Increasing demand from consumers for indulgent flavors drives the flavored milk market in North America. The best-selling varieties continue to be chocolate, vanilla, and strawberry; however, consumers are beginning to explore unique or exotic flavors such as caramel and coffee, and even seasonal options like pumpkin spice. The selection is appealing to both children and adults, thus expanding the customer base. As people look for comfort and enjoyment in their beverages, brands are bringing innovation into richer, creamier flavor profiles that intensify the indulgence factor. This has created continuous product innovations in the flavored milk market, therefore rendering it dynamic and competitive.

The major factor that has sustained the growth of the flavored milk market of North America is effective marketing strategies. Brands that have opted for mass television advertising, social media, and digital platforms alike are striving to create visibility for their brands and to raise consumer consciousness about the nutritional benefits, versatility, and flavor aspects of flavored milk. High-profile partnerships with influencers and celebrities, an increasingly focused approach toward flavor innovation or health benefits, and concentrated efforts to penetrate particular consumer segments have all been gaining the attention of marketers. Thus, more consumers are aware of their flavored milk alternatives through advertisements and promotions, which has led to a heightened interest and growth, giving flavored milk a greater share of the overall market.

North America Flavoured Milk Market Trends:

Growing demand for plant-based flavored milk

Demand for plant-based flavored milk has risen in North America, which is experiencing a heightened shift in vegan and dairy-free lifestyles. Consumers have slowly begun to become health-conscious, and therefore are looking for alternatives that are lower in cholesterol, lactose, and fat. Almond milk, oat milk, and coconut milk are popular options, flavored with vanilla, chocolate, or fruit infusions. Brands are therefore innovating to create dairy-free versions that still deliver the same rich, creamy taste and nutritional value of traditional flavored milk. This trend is also being fueled by growing environmental concerns regarding animal farming.Health-conscious flavored milk with functional ingredients

According to WHO, the world is already off-track on its achievement targets for the Universal health coverage plan by the year 2025, called the "Triple Billion Targets", which is an initiative by WHO. Keeping the health and wellness trends in view, consumers are moving toward products containing different flavors and functional ingredients in the form of probiotics, protein, or vitamins. This indicates the increasing demand for truly functional foods that go beyond providing bare essential nutrition. Protein-fortified flavored milk is beneficial for the fitness enthusiasts, whereas probiotic-infused products are marketed toward consumers concerned with digestive health. Hence, this is creating an avenue for the companies to capitalize on the trends of health and wellness, by launching products that appeal to health-conscious consumers, such as low-sugar or sugar-free versions made from quality ingredients.Increased popularity of convenience and ready-to-drink flavored milk

Significant increase in the ready to eat (RTE) food market is strengthening the market further. This demand for convenience has spurred the growth of products such as ready-to-drink (RTD) flavored milk in North America as well. Busy lifestyles and on-the-go consumption drive the need for portable, single-serve packaging in a range of flavors. Brands are bringing flavored milk into convenient bottles, cartons, and cans so that consumers can enjoy a nutritious, flavorful beverage wherever they may be. The trend will likely drive growth further, with increased interest in flavored milk as an on-the-go snack, providing healthy, quick offering options for kids and adults.North America Flavoured Milk Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the North America flavoured milk market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on flavour, packaging, and distribution channel.Analysis by Flavour:

- Chocolate

- Fruit

- Vanilla

- Others

Analysis by Packaging:

- Paper Based

- Plastic Based

- Glass Based

- Metal Based

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Analysis by Country:

- United States

- Canada

Competitive Landscape:

North America flavoured milk market is driven due to strategic initiatives by key market players. Companies are spending highly on research and development for launching new flavours and improving product quality to suit a wide variety of consumer tastes. For instance, Fairlife ultra-filtered milk is available in chocolate, strawberry, and vanilla flavors for a healthy-conscious consumer who seeks more protein and lesser sugar. To cater to the growing demand for healthy and convenient beverages, these companies are now diversifying their product lines to include lactose-free and plant-based products. Mooala, for instance, has developed organic, plant-based creamers and non-dairy milks, including its newly launched USDA-certified organic barista oatmilk, targeting the fast-growing vegan and lactose-intolerant consumer segments. Strategic partnerships and acquisitions are also undertaken to enhance market presence and distribution networks. An example of strategic moves is the collaboration between Select Milk Producers and The Coca-Cola Company for the launch of Fairlife, leveraging Coca-Cola's extensive distribution channels to reach a wider consumer base.The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies.

Key Questions Answered in This Report

1. How big is the North America flavoured milk market in the region?2. What factors are driving the growth of the North America flavoured milk market?

3. What is the forecast for the flavoured milk market in North America?

4. Which segment accounted for the largest North America flavoured milk flavour market share?

5. Which segment accounted for the largest North America flavoured milk packaging market share?

6. Which segment accounted for the largest North America flavoured milk distribution channel market share?

7. Which segment accounted for the largest North America flavoured milk country market share?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Flavoured Milk Market

5.1 Market Performance

5.2 Market Breakup by Flavour

5.3 Market Breakup by Packaging

5.4 Market Breakup by Distribution Channel

5.5 Market Breakup by Region

5.6 Market Forecast

6 North America Flavoured Milk Market

6.1 Market Performance

6.2 Impact of COVID-19

6.3 Market Forecast

7 North America Flavoured Milk Market: Breakup by Flavour

7.1 Chocolate

7.2 Fruit

7.3 Vanilla

7.4 Others

8 North America Flavoured Milk Market: Breakup by Packaging

8.1 Paper Based

8.2 Plastic Based

8.3 Glass Based

8.4 Metal Based

9 North America Flavoured Milk Market: Breakup by Distribution Channel

9.1 Supermarkets and Hypermarkets

9.2 Convenience Stores

9.3 Specialty Stores

9.4 Online Stores

9.5 Others

10 North America Flavoured Milk Market: Breakup by Country

10.1 United States

10.1.1 Historical Market Trends

10.1.2 Market Breakup by Flavour

10.1.3 Market Breakup by Packaging

10.1.4 Market Breakup by Distribution Channel

10.1.5 Market Forecast

10.2 Canada

10.2.1 Historical Market Trends

10.2.2 Market Breakup by Flavour

10.2.3 Market Breakup by Packaging

10.2.4 Market Breakup by Distribution Channel

10.2.5 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

12.1 Overview

12.2 Farmers

12.3 Collectors

12.4 Manufacturers

12.5 Distributors

12.6 Retailers

12.7 Exporters

12.8 End-Consumers

13 Porter’s Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Rivalry

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

List of Figures

Figure 1: North America: Flavoured Milk Market: Major Drivers and Challenges

Figure 2: Global: Flavoured Milk Market: Volume Trends (in Billion Litres), 2019-2024

Figure 3: Global: Flavoured Milk Market: Breakup by Flavour (in %), 2024

Figure 4: Global: Flavoured Milk Market: Breakup by Packaging (in %), 2024

Figure 5: Global: Flavoured Milk Market: Breakup by Distribution Channel (in %), 2024

Figure 6: Global: Flavoured Milk Market: Breakup by Region (in %), 2024

Figure 7: Global: Flavoured Milk Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 8: North America: Flavoured Milk Market: Volume Trends (in Billion Litres), 2019-2024

Figure 9: North America: Flavoured Milk Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 10: North America: Flavoured Milk Market: Breakup by Flavour (in %), 2024

Figure 11: North America: Flavoured Milk (Chocolate) Market: Volume Trends (in Billion Litres), 2019 & 2024

Figure 12: North America: Flavoured Milk (Chocolate) Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 13: North America: Flavoured Milk (Fruit) Market: Volume Trends (in Billion Litres), 2019 & 2024

Figure 14: North America: Flavoured Milk (Fruit) Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 15: North America: Flavoured Milk (Vanilla) Market: Volume Trends (in Billion Litres), 2019 & 2024

Figure 16: North America: Flavoured Milk (Vanilla) Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 17: North America: Flavoured Milk (Other Flavours) Market: Volume Trends (in Billion Litres), 2019 & 2024

Figure 18: North America: Flavoured Milk (Other Flavours) Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 19: North America: Flavoured Milk Market: Breakup by Packaging (in %), 2024

Figure 20: North America: Flavoured Milk (Paper Based) Market: Volume Trends (in Billion Litres), 2019 & 2024

Figure 21: North America: Flavoured Milk (Paper Based) Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 22: North America: Flavoured Milk (Plastic Based) Market: Volume Trends (in Billion Litres), 2019 & 2024

Figure 23: North America: Flavoured Milk (Plastic Based) Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 24: North America: Flavoured Milk (Glass Based) Market: Volume Trends (in Billion Litres), 2019 & 2024

Figure 25: North America: Flavoured Milk (Glass Based) Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 26: North America: Flavoured Milk (Metal Based) Market: Volume Trends (in Billion Litres), 2019 & 2024

Figure 27: North America: Flavoured Milk (Metal Based) Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 28: North America: Flavoured Milk Market: Breakup by Distribution Channel (in %), 2024

Figure 29: North America: Flavoured Milk Market: Sale through Supermarkets and Hypermarkets (in Billion Litres), 2019 & 2024

Figure 30: North America: Flavoured Milk Market Forecast: Sales through Supermarkets and Hypermarkets (in Billion Litres), 2025-2033

Figure 31: North America: Flavoured Milk Market: Sales through Convenience Stores (in Billion Litres), 2019 & 2024

Figure 32: North America: Flavoured Milk Market Forecast: Sales through Convenience Stores (in Billion Litres), 2025-2033

Figure 33: North America: Flavoured Milk Market: Sales through Specialty Stores (in Billion Litres), 2019 & 2024

Figure 34: North America: Flavoured Milk Market Forecast: Sales through Specialty Stores (in Billion Litres), 2025-2033

Figure 35: North America: Flavoured Milk Market: Sales through Online Stores (in Billion Litres), 2019 & 2024

Figure 36: North America: Flavoured Milk Market Forecast: Sales through Online Stores (in Billion Litres), 2025-2033

Figure 37: North America: Flavoured Milk Market: Sales through Other Distribution Channels (in Billion Litres), 2019 & 2024

Figure 38: North America: Flavoured Milk Market Forecast: Sales through Other Distribution Channels (in Billion Litres), 2025-2033

Figure 39: North America: Flavoured Milk Market: Breakup by Country (in %), 2024

Figure 40: United States: Flavoured Milk Market: Volume Trends (in Billion Litres), 2019-2024

Figure 41: United States: Flavoured Milk Market: Breakup by Flavour (in %), 2024

Figure 42: United States: Flavoured Milk Market: Breakup by Packaging (in %), 2024

Figure 43: United States: Flavoured Milk Market: Breakup by Distribution Channel (in %), 2024

Figure 44: United States: Flavoured Milk Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 45: Canada: Flavoured Milk Market: Volume Trends (in Billion Litres), 2019-2024

Figure 46: Canada: Flavoured Milk Market: Breakup by Flavour (in %), 2024

Figure 47: Canada: Flavoured Milk Market: Breakup by Packaging (in %), 2024

Figure 48: Canada: Flavoured Milk Market: Breakup by Distribution Channel (in %), 2024

Figure 49: Canada: Flavoured Milk Market Forecast: Volume Trends (in Billion Litres), 2025-2033

Figure 50: North America: Flavoured Milk Industry: SWOT Analysis

Figure 51: North America: Flavoured Milk Industry: Value Chain Analysis

Figure 52: North America: Flavoured Milk Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: North America: Flavoured Milk Market: Key Industry Highlights, 2024 and 2033

Table 2: North America: Flavoured Milk Market Forecast: Breakup by Flavour (in Billion Litres), 2025-2033

Table 3: North America: Flavoured Milk Market Forecast: Breakup by Packaging (in Billion Litres), 2025-2033

Table 4: North America: Flavoured Milk Market Forecast: Breakup by Distribution Channel (in Billion Litres), 2025-2033

Table 5: North America: Flavoured Milk Market Forecast: Breakup by Country (in Billion Litres), 2025-2033

Table 6: North America: Flavoured Milk Market: Competitive Structure

Table 7: North America: Flavoured Milk Market: Key Players

Table Information

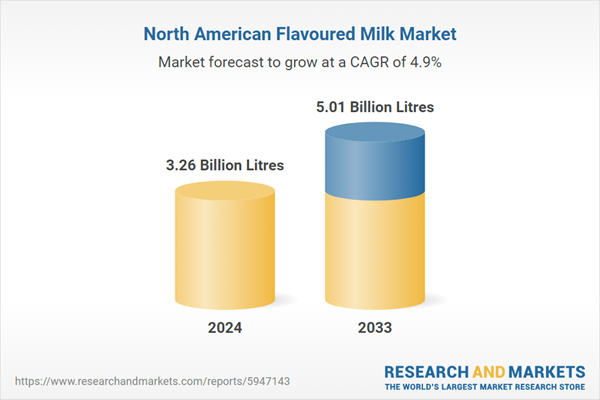

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 3.26 Billion Litres |

| Forecasted Market Value by 2033 | 5.01 Billion Litres |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | North America |