Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to the Confederation of European Waste-to-Energy Plants, the business climate index for plant operators increased to 91.7 points in 2024, indicating strong market activity and optimistic industry sentiment. Despite this positive outlook, the market faces a substantial barrier in the form of high capital expenditures necessary for constructing and maintaining complex facilities. The combination of significant initial investment costs and rigorous environmental compliance standards creates financial hurdles that can delay project implementation, particularly in regions that are sensitive to price fluctuations.

Market Drivers

Rapid global urbanization and a surge in municipal waste generation serve as the primary catalysts for the Global Waste-to-Energy Market, creating an urgent demand for effective disposal infrastructure. As metropolitan populations densify, traditional disposal methods become overwhelmed, necessitating advanced thermal and biological solutions to significantly reduce waste volumes and prevent environmental harm. The United Nations Environment Programme's 'Global Waste Management Outlook 2024' projects that municipal solid waste generation will rise from 2.1 billion tonnes in 2023 to 3.8 billion tonnes by 2050, underscoring the critical need to expand energy recovery capacities to transform this growing waste stream into resources.The market is further accelerated by the increasing demand for renewable and alternative energy sources as nations strive to diversify their energy mixes and lower reliance on fossil fuels. Waste-to-energy plants offer a dual benefit by processing waste while supplying baseload power and heat, which is particularly valuable during periods of volatile energy prices. For example, Veolia reported in February 2024 that its energy business revenue grew by 19.9% to €12.3 billion due to high energy prices and efficiency demands. Additionally, the World Bioenergy Association noted in 2024 that bioenergy contributed 697 TWh to global renewable electricity generation in the previous year, highlighting the sector's essential role in the renewable transition.

Market Challenges

The substantial capital expenditure required to develop and maintain Waste-to-Energy infrastructure presents a significant barrier to global market expansion. These facilities demand immense upfront funding to ensure compliance with safety protocols and operational efficiency standards. This high financial entry point often deters investors and extends the timeline for project approvals, particularly in price-sensitive regions where securing long-term financing is challenging. Consequently, this capital intensity limits the speed at which new capacity can be established to accommodate rising waste volumes.Additionally, the costs associated with adhering to strict environmental mandates frequently impede the integration of essential technologies needed for future growth. Financial constraints often delay the deployment of compliance-focused upgrades, creating uncertainty for ongoing projects. In 2024, the European Suppliers of Waste-to-Energy Technology reported that only 14% of plant operators had taken decisive steps toward implementing carbon capture projects despite broad industry discussions. This low adoption rate demonstrates how high investment costs act as a bottleneck, preventing the industry from rapidly scaling operations to meet broader market demands.

Market Trends

The integration of Carbon Capture, Utilization, and Storage (CCUS) technologies is fundamentally reshaping the sector, transforming waste treatment facilities into active hubs for carbon management. Operators are increasingly retrofitting infrastructure to capture emissions at the source, ensuring long-term viability amidst tightening net-zero regulations and potential carbon taxes. For instance, Rigzone reported in September 2024 that the Alberta government invested $2.04 million in a design study for Varme Energy's waste-to-energy facility, which aims to capture approximately 185,000 metric tons of carbon dioxide annually, demonstrating the growing financial commitment to this decarbonization strategy.Simultaneously, the production of Sustainable Aviation Fuel (SAF) from waste feedstocks represents a strategic shift from generating baseload electricity to producing high-value liquid fuels. With the aviation industry facing strict decarbonization mandates, developers are utilizing advanced gasification technologies to convert municipal solid waste into jet fuel. This transition addresses the shortage of low-carbon feedstocks while offering higher revenue potential than traditional power sales. The Pacific Northwest National Laboratory highlighted in April 2024 that US waste-to-fuel refineries could produce 3 to 5 billion gallons of SAF annually, emphasizing the immense potential of waste resources to decarbonize the aviation sector.

Key Players Profiled in the Waste-to-Energy Market

- Veolia Environnement SA

- Hitachi Zosen Corporation

- Wheelabrator Technologies Holdings Inc.

- Babcock & Wilcox Enterprises, Inc.

- Mitsubishi Heavy Industries Ltd.

- Waste Management Inc.

- Covanta Holding Corp.

- China Everbright Group

Report Scope

In this report, the Global Waste-to-Energy Market has been segmented into the following categories:Waste-to-Energy Market, by Technology:

- Thermochemical

- Biochemical

Waste-to-Energy Market, by Waste Type:

- Municipal Solid Waste

- Process Waste

- Agricultural waste

- Others

Waste-to-Energy Market, by Application:

- Electricity

- Heat

Waste-to-Energy Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Waste-to-Energy Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Waste-to-Energy market report include:- Veolia Environnement SA

- Hitachi Zosen Corporation

- Wheelabrator Technologies Holdings Inc.

- Babcock & Wilcox Enterprises, Inc.

- Mitsubishi Heavy Industries Ltd

- Waste Management Inc.

- Covanta Holding Corp.

- China Everbright Group

Table Information

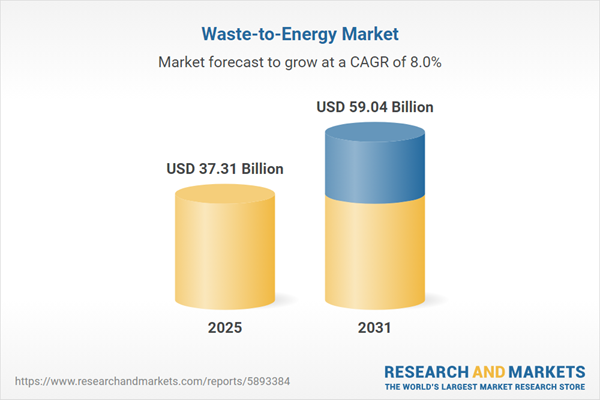

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 37.31 Billion |

| Forecasted Market Value ( USD | $ 59.04 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |