Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Factors driving the growth of the pet insurance market include a growing awareness of the benefits of pet insurance, the rising prevalence of chronic diseases in pets, and the expanding range of coverage options. As pet owners seek to provide the best possible healthcare for their furry companions, insurance plans that offer comprehensive coverage for everything from routine check-ups to major surgeries are increasingly appealing.

Moreover, advancements in veterinary medicine have led to more sophisticated and costly treatments and procedures, further underscoring the need for financial protection through insurance. This trend is particularly prominent in regions like North America and Europe, where pet insurance is becoming a standard part of responsible pet ownership.

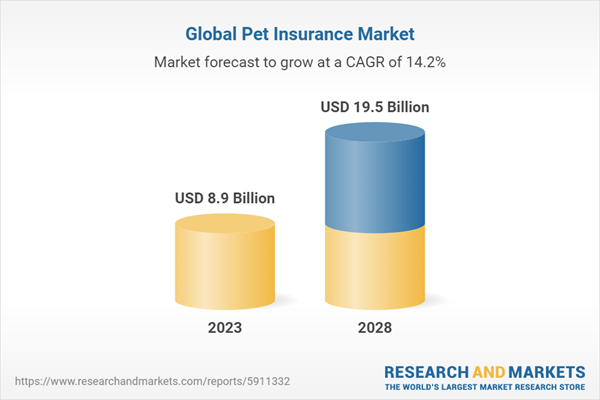

In summary, the global pet insurance market is experiencing robust growth, fueled by increasing pet ownership, growing awareness of its benefits, and the escalating costs of veterinary care. As the bond between pets and their owners strengthens, the pet insurance industry is expected to continue expanding to meet the evolving needs of pet-loving households worldwide.

Key Market Drivers

Rising Pet Ownership

One of the primary drivers behind the growth of the pet insurance market is the increasing number of households worldwide that own pets. Pets, including dogs, cats, and other companion animals, have become integral members of many families. The emotional connection and attachment people have with their pets have driven them to seek the best care possible, including comprehensive medical coverage. As pet ownership continues to rise, so does the potential customer base for pet insurance Animals.In recent years, there has been a notable trend towards urbanization, smaller living spaces, and delayed parenthood among humans. These trends have contributed to the growing popularity of pets as they provide companionship and emotional support in a changing social landscape. Consequently, pet ownership has surged in urban areas, further boosting the demand for pet insurance.

Growing Awareness of Pet Insurance

Another critical factor driving the expansion of the pet insurance market is the increasing awareness among pet owners about the benefits of having insurance for their furry companions. Pet insurance Animals and advocacy groups have played a significant role in educating the public about the advantages of coverage.Pet insurance not only provides financial protection in case of unexpected veterinary expenses but also encourages pet owners to seek timely and preventive healthcare for their animals. It helps alleviate the financial burden associated with expensive medical treatments, surgeries, and emergency care, making it a valuable resource for pet owners.

Additionally, the growth of digital and social media platforms has allowed pet insurance companies to reach a broader audience and educate pet owners about the available options. Pet owners are now more informed and discerning when it comes to their pets' well-being, contributing to the increasing adoption of pet insurance.

Expanding Range of Coverage Options

The pet insurance market has evolved significantly, offering a broader range of coverage options to cater to various pet owners' needs and budgets. Initially, pet insurance primarily covered accidents and injuries, but today's policies often include coverage for illnesses, chronic conditions, preventive care, and even alternative therapies.This expansion of coverage options allows pet owners to tailor their insurance plans to their pets' specific health requirements. For example, some policies offer wellness packages that cover routine check-ups, vaccinations, and dental care, while others focus on more comprehensive coverage for serious medical conditions or accidents.

Innovations in pet insurance have also led to the introduction of specialty plans, such as policies for exotic pets, birds, and reptiles. These diverse options cater to a wide range of pet owners, ensuring that virtually every type of pet can benefit from insurance coverage.

Increasing Pet Health Costs

The cost of veterinary care has been on the rise, driven by several factors. Advancements in veterinary medicine have made more sophisticated and specialized treatments available for pets, mirroring the advances in human healthcare. These advanced treatments, while improving the quality of care, can be expensive.Furthermore, the cost of medication, diagnostics, and surgical procedures has increased over time. As pets live longer due to improved healthcare, they are more likely to develop age-related illnesses that require ongoing treatment. This has put added pressure on pet owners to find ways to manage these escalating costs.

Pet insurance helps mitigate the financial burden of expensive veterinary care, ensuring that pet owners can afford the necessary treatments without compromising their pets' well-being. As the cost of pet healthcare continues to rise, the demand for insurance as a financial safety net is likely to grow.

Advancements in Veterinary Medicine

Advancements in veterinary medicine have not only contributed to higher healthcare costs but have also driven the demand for pet insurance. As veterinarians can offer more advanced and specialized treatments, pet owners are increasingly willing to explore all available options to ensure their pets receive the best care possible.Advanced treatments such as MRI scans, chemotherapy, orthopedic surgeries, and organ transplants are now accessible for pets, mirroring the types of care available to humans. While these treatments can be life-saving, they often come with substantial price tags.

Pet insurance provides pet owners with peace of mind, knowing that they can make the best medical decisions for their pets without being constrained by financial limitations. As pet medicine continues to advance, the demand for insurance coverage that supports these treatments is expected to grow.

Key Market Challenges

Lack of Awareness and Education

One of the most significant challenges in the pet insurance industry is the limited awareness and understanding of insurance options among pet owners. Many people are unaware that pet insurance exists or misunderstand how it works. This lack of awareness often leads to missed opportunities for pet owners to protect their pets and manage healthcare costs effectively.To address this challenge, pet insurance companies need to invest in robust education and awareness campaigns. These efforts should focus on explaining the benefits of pet insurance, the different coverage options available, and how the claims process works. Collaborations with veterinarians and pet-related organizations can also help spread the word about the importance of pet insurance as part of responsible pet ownership.

Cost and Affordability

The cost of pet insurance premiums can be a barrier for some pet owners. Premiums vary depending on factors such as the pet's breed, age, pre-existing conditions, and the coverage level chosen. Some pet owners may find it challenging to justify the ongoing expense, especially if they have multiple pets or face financial constraints.To address the affordability challenge, pet insurance Animals could consider offering more flexible payment options, tiered coverage plans, and discounts for multi-pet households. Providing clear and transparent pricing information can also help pet owners make informed decisions and understand the value of their insurance coverage.

Pre-Existing Conditions and Coverage Exclusions

Most pet insurance policies exclude coverage for pre-existing conditions, which can be a source of frustration for pet owners. When a pet has a pre-existing condition, it often means that the insurance policy will not cover any related treatments or expenses, making it less appealing for owners of pets with chronic illnesses or genetic predispositions.Pet insurance companies face the challenge of finding a balance between offering comprehensive coverage and managing the financial risks associated with covering pre-existing conditions. To address this challenge, Animals could explore innovative solutions, such as offering coverage for pre-existing conditions after a waiting period or creating specialized policies tailored to pets with existing health issues.

Clear communication and transparency about coverage exclusions are also essential. Pet owners should fully understand what their policy covers and what it does not to avoid disappointment and misunderstandings when filing claims.

Complex Claims Process

The claims process for pet insurance can be complex and cumbersome, discouraging some pet owners from utilizing their coverage. Pet owners may need to submit detailed documentation, including medical records and invoices, and wait for reimbursement, which can take time.To overcome this challenge, pet insurance companies should strive to streamline the claims process and make it more user-friendly. This includes developing user-friendly mobile apps or online portals for claims submission, ensuring prompt communication with policyholders, and simplifying the documentation requirements. By simplifying the claims process, pet insurance Animals can enhance the overall customer experience and encourage more pet owners to use their coverage.

Key Market Trends

Customized Coverage Plans

One of the prominent trends in the pet insurance industry is the move toward customized coverage plans. Pet owners have diverse needs and budgets, and insurers are recognizing the importance of offering flexibility in their policies. Instead of one-size-fits-all plans, insurers are providing options for pet owners to tailor their coverage based on their specific requirements.Customization can include options such as choosing deductibles, coverage limits, and the inclusion of wellness or preventive care. This trend allows pet owners to find a plan that aligns with their pet's age, breed, and health status, ensuring they get the coverage they need without paying for unnecessary services.

Telemedicine and Digital Health Services

In response to the rapid advancement of telemedicine and digital health services in human healthcare, the pet insurance industry is also embracing these technologies. Telemedicine allows pet owners to consult with veterinarians remotely, providing access to expert advice without the need for an in-person visit. This trend has gained significant traction, especially in situations where immediate veterinary care might not be readily available.Pet insurance companies are incorporating telemedicine into their coverage options, enabling policyholders to access virtual vet consultations and advice as part of their benefits. This not only enhances the convenience of pet healthcare but also reduces costs and provides a valuable resource for pet owners.

Wellness and Preventive Care Packages

Many pet insurance Animals now offer wellness and preventive care packages as add-ons or standalone policies. These packages cover routine veterinary visits, vaccinations, dental care, and preventive treatments like flea and tick control. The inclusion of wellness coverage encourages pet owners to proactively manage their pets' health and can lead to early detection of potential issues.This trend aligns with the growing emphasis on preventive care in both human and veterinary medicine. Pet owners are increasingly interested in keeping their pets healthy through regular check-ups and preventive measures, and wellness packages cater to this demand.

Increased Market Competition

As the pet insurance market continues to grow, competition among Animals is intensifying. New entrants and existing insurance companies are vying for a share of this expanding market. This competition is beneficial for consumers as it results in more choices, competitive pricing, and improved coverage options.Pet insurance Animals are striving to differentiate themselves by offering innovative features, superior customer service, and unique perks. This trend is driving continuous improvements within the industry and pushing Animals to enhance their offerings to attract and retain customers.

Emphasis on Education and Awareness

Pet insurance companies are increasingly recognizing the importance of educating pet owners about the benefits of insurance. They are investing in awareness campaigns and educational resources to inform pet owners about the value of pet insurance and how it works.These initiatives include online content, social media campaigns, partnerships with veterinarians, and community outreach programs. By focusing on education and awareness, insurers aim to bridge the gap between the relatively low awareness of pet insurance and the potential benefits it can provide.

Integration with Pet Healthcare Ecosystem

To provide a seamless and holistic pet healthcare experience, many pet insurance companies are integrating with the broader pet healthcare ecosystem. This includes partnerships with veterinary clinics, pharmacies, pet stores, and other pet-related services. These collaborations aim to simplify the claims process, offer discounts on pet services, and enhance the overall pet owner experience.For example, some insurers have mobile apps that allow policyholders to easily access their coverage information and locate nearby veterinary clinics that accept their insurance. Such integrations make it more convenient for pet owners to manage their pets' healthcare and insurance needs in one place.

Segmental Insights

Coverage Type Insights

Accident and illness coverage has emerged as a rapidly growing segment within the pet insurance industry. This specialized insurance category focuses on providing financial protection for pet owners in cases of both unexpected accidents and illnesses that their pets may experience.One of the primary drivers of the growth of accident and illness coverage is the increasing awareness among pet owners about the potential health risks and expenses associated with owning a pet. As pet owners become more educated about the diverse health issues that can affect their furry companions, they are seeking comprehensive coverage that safeguards against both accidents, such as injuries from accidents or mishaps, and illnesses, including chronic conditions or genetic predispositions.

Furthermore, advancements in veterinary medicine have made it possible to diagnose and treat a wide range of pet illnesses and injuries, including surgeries, specialized treatments, and even organ transplants. These medical advancements have also contributed to the appeal of accident and illness coverage, as pet owners seek financial protection for the high costs associated with advanced veterinary care.

In sum, accident and illness coverage is witnessing substantial growth due to the rising awareness of pet health issues and the desire of pet owners to provide their pets with the best possible care. This segment of pet insurance plays a crucial role in ensuring that pets receive prompt and comprehensive medical attention, helping pet owners navigate the financial challenges that can arise when unexpected accidents or illnesses occur.

Animal Type Insights

Dogs represent a rapidly growing segment within the pet insurance industry. This trend can be attributed to several factors that highlight the increasing importance of dogs in people's lives and the desire to ensure their well-being.Firstly, the bond between dogs and their owners has grown stronger over the years, with dogs often considered integral family members. This heightened emotional connection has led to a greater willingness among dog owners to invest in their pets' health and overall quality of life.

Secondly, the expanding range of veterinary care options for dogs has contributed to the rise in pet insurance. Advancements in canine medicine now offer specialized treatments, diagnostics, and surgeries that were once exclusive to human healthcare. As a result, the cost of healthcare for dogs has increased, prompting owners to seek financial protection through insurance.

Thirdly, the diversity of dog breeds and their unique healthcare needs has fueled the growth of specialized dog insurance plans. Different breeds are predisposed to various health issues, and policies tailored to specific breeds or breed types have gained popularity.

Lastly, dog owners' lifestyles have changed, with more people living in urban environments and adopting dogs as companions. Urban living can present different challenges for dog owners, such as exposure to pollution or accidents. This has heightened the interest in insurance coverage that addresses urban-specific concerns.

In conclusion, dogs represent a burgeoning segment in the pet insurance market due to the deep emotional connection between owners and their canine companions, the expanding range of veterinary care options, specialized breed-specific coverage, and evolving urban lifestyles. As the bond between humans and dogs continues to grow, the dog insurance sector is expected to expand further to meet the diverse needs of dog owners worldwide.

Regional Insights

Europe has emerged as a growing and dynamic segment within the global pet insurance industry. Several factors contribute to the expansion of the pet insurance market in Europe, reflecting the changing attitudes and priorities of pet owners across the continent.Firstly, there is a noticeable increase in pet ownership throughout Europe, with pets being regarded as integral members of households. This trend is particularly pronounced in urban areas, where lifestyles and living spaces are conducive to pet companionship. As pet ownership rises, so does the demand for insurance to safeguard pets' health and well-being.

Secondly, European pet owners are increasingly prioritizing their pets' healthcare needs. The awareness of advanced veterinary treatments and the willingness to provide comprehensive care to their furry companions have led to a greater interest in pet insurance. Owners recognize the financial benefits of insurance, which can cover the costs of surgeries, diagnostic tests, and emergency care.

Thirdly, the European pet insurance market has seen innovation in terms of product offerings and customization. Insurers are tailoring their policies to meet the specific needs of pet owners, such as breed-specific coverage, wellness packages, and travel insurance for pets. This flexibility attracts a diverse range of pet owners, from those with purebred dogs to those with rescue animals.

Lastly, the regulatory environment in Europe supports the growth of the pet insurance industry. Regulatory standards help ensure transparency, consumer protection, and fair practices within the market, which builds trust among pet owners and encourages them to invest in insurance coverage.

In conclusion, Europe has become a significant and growing segment within the global pet insurance market due to the increasing prevalence of pet ownership, heightened awareness of pet healthcare needs, product customization, and a supportive regulatory framework. As the bond between Europeans and their pets continues to strengthen, the pet insurance industry in Europe is poised for further expansion to meet the evolving needs and expectations of pet owners across the continent.

Report Scope:

In this report, the Global Pet Insurance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Pet Insurance Market, By Coverage Type:

- Accident & Illness

- Chronic Condition

- Others

Pet Insurance Market, By Animal:

- Dogs

- Cats

- Others

Pet Insurance Market, By Sales Channel:

- Agency

- Broker

- Others

Pet Insurance Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Argentina

- Colombia

- Brazil

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Pet Insurance Market.Available Customizations:

Global Pet Insurance market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- Animal Friends Insurance Services Limited

- Figo Pet Insurance, LLC

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency, LLC

- Anicom Insurance

- ipet Insurance Co., Ltd.

- MetLife Services and Solutions, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 8.9 Billion |

| Forecasted Market Value ( USD | $ 19.5 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |