Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Device Proliferation and Connectivity Demand

The global Router and Switch Market are experiencing substantial growth propelled by the ever-expanding array of networked devices. In the contemporary digital landscape, the ownership of electronic devices, including computers, printers, security cameras, and smart home appliances, has soared. This surge, fostered by the Internet of Things (IoT) revolution, has fundamentally transformed both personal and professional spheres. As the number of these connected devices multiplies, the need for seamless data transmission and efficient networks intensifies. Routers and switches have emerged as pivotal components, serving as the linchpin for data exchange between diverse endpoints. Routers manage traffic between different networks, while switches facilitate communication within the same network. The relentless integration of digital technology into various aspects of daily life and business operations necessitates robust network infrastructure. Consequently, enterprises, institutions, and individuals are investing significantly in advanced routers and switches to ensure uninterrupted data flow, driving innovation and growth in the Router and Switch Market.Rapid Technological Advancements and Network Security

The Router and Switch Market are marked by swift technological progress aimed at enhancing network speed, reliability, and security. Manufacturers are continuously innovating to develop routers and switches with higher data transmission rates and reduced latency. Advanced Wi-Fi standards such as Wi-Fi 6 (802.11ax) have gained prominence, offering faster and more efficient wireless connections. Additionally, the integration of features like Power over Ethernet (PoE) in switches has gained traction, enabling simultaneous data and power transmission through the same cable. Cybersecurity features are also evolving rapidly, with routers and switches incorporating robust firewall capabilities and intrusion detection systems. These advancements are crucial in safeguarding networks from the escalating array of cyber threats. Furthermore, the industry is witnessing the infusion of Artificial Intelligence (AI) and Machine Learning (ML) algorithms into routers and switches. These technologies optimize network performance, predict potential issues, and enhance overall efficiency, catering to the demands of modern digital networks. The confluence of these rapid technological advancements and robust cybersecurity features positions the Router and Switch Market at the forefront of innovation, meeting the evolving needs of businesses and individuals alike.Surge in Internet Users and Connected Devices

In today's digital age, the exponential surge in internet users and the proliferation of connected devices are driving unprecedented growth in the Global Router and Switch Market. With an ever-increasing number of people accessing the internet for diverse purposes, ranging from business transactions to social interactions, the demand for robust and high-performance network infrastructure has reached unprecedented levels. Simultaneously, the rise of connected devices, including smartphones, tablets, smart home appliances, and IoT gadgets, has led to an explosion in data traffic. This escalating data load necessitates sophisticated networking solutions to manage the seamless flow of information. Routers and switches, as the linchpins of network architecture, play a pivotal role in enabling this connectivity. Routers direct data traffic between various networks, ensuring that information reaches its intended destination swiftly and securely. Switches, on the other hand, facilitate communication between devices within the same network, enhancing internal data exchange efficiency. As more devices come online, these networking components are vital in establishing and maintaining stable, high-speed internet connections. Businesses, in particular, rely on routers and switches to maintain seamless communication between their employees, clients, and digital services. Moreover, the advent of cloud computing and the growing significance of data analytics further amplify the need for advanced networking equipment. Cloud services rely on robust network infrastructure for their operations, and routers and switches form the backbone of these systems, ensuring data accessibility and security. Additionally, as the Internet of Things (IoT) continues to expand, connecting everything from smart homes to industrial machinery, routers and switches become integral in managing the complex web of interconnections. In essence, the surge in internet users and connected devices propels the demand for cutting-edge routers and switches, pushing manufacturers and innovators to develop increasingly efficient, scalable, and secure networking solutions. This trend not only signifies the transformative power of connectivity in our modern world but also underscores the pivotal role played by routers and switches in shaping the very fabric of our interconnected society and global economy.Emergence of 5G Technology

The emergence of 5G technology stands as a revolutionary force propelling the Global Router and Switch Market into unprecedented growth and innovation. As the world ushers in the era of 5G connectivity, the demand for high-speed, low-latency networks has skyrocketed. 5G technology promises data transmission speeds that dwarf its predecessor, 4G, and facilitates near-instantaneous communication between devices. This transformation doesn’t just enhance the mobile experience; it sparks a chain reaction across industries. Industries are swiftly adopting 5G for applications like augmented reality (AR), virtual reality (VR), autonomous vehicles, and the Internet of Things (IoT). These applications, which demand rapid data exchange and real-time processing, necessitate a robust and agile network infrastructure. Here’s where routers and switches take the spotlight. Routers equipped to handle 5G networks are crucial in managing the colossal data flow, ensuring efficient routing of data packets. Switches, adept at handling high data volumes, facilitate seamless communication between connected devices within the network. The implications are profound: from smart cities relying on 5G for urban planning and traffic management to healthcare institutions employing 5G for telemedicine and remote patient monitoring, the applications are limitless. Furthermore, businesses are leveraging 5G to enable agile, responsive operations, relying on routers and switches to establish and maintain these high-speed connections. This technological leap not only enhances user experiences but also fundamentally reshapes industries, opening doors to innovations previously deemed unattainable. The Global Router and Switch Market are, therefore, at the epicenter of this transformative wave, evolving rapidly to meet the demands of an interconnected world racing towards a future defined by the speed and efficiency of 5G networks. Manufacturers and developers are meticulously engineering routers and switches that not only complement but also enhance the capabilities of 5G technology, ensuring that businesses and consumers alike can harness the full potential of this groundbreaking advancement. As 5G continues its global rollout, the Router and Switch Market stands poised on the edge of remarkable expansion, underlining their indispensable role in shaping our digitally connected tomorrow.Key Market Challenges

Compatibility and Interoperability

The global router and switch market faces significant challenges related to compatibility and interoperability. With a wide range of router and switch models available from various manufacturers, ensuring seamless integration and compatibility between different devices can be complex. Incompatibility issues can arise when organizations try to connect routers and switches from different vendors or when upgrading to newer models. This can lead to network disruptions, configuration difficulties, and limited functionality. The lack of standardized protocols and interfaces across the industry further exacerbates these challenges, requiring organizations to invest time and resources in ensuring compatibility between different network components.Security and Data Protection

Security is a critical concern in the router and switch market. As networks become more interconnected and data breaches become increasingly common, organizations face the challenge of protecting their sensitive information and ensuring the integrity of their network infrastructure. Router and switch vulnerabilities can be exploited by cybercriminals to gain unauthorized access, intercept data, or launch attacks. The constant evolution of cybersecurity threats and the need to stay ahead of sophisticated attacks pose ongoing challenges for manufacturers and users alike. Implementing robust security measures, such as encryption protocols, intrusion detection systems, and regular firmware updates, is crucial to mitigate these risks.Scalability and Performance

As organizations expand their operations and data requirements grow, scalability and performance become significant challenges in the router and switch market. Networks need to handle increasing volumes of data traffic, support a growing number of connected devices, and deliver high-speed connectivity without compromising performance. Scalability issues can arise when existing router and switch infrastructure cannot accommodate the expanding network demands, leading to bottlenecks, latency, and reduced network efficiency. Organizations must carefully plan and invest in scalable router and switch solutions to ensure smooth network operations and accommodate future growth.Complexity and Management

The complexity of managing and maintaining large-scale router and switch deployments poses a challenge for organizations. Configuring, monitoring, and troubleshooting network devices can be time-consuming and require specialized knowledge. As networks become more intricate, with multiple routers, switches, and network segments, organizations need skilled IT professionals who can effectively manage and optimize network performance. The lack of qualified personnel and the need for ongoing training to keep up with evolving technologies and best practices further compound the complexity challenge.Interoperability with Emerging Technologies

The router and switch market must also address the challenge of interoperability with emerging technologies. As organizations adopt new technologies such as cloud computing, virtualization, Internet of Things (IoT), and software-defined networking (SDN), routers and switches need to seamlessly integrate with these systems. Ensuring compatibility and interoperability between traditional network infrastructure and emerging technologies can be complex, requiring organizations to invest in specialized routers and switches or upgrade their existing infrastructure. The rapid pace of technological advancements and the need to stay ahead of the curve present ongoing challenges for manufacturers and users in the router and switch market.Key Market Trends

Proliferation of Connected Devices and Internet Users

The Global Router and Switch Market are experiencing unprecedented growth, largely driven by the surging numbers of internet users and connected devices worldwide. The proliferation of smartphones, tablets, laptops, IoT devices, and other gadgets has created an insatiable demand for robust networking solutions. Routers and switches, acting as the backbone of modern digital communication, are pivotal in ensuring seamless data flow between these devices. With more people accessing the internet and integrating smart devices into their lives, the demand for advanced routing and switching technologies is soaring. This trend is reshaping how individuals interact with technology, emphasizing the need for high-performance, low-latency networks that routers and switches facilitate.5G Technology Revolutionizes Connectivity

The rise of 5G technology stands as a transformative force propelling the Global Router and Switch Market into a new era. The introduction of 5G networks has revolutionized communication, offering lightning-fast data speeds and minimal latency. Industries are quick to adopt 5G for applications such as IoT, augmented reality, and real-time data analytics. 5G networks demand a sophisticated and agile infrastructure, making routers and switches indispensable components. These devices are instrumental in managing the colossal data flow, ensuring efficient data routing, and facilitating seamless communication between devices. From smart cities relying on 5G for urban planning to businesses optimizing operations with 5G-enabled IoT devices, routers and switches are at the forefront of this technological revolution, enabling a world where connectivity knows no bounds.Emphasis on Cybersecurity and Data Protection

The escalating concerns about cybersecurity threats and data breaches have led to a growing emphasis on network security within the Router and Switch Market. Companies are investing heavily in advanced cybersecurity solutions, including firewalls, intrusion detection systems, and encryption technologies, to safeguard sensitive data from cyber threats. As the sophistication of cyber-attacks increases, businesses are prioritizing secure network infrastructure to ensure the confidentiality and integrity of their digital assets, driving the market for robust security-focused networking solutions. Routers and switches, fortified with cutting-edge security features, are pivotal in fortifying networks against cyber threats, making them indispensable in today's digitally vulnerable landscape.Integration in Diverse Industries

The integration of routers and switches in various industries is propelling market growth. These devices have become essential components in sectors such as healthcare, automotive, manufacturing, and entertainment. In healthcare, routers and switches facilitate seamless data exchange in electronic health records and telemedicine applications. The automotive industry relies on these devices for connected vehicles and autonomous driving technologies. Similarly, in manufacturing, routers and switches enable real-time monitoring and automation. The entertainment sector utilizes these devices for high-speed content delivery and online gaming experiences. This integration showcases the versatility of routers and switches, positioning them as vital elements in the digital transformation across diverse domains. As industries continue to leverage technology for efficiency and innovation, the demand for advanced routers and switches is set to escalate, driving the market's evolution and expansion.Segmental Insights

Product Insights

The ATM & ethernet switch segment led the market in 2022, accounting for over 67% share of the global revenue. The ATM (asynchronous transfer mode) and ethernet switch are a subset of the larger networking market for router and switch. As more data-intensive applications and services emerge, demand for high-speed networking solutions is increasing, driving growth in the ATM & ethernet switch. Additionally, the convergence of ATM, ethernet, and other networking technologies is leading to the development of multi-protocol switch solutions, which offer greater flexibility and scalability to businesses. The ATM provides high-speed data transfer at up to gigabit speeds, making it suitable for demanding multimedia and video conferencing applications. It also allows for easy expansion as network requirements grow, making it an attractive choice for large networks.The service provider core router segment is expected to showcase lucrative growth over the forecast period. These routers are the backbone of service provider networks and deliver high-speed, reliable internet connectivity to consumers and businesses. Service providers are investing in new service provider core routers to support the deployment of 5G networks, which require high-speed, low-latency connectivity. Besides, cybersecurity threats continue to increase, and service provider core routers are becoming increasingly sophisticated in their security features, including encryption, firewalls, and intrusion detection systems. Additionally, there is a growing demand for higher-bandwidth routers, with the emergence of 400G and 800G routers offering significantly higher speeds than current 100G routers.

Service Insights

The internet data center/collocation/hosting segment dominated the market and accounted for over 38% share of the global revenue in 2022. The growth is attributed to the increased demand for high-performance, scalable, and secure network solutions. With the growing number of connected devices and the increasing reliance on cloud-based services, there is a need for routers and switches that can handle large amounts of data traffic and provide advanced network security features. To meet these demands, many manufacturers focus on developing routers and switches that can support multi-gigabit and 10-gigabit ethernet, software-defined networking (SDN), and security features such as firewalls and VPNs. Additionally, the trend toward edge computing and the Internet of Things (IoT) is driving the need for smaller, more compact, and low-power routers and switches that can be deployed in remote locations.The ethernet access segment is anticipated to register the highest CAGR over the forecast period as there has been an increase in the shift towards higher-speed ethernet connectivity. 10-gigabit ethernet (10GbE) has become increasingly popular for data centers, while multi-gigabit ethernet technologies such as 2.5GbE and 5GbE are gaining traction in the enterprise market for faster connectivity to devices such as wireless access points and network-attached storage. Additionally, there is a growing demand for 25-gigabit ethernet (25GbE) and 40-gigabit ethernet (40GbE) to meet the increasing bandwidth requirements of data centers. Besides, adopting software-defined networking (SDN) and network function virtualization (NFV), integrating IoT and AI/ML capabilities, drives the demand for ethernet access and network optimization. These technologies allow for greater network flexibility, efficiency, and intelligence, enabling organizations to manage their ethernet networks better.

Regional Insights

North America dominated the market and accounted for over 38% share of the global revenue in 2022, owing to the rapid adoption of advanced technologies across regional multinational companies. Rising fixed broadband traffic and increasing mobile data traffic propel service providers to upgrade their core networks, mobile backhaul, aggregation, and access in the North American regions. There has been a growing trend towards deploying software-defined networking (SDN) and network functions virtualization (NFV) technologies, creating a growing market for software-based routers and switches. The government has made significant investments in infrastructure to support the growth of technology, including developing high-speed networks and deploying new network infrastructure. For instance, in May 2021, the Government of Canada announced making triple spectrum available for Wi-Fi to support rural connectivity, competition, and deployment of 5G technologies in the country. Further, it will offer access to the 6GHz spectrum which will support higher speeds and higher user capacity for wireless devices connected to Wi-Fi routers.The Asia Pacific region is anticipated to witness significant growth in the router & switch owing to factors such as the growth of the internet and mobile usage, increasing adoption of cloud computing, and the growth of the IT industry in countries such as China, India, and Japan. Operators in the Asia Pacific region are actively promoting the benefits of 5G technology, the services it can enable, and the use cases and services that will benefit consumers the most, such as virtual and augmented reality, autonomous vehicles, and smart cities. For instance, in October 2022, Cisco Systems Inc., a digital communication technology provider, will set up a new manufacturing facility in India. The new manufacturing facility will produce mobility, network, and data center products, including routers, switches, access points, endpoints, and controllers.

Report Scope:

In this report, the Global Router and Switch Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Router and Switch Market, By Product:

- Internet Exchange Router

- Service Provider Core Router

- Multiservice Edge Router

- Ethernet Service Edge Router

- ATM & Ethernet Switch

Router and Switch Market, By Service:

- BRAS

- Ethernet Aggregation

- Ethernet Access

- Internet Data Center/Collocation/ Hosting

- Others

Router and Switch Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Router and Switch Market.Available Customizations:

Global Router and Switch market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Arista Networks, Inc.

- Nokia Corporation

- Hewlett Packard Enterprise Development LP

- Dell Technologies Inc.

- Extreme Networks, Inc.

- ZTE Corporation

- Ericsson AB

- Broadcom Inc.

- Fortinet, Inc.

- Allied Telesis Holdings K.K.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2023 |

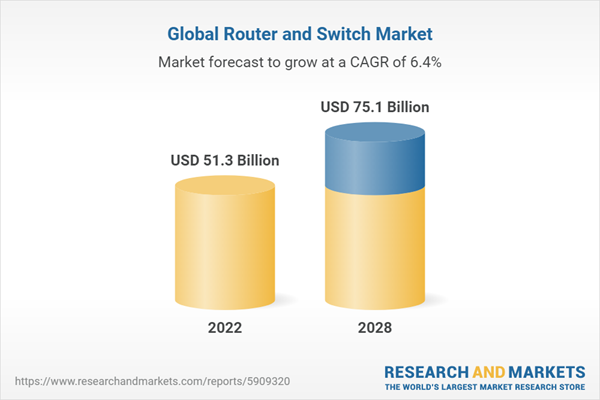

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 51.3 Billion |

| Forecasted Market Value ( USD | $ 75.1 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |