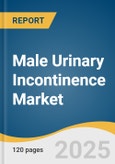

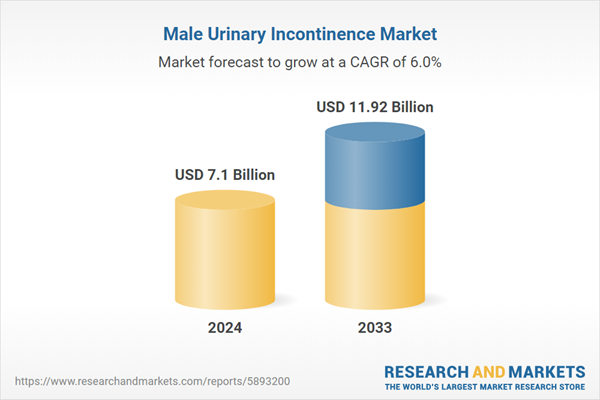

The global male urinary incontinence market size was estimated at USD 7.10 billion in 2024 and is projected to reach USD 11.92 billion by 2033, growing at a CAGR of 5.97% from 2025 to 2033. This growth is attributed to the aging population, rising incidence of prostate-related surgeries, and increasing awareness about incontinence management.

Advancements in medical technology, including male slings, artificial urinary sphincters, and magnetic stimulation devices, are improving patient outcomes and driving adoption. The growing number of clinical trials across regions further underscores innovation in treatment approaches, expanding the therapeutic pipeline. According to the Canadian Cancer Society, in 2024, prostate cancer remains a significant health concern among Canadian men, with approximately 27,900 new diagnoses, accounting for 22% of all newly diagnosed cancer cases in men.

Prostate cancer is a major driver of the male urinary incontinence industry’s growth, mainly due to the high incidence of urinary complications that arise following its treatment. Prostate cancer treatments, particularly radical prostatectomy (surgical removal of the prostate gland), radiotherapy, and hormone therapy, can lead to significant damage or weakening of the pelvic floor muscles, sphincter mechanism, and bladder function. This results in stress urinary incontinence, urge incontinence, or mixed forms of incontinence. Post-prostatectomy incontinence is one of the most common complications, affecting a substantial proportion of men in the months and even years following surgery. Similarly, radiation therapy can cause bladder irritation, reduced storage capacity, and involuntary leakage. As survival rates improve and more men live longer after prostate cancer treatment, the prevalence of urinary incontinence also rises, creating sustained demand for effective management options.

This product will be delivered within 2 business days.

Advancements in medical technology, including male slings, artificial urinary sphincters, and magnetic stimulation devices, are improving patient outcomes and driving adoption. The growing number of clinical trials across regions further underscores innovation in treatment approaches, expanding the therapeutic pipeline. According to the Canadian Cancer Society, in 2024, prostate cancer remains a significant health concern among Canadian men, with approximately 27,900 new diagnoses, accounting for 22% of all newly diagnosed cancer cases in men.

Prostate cancer is a major driver of the male urinary incontinence industry’s growth, mainly due to the high incidence of urinary complications that arise following its treatment. Prostate cancer treatments, particularly radical prostatectomy (surgical removal of the prostate gland), radiotherapy, and hormone therapy, can lead to significant damage or weakening of the pelvic floor muscles, sphincter mechanism, and bladder function. This results in stress urinary incontinence, urge incontinence, or mixed forms of incontinence. Post-prostatectomy incontinence is one of the most common complications, affecting a substantial proportion of men in the months and even years following surgery. Similarly, radiation therapy can cause bladder irritation, reduced storage capacity, and involuntary leakage. As survival rates improve and more men live longer after prostate cancer treatment, the prevalence of urinary incontinence also rises, creating sustained demand for effective management options.

Global Male Urinary Incontinence Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, the analyst has segmented the global male urinary incontinence market report based on product, incontinence type, usage, distribution channel, end-use, and region:Product Outlook (Revenue, USD Million, 2021 - 2033)

- Non-Absorbents

- Urinary Catheters

- Foley Catheters

- External Catheters

- Drainage Bags

- External Compression Devices/Penile Clamps

- Artificial Urinary Sphincter

- Others

- Absorbents

- Underwear & Briefs

- Drip Collectors & Bed Protectors

- Pads & Guards

Incontinence Type Outlook (Revenue, USD Million, 2021 - 2033)

- Stress Urinary Incontinence

- Urge Urinary Incontinence

- Overflow Incontinence

- Functional Urinary Incontinence

- Mixed Urinary Incontinence

Usage Outlook (Revenue, USD Million, 2021 - 2033)

- Reusable

- Disposable

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

- Offline Stores

- Online Channels

End-use Outlook (Revenue, USD Million, 2021 - 2033)

- Hospitals & Clinics

- Homecare

- Others

Regional Outlook (Revenue, USD Million, 2021 - 2033)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Norway

- Denmark

- Sweden

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product

1.1.2. Incontinence type

1.1.3. Usage

1.1.4. Distribution channel

1.1.5. End Use

1.1.6. Regional scope

1.1.7. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity price analysis (Model 1)

1.6.2. Approach 1: Commodity flow approach

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.1.1. Product

1.1.2. Incontinence type

1.1.3. Usage

1.1.4. Distribution channel

1.1.5. End Use

1.1.6. Regional scope

1.1.7. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity price analysis (Model 1)

1.6.2. Approach 1: Commodity flow approach

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Incontinence type outlook

2.2.3. Usage outlook

2.2.4. Distribution channel outlook

2.2.5. End use outlook

2.2.6. Regional outlook

2.3. Competitive Insights

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Incontinence type outlook

2.2.3. Usage outlook

2.2.4. Distribution channel outlook

2.2.5. End use outlook

2.2.6. Regional outlook

2.3. Competitive Insights

Chapter 3. Male Urinary Incontinence Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing prevalence of urinary incontinence

3.2.1.2. Growing geriatric population

3.2.1.3. Rapid technological advancements

3.2.1.4. Rise in demand for minimally invasive procedures

3.2.2. Market Restraint Analysis

3.2.2.1. Growing concerns regarding catheter associated urinary tract infection

3.2.2.2. Availability of alternatives

3.2.3. Market Challenge Analysis

3.2.3.1. Social stigma and psychological barriers

3.2.4. Market Opportunity Analysis

3.2.4.1. Expansion in home healthcare

3.2.4.2. Product innovation & customization

3.3. Male Urinary Incontinence Market Analysis Tools

3.3.1. Industry Analysis - Porter’s Five Forces

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

3.1.1. Parent Market Outlook

3.1.2. Related/ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing prevalence of urinary incontinence

3.2.1.2. Growing geriatric population

3.2.1.3. Rapid technological advancements

3.2.1.4. Rise in demand for minimally invasive procedures

3.2.2. Market Restraint Analysis

3.2.2.1. Growing concerns regarding catheter associated urinary tract infection

3.2.2.2. Availability of alternatives

3.2.3. Market Challenge Analysis

3.2.3.1. Social stigma and psychological barriers

3.2.4. Market Opportunity Analysis

3.2.4.1. Expansion in home healthcare

3.2.4.2. Product innovation & customization

3.3. Male Urinary Incontinence Market Analysis Tools

3.3.1. Industry Analysis - Porter’s Five Forces

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. Male Urinary Incontinence Market: Product Estimates & Trend Analysis

4.1. Male Urinary Incontinence Market: Product Dashboard

4.2. Male Urinary Incontinence Market: Product Movement Analysis

4.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by Product, 2021 to 2033 (USD Million)

4.3.1. Non-Absorbents

4.3.1.1. Non-absorbents market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.2. Urinary catheters

4.3.1.2.1. Urinary catheters market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.2.2. Foley catheters

4.3.1.2.2.1. Foley catheters market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.2.3. External catheters

4.3.1.2.3.1. External catheters market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.3. Drainage bags

4.3.1.3.1. Drainage bags market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.4. External compression devices/penile clamps

4.3.1.4.1. External compression devices/penile clamps market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.5. Artificial urinary sphincter

4.3.1.5.1. Artificial urinary sphincter market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.6. Others

4.3.1.6.1. Others market estimates and forecast 2021 to 2033 (USD Million)

4.3.2. Absorbents

4.3.2.1. Absorbents market estimates and forecast 2021 to 2033s (USD Million)

4.3.2.2. Underwear & Briefs

4.3.2.2.1. Underwear & briefs market estimates and forecast 2021 to 2033 (USD Million)

4.3.2.3. Drip Collectors & Bed Protectors

4.3.2.3.1. Drip collectors & bed protectors market estimates and forecast 2021 to 2033 (USD Million)

4.3.2.4. Pads & Guards

4.3.2.4.1. Pads & guards market estimates and forecast 2021 to 2033 (USD Million)

4.2. Male Urinary Incontinence Market: Product Movement Analysis

4.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by Product, 2021 to 2033 (USD Million)

4.3.1. Non-Absorbents

4.3.1.1. Non-absorbents market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.2. Urinary catheters

4.3.1.2.1. Urinary catheters market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.2.2. Foley catheters

4.3.1.2.2.1. Foley catheters market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.2.3. External catheters

4.3.1.2.3.1. External catheters market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.3. Drainage bags

4.3.1.3.1. Drainage bags market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.4. External compression devices/penile clamps

4.3.1.4.1. External compression devices/penile clamps market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.5. Artificial urinary sphincter

4.3.1.5.1. Artificial urinary sphincter market estimates and forecast 2021 to 2033 (USD Million)

4.3.1.6. Others

4.3.1.6.1. Others market estimates and forecast 2021 to 2033 (USD Million)

4.3.2. Absorbents

4.3.2.1. Absorbents market estimates and forecast 2021 to 2033s (USD Million)

4.3.2.2. Underwear & Briefs

4.3.2.2.1. Underwear & briefs market estimates and forecast 2021 to 2033 (USD Million)

4.3.2.3. Drip Collectors & Bed Protectors

4.3.2.3.1. Drip collectors & bed protectors market estimates and forecast 2021 to 2033 (USD Million)

4.3.2.4. Pads & Guards

4.3.2.4.1. Pads & guards market estimates and forecast 2021 to 2033 (USD Million)

Chapter 5. Male Urinary Incontinence Market: Incontinence Type Estimates & Trend Analysis

5.1. Male Urinary Incontinence Market: Incontinence Type Dashboard

5.2. Male Urinary Incontinence Market: Incontinence Type Movement Analysis

5.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by Incontinence Type, 2021 to 2033 (USD Million)

5.3.1. Stress Urinary Incontinence

5.3.1.1. Stress urinary incontinence market estimates and forecast 2021 to 2033 (USD Million)

5.3.2. Urge Urinary Incontinence

5.3.2.1. Urge urinary incontinence market estimates and forecast 2021 to 2033 (USD Million)

5.3.3. Overflow Incontinence

5.3.3.1. Overflow incontinence market estimates and forecast 2021 to 2033 (USD Million)

5.3.4. Functional Urinary Incontinence

5.3.4.1. Functional urinary incontinence market estimates and forecast 2021 to 2033 (USD Million

5.3.5. Mixed Urinary Incontinence

5.3.5.1. Mixed urinary incontinence market estimates and forecast 2021 to 2033 (USD Million)

5.2. Male Urinary Incontinence Market: Incontinence Type Movement Analysis

5.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by Incontinence Type, 2021 to 2033 (USD Million)

5.3.1. Stress Urinary Incontinence

5.3.1.1. Stress urinary incontinence market estimates and forecast 2021 to 2033 (USD Million)

5.3.2. Urge Urinary Incontinence

5.3.2.1. Urge urinary incontinence market estimates and forecast 2021 to 2033 (USD Million)

5.3.3. Overflow Incontinence

5.3.3.1. Overflow incontinence market estimates and forecast 2021 to 2033 (USD Million)

5.3.4. Functional Urinary Incontinence

5.3.4.1. Functional urinary incontinence market estimates and forecast 2021 to 2033 (USD Million

5.3.5. Mixed Urinary Incontinence

5.3.5.1. Mixed urinary incontinence market estimates and forecast 2021 to 2033 (USD Million)

Chapter 6. Male Urinary Incontinence Market: Usage Estimates & Trend Analysis

6.1. Male Urinary Incontinence Market: Usage Dashboard

6.2. Male Urinary Incontinence Market: Usage Movement Analysis

6.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by Usage, 2021 to 2033 (USD Million)

6.3.1. Reusable

6.3.1.1. Reusable market estimates and forecast 2021 to 2033 (USD Million)

6.3.2. Disposable

6.3.2.1. Disposable market estimates and forecast 2021 to 2033 (USD Million)

6.2. Male Urinary Incontinence Market: Usage Movement Analysis

6.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by Usage, 2021 to 2033 (USD Million)

6.3.1. Reusable

6.3.1.1. Reusable market estimates and forecast 2021 to 2033 (USD Million)

6.3.2. Disposable

6.3.2.1. Disposable market estimates and forecast 2021 to 2033 (USD Million)

Chapter 7. Male Urinary Incontinence Market: Distribution Channel Estimates & Trend Analysis

7.1. Male Urinary Incontinence Market: Distribution Channel Dashboard

7.2. Male Urinary Incontinence Market: Distribution Channel Movement Analysis

7.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by Distribution Channel, 2021 to 2033 (USD Million)

7.3.1. Offline Stores

7.3.1.1. Offline stores market estimates and forecast 2021 to 2033 (USD Million)

7.3.2. Online Channels

7.3.2.1. Online channels market estimates and forecast 2021 to 2033 (USD Million)

7.2. Male Urinary Incontinence Market: Distribution Channel Movement Analysis

7.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by Distribution Channel, 2021 to 2033 (USD Million)

7.3.1. Offline Stores

7.3.1.1. Offline stores market estimates and forecast 2021 to 2033 (USD Million)

7.3.2. Online Channels

7.3.2.1. Online channels market estimates and forecast 2021 to 2033 (USD Million)

Chapter 8. Male Urinary Incontinence Market: End Use Estimates & Trend Analysis

8.1. Male Urinary Incontinence Market: End Use Dashboard

8.2. Male Urinary Incontinence Market: End Use Movement Analysis

8.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by End Use, 2021 to 2033 (USD Million)

8.3.1. Hospitals & Clinics

8.3.1.1. Hospitals & clinics market estimates and forecast 2021 to 2033 (USD Million)

8.3.2. Homecare

8.3.2.1. Homecare market estimates and forecast 2021 to 2033 (USD Million)

8.3.3. Others

8.3.3.1. Others market estimates and forecast 2021 to 2033 (USD Million)

8.2. Male Urinary Incontinence Market: End Use Movement Analysis

8.3. Male Urinary Incontinence Market Size & Forecasts and Trend Analysis, by End Use, 2021 to 2033 (USD Million)

8.3.1. Hospitals & Clinics

8.3.1.1. Hospitals & clinics market estimates and forecast 2021 to 2033 (USD Million)

8.3.2. Homecare

8.3.2.1. Homecare market estimates and forecast 2021 to 2033 (USD Million)

8.3.3. Others

8.3.3.1. Others market estimates and forecast 2021 to 2033 (USD Million)

Chapter 9. Male Urinary Incontinence Market: Regional Estimates & Trend Analysis by Product, Incontinence Type, Usage, Distribution Channel, End Use, and Region

9.1. Global Male Urinary Incontinence Market: Regional Dashboard

9.2. Market Size & Forecasts Trend Analysis, 2021 to 2033

9.3. North America

9.3.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.3.2. U.S.

9.3.2.1. Key country dynamics

9.3.2.2. Regulatory framework/ reimbursement structure

9.3.2.3. Competitive scenario

9.3.2.4. U.S. market estimates and forecast, 2021 - 2033 (USD Million)

9.3.3. Canada

9.3.3.1. Key country dynamics

9.3.3.2. Regulatory framework/ reimbursement structure

9.3.3.3. Competitive scenario

9.3.3.4. Canada market estimates and forecast, 2021 - 2033 (USD Million)

9.3.4. Mexico

9.3.4.1. Key country dynamics

9.3.4.2. Regulatory framework/ reimbursement structure

9.3.4.3. Competitive scenario

9.3.4.4. Mexico market estimates and forecast, 2021 - 2033 (USD Million)

9.4. Europe

9.4.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.4.2. UK

9.4.2.1. Key country dynamics

9.4.2.2. Regulatory framework/ reimbursement structure

9.4.2.3. Competitive scenario

9.4.2.4. UK market estimates and forecast, 2021 - 2033 (USD Million)

9.4.3. Germany

9.4.3.1. Key country dynamics

9.4.3.2. Regulatory framework/ reimbursement structure

9.4.3.3. Competitive scenario

9.4.3.4. Germany market estimates and forecast, 2021 - 2033 (USD Million)

9.4.4. France

9.4.4.1. Key country dynamics

9.4.4.2. Regulatory framework/ reimbursement structure

9.4.4.3. Competitive scenario

9.4.4.4. France market estimates and forecast, 2021 - 2033 (USD Million)

9.4.5. Italy

9.4.5.1. Key country dynamics

9.4.5.2. Regulatory framework/ reimbursement structure

9.4.5.3. Competitive scenario

9.4.5.4. Italy market estimates and forecast, 2021 - 2033 (USD Million)

9.4.6. Spain

9.4.6.1. Key country dynamics

9.4.6.2. Regulatory framework/ reimbursement structure

9.4.6.3. Competitive scenario

9.4.6.4. Spain market estimates and forecast, 2021 - 2033 (USD Million)

9.4.7. Sweden

9.4.7.1. Key country dynamics

9.4.7.2. Regulatory framework/ reimbursement structure

9.4.7.3. Competitive scenario

9.4.7.4. Sweden market estimates and forecast, 2021 - 2033 (USD Million)

9.4.8. Norway

9.4.8.1. Key country dynamics

9.4.8.2. Regulatory framework/ reimbursement structure

9.4.8.3. Competitive scenario

9.4.8.4. Norway market estimates and forecast, 2021 - 2033 (USD Million)

9.4.9. Denmark

9.4.9.1. Key country dynamics

9.4.9.2. Regulatory framework/ reimbursement structure

9.4.9.3. Competitive scenario

9.4.9.4. Denmark market estimates and forecast, 2021 - 2033 (USD Million)

9.5. Asia Pacific

9.5.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.5.2. China

9.5.2.1. Key country dynamics

9.5.2.2. Regulatory framework/ reimbursement structure

9.5.2.3. Competitive scenario

9.5.2.4. China market estimates and forecast, 2021 - 2033 (USD Million)

9.5.3. Japan

9.5.3.1. Key country dynamics

9.5.3.2. Regulatory framework/ reimbursement structure

9.5.3.3. Competitive scenario

9.5.3.4. Japan market estimates and forecast, 2021 - 2033 (USD Million)

9.5.4. India

9.5.4.1. Key country dynamics

9.5.4.2. Regulatory framework/ reimbursement structure

9.5.4.3. Competitive scenario

9.5.4.4. India market estimates and forecast, 2021 - 2033 (USD Million)

9.5.5. Australia

9.5.5.1. Key country dynamics

9.5.5.2. Regulatory framework/ reimbursement structure

9.5.5.3. Competitive scenario

9.5.5.4. Australia market estimates and forecast, 2021 - 2033 (USD Million)

9.5.6. Thailand

9.5.6.1. Key country dynamics

9.5.6.2. Regulatory framework/ reimbursement structure

9.5.6.3. Competitive scenario

9.5.6.4. Thailand market estimates and forecast, 2021 - 2033 (USD Million)

9.5.7. South Korea

9.5.7.1. Key country dynamics

9.5.7.2. Regulatory framework/ reimbursement structure

9.5.7.3. Competitive scenario

9.5.7.4. South Korea market estimates and forecast, 2021 - 2033 (USD Million)

9.6. Latin America

9.6.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.6.2. Brazil

9.6.2.1. Key country dynamics

9.6.2.2. Regulatory framework/ reimbursement structure

9.6.2.3. Competitive scenario

9.6.2.4. Brazil market estimates and forecast, 2021 - 2033 (USD Million)

9.6.3. Argentina

9.6.3.1. Key country dynamics

9.6.3.2. Regulatory framework/ reimbursement structure

9.6.3.3. Competitive scenario

9.6.3.4. Argentina market estimates and forecast, 2021 - 2033 (USD Million)

9.7. MEA

9.7.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.7.2. Saudi Arabia

9.7.2.1. Key country dynamics

9.7.2.2. Regulatory framework/ reimbursement structure

9.7.2.3. Competitive scenario

9.7.2.4. Saudi Arabia market estimates and forecast, 2021 - 2033 (USD Million)

9.7.3. South Africa

9.7.3.1. Key country dynamics

9.7.3.2. Regulatory framework/ reimbursement structure

9.7.3.3. Competitive scenario

9.7.3.4. South Africa market estimates and forecast, 2021 - 2033 (USD Million)

9.7.4. UAE

9.7.4.1. Key country dynamics

9.7.4.2. Regulatory framework/ reimbursement structure

9.7.4.3. Competitive scenario

9.7.4.4. UAE market estimates and forecast, 2021 - 2033 (USD Million)

9.7.5. Kuwait

9.7.5.1. Key country dynamics

9.7.5.2. Regulatory framework/ reimbursement structure

9.7.5.3. Competitive scenario

9.7.5.4. Kuwait market estimates and forecast, 2021 - 2033 (USD Million)

9.2. Market Size & Forecasts Trend Analysis, 2021 to 2033

9.3. North America

9.3.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.3.2. U.S.

9.3.2.1. Key country dynamics

9.3.2.2. Regulatory framework/ reimbursement structure

9.3.2.3. Competitive scenario

9.3.2.4. U.S. market estimates and forecast, 2021 - 2033 (USD Million)

9.3.3. Canada

9.3.3.1. Key country dynamics

9.3.3.2. Regulatory framework/ reimbursement structure

9.3.3.3. Competitive scenario

9.3.3.4. Canada market estimates and forecast, 2021 - 2033 (USD Million)

9.3.4. Mexico

9.3.4.1. Key country dynamics

9.3.4.2. Regulatory framework/ reimbursement structure

9.3.4.3. Competitive scenario

9.3.4.4. Mexico market estimates and forecast, 2021 - 2033 (USD Million)

9.4. Europe

9.4.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.4.2. UK

9.4.2.1. Key country dynamics

9.4.2.2. Regulatory framework/ reimbursement structure

9.4.2.3. Competitive scenario

9.4.2.4. UK market estimates and forecast, 2021 - 2033 (USD Million)

9.4.3. Germany

9.4.3.1. Key country dynamics

9.4.3.2. Regulatory framework/ reimbursement structure

9.4.3.3. Competitive scenario

9.4.3.4. Germany market estimates and forecast, 2021 - 2033 (USD Million)

9.4.4. France

9.4.4.1. Key country dynamics

9.4.4.2. Regulatory framework/ reimbursement structure

9.4.4.3. Competitive scenario

9.4.4.4. France market estimates and forecast, 2021 - 2033 (USD Million)

9.4.5. Italy

9.4.5.1. Key country dynamics

9.4.5.2. Regulatory framework/ reimbursement structure

9.4.5.3. Competitive scenario

9.4.5.4. Italy market estimates and forecast, 2021 - 2033 (USD Million)

9.4.6. Spain

9.4.6.1. Key country dynamics

9.4.6.2. Regulatory framework/ reimbursement structure

9.4.6.3. Competitive scenario

9.4.6.4. Spain market estimates and forecast, 2021 - 2033 (USD Million)

9.4.7. Sweden

9.4.7.1. Key country dynamics

9.4.7.2. Regulatory framework/ reimbursement structure

9.4.7.3. Competitive scenario

9.4.7.4. Sweden market estimates and forecast, 2021 - 2033 (USD Million)

9.4.8. Norway

9.4.8.1. Key country dynamics

9.4.8.2. Regulatory framework/ reimbursement structure

9.4.8.3. Competitive scenario

9.4.8.4. Norway market estimates and forecast, 2021 - 2033 (USD Million)

9.4.9. Denmark

9.4.9.1. Key country dynamics

9.4.9.2. Regulatory framework/ reimbursement structure

9.4.9.3. Competitive scenario

9.4.9.4. Denmark market estimates and forecast, 2021 - 2033 (USD Million)

9.5. Asia Pacific

9.5.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.5.2. China

9.5.2.1. Key country dynamics

9.5.2.2. Regulatory framework/ reimbursement structure

9.5.2.3. Competitive scenario

9.5.2.4. China market estimates and forecast, 2021 - 2033 (USD Million)

9.5.3. Japan

9.5.3.1. Key country dynamics

9.5.3.2. Regulatory framework/ reimbursement structure

9.5.3.3. Competitive scenario

9.5.3.4. Japan market estimates and forecast, 2021 - 2033 (USD Million)

9.5.4. India

9.5.4.1. Key country dynamics

9.5.4.2. Regulatory framework/ reimbursement structure

9.5.4.3. Competitive scenario

9.5.4.4. India market estimates and forecast, 2021 - 2033 (USD Million)

9.5.5. Australia

9.5.5.1. Key country dynamics

9.5.5.2. Regulatory framework/ reimbursement structure

9.5.5.3. Competitive scenario

9.5.5.4. Australia market estimates and forecast, 2021 - 2033 (USD Million)

9.5.6. Thailand

9.5.6.1. Key country dynamics

9.5.6.2. Regulatory framework/ reimbursement structure

9.5.6.3. Competitive scenario

9.5.6.4. Thailand market estimates and forecast, 2021 - 2033 (USD Million)

9.5.7. South Korea

9.5.7.1. Key country dynamics

9.5.7.2. Regulatory framework/ reimbursement structure

9.5.7.3. Competitive scenario

9.5.7.4. South Korea market estimates and forecast, 2021 - 2033 (USD Million)

9.6. Latin America

9.6.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.6.2. Brazil

9.6.2.1. Key country dynamics

9.6.2.2. Regulatory framework/ reimbursement structure

9.6.2.3. Competitive scenario

9.6.2.4. Brazil market estimates and forecast, 2021 - 2033 (USD Million)

9.6.3. Argentina

9.6.3.1. Key country dynamics

9.6.3.2. Regulatory framework/ reimbursement structure

9.6.3.3. Competitive scenario

9.6.3.4. Argentina market estimates and forecast, 2021 - 2033 (USD Million)

9.7. MEA

9.7.1. Market Estimates and Forecasts 2021 to 2033 (USD Million)

9.7.2. Saudi Arabia

9.7.2.1. Key country dynamics

9.7.2.2. Regulatory framework/ reimbursement structure

9.7.2.3. Competitive scenario

9.7.2.4. Saudi Arabia market estimates and forecast, 2021 - 2033 (USD Million)

9.7.3. South Africa

9.7.3.1. Key country dynamics

9.7.3.2. Regulatory framework/ reimbursement structure

9.7.3.3. Competitive scenario

9.7.3.4. South Africa market estimates and forecast, 2021 - 2033 (USD Million)

9.7.4. UAE

9.7.4.1. Key country dynamics

9.7.4.2. Regulatory framework/ reimbursement structure

9.7.4.3. Competitive scenario

9.7.4.4. UAE market estimates and forecast, 2021 - 2033 (USD Million)

9.7.5. Kuwait

9.7.5.1. Key country dynamics

9.7.5.2. Regulatory framework/ reimbursement structure

9.7.5.3. Competitive scenario

9.7.5.4. Kuwait market estimates and forecast, 2021 - 2033 (USD Million)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis, By Key Market Participants

10.2. Company/Competition Categorization

10.2.1. Innovators

10.3. Vendor Landscape

10.3.1. List of key distributors and channel partners

10.3.2. Key customers

10.3.3. Key company market share analysis, 2024

10.3.4. Essity

10.3.4.1. Company overview

10.3.4.2. Financial performance

10.3.4.3. Usage benchmarking

10.3.4.4. Strategic initiatives

10.3.5. Boston Scientific Corporation

10.3.5.1. Company overview

10.3.5.2. Financial performance

10.3.5.3. Usage benchmarking

10.3.5.4. Strategic initiatives

10.3.6. Kimberly-Clark Worldwide Inc.

10.3.6.1. Company overview

10.3.6.2. Financial performance

10.3.6.3. Usage benchmarking

10.3.6.4. Strategic initiatives

10.3.7. Attends Healthcare Products, Inc. (Domtar Corporation)

10.3.7.1. Company overview

10.3.7.2. Financial performance

10.3.7.3. Usage benchmarking

10.3.7.4. Strategic initiatives

10.3.8. ABENA

10.3.8.1. Company overview

10.3.8.2. Financial performance

10.3.8.3. Usage benchmarking

10.3.8.4. Strategic initiatives

10.3.9. Ontex Healthcare

10.3.9.1. Company overview

10.3.9.2. Financial performance

10.3.9.3. Usage benchmarking

10.3.9.4. Strategic initiatives

10.3.10. PAUL HARTMANN AG

10.3.10.1. Company overview

10.3.10.2. Financial performance

10.3.10.3. Usage benchmarking

10.3.10.4. Strategic initiatives

10.3.11. Teleflex Incorporated

10.3.11.1. Company overview

10.3.11.2. Financial performance

10.3.11.3. Usage benchmarking

10.3.11.4. Strategic initiatives

10.3.12. First Quality

10.3.12.1. Company overview

10.3.12.2. Financial performance

10.3.12.3. Usage benchmarking

10.3.12.4. Strategic initiatives

10.3.13. Coloplast Corp.

10.3.13.1. Company overview

10.3.13.2. Financial performance

10.3.13.3. Usage benchmarking

10.3.13.4. Strategic initiatives

10.3.14. Medline

10.3.14.1. Company overview

10.3.14.2. Financial performance

10.3.14.3. Usage benchmarking

10.3.14.4. Strategic initiatives

10.3.15. BD

10.3.15.1. Company overview

10.3.15.2. Financial performance

10.3.15.3. Usage benchmarking

10.3.15.4. Strategic initiatives

10.3.16. Hollister Incorporated

10.3.16.1. Company overview

10.3.16.2. Financial performance

10.3.16.3. Usage benchmarking

10.3.16.4. Strategic initiatives

10.3.17. Cardinal Health

10.3.17.1. Company overview

10.3.17.2. Financial performance

10.3.17.3. Usage benchmarking

10.3.17.4. Strategic initiatives

10.2. Company/Competition Categorization

10.2.1. Innovators

10.3. Vendor Landscape

10.3.1. List of key distributors and channel partners

10.3.2. Key customers

10.3.3. Key company market share analysis, 2024

10.3.4. Essity

10.3.4.1. Company overview

10.3.4.2. Financial performance

10.3.4.3. Usage benchmarking

10.3.4.4. Strategic initiatives

10.3.5. Boston Scientific Corporation

10.3.5.1. Company overview

10.3.5.2. Financial performance

10.3.5.3. Usage benchmarking

10.3.5.4. Strategic initiatives

10.3.6. Kimberly-Clark Worldwide Inc.

10.3.6.1. Company overview

10.3.6.2. Financial performance

10.3.6.3. Usage benchmarking

10.3.6.4. Strategic initiatives

10.3.7. Attends Healthcare Products, Inc. (Domtar Corporation)

10.3.7.1. Company overview

10.3.7.2. Financial performance

10.3.7.3. Usage benchmarking

10.3.7.4. Strategic initiatives

10.3.8. ABENA

10.3.8.1. Company overview

10.3.8.2. Financial performance

10.3.8.3. Usage benchmarking

10.3.8.4. Strategic initiatives

10.3.9. Ontex Healthcare

10.3.9.1. Company overview

10.3.9.2. Financial performance

10.3.9.3. Usage benchmarking

10.3.9.4. Strategic initiatives

10.3.10. PAUL HARTMANN AG

10.3.10.1. Company overview

10.3.10.2. Financial performance

10.3.10.3. Usage benchmarking

10.3.10.4. Strategic initiatives

10.3.11. Teleflex Incorporated

10.3.11.1. Company overview

10.3.11.2. Financial performance

10.3.11.3. Usage benchmarking

10.3.11.4. Strategic initiatives

10.3.12. First Quality

10.3.12.1. Company overview

10.3.12.2. Financial performance

10.3.12.3. Usage benchmarking

10.3.12.4. Strategic initiatives

10.3.13. Coloplast Corp.

10.3.13.1. Company overview

10.3.13.2. Financial performance

10.3.13.3. Usage benchmarking

10.3.13.4. Strategic initiatives

10.3.14. Medline

10.3.14.1. Company overview

10.3.14.2. Financial performance

10.3.14.3. Usage benchmarking

10.3.14.4. Strategic initiatives

10.3.15. BD

10.3.15.1. Company overview

10.3.15.2. Financial performance

10.3.15.3. Usage benchmarking

10.3.15.4. Strategic initiatives

10.3.16. Hollister Incorporated

10.3.16.1. Company overview

10.3.16.2. Financial performance

10.3.16.3. Usage benchmarking

10.3.16.4. Strategic initiatives

10.3.17. Cardinal Health

10.3.17.1. Company overview

10.3.17.2. Financial performance

10.3.17.3. Usage benchmarking

10.3.17.4. Strategic initiatives

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviations

Table 3 Global male urinary incontinence market, by region, 2021 - 2033 (USD Million)

Table 4 Global male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 5 Global male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 6 Global male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 7 Global male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 8 Global male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 9 North America male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 10 North America male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 11 North America male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 12 North America male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 13 North America male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 14 North America male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 15 U.S. male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 16 U.S. male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 17 U.S. male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 18 U.S. male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 19 U.S. male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 20 Canada male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 21 Canada male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 22 Canada male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 23 Canada male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 24 Canada male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 25 Mexico male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 26 Mexico male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 27 Mexico male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 28 Mexico male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 29 Mexico male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 30 Europe male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 31 Europe male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 32 Europe male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 33 Europe male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 34 Europe male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 35 Europe male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 36 UK male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 37 UK male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 38 UK male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 39 UK male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 40 UK male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 41 Germany male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 42 Germany male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 43 Germany male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 44 Germany male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 45 Germany male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 46 France male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 47 France male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 48 France male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 49 France male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 50 France male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 51 Italy male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 52 Italy male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 53 Italy male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 54 Italy male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 55 Italy male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 56 Spain male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 57 Spain male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 58 Spain male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 59 Spain male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 60 Spain male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 61 Norway male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 62 Norway male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 63 Norway male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 64 Norway male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 65 Norway male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 66 Sweden male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 67 Sweden male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 68 Sweden male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 69 Sweden male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 70 Sweden male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 71 Denmark male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 72 Denmark male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 73 Denmark male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 74 Denmark male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 75 Denmark male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 76 Asia Pacific male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 77 Asia Pacific male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 78 Asia Pacific male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 79 Asia Pacific male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 80 Asia Pacific male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 81 Asia Pacific male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 82 Japan male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 83 Japan male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 84 Japan male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 85 Japan male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 86 Japan male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 87 China male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 88 China male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 89 China male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 90 China male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 91 China male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 92 India male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 93 India male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 94 India male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 95 India male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 96 India male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 97 Australia male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 98 Australia male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 99 Australia male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 100 Australia male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 101 Australia male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 102 South Korea male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 103 South Korea male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 104 South Korea male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 105 South Korea male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 106 South Korea male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 107 Thailand male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 108 Thailand male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 109 Thailand male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 110 Thailand male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 111 Thailand male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 112 Latin America male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 113 Latin America male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 114 Latin America male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 115 Latin America male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 116 Latin America male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 117 Latin America male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 118 Brazil male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 119 Brazil male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 120 Brazil male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 121 Brazil male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 122 Brazil male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 123 Argentina male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 124 Argentina male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 125 Argentina male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 126 Argentina male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 127 Argentina male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 128 Middle East & Africa male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 129 Middle East & Africa male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 130 Middle East & Africa male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 131 Middle East & Africa male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 132 Middle East & Africa male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 133 Middle East & Africa male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 134 South Africa male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 135 South Africa male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 136 South Africa male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 137 South Africa male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 138 South Africa male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 139 Saudi Arabia male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 140 Saudi Arabia male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 141 Saudi Arabia male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 142 Saudi Arabia male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 143 Saudi Arabia male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 144 UAE male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 145 UAE male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 146 UAE male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 147 UAE male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 148 UAE male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 149 Kuwait male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 150 Kuwait male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 151 Kuwait male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 152 Kuwait male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 153 Kuwait male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 2 List of abbreviations

Table 3 Global male urinary incontinence market, by region, 2021 - 2033 (USD Million)

Table 4 Global male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 5 Global male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 6 Global male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 7 Global male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 8 Global male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 9 North America male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 10 North America male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 11 North America male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 12 North America male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 13 North America male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 14 North America male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 15 U.S. male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 16 U.S. male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 17 U.S. male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 18 U.S. male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 19 U.S. male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 20 Canada male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 21 Canada male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 22 Canada male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 23 Canada male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 24 Canada male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 25 Mexico male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 26 Mexico male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 27 Mexico male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 28 Mexico male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 29 Mexico male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 30 Europe male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 31 Europe male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 32 Europe male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 33 Europe male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 34 Europe male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 35 Europe male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 36 UK male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 37 UK male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 38 UK male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 39 UK male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 40 UK male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 41 Germany male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 42 Germany male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 43 Germany male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 44 Germany male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 45 Germany male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 46 France male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 47 France male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 48 France male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 49 France male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 50 France male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 51 Italy male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 52 Italy male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 53 Italy male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 54 Italy male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 55 Italy male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 56 Spain male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 57 Spain male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 58 Spain male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 59 Spain male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 60 Spain male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 61 Norway male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 62 Norway male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 63 Norway male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 64 Norway male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 65 Norway male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 66 Sweden male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 67 Sweden male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 68 Sweden male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 69 Sweden male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 70 Sweden male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 71 Denmark male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 72 Denmark male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 73 Denmark male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 74 Denmark male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 75 Denmark male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 76 Asia Pacific male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 77 Asia Pacific male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 78 Asia Pacific male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 79 Asia Pacific male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 80 Asia Pacific male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 81 Asia Pacific male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 82 Japan male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 83 Japan male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 84 Japan male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 85 Japan male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 86 Japan male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 87 China male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 88 China male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 89 China male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 90 China male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 91 China male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 92 India male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 93 India male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 94 India male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 95 India male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 96 India male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 97 Australia male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 98 Australia male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 99 Australia male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 100 Australia male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 101 Australia male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 102 South Korea male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 103 South Korea male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 104 South Korea male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 105 South Korea male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 106 South Korea male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 107 Thailand male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 108 Thailand male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 109 Thailand male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 110 Thailand male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 111 Thailand male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 112 Latin America male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 113 Latin America male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 114 Latin America male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 115 Latin America male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 116 Latin America male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 117 Latin America male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 118 Brazil male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 119 Brazil male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 120 Brazil male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 121 Brazil male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 122 Brazil male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 123 Argentina male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 124 Argentina male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 125 Argentina male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 126 Argentina male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 127 Argentina male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 128 Middle East & Africa male urinary incontinence market, by country, 2021 - 2033 (USD Million)

Table 129 Middle East & Africa male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 130 Middle East & Africa male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 131 Middle East & Africa male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 132 Middle East & Africa male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 133 Middle East & Africa male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 134 South Africa male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 135 South Africa male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 136 South Africa male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 137 South Africa male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 138 South Africa male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 139 Saudi Arabia male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 140 Saudi Arabia male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 141 Saudi Arabia male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 142 Saudi Arabia male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 143 Saudi Arabia male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 144 UAE male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 145 UAE male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 146 UAE male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 147 UAE male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 148 UAE male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

Table 149 Kuwait male urinary incontinence market, by product, 2021 - 2033 (USD Million)

Table 150 Kuwait male urinary incontinence market, by incontinence type, 2021 - 2033 (USD Million)

Table 151 Kuwait male urinary incontinence market, by usage, 2021 - 2033 (USD Million)

Table 152 Kuwait male urinary incontinence market, by distribution channel, 2021 - 2033 (USD Million)

Table 153 Kuwait male urinary incontinence market, by end use, 2021 - 2033 (USD Million)

List of Figures

Fig. 1 Male urinary incontinence market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Male urinary incontinence market outlook, 2024 (USD Million)

Fig. 10 Market trends & outlook

Fig. 11 Market driver relevance analysis (Current & future impact)

Fig. 12 Market restraint relevance analysis (Current & future impact)

Fig. 13 Male urinary incontinence product type market share analysis, 2024 - 2033 (USD Million)

Fig. 14 Male urinary incontinence product type market: Segment dashboard

Fig. 15 Non-absorbents market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 16 Urinary catheters market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 17 Foley catheters market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 18 External catheters market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 19 Drainage bags market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 20 External compression devices/penile clamps market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 21 Artificial urinary sphincter market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 22 Others market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 23 Absorbents market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 24 Underwear & briefs market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 25 Drip collectors & bed protectors market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 26 Pads & guards market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 27 Male urinary incontinence type market share analysis, 2024 - 2033 (USD Million)

Fig. 28 Male urinary incontinence type market: Segment dashboard

Fig. 29 Stress urinary incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 30 Urge urinary incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 31 Overflow incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 32 Functional urinary incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 33 Mixed urinary incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 34 Male urinary incontinence usage market share analysis, 2024 - 2033 (USD Million)

Fig. 35 Male urinary incontinence usage market: Segment dashboard

Fig. 36 Reusable market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 37 Disposable market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 38 Male urinary incontinence distribution channel market share analysis, 2024 - 2033 (USD Million)

Fig. 39 Male urinary incontinence distribution channel market: Segment dashboard

Fig. 40 Offline stores market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 41 Online channels market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 42 Male urinary incontinence end use market share analysis, 2024 - 2033 (USD Million)

Fig. 43 Male urinary incontinence end use market: Segment dashboard

Fig. 44 Hospitals & clinics market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 45 Homecare market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 46 Others market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 47 Male urinary incontinence market: Regional key takeaways (USD Million)

Fig. 48 Male urinary incontinence market: Regional outlook, 2024 & 2033, USD Million

Fig. 49 North America male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 50 US male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 51 Canada male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 52 Mexico male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 53 Europe male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 54 UK male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 55 Germany male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 56 France male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 57 Spain male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 58 Italy male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 59 Sweden male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 60 Norway male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 61 Denmark male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 62 Asia Pacific male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 63 China male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 64 Japan male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 65 India male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 66 South Korea male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 67 Australia male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 68 Thailand male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 69 Latin America male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 70 Brazil male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 71 Argentina male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 72 Middle East and Africa male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 73 South Africa male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 74 Saudi Arabia male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 75 UAE male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 76 Kuwait male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 77 List of key emerging companies/incontinence type disruptors/innovators

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Male urinary incontinence market outlook, 2024 (USD Million)

Fig. 10 Market trends & outlook

Fig. 11 Market driver relevance analysis (Current & future impact)

Fig. 12 Market restraint relevance analysis (Current & future impact)

Fig. 13 Male urinary incontinence product type market share analysis, 2024 - 2033 (USD Million)

Fig. 14 Male urinary incontinence product type market: Segment dashboard

Fig. 15 Non-absorbents market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 16 Urinary catheters market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 17 Foley catheters market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 18 External catheters market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 19 Drainage bags market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 20 External compression devices/penile clamps market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 21 Artificial urinary sphincter market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 22 Others market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 23 Absorbents market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 24 Underwear & briefs market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 25 Drip collectors & bed protectors market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 26 Pads & guards market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 27 Male urinary incontinence type market share analysis, 2024 - 2033 (USD Million)

Fig. 28 Male urinary incontinence type market: Segment dashboard

Fig. 29 Stress urinary incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 30 Urge urinary incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 31 Overflow incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 32 Functional urinary incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 33 Mixed urinary incontinence market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 34 Male urinary incontinence usage market share analysis, 2024 - 2033 (USD Million)

Fig. 35 Male urinary incontinence usage market: Segment dashboard

Fig. 36 Reusable market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 37 Disposable market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 38 Male urinary incontinence distribution channel market share analysis, 2024 - 2033 (USD Million)

Fig. 39 Male urinary incontinence distribution channel market: Segment dashboard

Fig. 40 Offline stores market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 41 Online channels market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 42 Male urinary incontinence end use market share analysis, 2024 - 2033 (USD Million)

Fig. 43 Male urinary incontinence end use market: Segment dashboard

Fig. 44 Hospitals & clinics market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 45 Homecare market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 46 Others market revenue estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 47 Male urinary incontinence market: Regional key takeaways (USD Million)

Fig. 48 Male urinary incontinence market: Regional outlook, 2024 & 2033, USD Million

Fig. 49 North America male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 50 US male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 51 Canada male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 52 Mexico male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 53 Europe male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 54 UK male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 55 Germany male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)

Fig. 56 France male urinary incontinence market estimates and forecasts, 2021 - 2033 (USD Million)