Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Global Population and Food Demand

The global population is projected to surpass 8.1 billion by 2024, intensifying pressure on agriculture to produce higher crop yields. With food demand forecasted to grow by 35% over the next decade, farmers face increasing vulnerability to yield losses from fungal diseases. Fungicides play a vital role in safeguarding crops from pathogens like rusts, blights, and mildews, helping maintain both quantity and quality of harvests. Without effective fungal control, achieving food security for a burgeoning population would become significantly more challenging.Fungal infections not only reduce yields but also impair crop nutritional value and marketability. In regions with fragile infrastructure or declining arable land, outbreaks can devastate harvests. Fungicide application ensures that staple crops such as wheat, rice, and maize remain viable under stress from adverse weather or pathogen pressure. By mitigating disease risk, fungicides enable farmers to maximize productivity on existing farmland, supporting sustained food production without needing extensive land expansion.

Export-oriented agriculture relies heavily on quality control, and fungicides also serve to protect harvested produce during storage and transit. Post-harvest losses due to mold and rot can reach significant levels, especially in tropical or humid climates. Fungicidal treatments help preserve shelf life, reduce spoilage, and uphold food safety standards, ensuring that produce can reach distant markets in acceptable condition. This is especially critical for staple exports and high-value fresh produce moving through global supply chains.

As food systems globalize, reliance on fungicides becomes increasingly strategic. Farmers worldwide particularly in high-risk regions are adopting integrated disease management programs where targeted fungicide use is combined with resistant varieties and precision application. This approach not only enhances yield resilience but also helps curb disease resistance development. In doing so, farmers can consistently meet escalating food demand while safeguarding both the volume and quality of global harvests.

Key Market Challenges

Resistance Development in Fungal Pathogens

Resistance development in fungal pathogens is a significant challenge that is hindering the global fungicides market. Fungicides play a critical role in protecting crops from devastating fungal diseases, but the emergence of resistance in these pathogens threatens the effectiveness of these essential agricultural tools.Fungal pathogens have demonstrated an astonishing ability to adapt and evolve in response to the repeated exposure to fungicides. This adaptation often results in the development of resistance mechanisms that render the fungicides ineffective. Fungal resistance can occur due to various factors, including genetic mutations and the selection of resistant strains through natural processes.

The consequences of fungal resistance are far-reaching. Farmers rely on fungicides to safeguard their crops and maintain agricultural productivity. When resistance develops, the efficacy of these fungicides diminishes, leading to reduced disease control and increased crop losses. This not only affects farmers' incomes but also has broader implications for food security, as diminished crop yields can lead to food shortages and rising prices.

The management of resistance is a complex and ongoing challenge for the fungicides market. To combat resistance, farmers often resort to using higher dosages of fungicides or switching to different classes of fungicides with distinct modes of action. While these strategies can provide temporary relief, they are not sustainable in the long run. Increased fungicide dosages can have detrimental effects on the environment and can further contribute to resistance development.

Key Market Trends

Growing Awareness of Fungal Threats

The global fungicides market is experiencing a notable surge in demand, and one of the key drivers behind this growth is the growing awareness of fungal threats among farmers and agricultural stakeholders. Fungal diseases pose a significant risk to crop health, agricultural productivity, and global food security. As awareness of these threats continues to increase, farmers are becoming more proactive in adopting preventive and protective measures, with fungicides playing a pivotal role.Farmers are increasingly recognizing the devastating impact fungal diseases can have on their crops. These diseases can lead to substantial yield losses, reduced crop quality, and economic setbacks. With a growing global population and the need to produce more food, the consequences of fungal diseases have become more pressing than ever. Farmers are turning to fungicides as a vital tool in their arsenal to safeguard their crops from these insidious threats.

Moreover, the awareness of fungal threats has been heightened by educational initiatives, information dissemination, and access to knowledge through digital platforms. Agricultural extension services, online resources, and collaboration among researchers and farmers are contributing to a deeper understanding of the risks posed by fungal pathogens. As farmers gain access to information about disease cycles, symptoms, and the importance of early intervention, they are increasingly inclined to incorporate fungicides into their crop management strategies.

The awareness of fungal threats is not limited to experienced farmers but extends to new and emerging farmers, particularly in regions where agriculture is expanding. As these farmers become aware of the challenges posed by fungal diseases, they are more likely to adopt fungicides as a preventive measure, thereby boosting the fungicides market.

Key Market Players

- Nufarm Ltd.

- FMC Corporation

- Cheminova A/S

- Bayer CropScience

- Syngenta AG

- Dow AgroSciences

- Lanxess AG

- Monsanto

- Adama Agricultural Solutions

- Simonis B.V

Report Scope:

In this report, the Global Fungicides Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Fungicides Market, By Product:

- Inorganics

- Benzimidazoles

- Dithiocarbamates

- Triazoles & Diazoles

- Biofungicides

- Others

Fungicides Market, By Application:

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Fungicides Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fungicides Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Fungicides market report include:- Nufarm Ltd.

- FMC Corporation

- Cheminova A/S

- Bayer CropScience

- Syngenta AG

- Dow AgroSciences

- Lanxess AG

- Monsanto

- Adama Agricultural Solutions

- Simonis B.V

Table Information

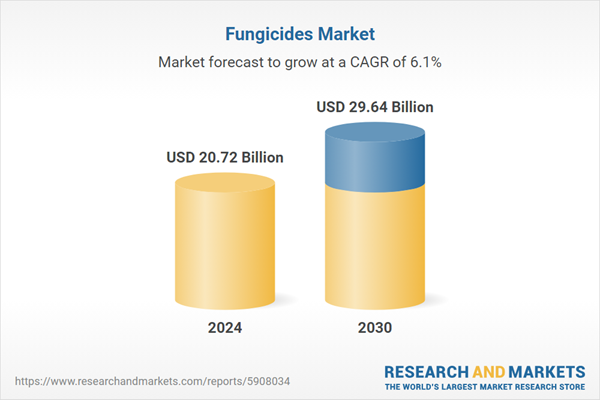

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 20.72 Billion |

| Forecasted Market Value ( USD | $ 29.64 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |