Flavoured Milk Market Growth

Flavoured milk is a sweetened dairy beverage that is sold as pasteurised, refrigerated product. It is made with sugar, milk, flavourings, and sometimes food colourings. It can also be easily made at home or restaurants by adding flavours to the milk. Flavoured milk is among the most popular milk-based beverages and is also regarded as a good alternative to regular milk as it has the same nutritional value as standard milk. The ultra-high-temperature (UHT) therapy pasteurises it, giving it a longer shelf-life than traditional milk. The growth of the flavoured milk market is driven by the rising inclination of consumer towards healthy lifestyle and changing dietary habits. Flavoured milk provides convenience, has a longer shelf-life, and can be consumed straight away without boiling. In contrast to soft drinks or not carbonated sweetened beverages, which comprises of about 40% of the added sugar, flavoured milk generally only has 4% as added sugars.Additionally, the market is set to grow as the flavoured milk demand, consumption, and sales is likely to increase in the coming years as it provides various nutrients such as potassium, calcium, and magnesium, without compromising on the taste of the product. For example, in India, flavoured milk consumption surged by 25% over the last five years, while in China, flavoured milk sales experienced a 20% increase in 2022 alone. Similarly, in the United States, flavoured milk represented approximately 15% of total milk sales in 2021, indicating a robust consumer interest in this product. Similarly, in April 2024, the U.S. Department of Agriculture (USDA) decided to keep flavoured milk options in school menus. This decision has garnered support from the International Dairy Foods Association, as it promotes ongoing milk consumption in educational institutions.

Key Trends and Developments

Launch of creative flavours and packaging, rising consumer focus on health and wellness, and increasing milk consumption are the key trends propelling growth of the market.September 2024

The Odisha Cabinet sanctioned a substantial scheme worth INR 1,400 crore, designed to enhance milk production. This initiative is anticipated to significantly benefit the state's dairy industry, increase the income of 15,47,837 farmers, and provide numerous flavoured milk market opportunities.November 2023

The Madras High Court ruled that flavoured milk should be taxed at a reduced rate of 5% under Goods and Services Tax (GST) regime. This has classified flavoured milk as a ‘milk and cream product’ rather than a milk-containing beverage, which is currently subjected to a 12% tax rate in India.September 2024

The West Assam Milk Producers' Cooperative Union Ltd (WAMUL), known for its brand 'Purabi Dairy', introduced the first long-shelf-life flavoured milk in Northeast India. The new variants, including Mango, Strawberry, and Kesar, increases milk production and positively impacts flavoured milk demand forecast.November 2023

Kwik Trip introduced special fall-themed flavoured milks, including pumpkin spice milk, which has demonstrated strong sales and thus, has boosted flavoured milk market revenue.Rising Strategic Acquisitions

Key players are actively pursuing acquisitions to enhance their product offerings and market presence. For instance, in February 2022, A2 Milk Co. collaborated with The Hershey Company to launch a new chocolate-flavoured milk product. Similarly, in September 2024, Forbidden Foods acquired Oat Milk Goodness (OMG) for USD 2.3 million to expand its offerings of flavoured oat milk in the US region. This strategic acquisition aims to use Forbidden Foods' distribution network and profit on the rising demand for milk alternatives. Such partnerships not only expand product lines but also leverage brand strengths to attract diverse consumer segments.Advancements in Packaging Technology

The market is witnessing variations in packaging formats. Single-serve, eco-friendly, and resealable bottles are becoming more popular among consumers who prioritise sustainability. A report by Tetra Pak in 2023 revealed that 60% of consumers favour eco-friendly packaging, prompting companies to innovate in this area. These developments in flavours and packaging are enabling brands to capture a wider flavoured milk market share.Launch of Creative Flavours

A notable trend is the emergence of distinctive and innovative flavours to meet the changing preferences of consumers. In 2024, companies are increasingly exploring beyond conventional flavours such as chocolate and strawberry by introducing options like vanilla chai and salted caramel. For example, in 2023, Amul unveiled a creative range of flavoured milk in India, showcasing regional favourites such as kesar (saffron), mango, rose, and elaichi (cardamom). Furthermore, brands like TruMoo in the United States have rolled out limited-edition flavours, including cookies and cream, to generate consumer demand/interest.Rising Demand for Milk Products

The rising demand for milk products, particularly in India, is influencing flavoured milk market dynamics. In 2023-24, India's milk production reached an impressive 239.30 million tonnes, reflecting a 3.78% increase from the previous year. As the world's largest milk producer, India contributes over 25% of global milk production, which is about three times that of China. This robust sector is expected to see revenue growth of 13-14% in FY 2024-25, driven by increased consumption of value-added products and liquid milk. These statistics underscore the increasing consumer preference for dairy products in India, including flavoured milk.Flavoured Milk Market Trends

Another factor influencing the market is the increasing consumer emphasis on health and wellness, particularly in 2024, as the appetite for low-sugar, organic, and fortified flavoured milk products has grown. In response, numerous manufacturers have launched flavoured milk enriched with essential vitamins, minerals, and proteins to appeal to health-oriented consumers. For instance, in 2023, Horizon Organic launched a series of organic, low-sugar flavoured milk products fortified with Omega-3s and DHA, designed to promote brain health in children. This transition towards healthier formulations is propelling flavoured milk market expansion, which is evident in industry reports starting a 12% rise in sales of organic and low-sugar flavoured milk products in North America. By addressing consumer apprehensions regarding sugar content and artificial ingredients, the market is expanding to include individuals who previously avoided flavoured milk for health-related issues.Opportunities in Flavoured Milk Market

As urbanisation intensifies in nations such as India and China, there is a notable increase in the demand for convenient and nutritious beverage options, which presents substantial growth opportunities. For example, the urban population in India rose from 34% in 2011 to 40% in 2023, contributing to a 25% rise in flavoured milk sales during this timeframe. Moreover, the trend towards health-oriented products, including low-sugar and fortified flavoured milk, provides avenues for companies to meet changing consumer demands, leading to influenced trends in the flavoured milk market.Additionally, the growing appeal of plant-based alternatives presents an opportunity for dairy-free flavoured milk options, catering to the swiftly growing vegan and lactose-intolerant populations. Sales of almond and oat milk, for instance, surged by 19% and 25% respectively in 2023, with brands like Silk successfully leveraging this trend by introducing flavoured options that resonate with health-conscious and environmentally conscious consumers.

Flavoured Milk Market Restraints

A notable challenge within the market is the growing consumer concern regarding high sugar content, leading to a shift away from traditional sweetened flavoured milk products. As knowledge about the health risks associated with excessive sugar consumption, such as obesity and diabetes, increases, consumers are becoming more selective in their beverage choices. For example, a report released by the World Health Organization (WHO) in 2023 highlighted a 40% increase in global obesity rates over the past two decades, resulting in stricter regulations on sugary products in various regions. In response, countries like the UK have implemented sugar taxes on high-sugar beverages, including flavoured milk. This has forced manufacturers to either reformulate their offerings or face a potential decline in sales, thereby affecting flavoured milk market dynamics and trends. For instance, in 2023, Nestlé introduced reduced-sugar versions of its flavoured milk line to appeal to health-conscious consumers.Additionally, the rise of plant-based milk alternatives, such as almond and oat milk, which are often perceived as healthier options, is further impeding the growth of traditional dairy-based flavoured milk. A 2023 study by the International Dairy Federation indicated that 35% of consumers in North America preferred plant-based beverages over flavoured milk due to health concerns, highlighting the impact of these challenges on market evolution.

Flavoured Milk Industry Segmentation

“Flavoured Milk Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Flavour

- Chocolate

- Fruits

- Vanilla

- Others

Market Breakup by Packaging

- Paper Based

- Plastic Based

- Glass Based

- Metal Based

- Others

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Flavoured Milk Market Share

Market Analysis by Flavour

Chocolate remains the most favoured category in the flavoured milk market, primarily due to its indulgent flavour and widespread appeal among both children and adults. In 2023, notable brands such as Hershey’s and Nestlé experienced a 10% rise in sales of chocolate-flavoured milk, a trend attributed to health-conscious consumers opting for low-sugar options.According to flavoured milk industry analysis, fruit-flavoured milk also commands a substantial portion of the market, propelled by innovations in tropical flavours and local tastes. For instance, in India, Amul introduced mango and banana flavoured milk products in 2023, resulting in a 15% increase in sales within the fruit segment across Asia.

Vanilla-flavoured milk, known for its mild flavour, also occupies a significant market share. In 2023, its popularity surged across various regions, largely due to its compatibility with lactose-free milk alternatives. Companies such as Slate and Fairlife have taken advantage of this trend by launching vanilla variants that feature reduced sugar and enhanced protein content, thereby contributing to the growth of this segment.

Market Analysis by Packaging

Paper-based packaging, commonly used in milk cartons, is increasingly favoured in flavoured milk market landscape for its environmentally friendly characteristics. Segment’s growth can be attributed to government initiatives that advocate for sustainable packaging solutions, such as the EU’s Circular Economy Action Plan, which promotes the use of recyclable materials. Companies like Fonterra have also transitioned to paper-based milk cartons.Conversely, plastic-based packaging, including PET bottles, continues to dominate the market share. Nevertheless, rising concerns regarding plastic waste and regulatory measures, such as India’s 2022 ban on single-use plastics, are driving companies to explore sustainable alternatives. In response, several brands are integrating recyclable plastics into their packaging, leading to flavoured milk market development. For example, Danone announced in 2023 its commitment to using 100% recyclable plastic bottles for its flavoured milk products in the United States.

Metal-based packaging, primarily in the form of aluminium cans, has witnessed growth in popularity due to the durable and recyclable nature of metal. Start-ups like Slate, which launched flavoured milk in recyclable aluminium cans in 2023, have reported a 20% increase in sales, further increasing overall flavoured milk market value.

Market Analysis by Distribution Channel

Supermarkets and hypermarkets continue to dominate the distribution landscape. Their extensive product selections and promotional strategies make them a preferred choice for bulk purchases. Retailers such as Walmart and Carrefour have notably expanded their flavoured milk ranges by including low-sugar and plant-based alternatives. Flavoured milk market analysis suggest that urbanisation and rising household incomes are significant factors propelling sales in this category.Convenience stores, on the other hand, attract consumers seeking single-serve milk options. A survey conducted by the International Dairy Foods Association (IDFA) revealed that 60% of flavoured milk purchases in these stores are impulsive, driven by the desire for quick, ready-to-drink beverages. Brands like TruMoo have successfully partnered with convenience store chains such as 7-Eleven to provide varied flavoured milk choices to consumers, leading to flavoured milk market growth.

Lastly, online sales channel has experienced significant growth. As per industry reports, e-commerce has seen 18% year-over-year increase in online flavoured milk sales, driven by the convenience of home delivery and the emergence of digital grocery platforms such as Amazon, Blinkit, Zepto, and Instacart. Brands are also increasingly using online channels to expand their reach and offer direct-to-consumer (DTC) subscription services.

Flavoured Milk Market Regional Insights

North America Flavoured Milk Market Trends

North America occupies a prominent position in the market, with the United States and Canada at the forefront of the region. In 2023, the consumption of flavoured milk in the U.S. represented 20% of total milk sales, as reported by the International Dairy Foods Association (IDFA). The rising preference for low-sugar and fortified options, including lactose-free products from brands such as Fairlife, significantly contributes to the market's expansion in this area. Additionally, the United States Department of Agriculture (USDA) noted a 10% rise in flavoured milk sales within schools in 2023, highlighting ongoing initiatives to encourage healthier beverage selections among young children.Asia Pacific Flavoured Milk Market Drivers

In the Asia Pacific region, the market holds the largest share, driven by increasing awareness of the nutritional advantages of flavoured milk and the growing disposable income of consumers. A report from the India Brand Equity Foundation (IBEF) in 2023 indicated that flavoured milk sales in India experienced a 25% increase over the last five years. Likewise, in China, flavoured milk is gaining traction among health-conscious individuals, according to the China Dairy Industry Association. The rapid enhancement of manufacturing capabilities in China is further stimulating market growth. Additionally, the expanding retail sector, heightened health consciousness, and a rising demand for healthier alternatives to carbonated beverages are further propelling market growth in the Asia Pacific region.Europe Flavoured Milk Market Opportunities

Europe remains a mature market for flavoured milk, but the demand for organic and plant-based options is growing rapidly. In 2023, the European Union reported a 12% increase in sales of organic flavoured milk, driven by rising health awareness and stringent regulations on sugar content in beverages. Brands like Alpro have expanded their range of plant-based flavoured milk in response to this trend, particularly in the UK and Germany. Additionally, the EU’s focus on sustainable packaging is pushing manufacturers to adopt paper and glass-based packaging for milk products.Latin America Flavoured Milk Market Growth

In Latin America, the market for flavoured milk is growing at a steady rate. According to a 2023 government report by Brazil’s Ministry of Agriculture, flavoured milk sales increased by 8%, driven by growing urban populations and a shift towards ready-to-drink beverages. Brands are also introducing flavours that cater to local tastes, such as coconut and dulce de leche. However, the market faces challenges due to economic instability in some countries, which has affected consumer spending on premium flavoured milk products.Middle East and Africa Flavoured Milk Market Dynamics

In Middle East and Africa, the market for flavoured milk is witnessing substantial growth. A 2023 report by the Saudi Ministry of Environment, Water, and Agriculture highlighted a 9% increase in flavoured milk consumption due to the region’s young population and growing preference for Westernised diets. In South Africa, demand for affordable and nutrient-rich beverages has bolstered flavoured milk sales, particularly among low- to middle-income households. However, challenges such as limited cold chain infrastructure in some parts of Africa is hindering market expansion.Flavoured Milk Market Overview of Innovative Start-ups

Start-ups in the flavoured milk industry are introducing low-sugar, organic, and plant-based alternatives to cater to the increasing consumer preference for healthier drink options. Numerous companies are also experimenting with unique flavours, such as turmeric or matcha-infused milk, to appeal to more adventurous consumers. Additionally, many start-ups are prioritizing sustainable packaging and responsibly sourced ingredients. For example, a start-up based in the United States has launched a high-protein, lactose-free flavoured milk packaged in recyclable aluminium, targeting environmentally conscious consumers. Notable start-ups contributing to a positive flavoured milk market outlook include:Slate Milk, established in 2019 and located in Boston, Massachusetts, focuses on lactose-free, high-protein flavoured milk designed for health-oriented individuals. The company provides flavours like chocolate and vanilla, with each can containing 20g of protein and no added sugar. By 2023, Slate had raised over USD 5 million in funding and successfully distributed its products to more than 2,000 retail locations, including Whole Foods and Walmart. Their dedication to using eco-friendly, recyclable aluminium packaging further enhances their appeal to environmentally aware consumers.

Mooala, established in 2016 and based in Dallas, Texas, has emerged as a prominent player in the flavoured milk market. The company offers almond and banana-based milk in flavoured varieties such as vanilla and chocolate, all of which are organic, dairy-free, and low in sugar. By 2023, Mooala expanded its distribution to over 5,000 retail locations across the United States, including major retailers like Kroger and Target.

Competitive Landscape

Market players in the flavoured milk industry are focused on product development to align with changing consumer preferences. For example, brands such as Horizon Organic provide organic flavoured milk alternatives, while Nesquik has launched chocolate and strawberry milk with reduced sugar levels. Companies like Fairlife are concentrating on high-protein, low-sugar products to attract health-conscious consumers. Furthermore, brands such as Chobani are improving their packaging solutions to enhance convenience and sustainability. There is also a notable focus on expanding distribution networks in the Asia-Pacific region, where brands like Dairy Farmers are gaining traction.The Hershey Company

The Hershey Company was founded in 1894 and is headquartered in Pennsylvania, United States. It stands as a prominent chocolate manufacturer, offering over 90 brands across 85 countries. It employs around 17,000 individuals worldwide and is renowned for its iconic products, such as Hershey's Kisses and Reese's Peanut Butter Cups.Saputo Inc.

Saputo Inc. was founded in 1954 and is headquartered in Quebec, Canada. It is recognised as one of the largest dairy processors globally, operating in ten countries, including Canada, the United States, Australia, and Argentina. The company offers cheese, fluid milk, and dairy ingredients in both Canadian and international markets.

Nestlé S.A.

Nestlé S.A. was founded in 1886 and is headquartered in Vevey, Switzerland. It is a global leader in nutrition and health products, operating in over 190 countries. The company offers baby food, bottled water, dairy products, and coffee.

Arla Foods amba

Arla Foods amba was founded in 2000 through a merger of Arla and MD Foods and is headquartered in Denmark, Germany. It is a cooperative dairy company owned by farmers from Denmark and Sweden, operating in over 100 countries. It offers milk, cheese, butter, and yogurt products.Other flavoured milk market players include Danone SA, Fonterra Co-orperative Group, Molkerei Alois Muller GmbH & Co. Kg, and Gujarat Cooperative Milk Marketing Federation Ltd., among others.

Table of Contents

Companies Mentioned

The key companies featured in this Flavoured Milk market report include:- The Hershey Company

- Saputo Inc

- Nestlé S.A.

- Danone SA

- Arla Foods amba

- Fonterra Co-operative Group

- Molkerei Alois Müller Gmbh & Co. Kg

- Gujarat Cooperative Milk Marketing Federation Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 171 |

| Published | August 2025 |

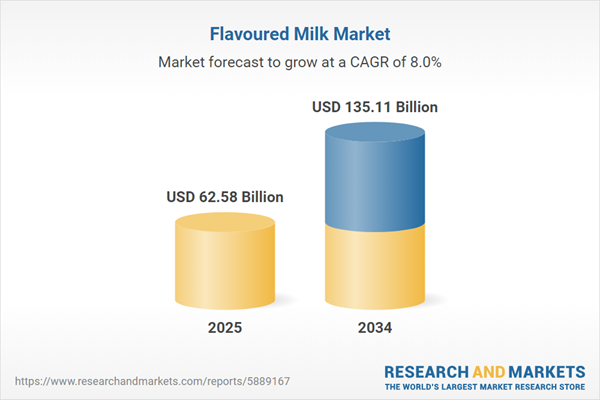

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 62.58 Billion |

| Forecasted Market Value ( USD | $ 135.11 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |