Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The report highlights the growing cancer burden in the country, emphasizing the need for enhanced awareness, early detection, and improved treatment strategies to address the rising incidence. Neoantigens are distinct from normal, healthy cell proteins, making them ideal targets for immune recognition and attack. Neoantigen therapies are highly personalized.

Once neoantigens are identified, the patient's immune system is trained to recognize these specific neoantigens as foreign invaders. This often involves creating a customized vaccine or adoptive cell therapy tailored to the patient's unique neoantigen profile. Neoantigen therapies can be used in combination with checkpoint inhibitors, another type of immunotherapy. Checkpoint inhibitors release the brakes on the immune system, allowing it to mount a stronger response against cancer cells, including those targeted by neoantigens.

The growing availability and affordability of genomic sequencing technologies have enabled the identification of neoantigens more accurately and quickly, facilitating the development of personalized therapies. Regulatory agencies like the FDA and EMA have shown willingness to support the development and approval of neoantigen therapies, streamlining the path to market for these treatments.

Patients and healthcare providers are increasingly seeking precision therapies that specifically target cancer cells. Neoantigen therapies offer the potential for more effective and less toxic treatments. Researchers are exploring the synergistic effects of combining neoantigen therapies with other treatment modalities, such as chemotherapy and radiation therapy, to enhance treatment outcomes. The aging population is at higher risk of developing cancer. As the global population ages, the demand for innovative cancer treatments, including neoantigen therapies, is expected to rise.

Key Market Drivers

Advancements in Genomic Testing

Next-generation sequencing technologies have revolutionized the field of genomics. NGS allows for the rapid and cost-effective sequencing of large stretches of DNA. It has enabled the sequencing of entire genomes, transcriptomes, and epigenomes with unprecedented speed and affordability. For instance, a study published in PNAS in September 2022 reported that researchers developed an antibody-based therapy that successfully eliminated circulating tumor cells (CTCs) in breast cancer mouse models. This breakthrough highlights the potential of targeted immunotherapy in preventing cancer metastasis, offering hope for improved treatment strategies and better outcomes for breast cancer patients in the future.High-throughput sequencing platforms can simultaneously process numerous DNA or RNA samples, allowing for large-scale studies and population-scale genomic research. This capability has accelerated the discovery of genetic variants associated with diseases and traits. Traditional short-read sequencing methods have limitations in resolving complex genomic regions. Long-read sequencing technologies, like Pacific Biosciences (PacBio) and Oxford Nanopore, can generate much longer sequencing reads, aiding in the assembly of complete genomes and the identification of structural variations.

Single-cell sequencing technologies enable the analysis of individual cells within a tissue or organism. This approach provides insights into cellular heterogeneity, cell types, and gene expression at a single-cell resolution, advancing our understanding of complex biological systems. Genomic sequencing has been instrumental in cancer research and precision oncology. It allows for the identification of driver mutations, assessment of tumor heterogeneity, and the development of targeted therapies tailored to a patient's genetic profile.

Key Market Challenges

Identification of Relevant Neoantigens

Tumors are often genetically heterogeneous, meaning they contain a mix of different cell types with various mutations. Identifying the specific neoantigens that are present across all tumor cells can be challenging. Neoantigen prediction relies on computational algorithms to predict potential neoantigens based on DNA sequencing data. These algorithms are continually improving, but false positives and false negatives are still common, leading to uncertainty in selecting the most relevant neoantigens. Predicted neoantigens must be experimentally validated to confirm their presentation on cancer cells and their immunogenicity. This validation process can be time-consuming and resource intensive.Each patient's tumor has a unique set of neoantigens, and these can vary greatly from one patient to another. Identifying relevant neoantigens requires a personalized approach for each patient, which can be logistically challenging. Some neoantigens may be present at very low frequencies within a tumor, making them difficult to detect and target effectively. Tumors can evolve over time, leading to changes in their neoantigen landscape. This requires ongoing monitoring and adaptation of neoantigen-targeted therapies. Cancer cells may develop mechanisms to evade the immune system, including downregulating the presentation of neoantigens. This immune evasion can hinder the effectiveness of neoantigen-targeted therapies.

Key Market Trends

Immunotherapy Dominance

Immunotherapy has gained prominence as a leading approach in cancer treatment. It harnesses the body's immune system to target and destroy cancer cells. Neoantigen-targeted therapies are a subset of immunotherapy that focuses on training the immune system to recognize and attack cancer-specific neoantigens. Immunotherapy, including neoantigen-targeted therapies, aligns with the principles of precision medicine. These therapies are tailored to the individual genetic and immunological profiles of each patient, aiming to maximize treatment efficacy while minimizing side effects. Neoantigen-targeted therapies often complement the use of checkpoint inhibitors, another class of immunotherapies.Checkpoint inhibitors release the brakes on the immune system, allowing it to attack cancer cells more effectively. Neoantigens can serve as specific targets for the immune system to recognize in combination with checkpoint inhibitors. Neoantigen-targeted therapies aim to enhance the immune system's response against cancer cells by targeting neoantigens, which are unique to the tumor. This can lead to a more focused and potent immune response compared to traditional treatments.

Positive outcomes and clinical successes in immunotherapy trials, including neoantigen therapies, have fueled interest and investment in this field. Patients who have experienced durable responses are advocating for and raising awareness of these treatments. The pharmaceutical and biotechnology industries have invested heavily in the research and development of immunotherapies, including neoantigen-based approaches. This investment has led to a growing pipeline of potential therapies.

Key Market Players

- BioNtech SE

- Gritstone Bio, Inc.

- Genocea Biosciences Inc.

- Moderna Inc

- Agenus Inc.

- Immatics NV

- Advaxis Inc

- Precision Biologics

- Gilead Sciences, Inc.

- Cellular Biomedicine Group Inc.

- Achillies Therapeutics Plc.

- Merck & Co Inc

Report Scope:

In this report, the Global Neoantigen Targeted Therapies Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Neoantigen Targeted Therapies Market, By Target Disease Indication:

- Bone Cancer

- Colorectal Cancer

- Gynecological Cancer

- Non-Small Cell Lung Cancer

- Renal Cell Carcinoma

Neoantigen Targeted Therapies Market, By Neoantigens Type:

- Off-the-Shelf Neoantigens

- Personalized Neoantigens

Neoantigen Targeted Therapies Market, By Immunotherapy Type:

- Dendritic Cell Vaccines

- DNA / RNA-Based Vaccines

- Protein / Peptide-based Vaccines

- TIL-Based Therapies

Neoantigen Targeted Therapies Market, By Route of Administration:

- Intradermal

- Intravenous

- Subcutaneous

Neoantigen Targeted Therapies Market, By region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Neoantigen Targeted Therapies Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BioNtech SE

- Gritstone Bio, Inc.

- Genocea Biosciences Inc.

- Moderna Inc

- Agenus Inc.

- Immatics NV

- Advaxis Inc

- Precision Biologics

- Gilead Sciences, Inc.

- Cellular Biomedicine Group Inc.

- Achillies Therapeutics Plc.

- Merck & Co Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | March 2025 |

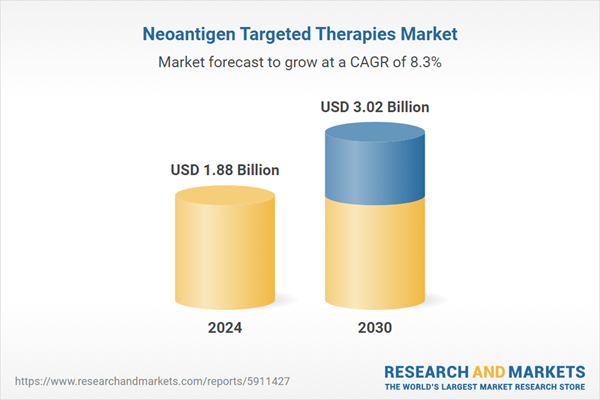

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.88 Billion |

| Forecasted Market Value ( USD | $ 3.02 Billion |

| Compound Annual Growth Rate | 8.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |