Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market’s steady growth is supported by rising consumer interest in natural ingredients, transparent labeling, and dietary products aligned with health and sustainability values. Manufacturers are adopting HVPs to replace synthetic flavor enhancers and respond to evolving consumer expectations without sacrificing taste or texture. With innovation focusing on allergen-free, non-GMO, and regionally tailored solutions, HVPs have evolved into a key ingredient in product reformulation strategies and flavor enhancement across diverse food categories.

Key Market Drivers

Rising Demand for Plant-Based and Natural Ingredients

Consumer preferences are shifting significantly toward plant-derived and natural ingredients, driving substantial demand for HVPs. With approximately 50% of consumers prioritizing health and 33% actively pursuing sustainability, food producers are rethinking product composition.HVPs are increasingly adopted as clean-label alternatives to artificial additives, supporting the trend toward healthier eating habits that emphasize reduced processed foods and increased plant intake. Their application is expanding rapidly in categories such as meat alternatives, soups, instant meals, and snacks, making them a central ingredient in the development of plant-based and health-focused formulations. The post-pandemic rise in preventive health awareness has further propelled this movement, positioning HVPs as key to delivering both nutritional and sensory value.

Key Market Challenges

Allergenicity Concerns

Allergen-related risks pose a significant challenge in the HVP market, especially for products derived from soy and wheat. With rising consumer sensitivity to allergens and stricter global labeling standards, manufacturers face growing pressure to ensure transparency, proper documentation, and robust allergen control.Failure to clearly indicate allergenic ingredients can lead to regulatory non-compliance and loss of consumer trust. As demand for allergen-free and inclusive formulations increases, companies must invest in research and production safeguards to address this issue effectively.

Key Market Trends

Continued Growth of the Plant-Based Movement

The accelerating plant-based movement is influencing the HVP market as food innovators seek plant-derived ingredients that enhance both flavor and functionality. HVPs play an essential role in formulating plant-based meat and dairy alternatives, offering the savory depth and texture traditionally associated with animal-based products.The convergence of ethical, environmental, and health motivations behind plant-based diets continues to drive HVP utilization, particularly in applications where taste, clean labeling, and protein content are critical. This trend is fostering R&D in novel HVP sources like peas and lentils to diversify offerings and reduce reliance on common allergens.

Key Market Players

- Ajinomoto Co Inc

- Kerry Group PLC

- Shanghai Aipu Food Industry Co Ltd

- Titan Bio-tech Ltd

- Cargill Inc

- Roquette Freres SA

- DSM BV

- Tate & Lyle PLC

- Archer-Daniels-Midland Co

- Griffith Foods SA De CV

Report Scope

In this report, the Global Hydrolyzed Vegetable Proteins Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.Hydrolyzed Vegetable Proteins Market, By Source:

- Soy

- Wheat

- Corn

- Pea

- Others

Hydrolyzed Vegetable Proteins Market, By Function:

- Flavoring Agent

- Emulsifying Agent

- Others

Hydrolyzed Vegetable Proteins Market, By Application:

- Flavoring Agent

- Emulsifying Agent

- Others

Hydrolyzed Vegetable Proteins Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hydrolyzed Vegetable Proteins Market.Available Customizations

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ajinomoto Co Inc

- Kerry Group PLC

- Shanghai Aipu Food Industry Co Ltd

- Titan Bio-tech Ltd

- Cargill Inc

- Roquette Freres SA

- DSM BV

- Tate & Lyle PLC

- Archer-Daniels-Midland Co

- Griffith Foods SA De CV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | April 2025 |

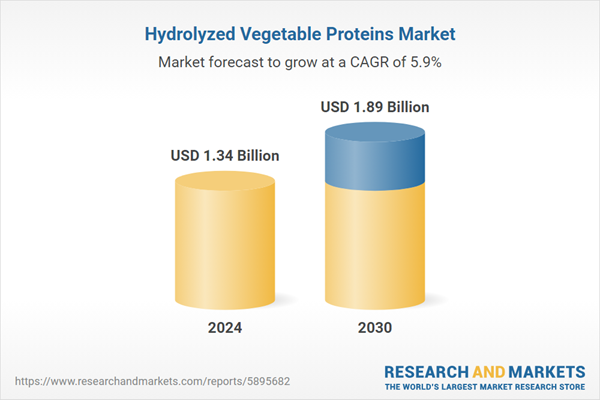

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.34 Billion |

| Forecasted Market Value ( USD | $ 1.89 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |