Ophthalmic Diseases: Introduction

Diseases or disorders that infect or impact the eye health in humans are known as ophthalmic diseases. With ever-changing lifestyle changes it is very common to suffer from ophthalmic diseases in today's time. These disorders may also be the result of some other diseases such as diabetes. The ophthalmic disorder that occurs in diabetic patients is known as diabetic retinopathy (DR).Ophthalmic Disease Therapeutics Market Analysis

The continuous integration of advanced technologies to predict the treatment demand for ophthalmic diseases is among the major trends propelling the market growth. The rise in ophthalmic disorders or diseases in diabetic patients is also driving market growth. The market has also been witnessing continuous growth as research and development activities associated with the discovery of new drugs or treatments for ophthalmic diseases are on the rise. For example, the drug analysis of an experimental drug 32-134D at Wilmer Eye Institute, Johns Hopkins Medicine was proven to be effective in reducing HIF levels in diseased eyes. This drug analysis was proven effective against slow vision loss in diabetic patients. Eye conditions leading to vision loss are common complications of diabetes and about 8 million Americans are impacted by them. According to the National Institutes of Health, these numbers are expected to nearly double by 2040.The ophthalmic disease therapeutics market growth is also influenced by the increasing number of clinical trials such as targeted retinal photocoagulation TRP has been proven effective against diabetic retinopathy (DR) and may become a substitute for Pan Retinal Photocoagulation (PRP) in the coming years. The combinational therapy produced out of TRP with intravitreal injection of anti-vascular endothelial growth factor (anti-VEGF) drugs can also be a potential new approach to expand the treatment regimen for the treatment of diabetic retinopathy. This combinational therapy has been effective on other retinal vascular diseases. The increasing awareness about combinational therapies among people and eye care professionals is also expected to drive market growth.

Ophthalmic Disease Therapeutics Market Segmentations

Ophthalmic Disease Therapeutics Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Disease Type

- Glaucoma

- Dry Eye Diseases

- Retinal Diseases

- Allergy & infections

- Diabetic Retinopathy

- Others

Market Breakup by Drug Class

- Anti-inflammatory Drugs

- Anti-infective Drugs

- Anti-VEGF (Vascular Endothelial Growth Factor) Drugs

- Anti-glaucoma Drugs

- Corticosteroids

- Others

Market Breakup by Route of Administration

- Topical

- Oral

- Intravenous

Market Breakup by Dosages Form

- Solid

- Liquid

- Semi- Solid

Market Breakup by Distribution Channel

- Hospitals Pharmacies

- Retail pharmacies

- Online Pharmacies

- Others

Market Breakup by End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Homecare Settings

- Others

Market Breakup by Region-7MM

- United States

- EU-4 and the United Kingdom

- Japan

Ophthalmic Disease Therapeutics Market Overview

The market has been witnessing significant growth due to the increasing geriatric population worldwide. This is due to the development of age-related macular degeneration (AMD) in which the macula is impacted causing central vision loss. The increasing demand for treatment of such eye disorders for the aged population is continuously driving the market growth. The increasing prevalence of chronic diseases such as diabetes is also driving the market growth as it can also cause diabetic retinopathy. The key players in the market are targeting more towards the development of new and improved treatments and drugs.The increasing research and development activities to develop advanced drugs for the treatment of ophthalmic disorders that may cause total blindness, in the long run, are continuously driving the ophthalmic disease therapeutics market growth. The early diagnosis and timely management of eye conditions such as diabetic retinopathy have been proven effective however, a lack of awareness about the treatments and diagnostic measures for ophthalmic diseases is anticipated to restrict the market growth. According to WHO, refractive errors and cataracts are the leading cause of vision impairment and blindness.

Geographically, North America is leading the global market and is expected to lead throughout the forecast period. The presence of a geriatric population and diabetic patient pool is majorly contributing to the ophthalmic disease therapeutics market share. Eye diseases such as age-related macular degeneration, cataracts, diabetic retinopathy, and glaucoma are the leading causes of blindness and low vision in the United States. Diabetic retinopathy (DR) is a common complication of diabetes. It is the leading cause of blindness in American adults.

Ophthalmic Disease Therapeutics Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Pfizer Inc.

- Alcon

- Novartis AG

- Bausch Health Companies Inc.

- Merck & Co., Inc.

- Regeneron Pharmaceuticals Inc

- Allergan

- Bayer AG

- Genentech, Inc.

- Nicox

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Pfizer Inc.

- Alcon

- Novartis AG

- Bausch Health Companies Inc.

- Merck & Co., Inc.

- Regeneron Pharmaceuticals Inc

- Allergan

- Bayer AG

- Genentech, Inc.

- Nicox

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

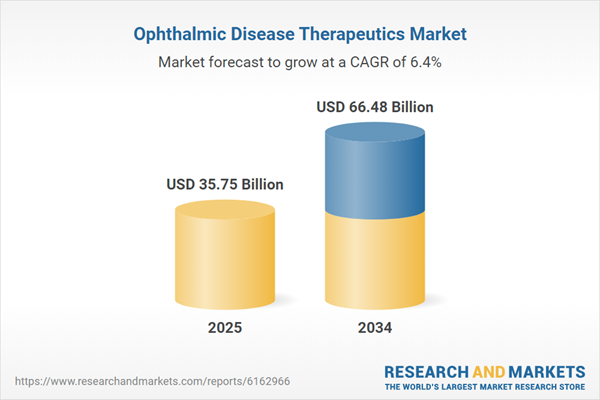

| Estimated Market Value ( USD | $ 35.75 Billion |

| Forecasted Market Value ( USD | $ 66.48 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |