Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Urban consumers increasingly prefer two-wheelers for flexibility and lower ownership costs, a trend encouraged by evolving digital ecosystems integrating ride-sharing, leasing, and smart connectivity. According to the Japan National Police Agency, two-wheelers accounted for nearly 19% of registered vehicles in urban prefectures, underscoring their importance in urban mobility. Growth in tourism, delivery services, and e-commerce logistics creates fresh avenues for commercial use, as demand for fast, last-mile transport rises. However, the market wrestles with high R&D expenses, complex emissions compliance, and stiff competition from neighboring Asian manufacturers, squeezing margins for mid-tier products.

Manufacturers face evolving safety regulations and shifting consumer preferences for sustainable transport. Rising battery costs and raw material price volatility hamper electric vehicle adoption rates. Nonetheless, Japan’s advanced R&D landscape, robust parts supply chain, and tech-savvy consumers maintain optimism for innovative two-wheeler solutions catering to performance, convenience, and sustainability demands.

Market Drivers

Urban Mobility Needs

Growing urbanization increases reliance on compact personal transport. According to JAMA, Japan’s two-wheeler sales surged to over 350,000 units domestically in 2023. Dense cities like Tokyo struggle with limited parking and traffic congestion, making scooters and motorcycles appealing. Rising living costs push consumers to seek economical commuting solutions, driving two-wheeler adoption. Two-wheelers also serve crucial roles in logistics, medical deliveries, and security services, supported by favorable regulations permitting easier maneuverability in urban streets.The cultural affinity for motorcycles blends with practical needs, reinforcing steady market demand. Short trip distances within cities align with the performance and range characteristics of modern scooters, while low emissions targets support eco-friendly options. METI’s drive toward reducing transportation CO₂ adds urgency for adopting lighter, fuel-efficient vehicles. Societal shifts emphasizing time efficiency and flexibility further elevate the relevance of two-wheelers in modern Japanese cities.

Market Challenges

High R&D Costs

Innovating modern two-wheelers, especially electric models, incurs significant research costs. Development of advanced battery systems, lighter frames, and electronic integration demands substantial investment. Japanese manufacturers often pursue in-house R&D to maintain brand prestige and proprietary technology, leading to considerable financial burdens. Fluctuating raw material prices exacerbate budget uncertainties. Government support helps mitigate costs, but subsidy eligibility is limited and competitive.Companies also invest heavily in compliance with evolving safety and emission norms. Smaller manufacturers struggle to keep pace with the technological race, risking market exit. Development cycles for electric motorcycles are shortening, intensifying financial strain to remain innovative. While cutting-edge products attract premium buyers, mass-market consumers remain price-sensitive, complicating return-on-investment calculations. Sustaining high R&D spending in a price-competitive market remains a persistent challenge for Japan’s two-wheeler industry.

Key Market Trends

Electric Performance Models Rising

Interest in electric motorcycles and scooters goes beyond commuter models. Enthusiasts seek high-performance electrics delivering instant torque and advanced ride dynamics. According to METI, Japan’s domestic EV motorcycle registrations in the performance segment rose 8% year-on-year in 2023, albeit from a small base. Innovators are developing electric sport bikes with acceleration comparable to 250cc petrol models. Premium segments attract riders drawn to quiet operation and futuristic design. Battery cooling systems, rapid charging, and lightweight composites enhance appeal.Motorcycle shows highlight electric concepts, signaling manufacturers’ commitment to blending sustainability with performance. Such models target consumers willing to pay for innovation and status. Electric performance bikes also attract media attention, boosting brand prestige. Though price remains a barrier, advances in battery density and cost reduction may soon broaden accessibility. The market trend signals electric two-wheelers’ shift from purely urban utility to lifestyle and enthusiast products.

Key Market Players

- BMW Motorrad Japan

- Ducati Japan Ltd.

- Harley-Davidson Japan

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- KTM Japan Co., Ltd.

- Piaggio Group Japan

- Suzuki Motor Corporation

- Triumph Motorcycles Japan Ltd.

- Yamaha Motor Co., Ltd.

Report Scope:

In this report, the Japan Two-Wheeler Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Japan Two-Wheeler Market, By Vehicle:

- Motorcycle

- Scooter/Moped

Japan Two-Wheeler Market, By Propulsion:

- Internal Combustion Engine

- Electric Vehicles

Japan Two-Wheeler Market, By End Use:

- Personal

- Commercial

Japan Two-Wheeler Market, By Region:

- Hokkaid & Tohoku

- Chubu

- Chugoku

- Kyushu

- Rest of Japan

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Japan Two-Wheeler Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- BMW Motorrad Japan

- Ducati Japan Ltd.

- Harley-Davidson Japan

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- KTM Japan Co., Ltd.

- Piaggio Group Japan

- Suzuki Motor Corporation

- Triumph Motorcycles Japan Ltd.

- Yamaha Motor Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | August 2025 |

| Forecast Period | 2025 - 2031 |

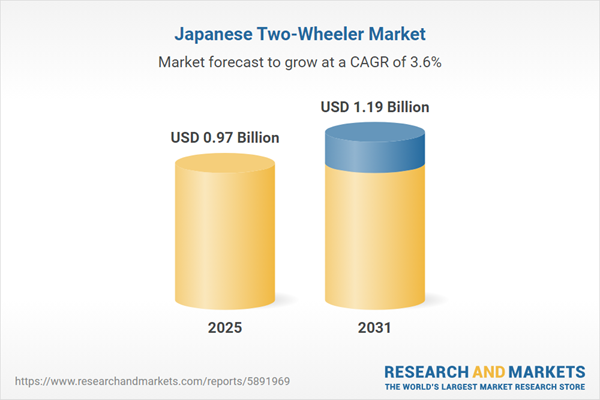

| Estimated Market Value ( USD | $ 0.97 Billion |

| Forecasted Market Value ( USD | $ 1.19 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 10 |