Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

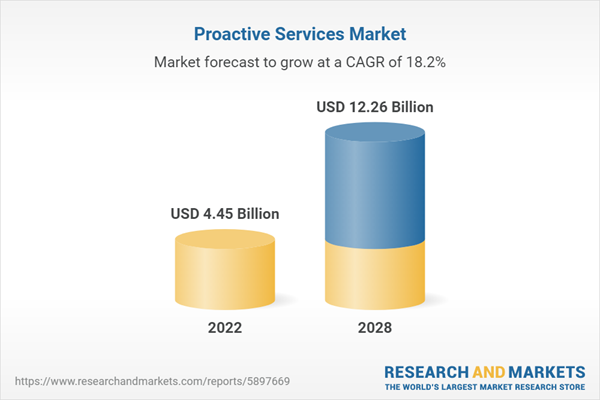

The Global Proactive Services Market was valued at USD 4.45 Billion in 2022 and is growing at a CAGR of 18.23% during the forecast period. The growing trend of understanding customer expectations & buying patterns, adoption of smartphones & tablets, and high usage of the internet, e-commerce websites & shopping applications are a few factors contributing to the growth of this market. Although the COVID-19 pandemic has overturned the way organizations have embraced their work, allowing employees to manage significant disturbances in worldwide supply chains. The pandemic caused stronger digitalization initiatives across the globe, it led organizations to acknowledge the disruption and adapt to proactive services to ensure business intelligence and process enhancement.

Key Market Drivers

The global proactive services market is experiencing robust growth, propelled by a confluence of factors driving demand across various industries. At the forefront of this expansion is the increasing reliance on predictive analytics, which has become indispensable for organizations striving to anticipate and preempt potential challenges. By leveraging advanced data analytics techniques, businesses can proactively monitor their operations, detect anomalies, and forecast trends, enabling them to take preemptive actions to mitigate risks and optimize performance. In parallel, the rapid evolution of artificial intelligence (AI) and machine learning (ML) technologies has significantly augmented the capabilities of proactive services. AI-driven algorithms can analyze vast datasets in real-time, uncovering insights that would be impractical or impossible for human operators to discern. These insights empower organizations to identify emerging issues before they escalate, enabling proactive intervention to prevent disruptions and downtime. As AI and ML continue to advance, the predictive capabilities of proactive services are expected to become even more sophisticated, driving further adoption across industries.

Another key driver of the proactive services market is the proliferation of Internet of Things (IoT) devices. With an ever-expanding network of interconnected sensors and devices, organizations have access to unprecedented volumes of real-time data about their assets and operations. Proactive services harness this wealth of IoT-generated data to provide actionable insights into equipment health, performance trends, and potential failure points. By leveraging IoT data analytics, organizations can implement predictive maintenance strategies, optimize asset utilization, and minimize unplanned downtime, thereby enhancing operational efficiency and reducing costs. Furthermore, the imperative to deliver exceptional customer experiences is fueling demand for proactive services across industries. In today's hyper-competitive business landscape, organizations recognize the importance of anticipating and addressing customer needs before they arise. Proactive services enable companies to stay ahead of customer expectations by preemptively identifying and resolving issues, thereby enhancing satisfaction and loyalty. By leveraging proactive monitoring and predictive analytics, businesses can personalize their offerings, streamline processes, and deliver seamless customer experiences across touchpoints. Regulatory compliance requirements also play a significant role in driving the adoption of proactive services, particularly in highly regulated sectors such as healthcare, finance, and cybersecurity. Stricter regulations necessitate robust risk management practices and proactive monitoring of critical systems and processes to ensure compliance and mitigate potential threats. Proactive services provide organizations with the tools and capabilities needed to monitor, analyze, and respond to compliance-related issues in real-time, thereby reducing the risk of non-compliance and associated penalties.

Moreover, the pursuit of cost reduction and operational efficiency is a perennial driver of investment in proactive services. By proactively managing their infrastructure, applications, and assets, organizations can minimize downtime, optimize resource utilization, and reduce maintenance costs. Proactive services enable businesses to identify inefficiencies, automate routine tasks, and implement preventive measures to avoid costly disruptions and delays. As companies seek to streamline operations and maximize productivity, the demand for proactive services that deliver tangible cost savings and efficiency gains continues to grow.

The global shift towards remote work and digital transformation initiatives in the wake of the COVID-19 pandemic has accelerated the adoption of proactive services. With distributed workforces and increasingly complex IT environments, organizations require proactive monitoring and management solutions to ensure the reliability and performance of their systems and applications. Proactive services enable businesses to adapt to evolving work models, safeguard against cybersecurity threats, and maintain business continuity in the face of disruptions. In conclusion, the global proactive services market is driven by a combination of factors, including the increasing demand for predictive analytics, advancements in AI and ML technologies, the proliferation of IoT devices, customer-centric strategies, regulatory compliance requirements, cost reduction goals, and the shift towards remote work and digital transformation. As organizations continue to prioritize proactive risk management, operational efficiency, and customer satisfaction, the demand for proactive services is expected to remain strong, driving further innovation and investment in this dynamic market.

Key Market Challenges

The global proactive services market, while experiencing significant growth and demand, is not without its challenges. These challenges encompass various aspects of technology, operations, and market dynamics, which necessitate careful consideration and strategic approaches to overcome. Here, delve into some of the key challenges facing the proactive services market: One prominent challenge is the complexity and diversity of IT environments. With the proliferation of hybrid cloud infrastructures, distributed networks, and diverse applications, organizations face the daunting task of managing and monitoring a myriad of interconnected systems and services. This complexity introduces challenges in terms of data integration, interoperability, and scalability for proactive service providers. Addressing these challenges requires robust solutions capable of aggregating and analyzing heterogeneous data sources while providing unified visibility and actionable insights across the entire IT landscape.

Another significant challenge is the evolving threat landscape and cybersecurity risks. As cyber threats become increasingly sophisticated and pervasive, organizations must adopt proactive cybersecurity measures to safeguard against potential breaches and data compromises. However, staying ahead of cyber threats requires continuous monitoring, threat intelligence, and adaptive security measures. Proactive service providers need to invest in advanced cybersecurity capabilities, such as threat detection, incident response, and vulnerability management, to effectively mitigate cyber risks and protect their clients' assets and data. Additionally, the shortage of skilled professionals presents a formidable challenge for the proactive services market. The rapid pace of technological innovation and the growing complexity of IT environments have created a high demand for skilled personnel with expertise in data analytics, AI, cybersecurity, and other specialized domains. However, there is a shortage of qualified professionals with the requisite skills and experience to meet this demand. As a result, proactive service providers face challenges in recruiting, training, and retaining top talent, which can impede their ability to deliver high-quality services and support to their clients.

Furthermore, regulatory compliance requirements pose significant challenges for proactive service providers, particularly in highly regulated industries such as healthcare, finance, and government. Compliance with regulations such as GDPR, HIPAA, PCI DSS, and others necessitates stringent data protection measures, privacy controls, and audit trails. Proactive service providers must ensure that their solutions adhere to regulatory standards and provide the necessary compliance reporting capabilities to support their clients' compliance efforts. Achieving and maintaining compliance can be resource-intensive and complex, requiring ongoing investments in technology, processes, and expertise.

Moreover, the increasing emphasis on data privacy and consumer rights introduces additional challenges for proactive service providers. Heightened consumer awareness and regulatory scrutiny surrounding data privacy issues require organizations to adopt proactive measures to protect personal data and ensure compliance with data protection regulations. Proactive service providers must implement robust data privacy controls, encryption mechanisms, and access management policies to safeguard sensitive information and mitigate the risk of data breaches or privacy violations. In conclusion, while the global proactive services market presents significant opportunities for innovation and growth, it also faces several challenges that must be addressed to realize its full potential. From navigating the complexity of IT environments and cybersecurity risks to overcoming talent shortages and ensuring regulatory compliance, proactive service providers must confront these challenges head-on to deliver value-added services and solutions to their clients. By embracing technology, investing in talent development, and fostering collaboration with clients and industry partners, proactive service providers can navigate these challenges and emerge as trusted partners in driving business success and resilience in an increasingly dynamic and interconnected world.

Key Market Trends

Several key trends are shaping the global proactive services market and driving innovation in the industry. One such trend is the convergence of proactive services with artificial intelligence (AI) and machine learning (ML) technologies. AI and ML algorithms can analyze vast amounts of data in real-time, uncovering patterns, anomalies, and insights that human operators may overlook. By integrating AI and ML capabilities into proactive service solutions, providers can enhance their predictive analytics, automate routine tasks, and enable proactive interventions to prevent issues before they occur. This trend is fueling the development of AI-driven proactive service platforms that offer advanced capabilities for monitoring, analysis, and decision-making across diverse IT environments. Another trend is the increasing focus on proactive customer engagement and personalized experiences. In today's digital era, customers expect proactive and personalized interactions with businesses, tailored to their preferences, needs, and behaviors. Proactive service providers are leveraging data analytics, AI-driven chatbots, and predictive modeling techniques to anticipate customer needs, deliver proactive support, and enhance overall customer satisfaction. By proactively engaging with customers through targeted communications, recommendations, and offers, businesses can foster stronger relationships, drive loyalty, and differentiate themselves in a competitive market.

Furthermore, the adoption of proactive services is expanding beyond traditional IT operations to encompass a wide range of industries and use cases. In sectors such as healthcare, manufacturing, and transportation, proactive services are being leveraged to optimize asset performance, improve operational efficiency, and enhance safety and reliability. For example, in healthcare, proactive monitoring and predictive analytics can help healthcare providers identify patients at risk of developing chronic conditions, enabling early intervention and preventive care. Similarly, in manufacturing, proactive maintenance and asset management solutions can minimize downtime, reduce costs, and optimize production processes. As proactive services continue to evolve and mature, their applicability and impact will extend to new domains and applications, driving further growth and innovation in the market. In conclusion, the global proactive services market faces significant challenges, including the complexity of IT environments, cybersecurity threats, talent shortages, and regulatory compliance requirements. However, these challenges also present opportunities for proactive service providers to innovate and differentiate themselves by leveraging emerging technologies, cultivating talent, and collaborating closely with clients to address their evolving needs. By staying abreast of key trends such as AI-driven analytics, proactive customer engagement, and industry-specific applications, proactive service providers can position themselves for success and drive value for their clients in an increasingly dynamic and competitive market landscape.

Segmental Insights

Services Insights

The Managed Services segment is dominating the global proactive services market by service. Managed services allow the outsourcing of IT tasks for better work efficiency. Advantages offered by the implementation of managed services are low operational cost, enhanced functional effectiveness, and reduced workload on the in-house IT team. The need for ideal resource allocation, remote monitoring, and management of hardware, security services, and communication support will further boost this segment's growth. In addition, cloud computing and big data analytics are also expected to drive the growth. A few of the benefits offered by managed services include minimized downtime, scalability, data compliance, and faster response time.

Regional Insights

North America is the dominating region in the global proactive services market. This is due to a number of factors, including: Proactive services demand active and flexible IT support, which can be found in most service vendors present in this region. In addition, stabilized economy and heavy investments by government bodies into various technologies, such as AI, advanced data analytics, and ML make North America one of the most advanced software and information technology service industries Moreover, North America has a large retail industry that focuses on delivering proactive services, which is one of the key factors supporting the regional market growth.

Key Market Players

- IBM Corporation

- Hewlett Packard Enterprise

- Cisco Systems, Inc.

- Dell Technologies

- DXC Technology

- Oracle Corporation

- SAP SE

- DXC Technology

- Splunk Inc.

- ServiceNow, Inc.

Report Scope:

In this report, the Global Proactive Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Global Proactive Services Market, By Service:

- Design & Consulting

- Managed Services

- Technical Support

Global Proactive Services Market, By Technology:

- Cloud Management

- Customer Experience Management

- Data Center Management

- End-point Management

- Network Management

- Others

Global Proactive Services Market, By Application:

- BFSI

- Government

- Healthcare

- Manufacturing

- Media & Communications

- Retail

- Others

Global Proactive Services Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Proactive Services Market.

Available Customizations:

Global Proactive Services Market report with the given market data, Tech Sci Research offers customizations according to a company's specific needs.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- IBM Corporation:

- Hewlett Packard Enterprise

- Cisco Systems, Inc.

- Dell Technologies

- DXC Technology

- Oracle Corporation

- SAP SE

- DXC Technology

- Splunk Inc.

- ServiceNow, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 4.45 Billion |

| Forecasted Market Value ( USD | $ 12.26 Billion |

| Compound Annual Growth Rate | 18.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |