Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

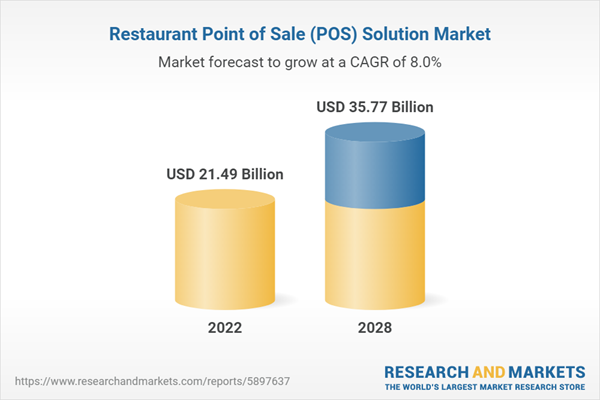

Global Restaurant Point of Sale (POS) Solution Market has experienced tremendous growth in recent years and is poised to continue its strong expansion. The Restaurant Point of Sale (POS) Solution Market reached a value of USD 21.49 billion in 2022 and is projected to maintain a compound annual growth rate of 7.98% through 2028.

This growth is driven largely by the widespread digital transformation of the restaurant industry globally. As restaurant owners increasingly leverage cutting-edge technologies like AI, cloud, mobile devices and analytics, they are optimizing operations, improving customer experience and ensuring regulatory compliance.

One key area witnessing rising adoption of restaurant POS solutions is back-of-house management. Advanced cloud-based POS platforms are using data analytics and AI to provide unprecedented visibility into business performance by gaining valuable insights from integrated systems and devices. These sophisticated tools continuously monitor inventory, sales, labor costs and more in real-time, quickly detecting issues like stock-outs or rising food costs. Industries like quick service restaurants and casual dining have implemented these innovative solutions effectively to address issues like reducing food waste, improving order accuracy and meeting health standards.

As restaurant chains become more globally distributed, overseeing performance across distributed locations through data and analytics is increasingly important. Leading chains are leveraging analytics from cloud-based POS systems and AI-powered tools to streamline collaboration within global networks while also protecting customer data and intellectual property. This dual focus enables more efficient distributed management while robustly securing sensitive information.

POS solution providers are making substantial R&D investments in predictive demand forecasting, digital ordering, mobile pay and loyalty programs. These investments are poised to unlock even greater value through applications like automated replenishment, optimized scheduling and highly personalized digital services for customers. Importantly, these solutions maintain strong privacy, security and regulatory controls to ensure compliance.

The convergence of operations management and customer experience presents major growth opportunities for restaurant POS solution providers. As these tools continue to evolve and integrate advanced capabilities, they will generate more personalized insights and automate critical processes. This will better equip restaurant owners to address constantly changing regulations and diner demands in our increasingly digital world.

In summary, the long-term outlook for continued strong growth in the global restaurant POS solution market remains positive. The sector's expansion underscores its critical role in safeguarding business performance, optimizing operations and enhancing the customer experience. As technology advances, POS solutions will remain central to ensuring efficient, compliant and secure restaurant management worldwide.

Key Market Drivers

Growing Emphasis on Digital Transformation

One of the primary drivers of growth in the global restaurant POS solution market is the increasing focus on digital transformation across the industry. Restaurant owners are recognizing the need to adopt customer-centric technologies to enhance operations, boost sales and streamline processes. This is driving rising demand for advanced POS systems with features like mobile and cloud capabilities, data analytics, integrated loyalty programs and online/mobile ordering. The ability of modern POS solutions to optimize the customer experience, increase average spend and drive repeat visits is a major attraction for owners looking to future-proof their businesses.

Demand for Actionable Business Insights

Another key growth driver is the growing need among restaurant owners and operators for real-time business intelligence and actionable insights. Traditional POS systems provided limited reporting capabilities, but advanced cloud-based solutions now leverage big data analytics, AI and automated reporting to deliver valuable metrics. This includes sales trends, inventory levels, labor costs, profitability analysis and more. Access to these deep insights allows owners to make informed decisions, reduce costs, quickly resolve issues and ultimately increase profits. The demand for data-driven decision making is propelling investments in sophisticated POS platforms.

Focus on Streamlining Operations

Rising labor costs, supply chain challenges and the general complexity of managing high-volume restaurant operations has also increased the importance of streamlining workflows. POS solutions with integrated inventory management, kitchen display systems, mobile pay and tableside ordering are helping owners address these issues. They are automating manual tasks, reducing errors and inefficiencies, balancing workloads in real-time and enhancing coordination between front and back-of-house teams. The ability of these solutions to optimize operations is another key factor driving their increased adoption worldwide..

Key Market Challenges

Data Security and Privacy Concerns

A major challenge restricting faster adoption of POS solutions is growing concerns around data security and privacy. Restaurant POS systems capture and store vast amounts of sensitive customer and business information. This includes payment details, personal data, sales and inventory records, and employee data. As cyberattacks have become more sophisticated, owners are wary of potential security breaches. High-profile incidents have eroded trust for some vendors. Maintaining compliance with stringent privacy regulations like GDPR also increases the technical ... requirements. While providers have strengthened defenses, perceived security risks continue to dissuade some independent restaurants from cloud-based options. Establishing long-term customer confidence in data protection practices remains crucial for the industry's growth.

High Upfront Investment Costs

Another key challenge is the substantial upfront capital required for purchasing and implementing advanced POS systems. Modern cloud-based solutions demand sizeable expenditure on hardware, software licenses and professional services for installation and training. Replacing legacy POS also incurs costs associated with migration, integration, troubleshooting initial issues and lost productivity during transition periods. For small businesses on tight budgets, such expenses pose significant barriers. Even vendors offering flexible financing and rental options may not entirely alleviate the challenge. This discourages some owners from procuring cutting-edge solutions, preferring instead to incrementally update aging POS equipment. The industry will need to further innovate cost-effective adoption models to achieve faster and wider penetration rates.

Key Market Trends

Growing Adoption of Mobile and Cloud Technologies

One of the major trends gaining momentum is the rising integration of mobile and cloud-based capabilities within POS solutions. Restaurant guests now expect highly convenient digital ordering options on their personal devices. In response, vendors are enhancing POS platforms with features like mobile ... ... and payment processing, inventory management from anywhere via cloud dashboards, and streamlined ... ... between online and in-store channels. The flexibility of cloud infrastructure also allows real-time updates, multi-location management, and software-as-a-service pricing models that reduce upfront costs. The ability of these technologies to improve agility, personalization and off-premise sales is driving increased investments and accelerating this trend. Advanced analytics available through cloud-based platforms will further optimize operations and the customer experience.

Rise of AI-Driven Personalization

Leveraging AI and machine learning algorithms to deliver hyper-personalized experiences has emerged as a major trend. POS vendors are integrating these advanced technologies to gain actionable insights from vast troves of customer behavior and transaction data. The applications include predictive ... ... based on past purchases, automated targeted promotions, customized digital menus highlighting preferred items and seamless loyalty programs. AI can also optimize internal operations through demand forecasting, automated replenishment, and workload balancing. As consumers expect increasingly individualized service, AI-driven personalization will be pivotal for building loyalty, driving incremental sales and boosting operational efficiency.

Focus on Enhancing the Front-End Experience

To attract and retain customers in a highly competitive market, restaurants are placing greater emphasis on enhancing the front-end experience. POS systems are evolving with large multi-touch displays for digital menus, ordering kiosks, tableside devices, beacon-enabled wayfinding and engaging loyalty programs. The goal is to streamline self-service options, place orders faster while still maintaining a personalized experience. Integrated solutions are also optimizing wait times through tools like reservations, queue management and predictive seating. This focus on convenience, speed and customer engagement through advanced front-end technologies is a major trend that will continue to grow in importance.

Segmental Insights

Deployment Insights

The cloud-based segment dominated the global restaurant POS solution market in 2022, accounting for around 60% share of the total revenue. The increased adoption of cloud-based POS systems can be attributed to various factors.

Cloud infrastructure allows restaurant owners to avoid upfront capital costs associated with purchasing hardware since cloud-based models are offered via affordable subscription plans. Transitioning to the cloud also removes the burden of maintaining expensive on-premise servers and systems. This provides greater flexibility and scalability to handle spikes in demand. Cloud-based POS platforms can be accessed from anywhere via an internet connection, enabling remote management of operations. This is highly beneficial for restaurants with multiple locations.

The cloud facilitates seamless software updates and new feature roll-outs without the need to replace existing equipment. This ensures restaurants always have access to the latest innovations. Transitioning to the cloud has also improved data security capabilities for many vendors compared to on-premise solutions. With these advantages, cloud-based POS systems are expected to continue dominating the market during the forecast period. Vendors are investing heavily in enhancing cloud infrastructure to provide advanced analytics, AI capabilities and customized solutions to drive further adoption of their cloud-based POS offerings.

Application Insights

The quick-service restaurant (QSR) segment dominated the global restaurant POS solution market in 2022 with around 40% share. QSRs have been early adopters of POS systems compared to other foodservice segments.

QSRs need to efficiently manage high volumes of transactions during peak hours with minimal wait times. Advanced POS solutions optimized for quick order taking and payment processing help boost throughput. Integrated features like digital signage, kitchen display systems and mobile ordering further streamline workflows. This enables QSRs to serve more customers with fewer resources.

Given their large number of outlets, centralized management of operations across multiple locations is also critical. Cloud-based POS platforms provide the real-time performance visibility and reporting that global QSR chains require. The data-driven insights help optimize areas like predictive demand forecasting, centralized procurement, standardized menu engineering, and workforce scheduling.

As consumer demand for convenience continues growing, QSRs are doubling down on digital innovations to meet evolving expectations. This reliance on technology underscores why the QSR segment is expected to maintain its strong dominance in the coming years. Vendors are also prioritizing enhancements to their QSR-optimized POS suites to capture this high-growth market.

Regional Insights

North America dominated the global restaurant POS solution market in 2022, accounting for over 35% of the total revenue. The region has been at the forefront of digital transformation within the foodservice industry, with restaurants and chains in the US and Canada quick to adopt new technologies.

The presence of leading POS solution providers like Oracle, Revel Systems and Toast in North America has ensured early availability of cutting-edge products. There is extensive R&D focused on developing advanced features such as mobile and cloud capabilities, analytics, AI and customized integrations. The region also has a high concentration of global QSR chains that are significant clients and early adopters of new POS systems. This helps drive greater investments in innovative product development specifically tailored for the North American market.

In terms of technology infrastructure as well, North America has widespread access to high-speed internet and 5G networks that allow seamless use of cloud-based POS platforms. Customers are also more receptive to digital ordering options. With its headstart in deployment and strong vendor base, North America is expected to continue dominating POS solution adoption globally during the forecast period. While other developed markets are increasing investments, North America's early mover advantage will help it maintain its market leading position.

Report Scope:

In this report, the Global Restaurant Point of Sale (POS) Solution Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Restaurant Point of Sale (POS) Solution Market, By Deployment:

- On-premises

- Cloud-based

Restaurant Point of Sale (POS) Solution Market, By Application:

- Full-service restaurants (FSR)

- Quick-service restaurants (QSR)

- Institutional FSR

Restaurant Point of Sale (POS) Solution Market, By End-Use:

- Retail

- Restaurants

- Entertainment

- Others (gas stations, transportation)

Restaurant Point of Sale (POS) Solution Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Restaurant Point of Sale (POS) Solution Market.

Available Customizations:

Global Restaurant Point of Sale (POS) Solution Market report with the given market data, the publisher offers customizations according to a company's specific needs.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Toast, Inc

- ShopKeep

- Revel Systems Inc.

- NCR Corporation

- Oracle Corporation

- Lightspeed POS Inc.

- PAR Technology Corporation

- Clover Network, Inc.

- Upserve, Inc.

- LimeTray

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 21.49 Billion |

| Forecasted Market Value ( USD | $ 35.77 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |