Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

As commercial vehicles become more technologically advanced, drivers and fleet operators seek infotainment solutions that offer seamless integration with smartphones, navigation systems, and voice-assisted technologies. The rise in demand for real-time connectivity, such as internet access and entertainment options, has spurred innovations in infotainment systems, which are now more versatile and user-friendly. These systems also help improve operational efficiency by offering navigation aids, fleet management tools, and driver assistance features, which have become increasingly crucial in the commercial vehicle industry.

Key trends shaping the market include the integration of artificial intelligence (AI) and machine learning (ML) in infotainment systems. AI-powered solutions, such as voice recognition and predictive analytics, have enhanced user experience and vehicle safety. Voice-controlled navigation and hands-free operations are becoming common, allowing drivers to focus on the road while still accessing critical information. These developments are driven by consumer demand for safer, more efficient systems, and the automotive industry's commitment to integrating next-generation technologies. The growing adoption of electric and autonomous commercial vehicles is also pushing the demand for more advanced infotainment solutions, as these vehicles require sophisticated technology for communication, monitoring, and operation.

The growing demand and technological advancements, the market faces several challenges. One major obstacle is the high cost of integrating advanced infotainment systems into commercial vehicles, particularly for small and medium-sized fleet operators. The complexity of these systems, combined with the need for continuous software updates and maintenance, poses further difficulties for manufacturers and fleet operators. Additionally, data privacy concerns and regulatory requirements around connectivity features have introduced hurdles for automakers looking to meet compliance standards. These challenges require ongoing innovation, collaboration, and investment to ensure the development of cost-effective, secure, and reliable infotainment solutions for the commercial vehicle market.

Market Drivers

Rising Demand for Advanced Connectivity Features

The increasing demand for advanced connectivity in commercial vehicles is a major driver for the automotive infotainment systems market. Fleet operators and drivers are seeking systems that enable seamless connectivity to smartphones, GPS navigation, and real-time traffic data. The growing integration of 4G and 5G technologies facilitates faster data transfer, enabling features such as live streaming, real-time updates, and cloud-based applications. These systems enhance the driving experience by improving communication, navigation, and overall vehicle management. As fleet operators increasingly prioritize efficiency and driver convenience, advanced connectivity features are crucial for meeting these needs.Integration of Artificial Intelligence and Voice Recognition

Artificial intelligence (AI) and voice recognition technologies are revolutionizing commercial vehicle infotainment systems. AI-powered systems are capable of learning driver preferences and optimizing the infotainment experience, offering tailored navigation routes, media suggestions, and alerts. Voice recognition allows drivers to interact with the system hands-free, improving safety by reducing distractions while driving. AI-enabled driver assistance features, such as predictive analytics, are becoming integrated into infotainment systems to enhance vehicle performance and safety.As these technologies continue to evolve, they significantly contribute to the adoption and development of advanced infotainment solutions in commercial vehicles. For instance, in March 2024, ZF Aftermarket is introducing sensors for commercial vehicle applications to the independent aftermarket under its WABCO brand. These sensors include a front camera for the OnLaneALERT lane departure warning system and a radar sensor for the OnGuardACTIVE automatic emergency braking system. ZF Aftermarket supplies these components with original equipment (OE) specifications and quality for a variety of DAF and Iveco commercial vehicle models.

Shift Toward Electric and Autonomous Commercial Vehicles

The shift toward electric and autonomous vehicles is contributing to the growth of the automotive infotainment systems market. Electric vehicles (EVs) require advanced infotainment systems for monitoring vehicle performance, energy consumption, and real-time diagnostics. Autonomous vehicles, on the other hand, require sophisticated infotainment solutions to keep drivers and passengers engaged, as traditional driving tasks are automated. These vehicles demand infotainment systems that provide entertainment, communication, and safety features in a highly integrated manner. As the adoption of EVs and autonomous technology increases, the demand for advanced infotainment systems in commercial vehicles is set to rise significantly.Key Market Challenges

High Integration and Development Cost

One of the key challenges in the commercial vehicle automotive infotainment systems market is the high cost of integrating advanced technologies. The development and implementation of infotainment systems that incorporate cutting-edge features like AI, voice recognition, and 5G connectivity require significant investment in research, development, and hardware. These costs can be prohibitive for smaller fleet operators and manufacturers, limiting the widespread adoption of advanced systems. As a result, there is pressure on manufacturers to balance high-quality, feature-rich systems with cost-effective solutions to meet the diverse needs of the commercial vehicle market.Data Privacy and Cybersecurity Concerns

The growing connectivity of commercial vehicle infotainment systems raises concerns about data privacy and cybersecurity. Infotainment systems collect vast amounts of data, such as driver behavior, location, and vehicle performance, which can be vulnerable to hacking and unauthorized access. Ensuring the protection of sensitive information and preventing potential cyberattacks are critical challenges for manufacturers. Stricter data privacy regulations and compliance requirements further complicate the development and deployment of these systems. To address these issues, companies must invest in robust cybersecurity measures and ensure compliance with global data protection laws, which adds complexity and cost to the market.Complexity of Software Maintenance and Updates

Maintaining and updating the software of commercial vehicle infotainment systems poses another significant challenge. These systems often require regular software updates to improve functionality, add new features, and enhance security. However, the complexity of these updates, particularly in large fleets, can be time-consuming and costly. Inconsistent software versions across fleets can create operational challenges, and improper updates may lead to system malfunctions or decreased performance. Ensuring a smooth and efficient update process while minimizing downtime for fleet operators is essential for the continued success and adoption of these infotainment systems in commercial vehicles.Key Market Trends

Increased Integration of AI and Machine Learning

AI and machine learning technologies are increasingly being integrated into commercial vehicle infotainment systems to enhance user experience and optimize performance. AI-powered systems can learn driver preferences, suggest personalized media content, and improve navigation by analyzing real-time traffic data. Additionally, AI enhances safety features such as predictive maintenance and driver assistance systems. These technologies allow for more intuitive, hands-free interactions through voice recognition, reducing distractions and enhancing safety. As these AI-driven features continue to evolve, they are becoming a standard part of infotainment solutions for commercial vehicles, driving further market growth.Growing Demand for Seamless Connectivity

The demand for seamless connectivity in commercial vehicles is rapidly increasing. Drivers and fleet operators expect infotainment systems to offer seamless integration with smartphones, tablets, and other devices to enhance productivity and entertainment options. The rise of 4G and 5G connectivity enables real-time data sharing, live streaming, and cloud-based applications, transforming how drivers and operators engage with vehicle systems. These connectivity advancements help improve route optimization, real-time monitoring of vehicle performance, and communication between drivers and fleet managers. The growing focus on in-car connectivity is a key trend shaping the evolution of the commercial vehicle infotainment market.Adoption of Electric and Autonomous Vehicles

The growing adoption of electric and autonomous commercial vehicles is influencing the demand for advanced infotainment systems. Electric vehicles (EVs) require sophisticated infotainment systems for energy management, performance monitoring, and real-time diagnostics. Autonomous vehicles create new opportunities for infotainment by shifting the focus from driving tasks to in-car entertainment, communication, and productivity. As the development of autonomous and electric commercial vehicles accelerates, infotainment systems are evolving to provide more interactive and immersive experiences, including augmented reality and advanced user interfaces. This trend is expected to continue as the market for EVs and autonomous vehicles expands.Segmental Insights

Installation Type Insights

The global commercial vehicle automotive infotainment systems market is segmented by installation type, with the primary categories being in-dash infotainment and rear-seat infotainment. In-dash infotainment systems are typically integrated into the dashboard of commercial vehicles, providing essential features such as navigation, connectivity, media, and communication services to the driver and front-seat passengers. These systems offer seamless integration with smartphones, GPS navigation, and real-time data, making them a crucial tool for improving the efficiency and safety of commercial vehicle operations. In-dash infotainment systems are increasingly being designed to support advanced technologies like voice recognition, AI-powered assistance, and cloud-based applications, enhancing the driving experience.Rear-seat infotainment systems are designed to provide entertainment, communication, and connectivity options to passengers in the rear seats of commercial vehicles, such as buses, trucks, and other transport vehicles. These systems are becoming a popular feature in commercial vehicles that cater to passenger transport, such as long-haul buses or premium transport services. Rear-seat infotainment systems typically include video displays, internet access, and multimedia content, enhancing passenger comfort during long journeys. They can also be equipped with connectivity features, allowing passengers to stream content or use internet-based applications, improving the overall travel experience.

Both installation types are crucial to the evolving needs of commercial vehicle owners and operators. In-dash infotainment systems are increasingly important in improving driver safety, efficiency, and operational control, while rear-seat infotainment systems are designed to cater to the growing demand for enhanced passenger experiences in commercial transport vehicles. The development of these systems is driven by technological advancements, the increasing demand for connectivity, and the need for improved customer satisfaction in the commercial vehicle sector. The segmentation highlights how different vehicle types and use cases require tailored infotainment solutions to meet the diverse needs of both drivers and passengers.

Region Insights

The Asia-Pacific region emerged as a dominant force in the global commercial vehicle automotive infotainment systems market in 2023, driven by rapid advancements in technology and increasing demand for connectivity in commercial vehicles. The region is home to several key automotive manufacturing hubs, and its growing economy has led to an increased demand for commercial vehicles equipped with advanced infotainment solutions. The rising need for real-time communication, navigation, and entertainment systems is particularly evident in countries such as China, India, and Japan, where commercial vehicle fleets are expanding rapidly to support the booming logistics and transportation sectors.The adoption of advanced infotainment systems in commercial vehicles is further fueled by the region’s growing focus on technological innovation. The integration of AI, machine learning, and 5G connectivity into infotainment systems is gaining traction across commercial vehicle segments. These technologies enhance driver safety, improve vehicle management, and increase operational efficiency, which are essential factors for fleet operators in Asia-Pacific. Furthermore, the increasing preference for electric and autonomous vehicles in countries like China and Japan has led to a surge in demand for sophisticated infotainment systems designed to meet the specific needs of these vehicles, such as energy management and autonomous driving features.

Consumer and passenger demand for enhanced in-vehicle experiences is also contributing to the growth of the infotainment market in Asia-Pacific. As the region’s middle class expands, there is a rising demand for more luxurious and comfortable passenger transport, particularly in buses, coaches, and premium commercial vehicles. This shift in consumer preferences has led to greater emphasis on rear-seat infotainment systems in commercial vehicles, where passengers expect access to entertainment, connectivity, and productivity tools during long-distance journeys. The region’s fast-growing infrastructure and technological investments in transportation make it a key market for the development and deployment of next-generation infotainment solutions for commercial vehicles.

Key Market Players

- Harman International Industries, Inc.

- Visteon Corporation

- Aptiv Global Operations Limited

- ALPINE ELECTRONICS, Inc.

- Pioneer Corporation

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Continental AG

- Garmin Ltd.

- LG Electronics

Report Scope:

In this report, the Global Commercial Vehicle Automotive Infotainment Systems Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Commercial Vehicle Automotive Infotainment Systems Market, By Installation Type:

- In-dash Infotainment

- Rear Seat Infotainment

Commercial Vehicle Automotive Infotainment Systems Market, By Operating System Type:

- QNX

- LINUX

- Microsoft

- Others

Commercial Vehicle Automotive Infotainment Systems Market, By Sales Channel Type:

- OEM

- Aftermarket

Commercial Vehicle Automotive Infotainment Systems Market, By Region:

- North America

- United State

- Canada

- Mexico

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Australia

- Thailand

- Europe & CIS

- France

- Germany

- Spain

- Italy

- United Kingdom

- South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Commercial Vehicle Automotive Infotainment Systems Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Harman International Industries, Inc.

- Visteon Corporation

- Aptiv Global Operations Limited

- ALPINE ELECTRONICS, Inc.

- Pioneer Corporation

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Continental AG

- Garmin Ltd.

- LG Electronics

Table Information

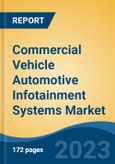

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | December 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 10.74 Billion |

| Forecasted Market Value ( USD | $ 17.08 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |