Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the key factors propelling the market's growth is the increasing need to minimize VOC emissions, as these compounds pose significant harm to both the environment and human health. Spray adhesives have gained popularity due to their comparatively lower VOC content when compared to traditional adhesives, thus contributing to the expansion of the market.

Furthermore, the growth of the spray adhesive market is influenced not only by environmental considerations but also by the inherent benefits offered by these adhesives. Spray adhesives provide uniform coverage, quick-drying capabilities, and exceptional bonding strength, making them an ideal choice for a wide range of applications in industries such as packaging, construction, and automotive.

In conclusion, the spray adhesive market in India is poised for substantial growth, driven by the increasing demand for adhesives with lower VOCs and the inherent advantages offered by spray adhesives. As environmental regulations continue to tighten and the need for efficient bonding solutions rises, the market's upward trajectory is expected to persist. With this positive outlook, stakeholders in the spray adhesive industry can anticipate significant opportunities for expansion and innovation.

Key Market Drivers

Growing Demand of Spray Adhesive in Construction Industry

India's construction sector is experiencing a remarkable boom, currently serving as the country's second-largest economic segment. As infrastructure projects, residential buildings, and commercial structures continue to take shape across the nation, the demand for reliable and efficient bonding solutions such as spray adhesives is skyrocketing. These adhesives offer a multitude of advantages that make them an ideal choice for construction applications.One of the key benefits of spray adhesives is their ability to provide uniform coverage, resulting in a strong bond across a large surface area. This ensures the durability and stability of the constructed structures. Additionally, the quick-drying nature of spray adhesives accelerates the construction process, saving valuable time and allowing for faster project completion.

The widespread adoption of spray adhesives in the construction industry is driven by their exceptional characteristics. However, the industry's growing concern over environmental impact has prompted a shift towards greener alternatives. Spray adhesives, with their lower Volatile Organic Compounds (VOCs) content, emerge as an eco-friendly choice. This environmental benefit further enhances their appeal in the construction sector, promoting sustainable practices and contributing to the market's growth.

In conclusion, the construction industry in India is witnessing an unprecedented surge, and spray adhesives are playing a vital role in meeting the demand for efficient and environmentally friendly bonding solutions. As the construction sector continues to expand and the focus on sustainability intensifies, the demand for spray adhesives is expected to escalate, propelling the market to new heights. The future of the spray adhesive market in India holds immense potential and promises exciting opportunities for growth and innovation.

Growing Demand of Spray Adhesive in Automotive Industry

The spray adhesive market in India is experiencing significant growth, propelled by the burgeoning demand from various industries. One notable contributor to this upward trend is the automotive industry, which is witnessing consistent growth and expanding year after year. The remarkable expansion of the automotive sector has led to an upsurge in the demand for efficient, durable, and fast-acting bonding solutions, thus driving the growth of the spray adhesive market even further.Spray adhesives offer several benefits that make them an ideal choice in automotive manufacturing. Their ability to provide uniform coverage ensures a robust bond across large surface areas, enhancing the overall strength and durability of the assembled components. Moreover, the quick-drying nature of spray adhesives accelerates the assembly process, resulting in improved productivity and cost-efficiency. Additionally, their versatility in bonding diverse materials - from metal and plastic to foam and fabric - makes them indispensable in the intricate production processes of vehicles.

In line with increasing environmental concerns, the automotive industry in India is also shifting towards greener manufacturing practices. Spray adhesives, known for their lower Volatile Organic Compounds (VOCs) content, emerge as an eco-friendly alternative to traditional bonding methods. This environmentally friendly attribute further bolsters their appeal in the automotive sector, contributing to the overall market growth of spray adhesives.

In conclusion, the robust growth of the automotive industry in India, coupled with the inherent advantages and environmental benefits of spray adhesives, is fueling the expansion of the spray adhesive market. As the automotive sector continues to thrive and the focus on sustainability intensifies, the demand for spray adhesives is set to rise steadily, catapulting the market to new heights, and opening new opportunities for manufacturers and suppliers alike.

Key Market Challenges

Volatility in Prices of Raw Materials

Fluctuating raw material prices can significantly affect the cost of production for spray adhesives. Key raw materials such as resins, solvents, and aerosol propellants often experience price volatility due to various factors like supply chain disruptions, geopolitical tensions, and changes in commodity markets. These cost variations, which can be sudden and unpredictable, not only impact the profitability of spray adhesive manufacturers but also have broader implications for the industry as a whole.The price volatility in raw materials can lead to inconsistent pricing for spray adhesives, making it challenging for manufacturers to establish stable pricing structures and deter potential customers. This can hinder market growth and pose a significant challenge for companies striving to maintain a competitive edge in the market.

Moreover, the impact of price volatility extends beyond pricing concerns. Smaller manufacturers, in particular, may face difficulties in absorbing the rising costs of raw materials, which can erode their profit margins and make it harder for them to compete with larger, more financially resilient companies. This scenario can further lead to market consolidation, reducing competition, potentially limiting innovation, and limiting customer choice.

In light of these challenges, spray adhesive manufacturers need to carefully manage the impact of price volatility and explore strategies to mitigate risks associated with fluctuating raw material costs. This may include diversifying the supply chain, exploring alternative raw materials, or engaging in forward buying or hedging practices to minimize the effects of price fluctuations. By doing so, companies can navigate the complexities of cost variations, maintain competitiveness, and ensure sustainable market growth.

Key Market Trends

Rising Demand of Environmentally Friendly Formulations

As environmental consciousness continues to gain momentum among consumers and industries alike, the demand for eco-friendly and sustainable solutions is experiencing an upward trajectory. This shift towards sustainability encompasses not only the end products but also the manufacturing processes themselves. Consequently, industries are increasingly prioritizing the use of adhesives that minimize volatile organic compound (VOC) emissions, thus driving the demand for environmentally friendly spray adhesives.The growing demand for environmentally friendly formulations is bringing about significant transformations in the spray adhesive market. This shift has led to a surge in the popularity of water-based and hot melt spray adhesives, which are known for their eco-friendlier nature when compared to solvent-based counterparts. Moreover, this trend has sparked innovation within the industry, with adhesive manufacturers focusing their efforts on developing sustainable solutions.

The rising demand for environmentally friendly spray adhesives is fueled by several benefits they offer. In addition to their lower VOC emissions, these adhesives often exhibit superior performance characteristics, such as higher heat resistance and lower toxicity. Furthermore, their usage aligns with the global movement towards sustainability, enabling companies to meet their environmental goals and regulatory requirements effectively.

In conclusion, the increasing demand for eco-friendly formulations stands as a prominent trend that is shaping the spray adhesive market in India. With this demand poised to grow further, driven by the growing environmental consciousness and the inherent advantages of these adhesives, the market is set to reach new heights. It will be intriguing to observe how adhesive manufacturers respond to this trend, as those who adapt and embrace sustainability are likely to secure a competitive edge in this ever-evolving market landscape.

Segmental Insights

Chemistry Insights

Based on the category of chemistry, the epoxy segment emerged as the dominant player in the Indian market for Spray Adhesive in 2023. Epoxy-based adhesives are highly favored for their exceptional qualities, including low shrinkage, remarkable resistance to chemicals and moisture, as well as impressive fatigue and mechanical strength. These adhesives find extensive usage in laminating plywood fiberglass, effectively providing the structure with enhanced toughness and strength. When it comes to coating wooden surfaces, this product emerges as an outstanding choice, ensuring durability and protection.End User Insights

The transportation segment is projected to experience rapid growth during the forecast period. The transport sector encompasses various industries such as automotive, aerospace, and marine, each playing a vital role in modern society. Adhesives have revolutionized these industries by enabling manufacturers to reduce vehicle weight, leading to improved fuel efficiency and performance. In particular, the use of spray adhesives has proven to be advantageous, as they not only minimize adhesive material costs and wastage but also provide a smooth coating that efficiently covers the entire target area in a short amount of time. These versatile spray adhesives find application in binding a wide range of materials, including leather, cotton, silk, fiberglass, plastic, and rubber, to the metal body of cars, aircraft, and ships. They are especially useful for attaching interior trim in automobiles and aircraft. Looking ahead, the market for spray adhesives is poised for significant growth, driven by the increasing demand for vehicles. Factors such as the rising popularity of electric cars and the growing disposable incomes of the middle-class population further contribute to this upward trend in vehicle demand.Regional Insights

West India emerged as the dominant player in the India Spray Adhesive Market in 2023, holding the largest market share in terms of value. West India, encompassing major states like Maharashtra and Gujarat, is renowned for its thriving industrial landscape. With a vibrant mix of manufacturing units spanning automotive, construction, and textile sectors, the region serves as a prominent consumer hub for spray adhesives. The ever-increasing industrial demand in this dynamic area is a key driver behind its dominant position in the spray adhesive market.Apart from its industrial prowess, West India boasts robust infrastructure and seamless connectivity that further facilitate a business-friendly environment. Well-established transportation links ensure smooth movement of raw materials and finished products, while meticulously planned industrial estates provide ample space for manufacturing units to flourish. This favorable infrastructure ecosystem plays a pivotal role in supporting the sustained growth and market domination of spray adhesives in this region.

Report Scope:

In this report, the India Spray Adhesive Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Spray Adhesive Market, By Chemistry:

- Epoxy

- Polyurethane

- Synthetic Rubber

- Vinyl Acetate Ethylene

- Others

India Spray Adhesive Market, By Type:

- Solvent-Based

- Water-Based

- Hot Melt

India Spray Adhesive Market, By End User:

- Transportation

- Construction

- Furniture

- Packaging

- Textile

- Others

India Spray Adhesive Market, By Region:

- North India

- East India

- West India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Spray Adhesive Market.Available Customizations:

India Spray Adhesive Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Henkel Adhesives Technologies India Pvt Ltd

- 3M India Limited

- H.B. Fuller India Adhesives Pvt. Ltd

- Avery Dennison India Pvt. Ltd.

- BASF SE

- Bostik India Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 78 |

| Published | October 2023 |

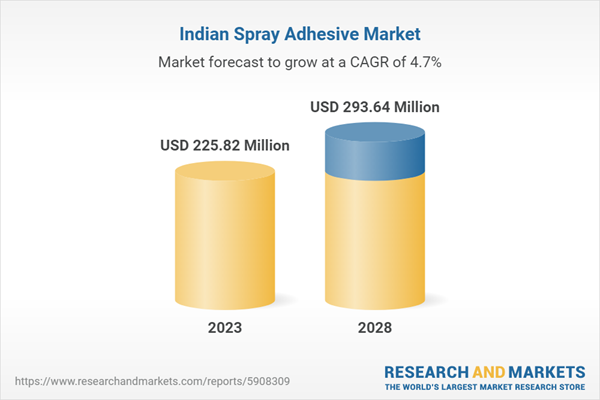

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 225.82 Million |

| Forecasted Market Value ( USD | $ 293.64 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 6 |