Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One standout feature of this market's evolution is the increasing demand for streamlined and interactive solutions, which is further fueled by the integration of Global Extreme Ultraviolet (EUV) Lithography technologies. Innovations like IoT-integrated operational platforms and interactive applications have elevated the capabilities of digital twins, adding new layers of sophistication to their utility. This shift towards technology-optimized solutions, in conjunction with operational enhancements, aligns seamlessly with the concept of transformative business strategies. Enterprises and industries are strategically harnessing Global Extreme Ultraviolet (EUV) Lithography technologies to enhance operational experiences, providing their teams with newfound dimensions of efficiency.

However, it is crucial to address the challenges that accompany these technological advancements. Managing regulatory compliance and security considerations is paramount to strike the right balance between innovation and operational effectiveness, ensuring that digital twin technology continues to deliver value while upholding data integrity and privacy. In the ever-evolving landscape of industrial technology, the Global Extreme Ultraviolet (EUV) Lithography market serves as a steadfast enabler, propelling the modernization of operational methodologies. Its influence extends beyond mere technological adoption, fostering improved adaptability, streamlined processes, and ultimately, enhanced outcomes. As industries continue to evolve, this market consistently reshapes traditional paradigms, establishing a robust foundation for interconnected and innovative operations.

In conclusion, the Global Extreme Ultraviolet (EUV) Lithography market's remarkable growth and impact underscore its pivotal role in shaping the future of various industries. With its ability to drive efficiency, productivity, and innovation, it is poised to remain a driving force in the ongoing transformation of business operations.

Key Market Drivers

Semiconductor Industry Advancements Fueling EUV Lithography Market Growth

The Global Extreme Ultraviolet (EUV) Lithography market has been experiencing significant growth, primarily driven by advancements in the semiconductor industry. As semiconductors are the fundamental building blocks of modern technology, their increasing complexity and demand for higher performance have necessitated the adoption of cutting-edge manufacturing processes. EUV lithography has emerged as a game-changing technology in this regard.Semiconductor Complexity Demands Precision: The semiconductor industry has witnessed a relentless pursuit of smaller, more powerful, and energy-efficient chips. EUV lithography's ability to produce intricate and precise patterns at nanoscale levels is critical to meeting these demands. It enables the creation of smaller transistors and densely packed circuits, enhancing the performance of electronic devices.

Next-Generation Devices Require EUV: Emerging technologies such as 5G, artificial intelligence, and autonomous vehicles rely on advanced semiconductor components. EUV lithography has become indispensable for manufacturing these next-generation devices, further driving its market growth.

Competitive Advantage and Cost Efficiency: Companies investing in EUV lithography gain a competitive advantage by producing chips with superior performance and reduced power consumption. While the technology requires significant initial investments, it ultimately leads to cost efficiency through higher chip yields and reduced manufacturing defects.

Growing Demand for Data Centers and High-Performance Computing

The exponential growth of data-driven technologies, cloud computing, and data centers is a pivotal driver propelling the Global EUV Lithography market forward. In an increasingly connected world, the need for processing and storing vast amounts of data has skyrocketed, creating a surge in demand for advanced semiconductor manufacturing techniques.Data Center Expansion: Data centers serve as the backbone of the digital age, housing servers and infrastructure critical for cloud computing and online services. EUV lithography enables the production of high-performance processors, facilitating the expansion and efficiency of data centers.

AI and Big Data Analytics: Artificial intelligence and big data analytics applications demand powerful processors capable of handling complex computations in real-time. EUV lithography is instrumental in manufacturing the high-performance chips required for these applications and Scientific Research: High-performance computing (HPC) clusters used in scientific research, simulations, and modeling rely on cutting-edge semiconductor technology. EUV lithography supports the development of processors that drive advancements in fields like climate modeling, drug discovery, and astrophysics.

Mobile and Consumer Electronics Revolution

The global proliferation of mobile and consumer electronics has spurred remarkable growth in the EUV lithography market. These devices, ranging from smartphones to wearable tech and smart home gadgets, demand smaller, more power-efficient, and high-performance chips, driving the need for EUV lithography.Smartphone Innovation: Smartphones continually push the boundaries of technology with features like advanced cameras, augmented reality, and artificial intelligence. EUV lithography enables the creation of compact, energy-efficient, and powerful chips that power these innovations. IoT and Wearables: The Internet of Things (IoT) and wearable devices are becoming increasingly prevalent in daily life. EUV lithography plays a pivotal role in manufacturing the small yet powerful chips that enable connectivity and functionality in these devices. Consumer Electronics Evolution: From gaming consoles to smart TVs, consumer electronics rely on semiconductor technology to deliver cutting-edge entertainment experiences. EUV lithography facilitates the production of high-performance chips that meet the demands of modern consumers.

In summary, the Global Extreme Ultraviolet (EUV) Lithography market is driven by a convergence of factors, including the semiconductor industry's need for precision, the growth of data-driven technologies, and the revolution in mobile and consumer electronics. These drivers underscore the market's significance in shaping technological advancements across various industries.

Key Market Challenges

Cost and Complexity of EUV Lithography Technology Implementation

Implementing Extreme Ultraviolet (EUV) lithography technology presents a substantial challenge to businesses, primarily due to its high cost and complexity. This cutting-edge technology requires significant investments in equipment, infrastructure, and expertise, posing hurdles for market adoption. Capital Intensive Investment: EUV lithography machines and related infrastructure are among the most expensive tools in semiconductor manufacturing. The high capital expenditure required for purchasing and setting up EUV equipment can be a significant barrier for semiconductor manufacturers, especially smaller players in the industry.Operational Expertise: Operating and maintaining EUV lithography machines demands a highly skilled workforce. Companies need to invest in training and development to ensure their staff can effectively manage and troubleshoot these complex systems. This challenge extends beyond initial implementation, as ongoing operational expertise is crucial for consistent performance.

Supply Chain Disruptions: The complex supply chain for EUV lithography equipment, which includes specialized components and materials, can be vulnerable to disruptions. Any delays or shortages in the supply chain can impact manufacturing schedules and increase costs.

Regulatory Compliance and Data Security Concerns

As the Global Extreme Ultraviolet (EUV) Lithography market continues to expand, it faces regulatory compliance and data security concerns that must be diligently managed to strike the right balance between innovation and operational effectiveness. Data Privacy and Security: EUV lithography involves the handling of sensitive design and manufacturing data, which makes it essential to prioritize data privacy and security. Ensuring that intellectual property and sensitive information remain protected throughout the manufacturing process is a significant challenge, given the potential for cyber threats and data breaches.Regulatory Compliance: The semiconductor industry is subject to stringent regulatory requirements, including export controls and environmental regulations. Companies operating in the EUV lithography market must navigate a complex landscape of regulations to ensure compliance, which can add complexity and cost to their operations. Global Standards and Collaboration: The global nature of the semiconductor industry necessitates adherence to international standards and collaboration among stakeholders. Coordinating efforts to establish common standards and practices for EUV lithography technology across different regions and organizations can be challenging, but it is vital for the industry's growth and success.

In conclusion, the Global Extreme Ultraviolet (EUV) Lithography market faces significant challenges related to the high cost and complexity of technology implementation, as well as regulatory compliance and data security concerns. Addressing these challenges is crucial for the continued growth and success of EUV lithography technology in semiconductor manufacturing.

Key Market Trends

Increasing Adoption of EUV Lithography in Advanced Nodes

Driving Semiconductor Miniaturization: One prominent trend shaping the Global Extreme Ultraviolet (EUV) Lithography Market is the increasing adoption of EUV technology in advanced semiconductor nodes. As the demand for smaller, more powerful, and energy-efficient chips continues to rise, semiconductor manufacturers are turning to EUV lithography to achieve the precision required for cutting-edge devices. EUV lithography enables the production of sub-7nm nodes and beyond, allowing for the creation of smaller transistors and densely packed circuits. This trend is critical for industries such as mobile computing, 5G connectivity, and artificial intelligence, where performance and power efficiency are paramount.Expanding Use Cases: Beyond traditional semiconductor applications, EUV lithography is finding new use cases in areas like photonic integrated circuits, advanced memory technologies, and specialized sensors. This expansion of applications is broadening the market's scope and increasing its relevance in various industries, from telecommunications to healthcare. Competitive Advantage: Companies that invest in EUV lithography gain a competitive advantage by producing chips with superior performance, reduced power consumption, and higher yields. This trend is expected to continue as semiconductor manufacturers seek ways to differentiate their products in a highly competitive market.

Integration of EUV Lithography into Smart Manufacturing and Industry 4.0

Smart Manufacturing Revolution: The integration of EUV lithography into smart manufacturing processes is another significant trend reshaping the industry. Industry 4.0 initiatives are driving the adoption of automation, data analytics, and artificial intelligence in manufacturing. EUV lithography fits seamlessly into this landscape by offering precise and efficient semiconductor manufacturing processes.Advanced Process Control: EUV lithography machines are equipped with advanced process control systems that enable real-time monitoring and adjustment of manufacturing parameters. This capability aligns with the principles of smart manufacturing, where data-driven decision-making and predictive maintenance are essential. As a result, EUV lithography contributes to higher manufacturing yields and reduced downtime. Data-Driven Insights: The data generated during EUV lithography processes can be leveraged for process optimization and predictive maintenance. This trend is expected to lead to the development of advanced analytics tools specifically designed for EUV lithography, further enhancing its efficiency and reliability.

Enhanced Sustainability Initiatives in EUV Lithography

Reducing Environmental Footprint: Sustainability is becoming a focal point in the Global Extreme Ultraviolet (EUV) Lithography Market. As industries worldwide prioritize reducing their environmental footprint, semiconductor manufacturers are seeking more eco-friendly lithography solutions. EUV lithography, compared to traditional optical lithography techniques, offers advantages such as reduced chemical usage, lower energy consumption, and lower greenhouse gas emissions. This trend aligns with corporate sustainability goals and regulatory pressures to minimize the environmental impact of semiconductor manufacturing. Green Material Innovations: Researchers and manufacturers are exploring green materials and processes for EUV lithography to further reduce its environmental impact. This includes the development of more sustainable photoresists and alternative materials with lower toxicity and waste generation.Supply Chain Sustainability: Sustainability initiatives are extending to the entire supply chain of EUV lithography equipment and materials. Companies are collaborating with suppliers to implement environmentally responsible practices and reduce the carbon footprint of the overall manufacturing process.

In conclusion, the Global Extreme Ultraviolet (EUV) Lithography Market is marked by trends including the increasing adoption in advanced nodes, integration into smart manufacturing, and enhanced sustainability initiatives. These trends reflect the industry's continuous evolution as it seeks to meet the demands of smaller and more efficient semiconductor devices while addressing environmental and manufacturing efficiency concerns.

Segmental Insights

Component Type Insights

In 2022, the Global Extreme Ultraviolet (EUV) Lithography Market was primarily dominated by the"Mirrors and Optics" segment. This dominance is expected to persist and even strengthen throughout the forecast period. Mirrors and optics play a critical role in EUV lithography, as they are responsible for directing and focusing the extreme ultraviolet light onto the semiconductor wafer, enabling the precise patterning of intricate features on the silicon substrate. The demand for advanced mirrors and optics is driven by the ever-increasing need for finer semiconductor geometries in manufacturing cutting-edge integrated circuits. As semiconductor technology continues to advance and nodes shrink to meet the demands of faster and more energy-efficient electronic devices, the importance of high-quality mirrors and optics in EUV lithography systems is paramount. Manufacturers in the semiconductor industry are consistently investing in research and development to enhance the performance and durability of these essential components. Consequently, the"Mirrors and Optics" segment is expected to maintain its dominance in the EUV lithography market during the forecast period, reflecting the industry's ongoing commitment to pushing the boundaries of semiconductor manufacturing technology. This sustained dominance will be underpinned by the pivotal role that mirrors and optics play in enabling semiconductor manufacturers to achieve smaller feature sizes and higher levels of integration in their products, driving innovation and competitiveness in the global electronics market.End-Use Industry Insights

In 2022, the"Semiconductor Manufacturing" segment emerged as the dominant force in the Global Extreme Ultraviolet (EUV) Lithography Market, and it is poised to maintain its dominance throughout the forecast period. This segment encompasses the primary application of EUV lithography technology, which is the production of advanced semiconductor devices. The semiconductor industry has been undergoing a rapid evolution characterized by shrinking transistor sizes and increasing chip complexity, driving the demand for EUV lithography solutions. Integrated Device Manufacturers (IDMs), foundries, and memory manufacturers are all key players within the semiconductor manufacturing ecosystem, and they have been at the forefront of adopting EUV lithography to meet the demands of producing smaller, more powerful, and energy-efficient semiconductor components. These end-users are motivated by the necessity to keep pace with Moore's Law and stay competitive in a tech-driven market. Furthermore, as emerging technologies such as 5G, artificial intelligence, and the Internet of Things continue to expand, the demand for advanced semiconductors is expected to surge, further solidifying the dominance of the"Semiconductor Manufacturing" segment in the EUV lithography market. This segment's leading position is reinforced by the continuous investment in research and development by semiconductor manufacturers and the semiconductor equipment suppliers, aiming to improve the capabilities and cost-effectiveness of EUV lithography systems, thereby ensuring their long-term relevance in semiconductor fabrication. As a result, the"Semiconductor Manufacturing" segment is expected to remain the driving force behind the EUV lithography market's growth, playing a pivotal role in advancing the technology and enabling the production of cutting-edge electronic devices.Regional Insights

In 2022, the Asia-Pacific region dominated the Global Extreme Ultraviolet (EUV) Lithography Market and is anticipated to continue its dominance throughout the forecast period. This regional dominance can be attributed to several key factors. Firstly, Asia-Pacific is home to some of the world's largest semiconductor manufacturers, making it a central hub for semiconductor production. Countries such as Taiwan, South Korea, Japan, and China host major semiconductor fabrication facilities, both by Integrated Device Manufacturers (IDMs) and foundries. These companies have been aggressively adopting EUV lithography technology to meet the growing demand for advanced and smaller semiconductor components.Secondly, the Asia-Pacific region benefits from a strong ecosystem of semiconductor equipment suppliers and technology developers. Companies in this region are actively involved in the research, development, and production of EUV lithography systems and related components, fostering innovation and technology advancement.

Additionally, government support and investment in the semiconductor industry in countries like South Korea and Taiwan have further fueled the adoption of EUV lithography technology. These governments recognize the strategic importance of semiconductor manufacturing and are keen on maintaining a competitive edge in the global market.

Furthermore, the Asia-Pacific region's rapidly expanding consumer electronics market and the increasing demand for high-performance semiconductors for applications like smartphones, tablets, and IoT devices continue to drive the need for advanced lithography solutions, including EUV. As a result, the Asia-Pacific region is expected to maintain its dominant position in the Global EUV Lithography Market during the forecast period, driven by the strong presence of semiconductor manufacturing giants, a thriving technology ecosystem, government support, and the escalating demand for cutting-edge semiconductor products in the region..

Key Market Players

- ASML Holding NV.

- CARL ZEISS AG.

- Toppan Photomasks Inc

- USHIO, INC

- NTT ADVANCED TECHNOLOGY CORPORATION.

- KLA CORPORATION

- ADVANTEST CORPORATION

- Photronics, Inc

- HOYA Corporation

- Trumpf

Report Scope

In this report, the Global Extreme Ultraviolet (EUV) Lithography market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Extreme Ultraviolet (EUV) Lithography Market, by Technology Node:

- 7nm and Below

- 5nm

- 3nm

Global Extreme Ultraviolet (EUV) Lithography Market, by Component Type:

- Light Source (EUV Sources)

- Mirrors and Optics

- Mask and Mask Handling Systems

- Others (Resists, Photoresist Ancillaries, etc.)

Global Extreme Ultraviolet (EUV) Lithography Market, by End-Use Industry:

- Semiconductor Manufacturing

- Integrated Device Manufacturers (IDMs)

- Foundries

- Memory Manufacturers

- Others (MEMS, LED, etc.)

Global Extreme Ultraviolet (EUV) Lithography Market, by Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Extreme Ultraviolet (EUV) Lithography Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ASML Holding NV.

- CARL ZEISS AG.

- Toppan Photomasks Inc.

- USHIO, Inc.

- NTT ADVANCED TECHNOLOGY CORPORATION.

- KLA CORPORATION

- ADVANTEST CORPORATION

- Photronics, Inc.

- HOYA Corporation

- Trumpf

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | October 2023 |

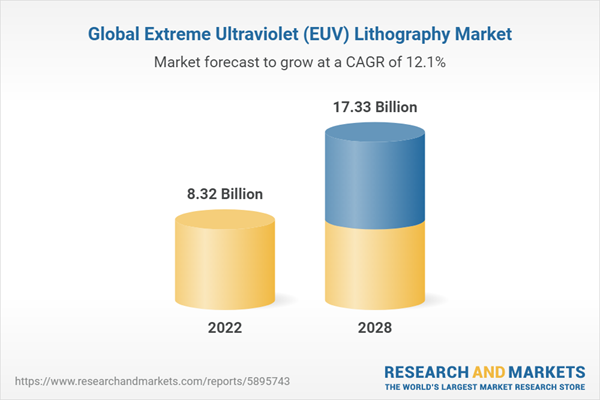

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 8.32 Billion |

| Forecasted Market Value ( USD | $ 17.33 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |