Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Regulations in Austria require the use of winter tires during specific months, further driving demand in this segment. This not only ensures safer driving conditions but also contributes to reducing accidents and promoting road safety. Additionally, the increasing adoption of electric and hybrid vehicles in Austria presents new growth opportunities in the tire sector.

As these eco-friendly vehicles become more prevalent on the roads, there is a growing need for specialized tires that meet the unique requirements of these vehicles, such as low rolling resistance and extended tread life. According to the European Alternative Fuels Observatory (EAFO, 2025), Austria had a total of 200,603 registered battery-electric vehicles (BEVs) by the end of 2024, rising from 155,490 in 2023. This expanding electric vehicle base is increasing demand for EV-specific tires that are optimized for higher torque, heavier loads, and low rolling resistance.

EAFO (2025) also reports that BEVs made up 17.6% of all new passenger car registrations in 2024. Despite this, BEVs represent only 4% of the total vehicle fleet, indicating that Austria's tire market is still largely driven by traditional fuel-powered vehicles, which make up more than 75% of the fleet.

Despite the challenging economic climate brought about by the COVID-19 pandemic, the Austrian tire market has shown remarkable resilience. This resilience can be attributed to the essential role that tires play in ensuring vehicle safety and performance. As drivers prioritize safety, the demand for high-quality tires remains strong, driving the market forward. Furthermore, the tire industry in Austria has been quick to adapt to changing market conditions by introducing innovative technologies and materials that enhance tire performance, durability, and fuel efficiency.

Overall, the Austrian tire market stands as a dynamic and resilient sector, adapting to changing market conditions while meeting the needs of a diverse range of vehicles and driving environments. With ongoing advancements in tire technology and a focus on sustainability, the future looks promising for the Austrian tire industry.

Market Drivers

Automobile Sales and Ownership

A fundamental driver of the Austria tire market is the country's automobile sales and ownership rates. According to Statistik Austria, Austria recorded over 5 million registered passenger vehicles in 2024, reflecting consistent growth in the national vehicle parc, which directly influences replacement tire demand. Austria has a relatively high rate of car ownership, with a significant portion of its population relying on personal vehicles for daily transportation. Austria had 289,000 new passenger car registrations in 2024. A substantial portion of these vehicles will enter the tire replacement cycle within 3-4 years, directly contributing to steady aftermarket tire demand across vehicle segments.This trend is driven by factors such as a well-developed road infrastructure, a strong economy, and a high standard of living. As the number of automobiles on Austrian roads continues to grow, the demand for tires also increases, creating a consistent and substantial market for tire manufacturers and retailers. New car sales and replacement tire purchases are closely tied to this driver, with both contributing to market growth.

Key Market Challenges

Seasonal Fluctuations and Demand Variability

One of the prominent challenges in the Austria tire market is the pronounced seasonality of tire demand. Austria experiences distinct seasons, with harsh winters necessitating winter tires and milder seasons allowing for all-season or summer tires. This leads to fluctuations in demand, with a surge in winter tire purchases during the cold months and a decline during the summer. Manufacturers and retailers must manage inventory effectively to meet these seasonal shifts, which can be challenging. Overstocking winter tires during summer can result in financial losses, while inadequate stock during winter can lead to missed sales opportunities and dissatisfied customers. Balancing this seasonal demand variability requires careful planning and logistics, making it a consistent challenge for industry players.Key Market Trends

Rising Demand for All-Season Tires

One notable trend in the Austria tire market is the increasing popularity of all-season tires. These tires offer a versatile solution for motorists facing Austria's diverse climate, which includes cold winters with snow and ice, as well as milder seasons with rain and occasional heatwaves. All-season tires provide good performance in a range of conditions, eliminating the need for frequent tire changes between winter and summer sets. This trend is driven by convenience and cost-effectiveness, as consumers seek tires that offer year-round reliability. Tire manufacturers have responded by developing advanced all-season tire models with improved performance, further fueling the demand for this category.Key Market Players

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Hankook Tire & Technology Co., Ltd.

- Kumho Tire Co. Inc.

- Michelin Group

- Nokian Tyres plc

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries Ltd

- Yokohama Rubber Company Limited

Report Scope:

In this report, the Austria Tire Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Austria Tire Market, By Vehicle Type:

- Passenger Car

- LCV

- M&HCV

- OTR

- Two-Wheeler

- Three-Wheeler

Austria Tire Market, By Demand Category:

- OEM

- Aftermarket

Austria Tire Market, By Tire Construction Type:

- Radial

- Bias

Austria Tire Market, By Region:

- Upper Austria

- Lower Austria

- Vienna

- Burgenland

- Rest of Austria

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Austria Tire Market.Available Customizations:

Austria Tire Market report with the given market data, TechSci Research, offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Hankook Tire & Technology Co., Ltd.

- Kumho Tire Co. Inc.

- Michelin Group

- Nokian Tyres plc

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries Ltd

- Yokohama Rubber Company Limited

Table Information

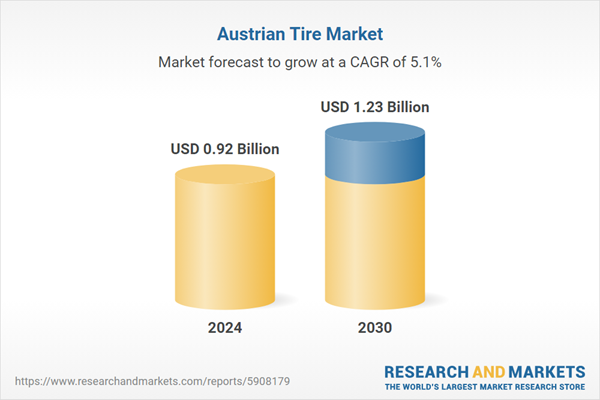

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.92 Billion |

| Forecasted Market Value ( USD | $ 1.23 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Austria |

| No. of Companies Mentioned | 10 |