Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

According to data from the China Association of Automobile Manufacturers, passenger vehicle sales in China hit 27.56 million units in 2024, highlighting the strong demand for conventional automotive components in major regions. However, the sector faces a significant obstacle due to the global shift toward battery electric vehicles, which do not require exhaust infrastructure. As the transition to electric powertrains accelerates and eliminates the need for traditional engine components, it presents a substantial long-term challenge to the continued expansion of the exhaust system market.

Market Drivers

The continuous growth of global passenger vehicle production acts as a fundamental driver for the market, as every internal combustion engine vehicle requires a corresponding exhaust system. Despite the rapid shift toward electrification, the sheer volume of conventional and hybrid vehicles being manufactured remains high, especially in developing nations where charging networks are still expanding. This sustained manufacturing output guarantees a steady baseline demand for essential components like catalytic converters and mufflers. For instance, the European Automobile Manufacturers' Association (ACEA) reported in March 2025 that global passenger car sales rose by 2.5% to 74.6 million units in 2024, confirming that the absolute market for exhaust parts continues to grow alongside economic recovery and fleet renewal cycles.Simultaneously, the rising adoption of Hybrid Electric Vehicles (HEVs) is generating high-value opportunities for advanced exhaust technologies, as these vehicles retain internal combustion engines that require sophisticated architectures to manage intermittent operation and thermal efficiency. This trend is prominent in major markets where consumers desire fuel efficiency without the range limitations of fully electric vehicles. According to the China Association of Automobile Manufacturers, plug-in hybrid sales in China surged by 17.8% year-on-year to 4.61 million units between January and October 2025. This segment's financial impact is underscored by Forvia's July 2025 report, which revealed that its Clean Mobility division achieved sales of €2.04 billion in the first half of the year, driven by the complexity and higher price points of these systems.

Market Challenges

The global transition toward battery electric vehicles (BEVs) represents a fundamental structural barrier to the growth of the Global Passenger Cars Exhaust System Market. Unlike internal combustion engines, which rely on complex assemblies of manifolds, catalytic converters, and mufflers to manage emissions, electric powertrains operate without any exhaust infrastructure. This technological shift results in a direct loss of volume for component manufacturers, as every electric vehicle sold signifies a unit of lost revenue potential. As automakers increasingly redirect R&D budgets and production capacity toward electrification, the total addressable market for exhaust systems inevitably contracts, limiting the sector's long-term expansion.This displacement effect is clearly measurable in major automotive hubs where the uptake of non-ICE vehicles is accelerating. Data from the China Association of Automobile Manufacturers indicates that in 2024, sales of new energy vehicles comprised 40.9% of total new car sales in China, demonstrating a significant market share for vehicles devoid of exhaust hardware. Consequently, the rising penetration of electric mobility directly reduces the demand for traditional after-treatment technologies, effectively countering the gains derived from general growth in vehicle production.

Market Trends

To adhere to stricter particle number limits under regulations such as Euro 6d and China VI, original equipment manufacturers are standardizing the use of particulate filters on gasoline direct-injection engines, following trends established in diesel powertrains. This regulatory pressure necessitates the integration of advanced filtration hardware to capture fine particulate matter, ensuring compliance with tightening global standards for tailpipe pollutants. As highlighted by Applus IDIADA in May 2024, the European Union's adoption of Regulation (EU) 2024/1257 enforces rigorous limits on particle emissions and mandates continuous onboard monitoring, compelling exhaust manufacturers to embed sophisticated filtration and sensor technologies into their gasoline architectures.Concurrently, as hybrid vehicle sales increase, exhaust systems are being redesigned with specialized thermal management capabilities to handle frequent engine start-stop cycles and lower exhaust gas temperatures. Engineers are focusing on lightweight, insulated designs that effectively retain heat to keep catalytic converters at optimal operating temperatures during electric-only driving phases. The commercial viability of this shift is evident in Forvia's October 2025 press release, which reported an 8.7% year-on-year sales growth for its Clean Mobility division in the third quarter of 2025, underscoring the sustained demand for advanced exhaust solutions compatible with electrified platforms despite broader market challenges.

Key Players Profiled in the Passenger Cars Exhaust System Market

- Faurecia

- Tenneco Inc.

- Continental AG

- Eberspacher

- Futaba Industrial Co., Ltd.

- Bosal

- Magna International

- Sango Co., Ltd.

- Sejong Industrial Co., Ltd.

- Yutaka Giken Co., Ltd.

Report Scope

In this report, the Global Passenger Cars Exhaust System Market has been segmented into the following categories:Passenger Cars Exhaust System Market, by Fuel Type:

- Gasoline

- Diesel

Passenger Cars Exhaust System Market, by After Treatment Type:

- Diesel Oxidation Catalyst

- Selective Catalytic Reduction

- Gasoline Particulate filter

Passenger Cars Exhaust System Market, by Component Type:

- Catalytic Converter

- Tailpipe

- Mufflers

Passenger Cars Exhaust System Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Passenger Cars Exhaust System Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Passenger Cars Exhaust System market report include:- Faurecia

- Tenneco Inc.

- Continental AG

- Eberspacher

- Futaba Industrial Co., Ltd.

- Bosal

- Magna International

- Sango Co., Ltd.

- Sejong Industrial Co., Ltd.

- Yutaka Giken Co., Ltd.

Table Information

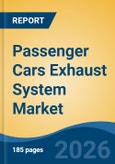

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 26.69 Billion |

| Forecasted Market Value ( USD | $ 37.92 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |