Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the primary drivers of the global lamp market is the increasing emphasis on energy efficiency and sustainability. LED lamps, in particular, have garnered widespread popularity due to their extended lifespan and reduced energy consumption, contributing significantly to the market's expansion. Furthermore, government regulations and incentives that promote energy-efficient lighting solutions have further propelled this trend.

Another pivotal factor shaping the market is the rapid pace of urbanization and infrastructure development occurring worldwide. The expansion of urban areas and the construction of new buildings and infrastructure projects have led to a heightened demand for lamps in both indoor and outdoor applications.

Additionally, technological advancements in smart lighting solutions have brought about a revolution in the lamp market. Smart lamps equipped with features such as remote control, color customization, and integration with home automation systems have gained traction among consumers seeking convenience and energy savings.

In conclusion, the global lamp market continues to thrive, driven by the imperative for energy-efficient and technologically advanced lighting solutions. As sustainability and smart technology trends persist, the market is expected to witness further innovation and growth in the forthcoming years.

Key Market Drivers

Customization and Design Preferences

Customization and design preferences are key drivers in the lamps market. Consumers no longer view lamps solely as functional lighting sources but also as essential elements of interior decor. As a result, they seek lamps that seamlessly blend with their home or office aesthetics.Lamp manufacturers recognize this demand and are actively responding by diversifying their product offerings. They provide a broad spectrum of designs, ranging from minimalist and contemporary to vintage and ornate styles. Moreover, customization options allow consumers to personalize lamps to their exact specifications, selecting materials, colors, and finishes that harmonize with their surroundings.

This trend not only caters to individual tastes but also offers businesses the opportunity to collaborate with designers and architects for bespoke lighting solutions in commercial and hospitality projects. In a market where aesthetics play a significant role, customization and design preferences continue to shape the lamps industry, providing consumers with lighting choices that reflect their unique personalities and design sensibilities.

Increasing emphasis on interior design

The global lamp market has witnessed a significant shift towards an increased emphasis on interior design. Lamps are no longer mere sources of illumination; they have become integral elements of interior decor and ambiance. This evolution is driven by consumers' growing awareness of the impact of lighting on the overall aesthetics and atmosphere of their spaces.Interior designers, homeowners, and businesses are now placing a premium on lamps that not only provide functional lighting but also enhance the visual appeal of rooms. This trend has led to a proliferation of lamp designs, styles, and materials, catering to a wide spectrum of tastes and preferences. Whether it's modern, minimalist lamps for contemporary interiors or vintage-inspired pieces for a touch of nostalgia, the lamp market has adapted to meet these demands.

Furthermore, the integration of smart lighting technology has allowed for even more personalized control over the lighting environment, enabling users to adjust color temperature, brightness, and even create dynamic lighting scenes to complement their interior design choices. As the intersection of lighting and design continues to expand, the emphasis on interior aesthetics in the global lamp market is expected to grow, offering consumers endless possibilities to illuminate and beautify their living and working spaces.

Changing Consumer Preferences

Consumer preferences are constantly evolving, and this has a profound impact on the global lamp market. Today's consumers are not only looking for functional lighting but also aesthetic and mood-enhancing options. This shift in preferences has led to a surge in demand for decorative and customizable lamps.Customization options, such as color-changing LEDs and adjustable brightness, enable users to tailor their lighting to specific tasks or moods. The rise of interior design trends like minimalism and industrial chic has also influenced lamp designs, with many manufacturers incorporating modern, sleek aesthetics into their product lines.

Furthermore, consumers are increasingly seeking lamps that blend seamlessly with their smart homes. The ability to control lighting remotely and integrate it with other smart devices is a major selling point. Therefore, lamp manufacturers are adapting to this trend by producing lamps compatible with popular home automation platforms like Apple HomeKit, Amazon Alexa, and Google Assistant.

Urbanization and Infrastructure Development

Urbanization is a global phenomenon, with an ever-increasing number of people living in cities. This trend has a direct impact on the global lamp market, as urban areas require extensive lighting infrastructure for both public spaces and private residences.Urban development projects often involve the installation of energy-efficient street lighting systems, further boosting the demand for LED lamps. These systems not only enhance safety and security but also contribute to the overall aesthetics of the cityscape.

Moreover, the expansion of smart cities, which rely on interconnected technology to improve urban living, presents an immense opportunity for lamp manufacturers. Smart streetlights, equipped with sensors for traffic monitoring, environmental data collection, and adaptive lighting, are becoming essential components of urban infrastructure.

Key Market Challenges

Environmental Sustainability

Perhaps the most pressing challenge for the global lamp industry is environmental sustainability. While energy-efficient lamps like LED (Light Emitting Diode) bulbs have significantly reduced energy consumption and greenhouse gas emissions, the production and disposal of lamps still have environmental consequences.Manufacturing LED lamps requires rare earth elements, which can be environmentally damaging to extract and process. Additionally, the disposal of lamps, especially those containing hazardous materials such as fluorescent tubes, can pose environmental risks if not handled properly. To mitigate these challenges, lamp manufacturers need to adopt more sustainable production practices and promote responsible lamp disposal and recycling.

Furthermore, the global shift towards sustainability has led to consumer demand for eco-friendly lighting solutions. Manufacturers must not only focus on producing energy-efficient lamps but also consider the entire lifecycle of their products, from raw material extraction to end-of-life disposal.

Market Saturation and Competition

Another significant challenge in the global lamp industry is market saturation and intense competition. As the adoption of LED lamps becomes widespread, many markets are approaching saturation, leaving manufacturers with limited room for growth. This saturation is coupled with intense competition from both established players and new entrants, leading to price wars and shrinking profit margins.In this fiercely competitive landscape, lamp manufacturers must find ways to differentiate their products. This includes innovation in areas such as design, smart features, and lighting quality. Moreover, companies should explore new markets, such as emerging economies, to counterbalance stagnant growth in mature markets.

Technological Obsolescence

While technological advancements have driven the evolution of lamps, they also present a challenge related to technological obsolescence. Rapid developments in lighting technology mean that today's cutting-edge products can become outdated in a matter of years. This poses challenges for both manufacturers and consumers.Manufacturers need to stay at the forefront of research and development to keep up with the latest innovations, which can be resource intensive. They must also manage inventory effectively to prevent the obsolescence of older product lines.

For consumers, the risk of technological obsolescence can be a barrier to investing in new, advanced lighting systems. To address this challenge, manufacturers can provide clear upgrade paths and backward compatibility to extend the lifespan of their products and enhance consumer confidence in adopting new technologies.

Trade and Supply Chain Disruptions

Global lamp manufacturers heavily rely on complex supply chains, which can be vulnerable to various disruptions. Trade tensions and geopolitical conflicts can lead to tariffs and export restrictions, impacting the flow of essential components and materials. Additionally, natural disasters, such as earthquakes and hurricanes, can disrupt manufacturing facilities and logistics networks.The COVID-19 pandemic highlighted the vulnerabilities of global supply chains, as lockdowns and restrictions disrupted production and shipping. These disruptions can lead to delays in product launches, increased costs, and challenges in meeting customer demand.

To mitigate these risks, lamp manufacturers need to diversify their supply chain sources, reduce dependence on single suppliers or regions, and invest in inventory management and risk assessment. Establishing robust contingency plans can help manufacturers navigate unforeseen disruptions and maintain a steady supply of components and finished products.

Key Market Trends

LED Dominance and Energy Efficiency

One of the most prominent trends in the global lamp industry is the dominance of LED (Light Emitting Diode) lighting. LED lamps have rapidly gained popularity due to their exceptional energy efficiency and longevity. They consume significantly less energy compared to traditional incandescent bulbs and even outperform CFL (Compact Fluorescent Lamp) alternatives. As governments worldwide emphasize energy conservation and sustainability, LED lamps have become a go-to choice for both residential and commercial applications.LED technology has evolved beyond standard white light bulbs. Manufacturers now offer a wide range of LED lamps, including color-changing options and tunable white light, allowing users to customize their lighting to suit various moods and activities. Additionally, LED lamps are compatible with smart home systems, enabling remote control and automation.

Sustainable and Eco-friendly Designs

Sustainability has become a focal point in the global lamp industry. Consumers are increasingly conscious of the environmental impact of their purchases, and manufacturers have responded by developing eco-friendly lighting solutions. This trend encompasses multiple aspects of lamp production and design.Firstly, there is a growing emphasis on materials and manufacturing processes that reduce environmental impact. Many lamp manufacturers are using recyclable materials and striving to minimize their carbon footprint during production. Additionally, lamp designs are becoming more energy-efficient, with a focus on longevity to reduce the need for frequent replacements.

Furthermore, LED lamps contribute to sustainability by consuming less energy and containing no hazardous materials like mercury, which is found in CFL bulbs. The longer lifespan of LED lamps reduces waste, making them a greener choice overall. Some companies are even exploring innovative ways to repurpose and recycle old lamps to further reduce their environmental impact.

Design Aesthetics and Personalization

Lamp design is evolving beyond pure functionality to become an integral part of interior decor. Today, consumers are not just looking for light sources; they want lamps that blend seamlessly with their home aesthetics. This trend has given rise to a wide variety of lamp designs, ranging from minimalist and modern to vintage and eclectic.Personalization is also a key driver in lamp design. Many manufacturers offer customizable options, allowing customers to choose the color, shape, and size of their lamps. Some even offer bespoke lighting solutions tailored to individual preferences.

Moreover, lamps are increasingly seen as decorative pieces that can set the mood in a room. Dimmable LED lamps, for example, enable users to adjust the brightness to create the desired ambiance. Color-changing LED lamps offer even more versatility, allowing users to select from a spectrum of colors to suit different occasions.

In conclusion, the global lamp industry is undergoing a dynamic transformation, shaped by the shift towards LED technology, the integration of smart features, a focus on sustainability, and a growing emphasis on design aesthetics and personalization. As consumers become more conscious of their lighting choices and seek to enhance their living spaces, these trends are likely to continue driving innovation in the industry. The future of lamps is not just about illumination; it's about creating an environment that aligns with individual preferences and values while minimizing environmental impact.

Development of New Launches

The global lamp market is marked by a continuous stream of new product launches and innovations. Manufacturers and designers are constantly pushing the boundaries to meet the evolving needs and preferences of consumers. These new launches play a pivotal role in driving the market forward.One prominent trend is the development of energy-efficient LED lamps in various form factors, including bulbs, fixtures, and smart lighting solutions. These innovations not only reduce energy consumption but also offer enhanced durability and versatility.

Additionally, the integration of smart technology has given rise to a new generation of lamps that can be controlled remotely via mobile apps or voice commands, offering features such as color changing, dimming, and scheduling. In terms of design, lamps are now available in a wide array of styles, materials, and finishes, catering to diverse interior aesthetics. Vintage-inspired designs, minimalist fixtures, and artistic, avant-garde pieces are among the many options available.

Moreover, lamps with health-conscious features like circadian lighting, which mimics natural daylight to support well-being, are gaining traction. These innovations demonstrate the dynamic nature of the global lamp market, where innovation and consumer-centric design continue to be key drivers of growth and competitiveness.

Segmental Insights

Product Insights

The desk lamp segment is emerging as the fastest-growing category in the global lamps market. This growth is attributed to the increasing trend of remote work and home offices, where individuals seek task-oriented lighting solutions. Desk lamps provide focused illumination for workspaces, reducing eye strain and enhancing productivity. Manufacturers are responding with innovative designs, incorporating features like adjustable brightness levels, color temperature control, and USB charging ports. Moreover, the demand for compact and aesthetically pleasing desk lamps that complement modern decor is on the rise. This surge in demand makes the desk lamp segment a dynamic and rapidly expanding part of the global lamps market.Application Insights

The residential lighting segment is currently the fastest-growing sector in the global lamps market. This growth can be attributed to various factors, including increased home improvement and renovation activities, rising consumer interest in smart lighting solutions for homes, and a growing focus on interior decor. Homeowners are increasingly investing in lamps that not only provide functional illumination but also enhance the aesthetic appeal of their living spaces. Manufacturers are responding by offering a diverse range of residential lamps, including energy-efficient LEDs, decorative fixtures, and smart lighting options. This emphasis on residential lighting reflects the growing importance of creating comfortable and visually appealing home environments.Regional Insights

North America stands as the dominating region in the global lamps market. This dominance is attributed to several factors, including a robust construction industry, high consumer purchasing power, and a growing emphasis on energy-efficient lighting solutions. The region has witnessed a substantial shift towards LED technology due to energy conservation initiatives and environmental awareness. Furthermore, the adoption of smart lighting systems in homes and commercial spaces has been significant. North American lamp manufacturers and suppliers continuously innovate to meet the evolving demands of the market. With a strong focus on energy efficiency, aesthetics, and technology integration, North America maintains its leadership in the global lamps market.Report Scope:

In this report, the Global Lamp Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Lamp Market, By Product:

- Desk Lamp

- Floor Lamp

Lamp Market, By Type:

- Reading Lamp

- Decorative Lamp

Lamp Market, By Application:

- Residential

- Commercial

Lamp Market, By Sales Channel:

- Hypermarkets

- Online

- Specialty Stores

- Others

Lamp Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- Italy

- France

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Lamp Market.Available Customizations:

Global Lamp market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Osram GmbH

- Inter IKEA B.V.

- Pablo Design

- Koncept Inc.

- Flos S.p.A.

- Signify (Philips Lighting)

- OttLite Technologies

- Artemide S.p.A.

- Lutron Electronics

- Herman Miller Inc.

Table Information

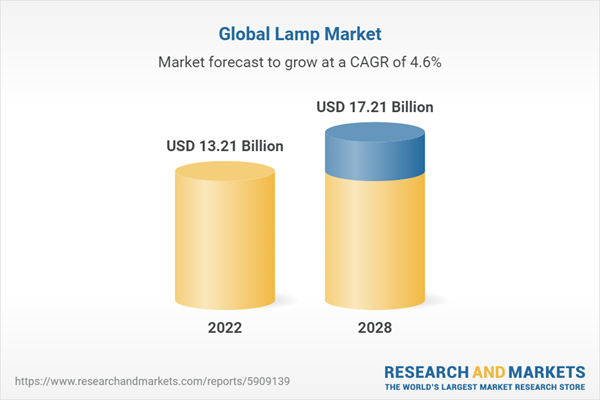

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 13.21 Billion |

| Forecasted Market Value ( USD | $ 17.21 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |