelligent automation, workforce evolution, and heightened governance expectations

The landscape of task management is undergoing a sequence of transformative shifts driven by technological maturation, workforce expectations, and regulatory demands. Cloud-native architectures and modular integrations are enabling deeper interoperability between task systems, communication platforms, and enterprise applications, which in turn reduces context switching and accelerates decision cycles. Simultaneously, advances in AI and automation are moving beyond simple notifications to enable intelligent task routing, priority scoring, and contextual recommendations that reduce manual coordination burdens.These technological shifts are mirrored by changes in work practices. Hybrid and distributed teams require asynchronous collaboration patterns and clearer artifacts for accountability, which elevates the importance of transparent workflows and role-based access controls. Moreover, organizations are increasingly treating task management tools as strategic infrastructure for knowledge capture and process standardization rather than as ad hoc utilities. This shift amplifies requirements for data portability, auditability, and integration with identity and security frameworks.

Finally, compliance and data sovereignty considerations are reshaping vendor evaluation criteria, particularly for regulated industries. The net effect of these forces is a market that favors adaptable platforms with strong integration ecosystems and demonstrable governance capabilities. Leaders who anticipate and invest in these transformative trends will reap benefits in agility, resiliency, and operational clarity.

An analysis of how shifting tariff policies reshape procurement, deployment choices, and commercial protections for technology-driven task management solutions

The evolving tariff environment in the United States is influencing procurement strategies, vendor selection, and cost modeling across technology-dependent initiatives. Tariff adjustments affect the total landed cost of hardware-dependent solutions and have ripple effects across vendor supply chains, particularly for providers that maintain physical appliances or specialized devices as part of their task management offerings. Procurement teams are responding by re-evaluating vendor relationships, seeking greater transparency in bill-of-materials, and negotiating flexible commercial terms that mitigate exposure to import duty volatility.In parallel, organizations are adapting their deployment choices to reduce the impact of tariff-driven cost fluctuations. Cloud-first and software-centric models reduce dependency on shipped hardware, thereby limiting direct tariff exposure and enabling more predictable operating expense profiles. Where on-premise appliances remain necessary for latency, sovereignty, or compliance reasons, buyers are increasingly demanding clear sourcing declarations and contingency plans from suppliers to manage tariff risk.

As a result, procurement policies now emphasize contractual protections, diversified sourcing, and lifecycle cost analyses that incorporate potential tariff scenarios. Finance and procurement stakeholders must maintain close coordination with product and IT teams to align technical requirements with commercially resilient sourcing strategies. This collaborative approach ensures that deployment decisions reflect both operational imperatives and evolving macroeconomic constraints.

Insightful segmentation analysis revealing how deployment, component focus, organization scale, and industry requirements uniquely influence adoption patterns and procurement priorities

A nuanced segmentation view reveals how adoption patterns and value propositions vary across deployment models, component focus, organizational scale, and industry demands. Deployment considerations differentiate Cloud, Hybrid, and On-Premise approaches, with Cloud further delineated into Private Cloud and Public Cloud options that address differing priorities for scalability, control, and data governance. Component-level segmentation distinguishes Services and Software, where Services encompasses Professional Services and Training And Support, highlighting the recurring need for implementation expertise and user enablement alongside platform capabilities.Organization size plays a critical role in shaping procurement criteria. Large Enterprises prioritize centralized governance, extensive integration capabilities, and enterprise-grade security, while Small And Medium Enterprises emphasize rapid time-to-value, cost efficiency, and simplicity of administration. End-user industry characteristics further influence functional requirements; sectors such as BFSI, Government And Defense, Healthcare, IT And Telecom, and Retail And Ecommerce impose distinct compliance, latency, and interoperability constraints that alter feature prioritization and vendor evaluation.

Understanding these intersecting segmentation layers enables vendors and buyers to align solution design, commercial models, and support frameworks with real-world needs. Consequently, tailored deployment options, modular pricing, and industry-specific compliance toolkits are essential to achieve high adoption and sustained value realization across diverse customer segments.

A regional perspective that connects regulatory realities, procurement behaviors, and ecosystem maturity to targeted go-to-market and product strategies across global markets

Geographic dynamics continue to shape product roadmaps, partner strategies, and go-to-market priorities across major regions. In the Americas, emphasis is placed on rapid innovation cycles, integration with widely adopted collaboration suites, and scalability for enterprises that prioritize centralized procurement and cross-border operations. This region also demonstrates a strong appetite for flexible commercial arrangements and cloud-centric deployments that reduce capital expenditure and accelerate time-to-value.Across Europe, Middle East & Africa, regulatory considerations and data sovereignty play an outsized role in shaping adoption choices. Buyers in this region frequently require private cloud or hybrid configurations, granular data residency controls, and exhaustive audit capabilities, driving vendors to enhance compliance features and local partner ecosystems. Meanwhile, demand for industry-specific certifications and regional support presence can be decisive factors in selection.

In Asia-Pacific, growth is propelled by a mix of large digital-native enterprises and rapidly modernizing public sector organizations. This market favors localized feature sets, multilingual support, and solutions that accommodate diverse connectivity and infrastructure conditions. Vendors aiming for traction in this region must balance global product standards with local adaptability and strong channel partnerships. Overall, regional strategies must be calibrated to regulatory environments, procurement behaviors, and ecosystem maturity to ensure sustained adoption.

Key competitive and partnership insights that reveal how integration ecosystems, services expertise, and customer success frameworks determine platform selection and long-term adoption

Competitive dynamics are shaped by a mix of established platform providers, specialized niche players, and integrators that offer bespoke services. Leading vendors differentiate through breadth of integrations, depth of workflow customization, and the ability to embed intelligent automation into routine processes. Complementary service providers play an essential role in enabling successful adoption by offering implementation expertise, change management, and ongoing training that translate technical capabilities into operational outcomes.Partnership ecosystems and developer communities increasingly determine platform stickiness. Vendors that foster rich APIs, extensible marketplaces, and third-party connectors enable customers to tailor solutions without incurring prohibitive implementation costs. At the same time, strategic alliances with systems integrators and managed service providers expand the reach of vendors into specialized verticals and geographic markets.

Buyers evaluate vendors not only on feature parity but on evidence of sustained customer success, support responsiveness, and roadmap transparency. The most compelling vendor propositions combine product excellence with a clear services model for deployment and ongoing enablement, underscoring the importance of end-to-end capability to realize the promise of modern task management.

Actionable recommendations to convert task management strategy into measurable outcomes by aligning governance, interoperability, enablement, and commercially resilient procurement practices

Industry leaders should adopt a set of prioritized actions that bridge strategic intent with rapid operational improvements. First, align task management initiatives with measurable business outcomes and define clear adoption metrics tied to productivity, cycle time, and customer experience. This orientation ensures that investments are evaluated on impact rather than feature counts and supports disciplined prioritization across competing initiatives.Second, pursue interoperable architectures that minimize vendor lock-in and facilitate data portability. By insisting on open APIs, standard connectors, and exportable metadata models, organizations retain strategic flexibility while enabling rapid composition of integrated workflows. Third, invest in structured enablement programs that include role-based training, playbooks for common processes, and internal champions to sustain adoption momentum. People and process investments are often the primary determinant of long-term success.

Finally, incorporate procurement and legal teams early to design flexible commercial models and risk-sharing clauses that address macroeconomic variables such as tariff shifts and supply chain constraints. Taken together, these actions create a resilient foundation that allows organizations to scale task management capabilities while preserving agility and fiscal control.

A rigorous mixed-method research approach combining executive interviews, cross-functional validation, and secondary analysis to produce actionable and defensible insights for decision-makers

The research methodology underpinning these insights combines primary qualitative interviews, secondary industry analysis, and cross-functional validation to ensure robust and applicable findings. Primary inputs include in-depth conversations with technology buyers, IT leaders, and solution architects to capture real-world deployment patterns, pain points, and success criteria. These conversations were structured to elicit both strategic objectives and the operational practices that enable or hinder adoption.Secondary analysis synthesizes industry publications, vendor documentation, and publicly available regulatory guidance to contextualize primary findings within broader technological and policy trends. Cross-functional validation workshops brought together practitioners from procurement, product, and legal functions to test emerging hypotheses and refine recommendations. Throughout the process, emphasis was placed on triangulating evidence, documenting assumptions, and ensuring that conclusions are supported by observed behaviors rather than vendor marketing claims.

This mixed-method approach yields insights that are both actionable and defensible, enabling leaders to apply recommendations with confidence while adapting them to their unique organizational constraints and goals.

A conclusive synthesis emphasizing that task management must be governed as an evolving organizational capability that drives sustainable productivity and strategic agility

In closing, modern task management is no longer a tactical convenience but a strategic enabler that influences operational efficiency, cross-team collaboration, and governance posture. Leaders who integrate task management into their broader digital workplace architecture and prioritize people-centric adoption practices will realize disproportionate benefits in throughput and responsiveness. Conversely, approaches that prioritize feature accumulation over integration, training, and measurement risk creating tool sprawl and adoption fatigue.Moving forward, organizations should maintain a dual focus on technological adaptability and organizational readiness. This means selecting platforms that support modular growth and interoperability while investing in the change practices that ensure sustained use. By aligning procurement, IT, and business stakeholders around a common set of outcomes and by embedding continuous improvement into governance routines, teams can convert tactical wins into strategic advantage.

Ultimately, the path to long-term success lies in treating task management as an evolving capability that requires both technical stewardship and disciplined organizational change, ensuring that investments deliver repeatable value across initiatives and time horizons.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Task Management Software Market

Companies Mentioned

The key companies profiled in this Task Management Software market report include:- Adobe Inc.

- Airtable

- Asana, Inc.

- Atlassian, Inc.

- Basecamp, LLC

- Bitrix Inc.

- ClickUp

- Dell Inc.

- Doist Inc.

- Evernote Corporation

- HCL Technologies Limited

- Inflectra Corporation

- Microsoft Corporation

- Pivotal Software, Inc.

- Planview

- Quickbase, Inc.

- Redbooth, Inc.

- RingCentral, Inc.

- SAS Institute Inc.

- TeamWave Inc.

- Upland Software, Inc.

- WebWork Time Tracker, Inc.

- Wrike, Inc.

- Zendesk, Inc.

- Zoho Corporation Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

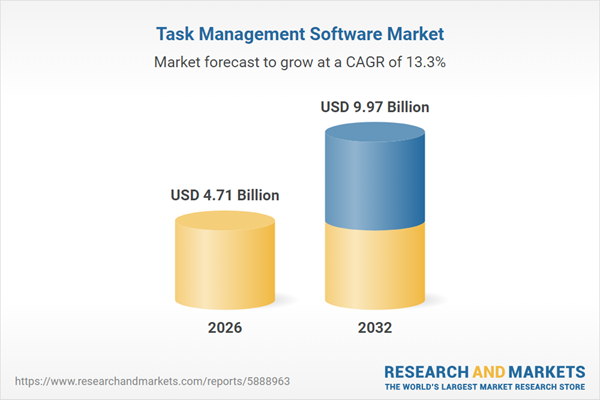

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.71 Billion |

| Forecasted Market Value ( USD | $ 9.97 Billion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |